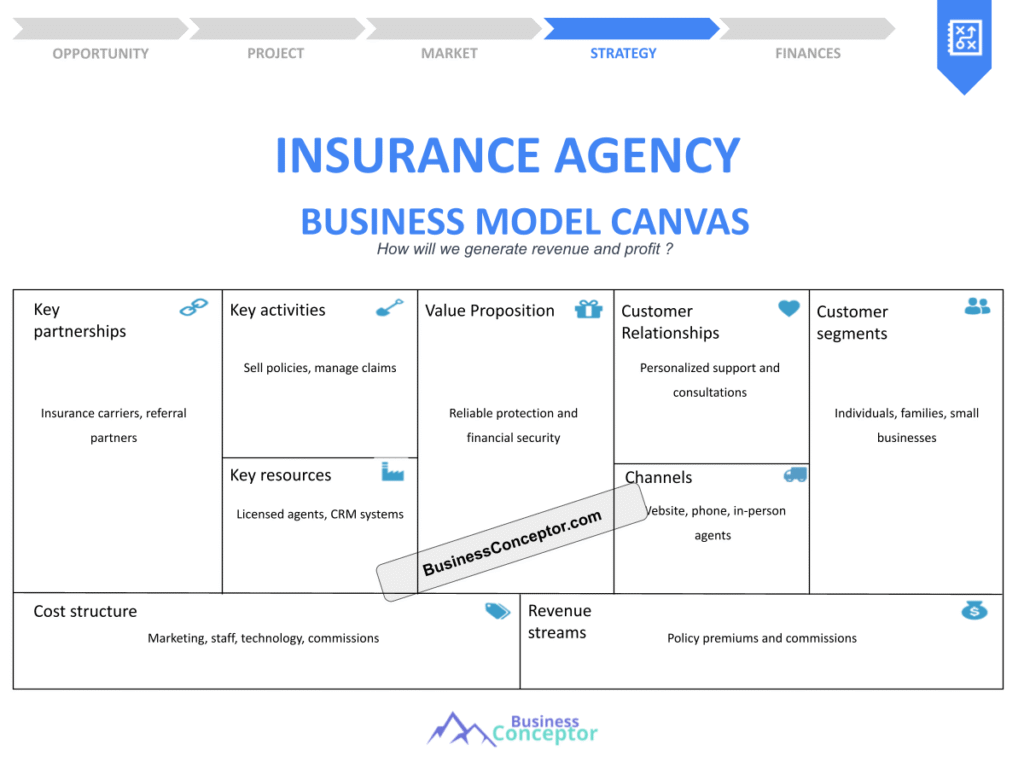

The Insurance Agency Business Model Canvas is a transformative tool that can reshape the way you think about your insurance agency. It’s not just a trendy term thrown around in business meetings; it’s a practical framework that helps you visualize your agency’s operations and strategy on a single page. The Business Model Canvas allows you to outline your agency’s value proposition, identify your customer segments, and define your revenue streams, among other crucial components. This clarity can be a game-changer for both new and existing agencies.

Here’s what you’ll gain from this article:

– A clear understanding of what a Business Model Canvas is and why it matters for insurance agencies.

– Detailed insights into the key components of the canvas tailored specifically for the insurance industry.

– Real-life examples and actionable tips to help you create your own canvas.

Understanding the Business Model Canvas for Insurance Agencies

The Business Model Canvas (BMC) is a strategic management tool that offers a visual framework for developing new or documenting existing business models. In the context of the insurance sector, this canvas can be particularly beneficial. It allows insurance professionals to break down their business into nine essential components, each interlinked to form a complete picture of the agency’s operational model.

Let’s dive into these nine components:

– Value Propositions: What unique value do you deliver to your customers? Are you offering personalized service, specialized coverage, or competitive pricing?

– Customer Segments: Who are your target customers? Are they families, businesses, or specific demographics like millennials or retirees?

– Channels: How do you deliver your value propositions? This could include online platforms, direct mail, or in-person consultations.

– Customer Relationships: What type of relationship do you establish with your customers? Do you focus on long-term partnerships or quick transactions?

– Revenue Streams: How does your agency earn money? Is it primarily through commissions, fees, or renewals?

– Key Resources: What resources do you need to deliver your value? This could include technology, skilled staff, or partnerships.

– Key Activities: What activities are crucial for your business? Think about marketing, customer service, and claims management.

– Key Partnerships: Who are your partners and suppliers? Collaborating with insurance carriers or tech companies can expand your offerings.

