Finding the right Wellness Spa Funding Options can be a game-changer for aspiring spa owners. Did you know that nearly 70% of small businesses rely on some form of financing to get started? A wellness spa is no different; it requires significant investment upfront. But what exactly are these funding options? A wellness spa typically refers to a facility that offers various health and relaxation services, such as massages, facials, and holistic treatments. Here’s a quick rundown of what you’ll learn:

- The different funding options available for starting a wellness spa.

- How to create a solid business plan to attract investors.

- Tips on securing grants and loans.

- Real-life examples of successful spa funding strategies.

Let’s dive right into the details!

Understanding the Funding Landscape for Wellness Spas

Getting your wellness spa off the ground requires an understanding of the various funding options available. It’s not just about having a great idea; you need the capital to bring it to life. Many entrepreneurs are surprised to learn that there are numerous avenues to explore when it comes to financing their spa.

For example, traditional bank loans are a common choice, but they often come with strict requirements. You might need to provide a detailed business plan, proof of collateral, and a solid credit score. This can be a hurdle for many new entrepreneurs. On the other hand, alternative options like crowdfunding or angel investors can provide the necessary funds without the hefty interest rates or rigid repayment terms. The key is to evaluate what works best for your specific situation.

One of the significant advantages of exploring various funding options is the flexibility it offers. For instance, if you opt for a crowdfunding platform, you not only raise funds but also create a community around your brand before it even launches. This community can become your first set of loyal customers, providing a solid customer base from day one.

Here’s a summary of some common funding options:

| Funding Option | Description |

|---|---|

| Bank Loans | Traditional loans with set repayment terms. |

| SBA Loans | Loans backed by the Small Business Administration. |

| Crowdfunding | Raising small amounts from many people online. |

| Angel Investors | Wealthy individuals who invest in startups. |

| Grants | Funds that do not need to be repaid. |

- Key Points:

- Explore various funding avenues.

- Assess the pros and cons of each option.

- Tailor your funding strategy to your business model.

“Funding is not just about money; it's about building your dream.” 💡

In summary, understanding the landscape of wellness spa funding options can significantly impact your journey. By familiarizing yourself with the different types of financing available, you can make informed decisions that will help you secure the necessary funds to launch and sustain your spa. Each funding source comes with its own set of advantages and challenges, but being aware of them will empower you to choose the best path forward.

