Did you know that a well-planned financial strategy can make or break the success of your hunting lodge? Hunting Lodge Financial Plan is not just a series of numbers; it’s the backbone of your business that can dictate whether you thrive or struggle. When you invest time in crafting a solid financial plan, you set the stage for growth and sustainability. In essence, a financial plan is a strategic outline that encompasses budgeting, forecasting, and managing your lodge’s financial resources to achieve your goals.

- Importance of a financial plan for hunting lodges

- Key components of an effective financial plan

- Steps to create a comprehensive financial strategy

- Examples of successful hunting lodge financial plans

- Tips for managing operational costs

- Revenue generation ideas for hunting lodges

- Tools and resources for financial planning

- Common pitfalls to avoid in financial planning

- Importance of regular financial reviews

- Case studies of successful lodges

Understanding the Importance of a Financial Plan

A financial plan is crucial for any business, especially for a hunting lodge. It serves as a roadmap, guiding you through your income and expenses while helping you make informed decisions. Without a solid financial plan, you might find yourself struggling to manage costs or capitalize on revenue opportunities.

For example, consider a lodge that has no clear financial strategy. They might overspend on marketing or fail to account for seasonal fluctuations in guest bookings. This could lead to a cash flow crisis, ultimately jeopardizing the lodge’s future. On the flip side, a well-structured financial plan allows you to identify potential revenue streams, manage expenses, and maintain a healthy cash flow.

In summary, understanding the significance of a financial plan is the first step towards building a successful hunting lodge. As we delve deeper into this topic, we’ll explore the essential components of a financial plan that can help you achieve your lodge’s goals.

| Key Aspect | Description |

|---|---|

| Financial Roadmap | Guides income and expenses |

| Decision-Making | Informs business decisions |

| Revenue Opportunities | Identifies potential revenue streams |

| Cash Flow Management | Ensures healthy cash flow |

- A financial plan is essential for success.

- It serves as a roadmap for your lodge.

- Helps in managing income and expenses…

– “A goal without a plan is just a wish.”

Key Components of a Financial Plan

When crafting a financial plan, several key components should be included. These components will ensure that your plan is comprehensive and addresses all aspects of your hunting lodge’s financial health. From budgeting to forecasting, each element plays a vital role in your lodge’s financial success.

For instance, a detailed budget that outlines your operational costs, marketing expenses, and expected revenue will give you a clear picture of your financial landscape. Additionally, financial forecasting helps you anticipate future earnings and expenses, allowing you to adjust your strategies as needed. Understanding these components will empower you to make better financial decisions for your lodge.

In conclusion, knowing the key components of a financial plan is essential for effective management of your hunting lodge’s finances. In the next section, we will explore actionable steps to create a financial plan tailored to your lodge’s unique needs.

- Create a detailed budget.

- Develop financial forecasts.

- Monitor cash flow regularly.

- Set financial goals.

- Review and adjust your plan periodically.

– The above steps must be followed rigorously for optimal success.

Steps to Create a Comprehensive Financial Plan

Creating a comprehensive financial plan involves several steps that require careful consideration. Start by gathering all relevant financial data, including previous years’ income statements, expense reports, and market analysis. This foundational information will inform your budgeting and forecasting processes.

Next, engage in a thorough analysis of your lodge’s financial health. Identify areas where you can cut costs or improve efficiency. For example, if you notice high maintenance expenses, consider investing in preventive measures to reduce long-term costs. This proactive approach can significantly impact your bottom line.

Finally, document your financial plan in a clear and organized manner. This document should serve as a reference point for decision-making and strategy adjustments. As we move forward, we’ll look at practical examples of successful financial plans in the hunting lodge industry.

- Gather relevant financial data.

- Analyze your lodge’s financial health.

- Document your financial plan…

– “Planning is bringing the future into the present.”

Practical Examples of Successful Financial Plans

Looking at successful financial plans can provide invaluable insights into effective strategies for your hunting lodge. Many lodges have implemented unique financial strategies that cater to their specific operational needs and target audience.