– Cost Structure: What are the costs involved in operating your agency? Understanding your fixed and variable costs can help improve profitability.

By breaking down your business model into these nine segments, you can gain a clearer understanding of how each part interacts and contributes to your overall strategy. This comprehensive view not only helps you spot potential weaknesses but also highlights areas of opportunity that you may have overlooked.

| Component | Description |

|---|---|

| Value Propositions | Unique offerings for customers |

| Customer Segments | Target demographics and market niches |

| Channels | Distribution methods for your services |

| Customer Relationships | Ways to engage and retain clients |

| Revenue Streams | Income sources from policies and services |

| Key Resources | Essential assets and tools required |

| Key Activities | Main tasks to deliver your value proposition |

| Key Partnerships | Collaborations with other businesses |

| Cost Structure | Breakdown of operational expenses |

Key Takeaway: The BMC helps you visualize your insurance agency’s entire business model in a single glance, enabling you to identify strengths and weaknesses. This structured approach not only enhances your strategic planning but also improves communication with stakeholders, making it easier to articulate your business model to potential investors and partners.

“A goal without a plan is just a wish.” 🌟

Key Components of the Insurance Agency Business Model Canvas

Now that we’ve covered the basic structure of the Business Model Canvas, let’s dive deeper into each component, specifically for insurance agencies. Understanding these key components is crucial because they help you tailor your strategies to meet the unique needs of your market.

Starting with the Value Propositions, what unique value does your insurance agency offer? This is your opportunity to shine! Are you specializing in niche markets like pet insurance, or do you provide a level of personalized service that sets you apart from competitors? For example, an agency that offers customized coverage plans based on individual client needs can attract a diverse clientele who appreciate tailored solutions. Highlighting your value proposition clearly on your canvas can make a significant difference in how potential clients perceive your agency.

Next, let’s examine your Customer Segments. This aspect is all about identifying who your ideal clients are. Are you targeting families looking for comprehensive health insurance, or perhaps small businesses in need of liability coverage? The more specific you can be, the better. Understanding your customer segments allows you to craft targeted marketing messages and tailor your services to meet the specific needs of these groups. For instance, if you discover a growing trend in millennial homebuyers, you might consider creating a specialized package that addresses their unique concerns and preferences.

When it comes to Channels, think about how you will deliver your value propositions. Are you using social media, email marketing, or perhaps hosting community events? Each channel will have different implications for how you engage with your audience. If you primarily use online channels, investing in a user-friendly website and active social media presence can enhance your visibility. Conversely, if your agency focuses on local clientele, consider traditional methods like flyers and local networking events. The channels you choose should align with where your customer segments spend their time.

| Component | Description |

|---|---|

| Value Propositions | Unique offerings for customers |

| Customer Segments | Target demographics and market niches |

| Channels | Distribution methods for your services |

Key Insight: Identifying these elements not only clarifies your offerings but also enhances your marketing strategy. The clearer you are about your value propositions, customer segments, and channels, the more effective your outreach efforts will be.

“Success usually comes to those who are too busy to be looking for it.” 🚀

Building Strong Customer Relationships

One of the most crucial aspects of any business, including insurance agencies, is building strong customer relationships. This is where you can differentiate yourself from the competition. Consider the type of relationship you want to foster. Are you aiming for a transactional relationship, or do you want to create long-lasting partnerships? For instance, offering free consultations can help establish trust and showcase your expertise. Many clients appreciate a personalized touch, and being approachable can make all the difference.

When looking at Customer Relationships, think about how you can provide ongoing value. Regular follow-ups and personalized communications can keep you top-of-mind. For example, sending out annual policy reviews or reminders about policy renewals can demonstrate your commitment to customer service. Moreover, creating a customer loyalty program can incentivize clients to stay with your agency long-term. This could be in the form of discounts for referrals or exclusive offers for long-term clients.

Additionally, implementing a robust feedback mechanism can help you understand your clients’ needs better. Surveys and direct feedback can offer insights into areas of improvement, allowing you to refine your offerings. A proactive approach in addressing client concerns not only strengthens relationships but also builds a positive reputation in the community. Clients who feel valued and heard are more likely to recommend your services to others.

| Relationship Type | Strategy |

|---|---|

| Transactional | Quick and efficient policy quotes |

| Long-term partnership | Regular check-ins and personalized service |

Key Takeaway: Building a solid relationship with your clients can lead to referrals and increased customer loyalty. The more you invest in understanding and nurturing these relationships, the more likely you are to see positive outcomes for your agency.

