Did you know that nearly 75% of logistics companies struggle with securing adequate funding? Logistics Agency Funding Options play a pivotal role in the success of these businesses, often determining whether they can expand, invest in technology, or even stay afloat during challenging times. In this article, we’ll dive into various funding options available for logistics agencies, from traditional loans to innovative financing solutions. Understanding these options can empower you to make informed decisions that will positively impact your agency’s growth.

- Funding sources overview

- Importance of financial planning

- Types of funding options

- Pros and cons of each option

- Real-life examples of successful funding

- Tips for securing funding

- Common pitfalls to avoid

- Future trends in logistics funding

- Resources for further information

- Call to action for readers

Understanding Logistics Agency Funding Options

The landscape of logistics is ever-changing, and so are the funding options available to agencies. As the industry evolves, logistics agencies must adapt and explore various funding avenues to remain competitive. From traditional bank loans to innovative crowdfunding platforms, understanding these options is essential for any agency looking to grow or sustain its operations.

For instance, a logistics agency seeking to expand its fleet may consider equipment financing, allowing them to acquire new vehicles without a significant upfront investment. Alternatively, a startup may opt for venture capital to fuel rapid growth. Each funding option comes with its own set of requirements, benefits, and potential challenges, making it crucial to assess which aligns best with your agency’s goals.

Ultimately, understanding the diverse funding landscape will help logistics agencies navigate their unique challenges. As we delve deeper into specific funding options, you’ll discover which paths may be most suitable for your agency’s needs.

| Funding Option | Description |

|---|---|

| Traditional Loans | Bank loans with specific terms |

| Equipment Financing | Financing for acquiring logistics assets |

| Venture Capital | Investment from firms for growth |

| Crowdfunding | Raising small amounts from many people |

- Understanding funding sources is crucial.

- Different options cater to various needs.

- Choosing the right funding can drive growth.

– “Funding is not just about money; it’s about opportunity.”

Traditional Loans and Financing

Traditional loans remain one of the most common funding options for logistics agencies. These loans can come from banks or credit unions and often have defined repayment terms. They can be used for various purposes, such as purchasing equipment, expanding facilities, or managing operational costs.

According to recent statistics, approximately 50% of small businesses apply for loans to manage cash flow. In the logistics sector, maintaining cash flow is vital for meeting operational demands, especially when handling large freight contracts. Understanding the application process and requirements for traditional loans can enhance your chances of approval.

As we explore the pros and cons of traditional loans, it’s essential to consider the implications of interest rates and repayment schedules. This analysis will help you make informed decisions about whether this funding route aligns with your agency’s financial strategy.

- Research different lenders and their terms.

- Prepare necessary documentation (financial statements, business plan).

- Submit applications to multiple lenders for better chances.

– The above steps must be followed rigorously for optimal success.

Exploring Alternative Funding Options

Alternative funding options have gained traction in recent years, offering logistics agencies more flexibility than traditional loans. These may include crowdfunding, invoice financing, and revenue-based financing. Each option presents unique advantages and caters to specific needs within the logistics sector.

For example, crowdfunding allows logistics agencies to raise capital by appealing to the public, making it an excellent option for startups. Invoice financing, on the other hand, lets agencies borrow against their outstanding invoices, providing immediate cash flow without waiting for customer payments.

By examining these alternative funding options, logistics agencies can discover innovative ways to secure the necessary capital while minimizing debt. As we move on, we’ll discuss how these options can fit into your overall financial strategy.

- Alternative funding offers flexibility.

- Crowdfunding can attract community support.

- Invoice financing improves cash flow.

– “Innovation in funding can lead to unexpected growth.”

Government Grants and Assistance Programs

Government grants and assistance programs are valuable resources for logistics agencies looking to fund specific projects or initiatives. These programs often aim to stimulate economic growth, support innovation, and encourage job creation within the logistics sector.

For instance, many states offer grants to logistics companies that implement sustainable practices or invest in technology upgrades. Understanding the eligibility criteria and application processes for these grants can significantly enhance your agency’s funding opportunities.

