The grocery industry is booming, with sales expected to reach unprecedented levels in the coming years. But here’s the kicker: many aspiring grocery store owners struggle to find the right Grocery Store Funding Options to kickstart their dreams. Grocery Store Funding Options can be your lifeline to establishing a successful business. In this article, we’ll dive into the various funding avenues available, from loans to grants, and provide insights to help you make informed decisions.

Funding options for grocery stores can be diverse and tailored to meet unique business needs. They encompass a range of financial resources designed to support your grocery venture, whether you’re starting from scratch or looking to expand an existing operation. By understanding these options, you can strategically position your grocery store for success.

- Overview of grocery store funding options

- Importance of financial planning

- Types of loans available

- Grants and their benefits

- Crowdfunding as a funding source

- Equipment and inventory financing

- Angel investors and venture capital

- Government programs for grocery stores

- Real-life success stories

- Tips for securing funding

Understanding the Landscape of Grocery Store Funding

Funding a grocery store can feel overwhelming at first, especially with so many options available. In this section, we’ll take a closer look at the landscape of grocery store funding, breaking down the primary avenues you can explore. Each funding option comes with its pros and cons, and understanding these will help you navigate your choices.

For instance, small business loans are a popular choice for many grocery store owners. They can provide the capital needed for inventory, equipment, and operational expenses. However, securing a loan often requires a solid business plan and good credit history. On the other hand, grants can be a fantastic option since they don’t require repayment, but they often come with strict eligibility criteria and can be highly competitive.

Ultimately, the right funding option for you will depend on your specific business goals and financial situation. As we move forward, you’ll gain insights into various funding sources and how to leverage them effectively.

| Funding Option | Key Considerations |

|---|---|

| Small Business Loans | Credit requirements |

| Grants | Eligibility criteria |

| Crowdfunding | Marketing efforts |

| Angel Investors | Equity sharing |

- Small business loans require a solid business plan.

- Grants offer funds without repayment.

- Crowdfunding needs strong marketing strategies.

– “Every financial challenge is an opportunity for growth.”

The Power of Small Business Loans

When it comes to grocery store funding options, small business loans are often the go-to choice. These loans can provide significant capital, enabling you to cover startup costs, manage operational expenses, and invest in marketing strategies. But what should you know before applying for a loan?

There are various types of loans available, including traditional bank loans, SBA loans, and online lenders. Each type has its own requirements and terms, so it’s crucial to research and find the best fit for your needs. For example, SBA loans are backed by the government, making them more accessible to new business owners, but they may require extensive documentation.

Statistics show that around 75% of small business owners rely on loans to fund their operations. This highlights the importance of understanding the loan landscape and preparing to present a strong application.

- Research different loan options.

- Prepare a solid business plan.

- Gather necessary documentation.

- Apply for the loan that suits your needs.

– Following these steps will enhance your chances of securing funding.

Grants as a Viable Funding Source

Grants can be a game-changer for grocery store owners. Unlike loans, grants do not require repayment, making them an attractive funding source. However, securing a grant can be competitive and often comes with specific requirements.

There are various types of grants available for grocery stores, including those focused on community development, sustainability, and food access initiatives. These grants can provide funds for specific projects, such as expanding your product line or improving energy efficiency in your store.

For instance, the USDA offers grants aimed at enhancing food access in underserved areas. By applying for such grants, you not only secure funding but also contribute to your community’s well-being.

- Grants provide non-repayable funds.

- Various grants target different needs.

- Applications can be competitive.

– “Grants are a pathway to making your grocery store dreams a reality.”

Crowdfunding for Grocery Store Ventures

In recent years, crowdfunding has emerged as a popular funding option for many entrepreneurs, including grocery store owners. This method involves raising small amounts of money from a large number of people, often through online platforms.

Crowdfunding can be particularly effective if you have a compelling story or unique product offering. Platforms like Kickstarter and Indiegogo allow you to showcase your grocery store concept and attract potential backers. However, successful crowdfunding campaigns require strategic marketing and engagement with your audience.

Statistics indicate that nearly 40% of crowdfunding campaigns reach their funding goals. This highlights the potential of this funding avenue if executed effectively.

- Create a compelling campaign.

- Utilize social media for promotion.

- Engage with backers throughout the process.

– These strategies will help maximize your crowdfunding success.

The Role of Angel Investors

Angel investors can be an excellent source of funding for grocery store entrepreneurs looking for capital and guidance. These individuals typically invest their own money in exchange for equity in your business. While this means giving up a portion of ownership, the benefits can outweigh the costs.

Angel investors often bring valuable industry experience and connections, which can be instrumental in your grocery store’s growth. However, attracting an angel investor requires a strong business plan and the ability to pitch your vision effectively.