“People don’t care how much you know until they know how much you care.” ❤️

Revenue Streams: How Insurance Agencies Make Money

Let’s get to the heart of the matter—how does your insurance agency make money? Understanding your Revenue Streams is vital for sustainability and growth. This component of the Business Model Canvas allows you to analyze the various ways your agency can generate income. Common revenue streams for insurance agencies include commissions, fees, and renewals, each contributing differently to your overall financial health.

Commissions are perhaps the most well-known revenue source for insurance agencies. When your agency sells a policy, you earn a percentage of the premium paid by the client. This can vary depending on the type of insurance and the agreement with the insurance carrier. For instance, life insurance policies might offer higher commissions compared to auto insurance. By diversifying the types of policies you sell, you can create multiple streams of commission income, thereby reducing dependency on any single product.

Another significant revenue stream is fees. These can be charged for various services, such as policy adjustments, consultations, or even educational workshops on insurance literacy. Offering workshops can not only generate additional income but also position your agency as a thought leader in the industry. Clients are more likely to trust an agency that actively educates them about their insurance options and the importance of coverage.

Additionally, renewals are a critical aspect of your revenue model. Many insurance policies require annual or semi-annual renewals, and these can provide a steady flow of income. Encouraging clients to renew their policies through excellent customer service and regular check-ins can significantly boost your renewal rates. Implementing a reminder system to notify clients before their policies expire can also ensure that they don’t lapse, thus securing that revenue.

| Revenue Stream | Description |

|---|---|

| Commissions | Earnings from policy sales |

| Fees | Charges for consultations and adjustments |

| Renewals | Income from clients renewing their policies |

Key Insight: Diversifying your revenue streams can create more stability and reduce risks associated with market fluctuations. Understanding how each stream contributes to your overall financial picture will help you make informed decisions about where to focus your efforts.

“Don’t watch the clock; do what it does. Keep going.” ⏰

Key Activities for Running Your Insurance Agency

Every successful business has key activities that drive its operations. For insurance agencies, these activities can range from marketing and customer service to policy management and claims processing. Identifying these key activities allows you to focus on what truly matters for your business’s success.

One of the most crucial key activities is marketing. Whether you’re utilizing digital platforms or traditional methods, effective marketing strategies are essential for attracting new clients. This includes creating engaging content, optimizing your website for search engines, and utilizing social media to reach a wider audience. Investing in a solid marketing plan can yield long-term benefits, as it helps establish your brand and builds trust within the community.

Customer service is another vital activity. Providing exceptional service not only retains existing clients but also encourages referrals. Training your team to handle inquiries efficiently and compassionately can significantly enhance customer satisfaction. Consider implementing a feedback system to continuously improve your service based on client input. This proactive approach will help you understand your clients better and adapt your services accordingly.

Claims processing is also a significant activity that can impact your agency’s reputation. Streamlining this process can lead to higher customer satisfaction. Efficiently handling claims can make a stressful situation easier for your clients, which in turn fosters loyalty. Implementing technology solutions to automate parts of the claims process can reduce errors and speed up resolution times, making your agency more competitive.

| Key Activity | Description |

|---|---|

| Marketing | Strategies for attracting new clients |

| Customer Service | Providing support and assistance to policyholders |

| Claims Processing | Managing and facilitating claims for clients |

Key Takeaway: Knowing your key activities helps streamline operations and allocate resources effectively. By focusing on marketing, customer service, and claims processing, you can enhance your agency’s performance and client satisfaction.

“The secret to success is to start from scratch and keep on scratching.” 🛠️

The Role of Key Partnerships in Insurance Agencies

In the world of insurance, no agency operates in isolation. Building key partnerships can significantly enhance your service offerings and expand your reach. This component of the Business Model Canvas allows you to leverage external resources and expertise, which can be crucial for your agency’s success.

Consider partnerships with insurance carriers. Collaborating with various carriers allows you to offer a broader range of products, making your agency more attractive to potential clients. When you have access to multiple insurance options, you can cater to different customer needs, whether it’s auto, home, or specialized insurance like travel insurance. This diversity not only improves customer satisfaction but also positions your agency as a one-stop shop for all insurance needs.

Another important type of partnership is with technology providers. In today’s digital age, having the right technology can set your agency apart from competitors. By partnering with insurtech companies, you can gain access to innovative tools that streamline operations, improve customer service, and enhance your marketing efforts. For example, implementing a robust customer relationship management (CRM) system can help you manage client interactions more effectively, leading to better service and increased sales.