Crafting a Business Plan to Attract Investors

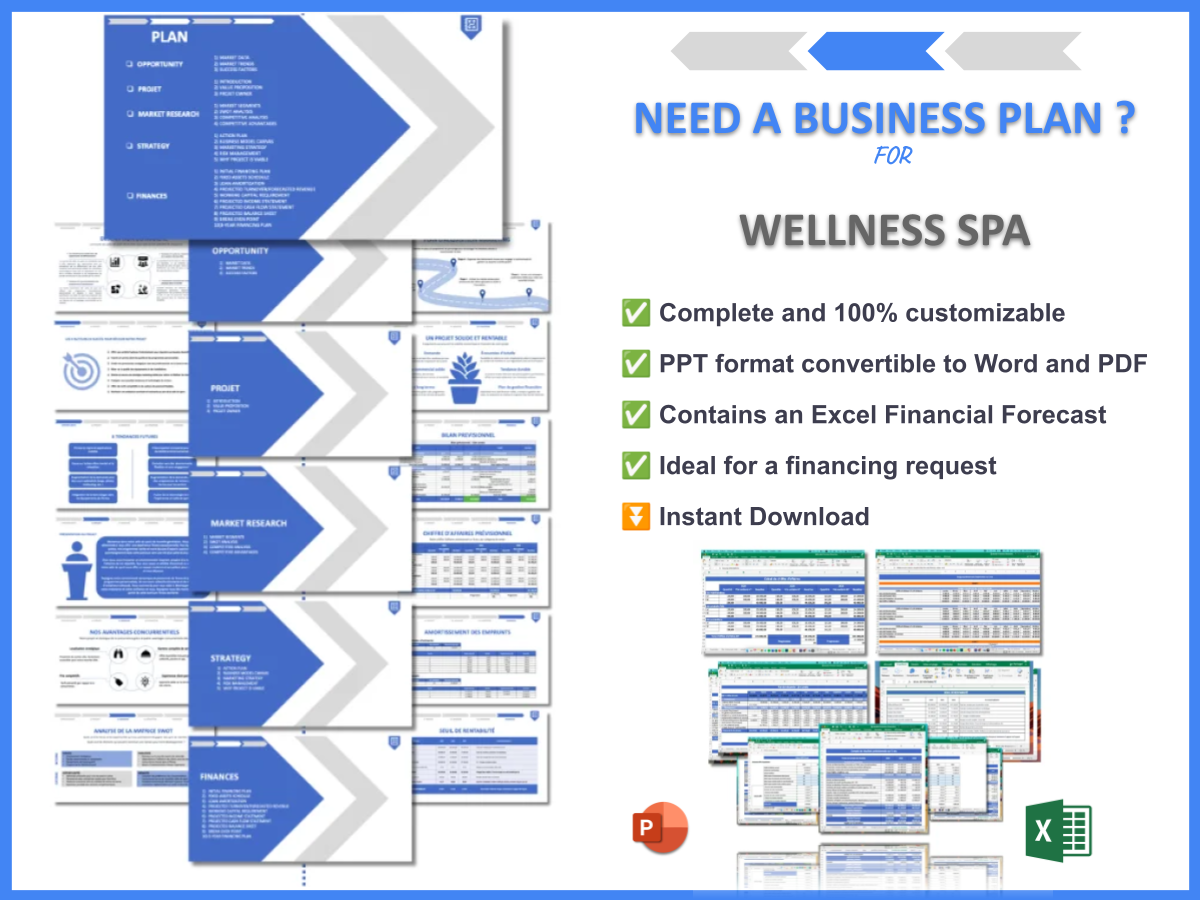

A solid business plan is your best friend when it comes to securing funding for your wellness spa. It serves as a roadmap for your spa and outlines your vision, target market, and financial projections. Investors want to see that you’ve done your homework and have a clear plan for success. Without a well-thought-out plan, even the best ideas can fall flat.

When I was looking to fund my first wellness venture, I spent countless hours perfecting my business plan. I included detailed market research, outlining my competitors and potential customer demographics. This research was crucial in helping me identify gaps in the market that my spa could fill. Additionally, I highlighted my unique selling proposition (USP) — what sets my spa apart from others. For instance, while many spas offered standard services, I decided to focus on holistic wellness, incorporating alternative therapies like aromatherapy and acupuncture. This differentiation not only attracted customers but also caught the attention of potential investors.

Here’s a quick checklist of what to include in your business plan:

| Business Plan Component | Description |

|---|---|

| Executive Summary | Overview of your business and goals. |

| Market Analysis | Research on your target audience and competitors. |

| Marketing Strategy | How you plan to attract customers. |

| Financial Projections | Expected income, expenses, and profitability. |

- Key Points:

- Invest time in creating a detailed business plan.

- Highlight your USP to stand out.

- Include financial projections to assure investors.

“A goal without a plan is just a wish.” 🌟

By crafting a comprehensive business plan, you not only clarify your vision but also enhance your credibility with potential investors. Remember, they are looking for assurance that their investment will yield returns. Therefore, being transparent about your plans and showing how you intend to achieve your goals can significantly boost your chances of securing funding.

Government Grants and Loans for Wellness Spas

One of the most attractive funding options for wellness spas is government grants and loans. These can provide significant financial support without the burden of repayment, especially if you meet specific criteria. For example, some grants are aimed at promoting health and wellness initiatives in communities. This means that if your spa has a mission aligned with improving public health, you may qualify for these funds.

To find these opportunities, you can start by visiting local government websites or looking into the Small Business Administration (SBA). They often have resources tailored to wellness businesses. When I discovered a local grant for wellness initiatives, it felt like winning the lottery. I was able to secure funds that allowed me to purchase equipment and market my services effectively. The best part? I didn’t have to pay back a dime!

Here’s a quick overview of potential government funding sources:

| Funding Source | Description |

|---|---|

| Local Government Grants | Funds for community health initiatives. |

| SBA Microloans | Smaller loans with favorable terms. |

| State-Specific Programs | Varies by state, focusing on wellness. |

- Key Points:

- Look for grants that support wellness initiatives.