For instance, one lodge utilized a tiered pricing model, adjusting rates based on seasonality and demand. This approach allowed them to maximize occupancy during peak times while still attracting guests during the off-season. Analyzing such examples can inspire you to develop creative financial strategies tailored to your lodge.

In summary, examining practical examples of successful financial plans can offer valuable lessons for your hunting lodge. The next section will explore tools and resources that can assist you in crafting your financial plan.

| Lodge Name | Strategy Used |

|---|---|

| Lodge A | Tiered pricing model |

| Lodge B | Seasonal package deals |

| Lodge C | Membership and loyalty programs |

- Research successful lodges for inspiration.

- Analyze their financial strategies.

- Adapt their ideas to fit your lodge…

– “Planning is bringing the future into the present.”

Tools and Resources for Financial Planning

In today’s digital age, there are numerous tools and resources available to assist you in creating a financial plan for your hunting lodge. From budgeting software to financial forecasting tools, these resources can simplify the process and enhance accuracy.

For example, using software like QuickBooks or FreshBooks can help you track expenses and manage invoices efficiently. Additionally, financial modeling tools can assist in forecasting revenue and expenses, allowing for more informed decision-making. Leveraging these tools can save you time and reduce stress in managing your lodge’s finances.

In conclusion, utilizing the right tools and resources can significantly streamline the financial planning process for your hunting lodge. In the next section, we’ll discuss common pitfalls to avoid in financial planning.

| Tool Name | Purpose |

|---|---|

| QuickBooks | Expense tracking and invoicing |

| FreshBooks | Financial management for small businesses |

| Excel/Google Sheets | Custom financial modeling and forecasting |

- Explore budgeting software options.

- Consider financial forecasting tools.

- Utilize online resources for best practices…

Common Pitfalls in Financial Planning

While crafting a financial plan, it’s crucial to be aware of common pitfalls that can derail your efforts. Many lodge owners make the mistake of underestimating expenses or failing to account for unexpected costs, which can lead to financial strain.

Another common mistake is neglecting to regularly review and adjust the financial plan. As market conditions change, so should your strategies. For instance, if you notice a decline in bookings during certain months, it may be time to reassess your pricing or marketing strategies. Ignoring these changes can result in missed opportunities for revenue enhancement.

In summary, being aware of these common pitfalls can help you avoid significant financial missteps. The next section will delve into the importance of regular financial reviews and adjustments, which are essential for maintaining the health of your hunting lodge.

| Pitfall | Consequence |

|---|---|

| Underestimating expenses | Financial strain |

| Neglecting reviews | Missed opportunities for adjustments |

| Ignoring market changes | Outdated strategies |

- Be cautious of underestimating expenses.

- Schedule regular financial reviews.

- Stay informed about market trends…

The Importance of Regular Financial Reviews

Regular financial reviews are essential for maintaining the health of your hunting lodge. These reviews allow you to assess the effectiveness of your financial strategies and make necessary adjustments. Ignoring this practice can lead to financial mismanagement.

For example, conducting quarterly reviews can help you identify trends in revenue and expenses. If you notice a drop in bookings, you can quickly pivot your marketing strategy to address the issue. This proactive approach can prevent small issues from becoming significant financial problems that could jeopardize your lodge’s operations.

In conclusion, prioritizing regular financial reviews is vital for the long-term success of your hunting lodge. By continually assessing your financial health, you can make informed decisions that will support your lodge’s growth and sustainability. In the final section, we’ll summarize the key points and provide actionable recommendations for your financial plan.

| Benefit | Description |

|---|---|

| Trend Identification | Helps spot revenue and expense trends |

| Proactive Adjustments | Enables quick strategy pivots |

| Long-term Planning | Supports sustained financial health |

- Schedule regular financial reviews.

- Analyze trends in income and expenses.

- Adjust strategies as necessary…

Actionable Recommendations for Your Financial Plan

As we wrap up our discussion on crafting a financial plan for your hunting lodge, here are some actionable recommendations to keep in mind. Implementing these strategies can enhance your financial management and ensure your lodge’s success.