Local businesses can also be valuable partners. Forming alliances with businesses in your community can open up new customer segments. For instance, if you partner with a real estate agency, you can offer insurance packages to new homeowners, effectively tapping into a fresh market. These local partnerships not only help you reach potential clients but also build your reputation within the community.

| Partner Type | Benefit |

|---|---|

| Insurance Carriers | Access to diverse products |

| Technology Providers | Enhanced operational efficiency |

| Local Businesses | Increased visibility and customer acquisition |

Key Insight: Leveraging partnerships can lead to mutual growth and expanded service offerings. By collaborating with the right partners, you can not only improve your service portfolio but also enhance your agency’s credibility in the marketplace.

“Alone we can do so little; together we can do so much.” 🤝

Understanding the Cost Structure of Your Insurance Agency

Every business has costs, and understanding your cost structure is crucial for profitability. This component of the Business Model Canvas allows you to break down the various costs associated with running your insurance agency. By identifying these costs, you can make informed decisions about where to allocate resources and how to manage expenses effectively.

Common costs for insurance agencies include operational expenses, which encompass rent, utilities, and employee salaries. These fixed costs are essential for keeping the business running smoothly. However, it’s important to regularly review these expenses to identify areas where you can cut costs without sacrificing service quality. For instance, negotiating better rates for office space or using remote work solutions can significantly reduce overhead.

Marketing costs also play a significant role in your cost structure. Effective marketing is essential for attracting new clients and retaining existing ones. This includes digital marketing efforts, traditional advertising, and promotional materials. While these expenses can add up, they are investments in your agency’s future. Tracking the return on investment (ROI) for different marketing campaigns can help you determine which strategies yield the best results, allowing you to focus your budget on what works.

Another area to consider is technology investments. Implementing software solutions for customer management, claims processing, and marketing automation can improve efficiency and reduce long-term costs. While there may be initial setup costs, the benefits of streamlined operations often outweigh these expenses. Additionally, investing in technology can enhance the customer experience, leading to higher satisfaction and retention rates.

| Cost Type | Description |

|---|---|

| Operational Expenses | Regular costs for running the agency |

| Marketing Costs | Expenses related to attracting clients |

| Technology Investments | Costs associated with software and tools |

Key Takeaway: Keeping a close eye on your cost structure can lead to improved margins and overall financial health. Regularly assessing your costs will help you make better strategic decisions and enhance your agency’s profitability.

“The only way to do great work is to love what you do.” 💼

Putting It All Together: Your Insurance Agency Business Model Canvas

Now that we’ve explored each component in detail, it’s time to put everything together into your own Insurance Agency Business Model Canvas. This is where you can synthesize all the insights and strategies you’ve gathered to create a comprehensive overview of your agency’s operations. A well-constructed canvas will not only guide your strategic planning but also serve as a communication tool for stakeholders, partners, and potential investors.

Start by filling out each section based on your research and insights. For instance, in the Value Propositions section, clearly define what makes your agency unique. Are you offering innovative insurance solutions, personalized service, or niche market expertise? This clarity will help you articulate your agency’s strengths to clients and differentiate yourself from competitors.

Next, examine the Customer Segments. Who are your ideal clients? Are you targeting young families, small business owners, or retirees? The more specific you can be about your target demographics, the better you can tailor your marketing efforts and service offerings. By understanding your clients’ needs and preferences, you can develop solutions that resonate with them, ultimately driving customer satisfaction and loyalty.

Don’t forget to include your Revenue Streams in the canvas. Analyze how each revenue source contributes to your agency’s financial health. Understanding the profitability of each stream will allow you to make informed decisions about where to focus your efforts. For example, if you find that renewals provide a substantial income, consider implementing strategies to boost client retention, such as regular follow-ups and personalized service.

| Component | Description |

|---|---|

| Value Propositions | Unique offerings for customers |

| Customer Segments | Target demographics and market niches |

| Revenue Streams | Income sources from policies and services |

Key Insight: Your Business Model Canvas is a living document. Regularly update it to reflect changes in your business environment and strategy. As your agency evolves, so should your canvas. This adaptability will ensure that you remain competitive and responsive to market demands.