- Research SBA loan options for favorable terms.

- Don’t overlook state-specific programs.

“Grants are like hidden treasures waiting to be discovered!” 💰

Utilizing government grants and loans can significantly reduce the financial strain of starting your wellness spa. They allow you to invest more in your services and customer experience, which can lead to higher customer satisfaction and retention rates. Furthermore, by tapping into these resources, you can build a solid foundation for your spa, ensuring long-term success.

Exploring Alternative Financing Options

If traditional routes aren’t working for you, don’t despair! There are plenty of alternative financing options available for wellness spas. Crowdfunding has become increasingly popular, allowing you to raise money from individuals who believe in your vision. Platforms like Kickstarter and GoFundMe have helped many entrepreneurs launch their dreams by connecting them directly with potential supporters. This method not only generates funds but also builds a community around your brand even before you open your doors.

When I started my first wellness spa, I turned to crowdfunding to gauge interest in my services. I offered unique incentives, such as discounted spa packages and exclusive memberships for early supporters. This not only provided me with the necessary capital to get started but also created a loyal customer base that was eager to visit once I opened. The emotional investment from these backers can be incredibly motivating, as they often become your best advocates and repeat customers.

Here’s a quick overview of some alternative financing methods:

| Financing Method | Description |

|---|---|

| Crowdfunding | Raise money from the public online. |

| Peer-to-Peer Lending | Borrow from individual investors. |

| Microloans | Small loans for startups with flexible terms. |

- Key Points:

- Consider crowdfunding for community support.

- Explore peer-to-peer lending for flexible options.

- Microloans can be a great starting point.

“Sometimes the best funding comes from the people around you.” 🌍

By exploring these alternative financing options, you can find the support you need without the stress of traditional loans. This flexibility allows you to focus on building your spa and serving your clients, rather than worrying about repayment schedules or high-interest rates. Additionally, the community engagement that comes with crowdfunding can help establish your brand in the local market, creating a buzz that can lead to increased foot traffic once you launch.

Securing Angel Investors for Your Spa

Angel investors can be a fantastic source of funding for wellness spas. These individuals are typically affluent and looking to invest in promising startups. They often bring not only money but also valuable expertise and connections to the table. This can be particularly beneficial for first-time spa owners who may not have extensive experience in the industry.

When pitching to angel investors, be prepared to articulate your vision clearly and concisely. I learned this the hard way when I first approached an investor without a solid pitch. After refining my presentation and showcasing my spa’s potential, including detailed projections on customer growth and profitability, I secured the funding I needed to take my business to the next level. The investment not only provided the necessary capital but also opened doors to valuable mentorship and networking opportunities.

Here’s what to keep in mind when seeking angel investors:

| Consideration | Description |

|---|---|

| Clear Vision | Articulate your spa’s mission and goals. |

| Financial Projections | Show potential returns on investment. |

| Networking | Build relationships within the wellness community. |

- Key Points:

- Prepare a clear and concise pitch.

- Highlight potential returns for investors.

- Network within the wellness community for connections.

“Investors want to see passion and potential!” 🚀

Securing funding from angel investors can propel your wellness spa into the spotlight. Their financial support, combined with their industry knowledge, can help you navigate challenges and capitalize on opportunities. Furthermore, having an investor who believes in your vision can boost your credibility and attract more customers. By effectively communicating your goals and demonstrating the potential for profitability, you can create a compelling case that resonates with potential investors.

Financing Equipment for Your Wellness Spa

When starting a wellness spa, one of the significant expenses is purchasing equipment. From massage tables to skincare products, these items can add up quickly. Luckily, there are financing options specifically tailored for spa equipment. Understanding these options can significantly ease the financial burden, allowing you to focus on delivering quality services instead of worrying about upfront costs.

Equipment financing allows you to spread the cost over time, making it more manageable. Many financial institutions offer loans specifically designed for purchasing spa equipment, which can often come with lower interest rates compared to traditional loans. Some companies even offer lease-to-own options, which can be beneficial if you’re looking to conserve cash flow while still acquiring high-quality equipment. I remember financing my massage tables through a lease-to-own program, which allowed me to invest more in marketing my services right out of the gate. This strategy enabled me to establish my brand without the stress of immediate full payments.