First, be diligent in tracking all income and expenses. This will provide you with a clear picture of your financial health. Additionally, don’t hesitate to seek professional advice if needed. Consulting with a financial advisor can provide insights that you may not have considered, helping you make more informed decisions.

Finally, remember that a financial plan is not a one-time task but an ongoing process. Regularly review and adjust your strategies to adapt to changing market conditions. As we conclude, let’s look at some final thoughts and a motivating call to action.

| Recommendation | Description |

|---|---|

| Track income and expenses | Maintain a clear financial overview |

| Seek professional advice | Gain insights from financial experts |

| Regularly review plans | Ensure your strategies remain effective |

- Keep meticulous financial records.

- Consult with financial professionals.

- Regularly revisit and adjust your financial plan…

Final Thoughts on Crafting Your Financial Plan

Crafting a financial plan for your hunting lodge is not just a task; it’s a commitment to your lodge’s future success. By understanding the importance of financial planning and implementing effective strategies, you can ensure your lodge thrives in a competitive market.

Remember, the journey of financial planning is ongoing. Regular reviews, adjustments, and a willingness to adapt are essential for navigating the challenges that come your way. With a solid financial plan in place, you can focus on what you love most—providing unforgettable experiences for your guests.

In conclusion, take action today to craft your financial plan. The future of your hunting lodge depends on the decisions you make now.

– “Success comes to those who persevere.”

- Start creating your financial plan today.

- Regularly review and adjust as needed.

- Don’t hesitate to seek professional advice…

Conclusion

In summary, crafting a financial plan for your hunting lodge is essential for ensuring its success and sustainability. By understanding the key components of a financial plan, utilizing effective tools, and being aware of common pitfalls, you can create a strategy that not only helps manage your finances but also positions your lodge for growth. Remember, a well-structured financial plan is a living document that requires regular reviews and adjustments.