“Success is not the key to happiness. Happiness is the key to success.” 😊

Final Thoughts on Your Insurance Agency Business Model Canvas

Creating a Business Model Canvas for your insurance agency is not just an exercise in strategic planning; it’s a roadmap for your business’s future. By understanding and articulating each component, you can better navigate the complexities of the insurance market and position your agency for long-term success.

As you finalize your canvas, take the time to evaluate your key partnerships. Collaborations with insurance carriers, technology providers, and local businesses can enhance your service offerings and expand your reach. These partnerships can also provide valuable resources and expertise that you might not have in-house, allowing you to deliver superior value to your clients.

Additionally, closely monitor your cost structure and ensure that you are operating efficiently. Keeping your expenses in check while investing in growth opportunities can lead to improved profitability. This is especially important in a competitive landscape where margins can be tight.

Finally, remember that your Business Model Canvas is a dynamic tool that should evolve as your agency grows. Regularly revisiting and updating your canvas will help you stay aligned with your goals and responsive to changes in the market. By doing so, you will not only enhance your operational efficiency but also improve customer satisfaction and loyalty.

| Component | Description |

|---|---|

| Key Partnerships | Collaborations that enhance service offerings |

| Cost Structure | Expenses associated with running the agency |

Key Takeaway: Your Insurance Agency Business Model Canvas is a crucial tool for navigating the complexities of the insurance market. By clearly outlining your strategies and goals, you can set your agency on a path to success and sustainability.

“The best way to predict the future is to create it.” 🌟

Recommendations

In summary, creating a Business Model Canvas for your insurance agency is essential for understanding your business operations and strategizing for future growth. By clearly outlining your value propositions, customer segments, and revenue streams, you can set your agency up for success. For those looking for a structured approach to develop their agency further, consider using the Insurance Agency Business Plan Template. This template provides a comprehensive framework that can guide you through the process of planning and executing your business strategy effectively.

Additionally, here are some valuable articles related to Insurance Agency that you may find useful:

- Article 1 on Insurance Agency SWOT Analysis Essentials

- Article 2 on Insurance Agencies: How Profitable Can They Be?

- Article 3 on Insurance Agency Business Plan: Comprehensive Guide with Examples

- Article 4 on Insurance Agency Financial Plan: Essential Steps and Example

- Article 5 on Starting an Insurance Agency: A Comprehensive Guide with Examples

- Article 6 on Create a Marketing Plan for Your Insurance Agency (+ Example)

- Article 7 on Customer Segments for Insurance Agencies: Examples and Analysis

- Article 8 on How Much Does It Cost to Operate an Insurance Agency?

- Article 9 on What Are the Steps for a Successful Insurance Agency Feasibility Study?

- Article 10 on What Are the Key Steps for Risk Management in Insurance Agency?

- Article 11 on What Are the Steps for a Successful Insurance Agency Competition Study?

- Article 12 on How to Navigate Legal Considerations in Insurance Agency?

- Article 13 on How to Secure Funding for Insurance Agency?

- Article 14 on Insurance Agency Growth Strategies: Scaling Guide

FAQ

What is the insurance business model explained?

The insurance business model refers to the way an insurance agency operates to deliver value to its customers while generating revenue. It includes various components such as value propositions, customer segments, and revenue streams. Understanding this model is crucial for effectively managing your agency and ensuring profitability.

What are the components of an insurance agency business model?

The key components of an insurance agency business model include value propositions, which define what makes your services unique; customer segments, identifying your target market; channels for delivering your services; and revenue streams that outline how your agency earns money. Each component plays a vital role in shaping the overall strategy of your agency.

How do insurance agencies make money?

Insurance agencies primarily make money through commissions earned from the sale of insurance policies. They may also charge fees for additional services and earn income from renewals of existing policies. Understanding these revenue streams is essential for maintaining financial health and planning for future growth.

What is a business model canvas for insurance agents?

A business model canvas for insurance agents is a visual framework that outlines the essential components of an insurance agency’s operations. It includes sections for value propositions, customer segments, revenue streams, key activities, and more. This tool helps agents strategize and understand how their agency functions, making it easier to identify areas for improvement.

What are the key activities for insurance agents?

The key activities for insurance agents include marketing to attract new clients, providing customer service to retain existing clients, and managing claims processing to ensure timely and efficient service. These activities are crucial for the success and growth of an insurance agency.

What is the cost structure of an insurance agency?

The cost structure of an insurance agency includes fixed costs like rent and salaries, as well as variable costs such as marketing expenses and technology investments. Understanding these costs is essential for managing finances and ensuring profitability in a competitive market.