Did you know that nearly 60% of new grocery stores fail within their first three years? That’s a staggering statistic that underscores the importance of having a solid grocery store financial plan in place. A grocery store financial plan is essentially a roadmap that outlines how your business will achieve its financial goals, manage its resources, and navigate the complexities of the retail market. In this guide, we will explore every aspect of creating a financial plan tailored to your grocery store, ensuring you’re equipped for success.

- Importance of a financial plan for grocery stores

- Key components of a grocery store financial plan

- Steps to create your financial plan

- Tools and templates available

- Common pitfalls to avoid

- Real-life examples of successful financial planning

- Tips for maintaining your financial plan

- How to adjust your plan over time

- The role of technology in financial planning

- Conclusion and next steps

Understanding the Importance of a Grocery Store Financial Plan

A grocery store financial plan isn’t just a document; it’s a critical tool for guiding your business decisions. It helps you understand where your money is coming from and where it’s going. Without a well-structured plan, you could find yourself in a financial mess before you even open your doors. For instance, when I first opened my grocery store, I thought I could wing it without a solid financial plan. But after a few months of struggling with cash flow, I realized how vital it was to have a detailed budget and financial projections. A financial plan can help forecast sales, manage inventory, and optimize operating costs.

In short, a financial plan is essential not just for startups but for established grocery stores looking to grow. The next section will delve into the key components that make up a successful grocery store financial plan.

| Key Component | Description |

| Budgeting | Outlining income and expenses |

| Forecasting | Predicting future sales and expenses |

| Cash Flow Management | Ensuring liquidity for daily operations |

| Inventory Management | Keeping track of stock and minimizing waste |

- Importance of having a financial plan

- Benefits of financial projections

- Role of cash flow management

– “A goal without a plan is just a wish.” – Antoine de Saint-Exupéry

Key Components of a Grocery Store Financial Plan

Now that we’ve established the importance of a financial plan, let’s break down its key components. A comprehensive grocery store financial plan typically includes budgeting, forecasting, cash flow management, and inventory management. Each of these elements plays a crucial role in ensuring your grocery store remains profitable and sustainable.

For example, budgeting allows you to allocate resources effectively. By analyzing past performance and market trends, you can create a realistic budget that reflects your grocery store’s needs. A solid forecast will help you predict seasonal fluctuations, enabling you to stock up on popular items during peak times and reduce inventory during slower months. Understanding these components will set a strong foundation for your financial planning process. The next section will discuss how to develop a step-by-step plan for your grocery store’s finances.

- Define your financial goals

- Analyze your current financial situation

- Create a detailed budget

- Develop sales forecasts

- Plan for cash flow management

The above steps must be followed rigorously for optimal success.

Developing a Step-by-Step Financial Plan

Developing a financial plan may seem daunting, but breaking it down into manageable steps can simplify the process. Start by defining your financial goals, such as reaching a specific revenue target or achieving a certain profit margin. For instance, when I set my revenue target for the first year, I based it on market research and my projected customer base.

Next, analyze your current financial situation by reviewing your existing assets, liabilities, and cash flow. This analysis will provide a clearer picture of where you stand financially. With these insights, you can create a detailed budget that includes projected income and expenses. This step is vital to understanding how much you can spend and where you can cut costs if necessary. The next section will focus on the tools and templates that can assist you in this process.