Many successful grocery stores have leveraged angel investments to scale their operations and expand their product offerings. By aligning with the right investors, you can unlock significant capital and mentorship opportunities.

| Advantages of Angel Investors | Considerations |

|---|---|

| Capital infusion | Equity dilution |

| Industry expertise | High expectations |

- Find investors who align with your vision.

- Prepare a compelling pitch.

– “Partnering with the right investor can elevate your grocery store to new heights.”

Navigating Government Programs and Support

Government programs can provide crucial support for grocery store owners seeking funding. Various federal, state, and local initiatives offer financial assistance tailored to the needs of small businesses.

These programs often focus on promoting economic development, food security, and access to healthy food options. By researching available government funding opportunities, you can tap into resources that align with your grocery store’s mission.

For instance, the USDA’s Food and Nutrition Service offers grants to improve access to healthy food in low-income communities. Understanding these programs and their requirements can help you secure valuable funding.

- Research local government initiatives.

- Identify programs that align with your goals.

- Prepare necessary documentation for applications.

– Accessing government funding can significantly impact your business.

Learning from Successful Grocery Entrepreneurs

One of the best ways to understand grocery store funding options is to learn from real-life success stories. Many entrepreneurs have successfully navigated the funding landscape, utilizing various options to grow their businesses.

For example, a local grocery store in my area started with a small loan and expanded through grants and crowdfunding. By diversifying their funding sources, they were able to create a community hub that thrives today.

These stories inspire and provide practical insights into how to approach funding your grocery store. They remind us that with determination and the right strategy, success is within reach.

- Research success stories in your area.

- Apply lessons learned to your funding strategy.

– “Every success story begins with a leap of faith.”

Exploring Alternative Financing Options

In addition to traditional funding sources, there are several alternative financing options available for grocery store owners. These options can provide flexibility and help you meet your financial needs without relying solely on banks or conventional lenders.

One popular alternative is a business line of credit. This option allows you to borrow funds as needed, making it ideal for managing cash flow fluctuations. Another alternative is merchant cash advances, which provide quick funding based on your future sales, though they often come with higher fees.

Exploring these alternative financing options can help you find a solution that fits your unique business model and financial situation. It’s essential to weigh the pros and cons of each option to determine the best fit for your grocery store.

- Consider a business line of credit for flexibility.

- Evaluate merchant cash advances for quick access to funds.

- Research local community development financial institutions.

– “Innovation in financing can lead to new opportunities.”

Practical Tips for Securing Funding

Securing funding for your grocery store doesn’t have to be a daunting task. With the right approach and preparation, you can increase your chances of success. Start by developing a comprehensive business plan that outlines your goals, target market, and financial projections.

Networking is also crucial. Attend local business events, join industry associations, and connect with other grocery store owners to learn from their experiences. Building relationships can open doors to funding opportunities that you might not have considered.

Finally, be persistent. The funding landscape can be competitive, and it may take time to find the right fit for your grocery store. Keep refining your approach and stay informed about new funding options that may arise.

- Develop a comprehensive business plan.

- Network with other entrepreneurs.

- Stay persistent in your search for funding.

– “Success often comes to those who refuse to give up.”

Conclusion

In summary, navigating the landscape of grocery store funding options can be daunting, but with the right knowledge and strategy, you can find the perfect funding sources for your business. Whether you choose loans, grants, crowdfunding, or angel investors, understanding your options is crucial for success. Don’t hesitate to explore these avenues and take action on your grocery store dreams today!