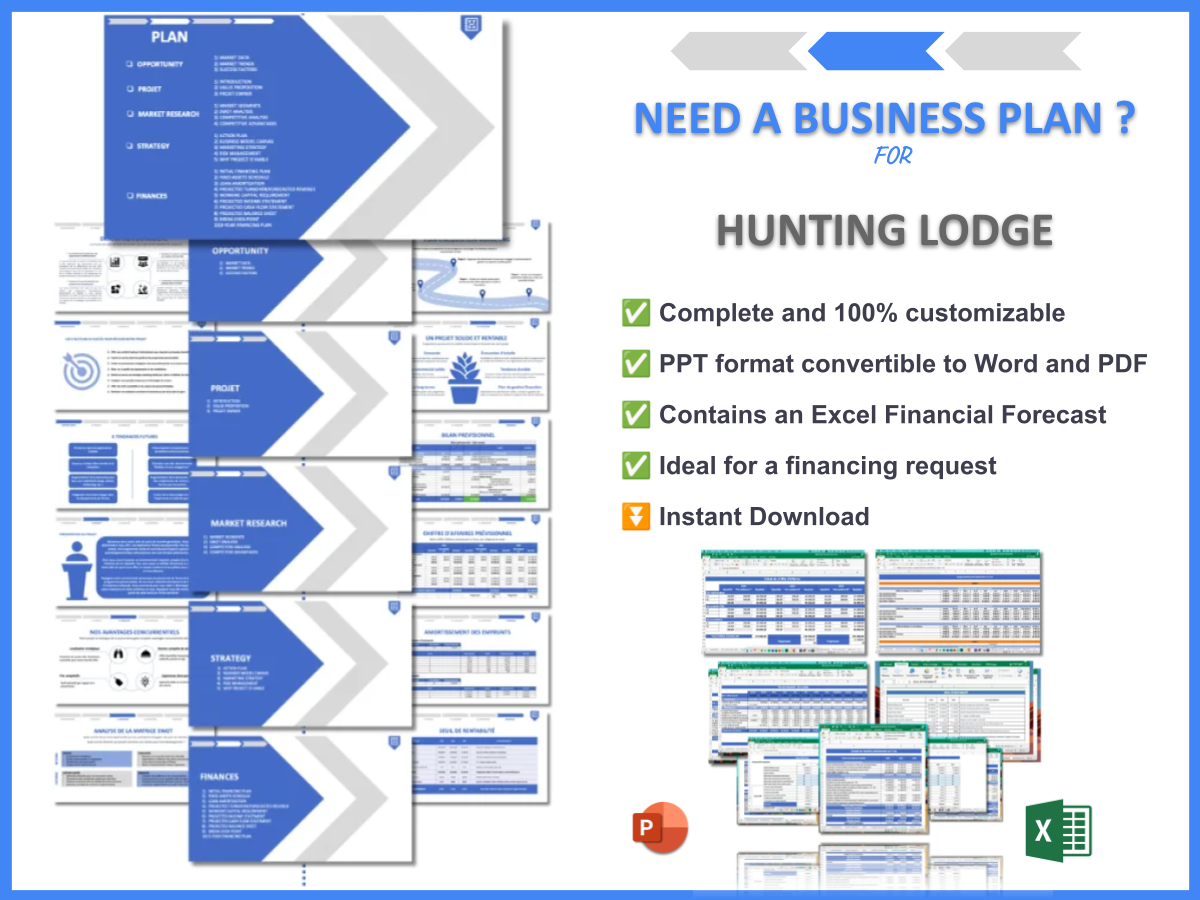

For those looking to take the next step, consider using a Hunting Lodge Business Plan Template to streamline your planning process.

Additionally, you may find these articles beneficial as you further develop your knowledge and strategies for your hunting lodge:

- Article 1: SWOT Analysis for Hunting Lodge: Achieving Market Dominance

- Article 2: Hunting Lodge Profitability: What You Need to Know

- Article 3: Developing a Business Plan for Your Hunting Lodge: Comprehensive Guide

- Article 4: Building a Hunting Lodge: A Detailed Guide

- Article 5: Building a Hunting Lodge Marketing Plan: Strategies and Example

- Article 6: Building a Business Model Canvas for a Hunting Lodge: A Comprehensive Guide

- Article 7: Identifying Customer Segments for Hunting Lodges: Examples and Strategies

- Article 8: How Much Does It Cost to Establish a Hunting Lodge?

- Article 9: How to Start a Feasibility Study for Hunting Lodge?

- Article 10: How to Start Risk Management for Hunting Lodge?

- Article 11: Hunting Lodge Competition Study: Detailed Insights

- Article 12: What Are the Key Legal Considerations for Hunting Lodge?

- Article 13: Hunting Lodge Funding Options: Detailed Analysis

- Article 14: Hunting Lodge Growth Strategies: Scaling Success Stories

FAQ

What is a hunting lodge financial plan?

A hunting lodge financial plan is a strategic document that outlines budgeting, forecasting, and financial management practices specific to the operation of a hunting lodge.

Why is a financial plan important for a hunting lodge?

A financial plan is vital for managing income and expenses effectively, identifying revenue opportunities, and ensuring long-term sustainability for your lodge.

What key components should be included in a hunting lodge financial plan?

Key components include a detailed budget, financial forecasts, cash flow management, and clearly defined financial goals.

How can I create a financial plan for my hunting lodge?

Start by gathering all relevant financial data, analyzing your lodge’s financial health, and documenting your financial strategies in a clear format.

What tools can assist in financial planning for a hunting lodge?

Tools such as QuickBooks, FreshBooks, and Excel can help streamline budgeting and financial forecasting processes.

What are common pitfalls in financial planning for hunting lodges?

Common pitfalls include underestimating expenses, neglecting regular financial reviews, and failing to adapt strategies based on market changes.

How often should I review my hunting lodge financial plan?

Regular reviews should be conducted at least quarterly to assess financial health and make necessary adjustments.

What are some revenue generation ideas for hunting lodges?

Consider implementing package deals, seasonal discounts, and loyalty programs to attract and retain guests.

How can I ensure my financial plan is effective?

Regularly track all income and expenses, seek professional advice when necessary, and remain flexible to adjust to changing circumstances.

What should I do if my lodge is experiencing financial difficulties?

Analyze your financial data, identify problem areas, and consider consulting with a financial advisor for tailored solutions.