Here’s a quick look at equipment financing options:

| Financing Option | Description |

|---|---|

| Equipment Loans | Loans specifically for purchasing equipment. |

| Lease-to-Own Programs | Lease agreements that lead to ownership. |

| Vendor Financing | Financing offered directly by equipment vendors. |

- Key Points:

- Consider equipment loans for large purchases.

- Look into lease-to-own options to manage cash flow.

- Explore vendor financing for convenient payment plans.

“Investing in quality equipment is investing in your business!” 🔧

Utilizing equipment financing can free up cash for other essential aspects of your wellness spa, such as marketing and staffing. Additionally, having high-quality equipment can enhance the customer experience, leading to higher satisfaction and repeat business. For instance, clients are more likely to return if they enjoy a relaxing massage on a top-notch table or benefit from the latest skincare technologies. Investing in the right equipment not only improves your service quality but can also differentiate your spa from competitors.

Navigating Challenges in Spa Business Financing

Securing funding for a wellness spa is not without its challenges. Many entrepreneurs face hurdles such as credit issues, lack of collateral, or simply not knowing where to start. It can feel overwhelming, but it’s important to remember that you’re not alone in this journey. Understanding these challenges and how to overcome them is crucial for success.

When I first sought funding, I encountered several obstacles. My credit score was lower than I’d hoped, and I didn’t have significant collateral. However, I learned to pivot my strategy by seeking out alternative funding sources and improving my credit score over time. For example, I focused on building my credit by paying off small debts and ensuring timely bill payments. This effort paid off when I was able to secure a loan with favorable terms a few months later.

Here are some common challenges and tips to overcome them:

| Challenge | Solution |

|---|---|

| Poor Credit | Work on improving your credit score. |

| Lack of Collateral | Explore unsecured loan options. |

| Uncertainty in Business Plan | Refine your business plan with professional help. |

- Key Points:

- Address credit issues before applying for loans.

- Consider unsecured loans if collateral is lacking.

- Seek professional guidance for your business plan.

“Challenges are just opportunities in disguise.” 🌈

By proactively addressing these challenges, you can position yourself for success in securing the necessary funding for your wellness spa. Remember, persistence is key. Each challenge you face can teach you valuable lessons that will make you a stronger business owner. Whether it’s improving your credit score or refining your business plan, every step you take brings you closer to achieving your dream of owning a successful spa.

Understanding Tax Incentives for Wellness Businesses

Tax incentives can be a hidden gem for wellness spa owners. These incentives can significantly reduce your tax burden and free up cash flow for other business needs. Many states offer tax credits for wellness initiatives or investments in health-focused businesses. By taking advantage of these incentives, you can improve your spa’s financial health and reinvest those savings back into your business.

For instance, some local governments provide tax breaks for businesses that promote community health and wellness. This can include anything from hiring local staff to offering discounts for first responders or healthcare workers. When I discovered that my wellness spa could qualify for a tax credit by implementing a community wellness program, it felt like an incredible opportunity. Not only did this initiative enhance my business’s reputation, but it also provided financial relief that I could redirect towards marketing and expanding my services.

Here’s a quick overview of potential tax incentives:

| Tax Incentive | Description |

|---|---|

| Health Initiative Credits | Credits for promoting health and wellness. |

| Eco-Friendly Product Deductions | Deductions for sustainable product purchases. |

| Local Hiring Incentives | Credits for hiring within the community. |

- Key Points:

- Consult with a tax professional for guidance.

- Explore state-specific tax credits.

- Take advantage of eco-friendly product deductions.

“Saving on taxes is as good as earning more!” 💸

Utilizing tax incentives not only helps in managing costs but also encourages you to adopt practices that are beneficial for both your business and the community. Additionally, these incentives can enhance your spa’s sustainability efforts, making you more attractive to environmentally conscious customers. When clients see that you’re committed to reducing your environmental impact, it can lead to increased loyalty and positive word-of-mouth, which are invaluable for any business.

Building Relationships with Private Investors

Another effective way to secure funding for your wellness spa is by building relationships with private investors. These individuals or groups are often looking for promising business opportunities to support, and they can provide not only funding but also valuable industry insights. Establishing a solid network can lead to partnerships that benefit both parties, making it a win-win situation.