- Define clear financial goals

- Analyze current financial status

- Create a comprehensive budget

– “Planning is bringing the future into the present.” – Alan Lakein

Tools and Templates for Financial Planning

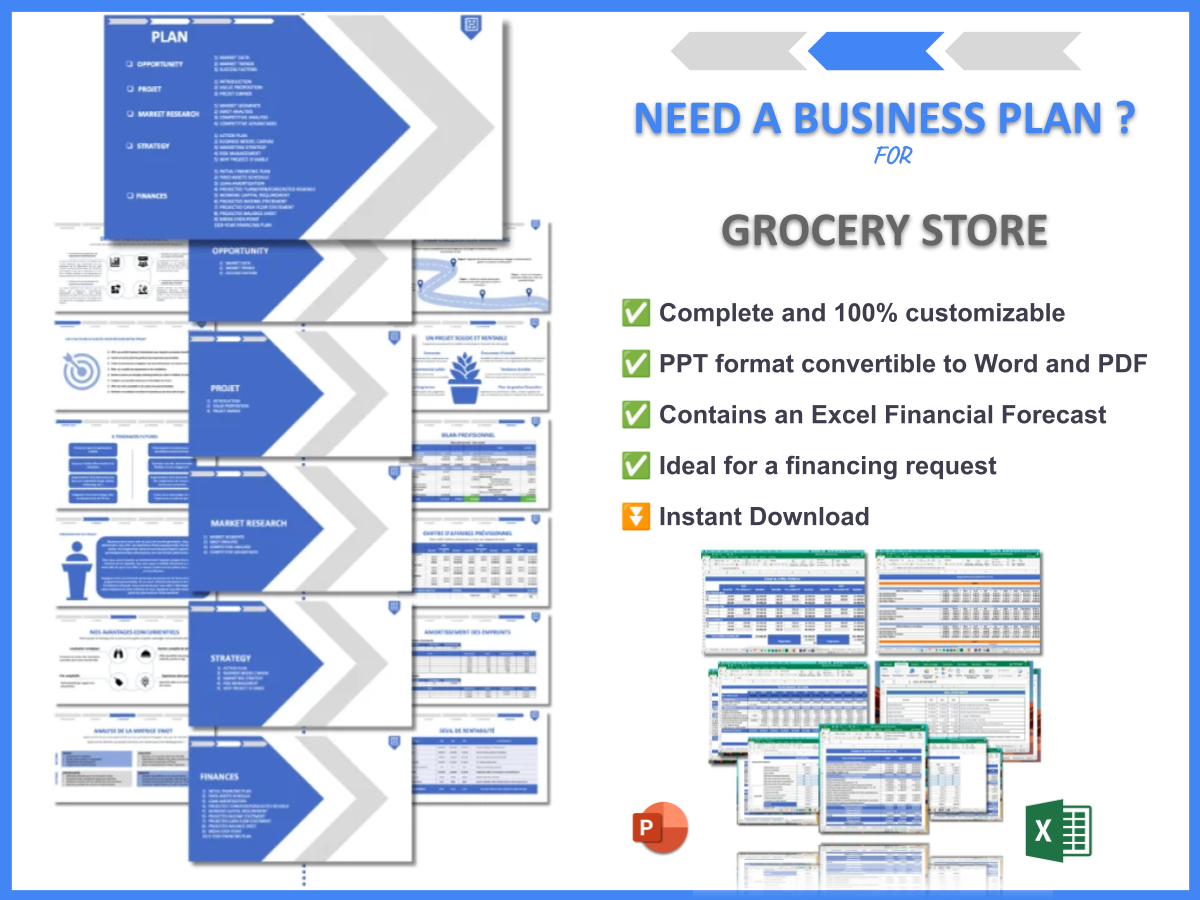

Luckily, you don’t have to start from scratch when creating your grocery store financial plan. There are numerous tools and templates available that can streamline the process and help you stay organized. From budgeting software to Excel templates, these resources can save you time and reduce errors.

For instance, I found that using financial management software helped me track expenses and generate reports quickly. Many of these tools also offer forecasting features, which can be incredibly helpful for predicting future sales and expenses based on historical data. Utilizing these tools can make your financial planning more efficient and less stressful. In the next section, we’ll discuss common pitfalls to avoid when creating your financial plan.

| Tool/Template | Description |

| Budgeting Software | Helps track income and expenses |

| Excel Templates | Customizable spreadsheets for financial planning |

| Financial Management Apps | Mobile solutions for on-the-go financial tracking |

- Research available tools

- Choose the right software for your needs

- Download or create templates for budgeting

– “Planning is bringing the future into the present.” – Alan Lakein

Common Pitfalls to Avoid in Financial Planning

Even with a solid plan, it’s easy to fall into common traps that can derail your financial success. One of the biggest mistakes is underestimating expenses, which can lead to cash flow problems. It’s crucial to account for all potential costs, including hidden ones like utilities and maintenance.

Additionally, failing to revisit and adjust your financial plan regularly can also be detrimental. I learned the hard way that market conditions change, and what worked last year might not be effective now. Keeping your financial plan dynamic and adaptable is key to long-term success. In the next section, we’ll explore how to maintain and adjust your financial plan over time to ensure it continues to serve your grocery store effectively.

| Common Pitfall | Consequence |

| Underestimating expenses | Cash flow problems |

| Not adjusting the plan | Inefficiency and missed opportunities |

- Conduct regular reviews of your financial plan

- Be thorough in estimating expenses

- Stay informed about market trends

Maintaining and Adjusting Your Financial Plan

Maintaining your grocery store financial plan is just as important as creating it. Regular reviews can help you identify any discrepancies and ensure you’re on track to meet your financial goals. I recommend scheduling quarterly reviews to assess your progress and make necessary adjustments.

For instance, if you notice a consistent dip in sales during a particular season, you may need to revise your marketing strategy or diversify your product offerings. Keeping an eye on your cash flow is also crucial; if you see a pattern of late payments from suppliers, you might need to renegotiate terms or find alternative suppliers. By proactively managing your financial plan, you can adapt to changes and continue to thrive. The next section will highlight the role of technology in financial planning for grocery stores.

| Action | Purpose |

| Schedule quarterly reviews | Assess progress and make adjustments |

| Monitor cash flow | Ensure liquidity and manage expenses |

- Set review dates in your calendar

- Analyze sales data regularly

- Adjust budgets as needed

The Role of Technology in Financial Planning

Technology has transformed how grocery stores manage their finances. With various software solutions available, you can automate budgeting, forecasting, and reporting tasks, which saves time and reduces errors. Embracing technology can significantly enhance your financial planning efforts and streamline operations.