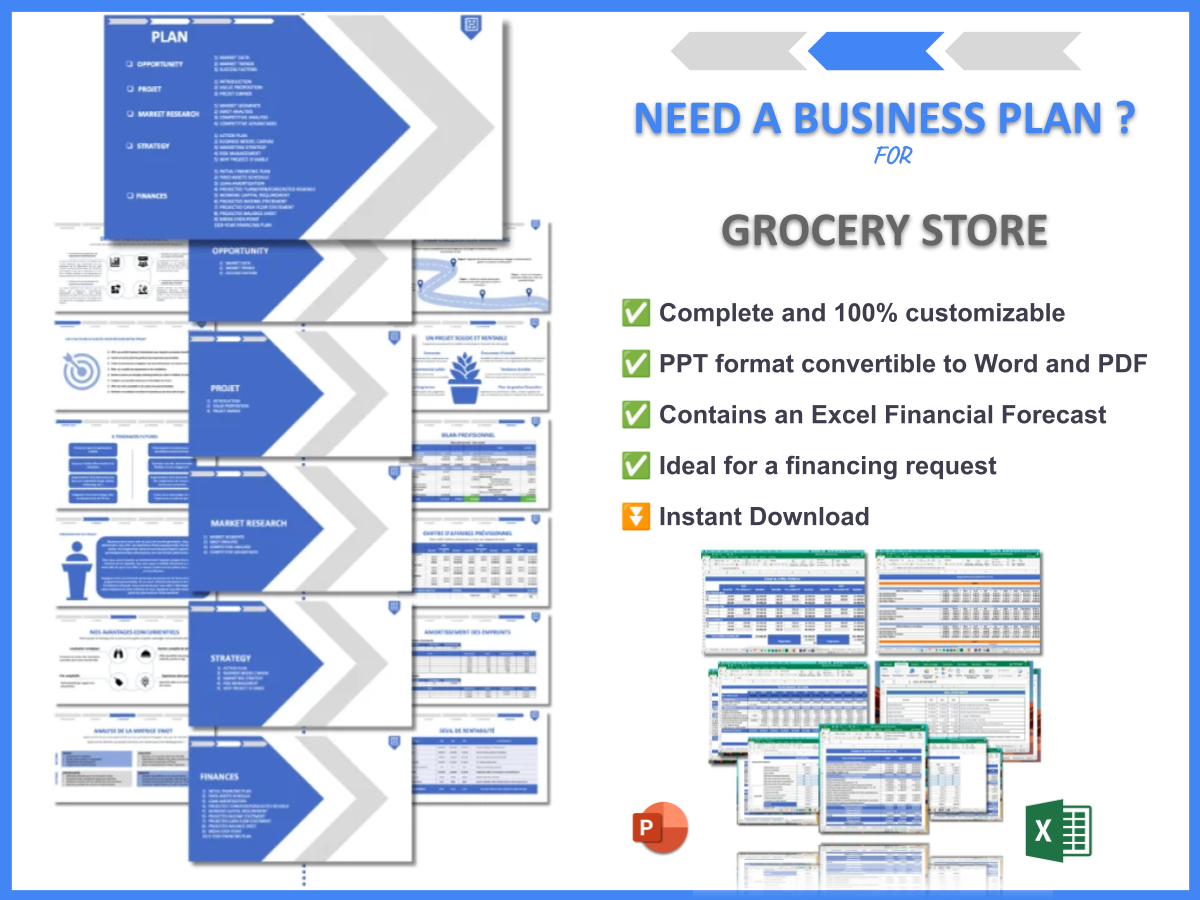

To assist you in developing a solid foundation for your grocery store, consider using the Grocery Store Business Plan Template. It can help you outline your business strategy effectively.

Additionally, check out these helpful articles to further your knowledge on managing and growing your grocery store:

- Grocery Store SWOT Analysis – Key Insights Revealed

- Grocery Store Business Plan: Template and Tips

- Grocery Store Financial Plan: Step-by-Step Guide with Template

- How to Start a Grocery Store: A Detailed Guide with Examples

- Crafting a Grocery Store Marketing Plan: Strategies and Examples

- How to Begin Crafting a Business Model Canvas for Your Grocery Store

- Grocery Store Customer Segments: Tips and Examples for Success

- Grocery Stores: Unlocking Profit Potential

- How Much Does It Cost to Operate a Grocery Store?

- Grocery Store Feasibility Study: Detailed Analysis

- How to Build a Competition Study for Grocery Store?

- Gourmet Grocery Store Risk Management: Detailed Analysis

- Grocery Store Legal Considerations: Expert Analysis

- How to Scale Grocery Store: Proven Growth Strategies

FAQ Section

What are the best funding options for grocery stores?

The best funding options for grocery stores include small business loans, grants, crowdfunding, and angel investors.

How can I apply for a grocery store grant?

To apply for a grocery store grant, research available grants, check eligibility requirements, and prepare a compelling application.

What are the requirements for small business loans?

Requirements for small business loans typically include a solid business plan, good credit history, and necessary documentation.

How does crowdfunding work for grocery stores?

Crowdfunding involves raising small amounts of money from a large number of people, often through online platforms.

What are angel investors looking for?

Angel investors usually seek strong business plans, potential for growth, and a compelling pitch.

Are there government grants for grocery stores?

Yes, various government programs provide grants to support grocery stores, especially in underserved areas.

What is inventory financing?

Inventory financing is a type of loan that allows businesses to borrow against their inventory to fund operations.

How can I find local funding sources?

You can find local funding sources by researching local economic development programs, community banks, and business incubators for funding opportunities.

What role do community development financial institutions play?

Community development financial institutions provide financing and support to small businesses, including grocery stores, particularly in low-income areas.

What steps should I take if I want to start a grocery store?

To start a grocery store, develop a solid business plan, explore funding options, and engage with your community for support.