When I started looking for private investors, I focused on individuals who had a background in health and wellness. This strategy allowed me to connect with people who understood my vision and were genuinely interested in the industry. By attending local health fairs, wellness expos, and networking events, I was able to meet potential investors who were excited about the idea of supporting a community-focused spa. Their investment not only provided the necessary capital but also brought expertise and connections that helped me grow my business faster than I ever anticipated.

Here are some key points to consider when building relationships with private investors:

| Consideration | Description |

|---|---|

| Networking | Attend industry events and meet potential investors. |

| Clear Value Proposition | Articulate what makes your spa unique and profitable. |

| Follow-Up | Maintain contact with potential investors after initial meetings. |

- Key Points:

- Network actively within the wellness community.

- Present a clear and compelling value proposition.

- Follow up to nurture relationships.

“Investing in relationships is as crucial as investing in business.” 🤝

By focusing on building relationships with private investors, you can create a support system that not only provides financial backing but also enhances your business acumen. The insights and advice from experienced investors can guide you through challenges and help you make informed decisions that align with your long-term goals. Furthermore, a strong relationship with investors can lead to additional funding opportunities down the road, making it a vital component of your overall funding strategy for your wellness spa.

Recommendations

In summary, navigating the world of Wellness Spa Funding Options involves understanding various financing avenues, crafting a solid business plan, and leveraging tax incentives. It is crucial to explore all available options, from traditional loans to crowdfunding and angel investors, to find the best fit for your needs. For those looking to create a comprehensive and effective business plan, check out the Wellness Spa Business Plan Template, which provides a structured approach to outlining your vision and goals.

Additionally, if you’re interested in further expanding your knowledge about wellness spas, consider reading the following articles:

- Wellness Spa SWOT Analysis: Strengths & Insights

- Wellness Spas: A Lucrative Path to High Profits

- Wellness Spa Business Plan: Template and Examples

- Wellness Spa Financial Plan: A Detailed Guide

- The Complete Guide to Opening a Wellness Spa: Tips and Examples

- Start Your Wellness Spa Marketing Plan with This Example

- Begin Your Wellness Spa Business Model Canvas: Step-by-Step

- Customer Segments for Wellness Spas: Who Are Your Potential Clients?

- How Much Does It Cost to Establish a Wellness Spa?

- Ultimate Wellness Spa Feasibility Study: Tips and Tricks

- Ultimate Guide to Wellness Spa Risk Management

- Wellness Spa Competition Study: Comprehensive Analysis

- What Legal Considerations Should You Be Aware of for Wellness Spa?

- Wellness Spa Growth Strategies: Scaling Examples

FAQ

What are the best ways to fund a wellness spa?

When considering funding options for a wellness spa, it’s essential to explore various avenues such as traditional bank loans, SBA loans, and crowdfunding. Each option has its own advantages, and selecting the right one depends on your specific needs and business model. For instance, crowdfunding can help you build a community around your spa while securing necessary funds.

How do I create a successful business plan for my wellness spa?

A successful business plan for a wellness spa should include a clear executive summary, market analysis, marketing strategy, and financial projections. It’s vital to articulate your unique selling proposition and how you plan to attract and retain customers. This will not only help you secure funding but also guide your business operations.

Are there grants available for wellness spas?

Yes, there are several government grants available for wellness spas, particularly those that focus on health and community wellness initiatives. Researching local and state government programs can help you find suitable grants that can provide funding without the need for repayment.

What tax incentives can I take advantage of for my wellness spa?

Various tax incentives are available for wellness businesses, such as credits for promoting health initiatives or hiring locally. Consulting with a tax professional can help you identify and maximize these opportunities, which can significantly reduce your overall tax burden.

How can I find private investors for my wellness spa?

Building relationships with private investors can be beneficial for funding your wellness spa. Attend industry networking events and clearly communicate your business vision and the potential for profitability. This approach will help you connect with investors who share an interest in the wellness industry.

What are the typical startup costs for a wellness spa?

The typical startup costs for a wellness spa can vary widely based on location, size, and services offered. Common expenses include equipment purchases, leasehold improvements, and marketing. It’s essential to create a detailed financial plan to estimate your startup costs accurately.