For example, I began using cloud-based accounting software that allowed me to access my financial data from anywhere, making it easier to make informed decisions on the go. Additionally, many of these tools integrate with point-of-sale systems, providing real-time insights into sales performance. In the next section, we’ll discuss how to prepare for the future of your grocery store through effective financial planning.

| Technology | Benefits |

| Accounting Software | Automates financial tasks and provides insights |

| Point-of-Sale Integration | Real-time sales data for better decision-making |

- Research and select appropriate software

- Train staff on new systems

- Regularly update technology tools

Preparing for the Future of Your Grocery Store

A forward-thinking grocery store owner must prepare for the future. This involves not just maintaining your current financial plan but also anticipating market trends and changes in consumer behavior. For instance, I noticed a growing trend towards online grocery shopping. By adapting my financial plan to allocate resources for an e-commerce platform, I was able to capture a new customer base.

This kind of adaptability is crucial for long-term success. You need to stay informed about the latest trends in the grocery industry, whether it’s shifts in customer preferences or new technologies that can enhance your operations. As we conclude this guide, remember that your grocery store financial plan should be a living document that evolves with your business and the market landscape. The final section will provide key recommendations to keep in mind as you implement your plan.

| Future Consideration | Strategy |

| E-commerce growth | Allocate budget for online sales |

| Consumer trends | Regularly research and adapt to changes |

- Monitor market trends

- Stay flexible in your planning

- Invest in new opportunities

Key Recommendations for Successful Financial Planning

As we wrap up, let’s revisit some key recommendations for ensuring your grocery store financial plan is successful. Always start with a clear understanding of your goals and current financial situation. This means taking the time to assess your operating costs, understanding your profit margins, and identifying any areas where you can improve efficiency.

Additionally, don’t forget the importance of regular reviews and adjustments. If something isn’t working, don’t be afraid to change your approach. Practical advice is to involve your team in the financial planning process; their insights can be invaluable. By following these recommendations and leveraging the tools available to you, you can build a robust financial plan that sets your grocery store up for success.

– “Success is the sum of small efforts, repeated day in and day out.” – Robert Collier

- Set clear financial goals

- Regularly review and adjust your plan

- Involve your team in the process

Conclusion

In summary, a comprehensive grocery store financial plan is essential for navigating the complexities of the retail market and ensuring long-term success. By understanding the key components, utilizing available tools, and maintaining flexibility, you can create a plan that adapts to your store’s needs. To assist you in this process, consider using the Grocery Store Business Plan Template which can provide a solid foundation for your planning efforts.

Additionally, we invite you to explore more insightful articles related to your grocery store journey:

- Grocery Store SWOT Analysis – Key Insights Revealed

- Grocery Stores: Unlocking Profit Potential

- Grocery Store Business Plan: Template and Tips

- How to Start a Grocery Store: A Detailed Guide with Examples

- Crafting a Grocery Store Marketing Plan: Strategies and Examples

- How to Begin Crafting a Business Model Canvas for Your Grocery Store

- Grocery Store Customer Segments: Tips and Examples for Success

- How Much Does It Cost to Operate a Grocery Store?

- Grocery Store Feasibility Study: Detailed Analysis

- Gourmet Grocery Store Risk Management: Detailed Analysis

- How to Build a Competition Study for Grocery Store?

- Grocery Store Legal Considerations: Expert Analysis

- What Are the Best Funding Options for Grocery Store?

- How to Scale Grocery Store: Proven Growth Strategies

FAQ

What is a grocery store financial plan?

A grocery store financial plan is a strategic document that outlines how a grocery store will manage its finances to achieve its goals, including budgeting, forecasting, and cash flow management.

Why is budgeting important for a grocery store?

Budgeting helps grocery stores allocate resources effectively, ensuring that they can cover expenses and invest in growth opportunities.

How can I forecast sales for my grocery store?

Sales forecasting can be done by analyzing past sales data, understanding market trends, and considering seasonal fluctuations in consumer behavior.

What tools are available for grocery store financial planning?

There are many tools available, including budgeting software, Excel templates, and financial management apps that can automate and streamline the planning process.

How often should I review my financial plan?

It’s recommended to review your financial plan quarterly to ensure you’re on track and to make adjustments as necessary.

What are common pitfalls in grocery store financial planning?

Common pitfalls include underestimating expenses, failing to adjust the plan regularly, and not accounting for market changes.

How can technology help with financial planning?

Technology can automate budgeting, forecasting, and reporting, making it easier to manage finances and gain insights into sales performance.

What should I include in my grocery store budget?

Your grocery store budget should include all expected income, operating expenses, inventory costs, and any anticipated capital expenditures.

How can I ensure my financial plan is successful?

To ensure success, set clear financial goals, involve your team in the planning process, and remain flexible to adapt to changing circumstances.

What is the best way to prepare for economic changes?

Stay informed about market trends, regularly review your financial plan, and be ready to adjust your strategies to align with new economic conditions.