As we explore these government programs, it’s important to highlight the potential impact they can have on your agency’s growth trajectory. Next, we’ll delve into how to effectively apply for these grants and maximize your chances of securing funding.

| Grant Type | Purpose |

|---|---|

| Sustainable Practices | Funding for eco-friendly initiatives |

| Technology Upgrades | Financial support for tech investments |

- Research available grants in your state.

- Prepare a compelling project proposal.

- Follow up on your application status.

– “Funding is a pathway to innovation and growth.”

The Role of Venture Capital in Logistics

Venture capital plays a crucial role in funding logistics startups and innovative companies. Venture capitalists provide funding in exchange for equity, allowing agencies to access significant capital without immediate repayment pressures.

Notably, logistics technology startups have attracted substantial venture capital investments, with funds often directed towards developing innovative solutions for supply chain challenges. Understanding the expectations of venture capitalists can help logistics agencies prepare for potential investments.

As we explore the dynamics of venture capital, it’s essential to recognize both the benefits and challenges associated with equity financing. This knowledge will empower you to navigate the venture capital landscape effectively.

| Venture Capital Benefits | Considerations |

|---|---|

| Access to large funds | Equity dilution |

| Mentorship and support | High expectations from investors |

- Identify potential venture capital firms.

- Develop a strong business plan.

- Pitch your agency effectively.

Tips for Securing Funding Successfully

Securing funding can be a daunting task, but certain strategies can enhance your chances of success. From preparing your financial documents to understanding your funding needs, being well-prepared is key to navigating the funding landscape.

For instance, maintaining accurate financial records can demonstrate your agency’s stability to potential lenders. Additionally, having a clear business plan that outlines your growth strategy can significantly influence funding decisions. By presenting a strong case for your logistics agency, you can increase the likelihood of securing the necessary capital.

By implementing these tips, logistics agencies can position themselves favorably when seeking funding. In the next section, we’ll summarize the critical steps for successful funding acquisition.

| Preparation Steps | Importance |

|---|---|

| Accurate financial records | Demonstrates stability |

| Clear business plan | Influences funding decisions |

- Maintain updated financial records.

- Create a comprehensive business plan.

- Practice your funding pitch.

Common Pitfalls to Avoid

While pursuing funding, logistics agencies must be aware of common pitfalls that can hinder their efforts. These may include inadequate preparation, unrealistic funding expectations, and neglecting to research funding sources thoroughly.

For example, many agencies underestimate the time it takes to secure funding and fail to have contingency plans in place. By recognizing these pitfalls, agencies can better navigate the funding landscape and avoid costly mistakes. Awareness of these challenges is essential for any logistics agency looking to secure funding successfully.

Understanding these common challenges is essential for any logistics agency looking to secure funding successfully. As we conclude, we’ll summarize the key takeaways to ensure you’re well-equipped for your funding journey.

| Pitfall | Avoidance Strategy |

|---|---|

| Inadequate preparation | Conduct thorough research |

| Unrealistic expectations | Set achievable funding goals |

- Prepare thoroughly for funding applications.

- Set realistic expectations.

- Research potential funding sources.

Future Trends in Logistics Funding

As the logistics industry continues to evolve, so do the funding options available. Future trends may include a greater emphasis on sustainable practices, digital financing platforms, and collaborative funding models. These trends are shaping how logistics agencies approach their financing needs.

For instance, as more logistics agencies adopt green practices, funding opportunities related to sustainability are likely to increase. Additionally, the rise of fintech solutions may offer more streamlined and accessible funding options for agencies of all sizes. Understanding these trends will help logistics agencies stay ahead in securing the necessary capital for growth.

By staying informed about these trends, logistics agencies can position themselves to take advantage of new funding opportunities as they arise. In the final section, we’ll summarize the essential points covered throughout the article.

| Trend | Implication for Logistics Agencies |

|---|---|

| Sustainable funding | Increased grants and investments |

| Digital financing platforms | Easier access to diverse funding options |

- Monitor industry trends regularly.

- Embrace sustainability in operations.

- Explore digital financing solutions.

Conclusion

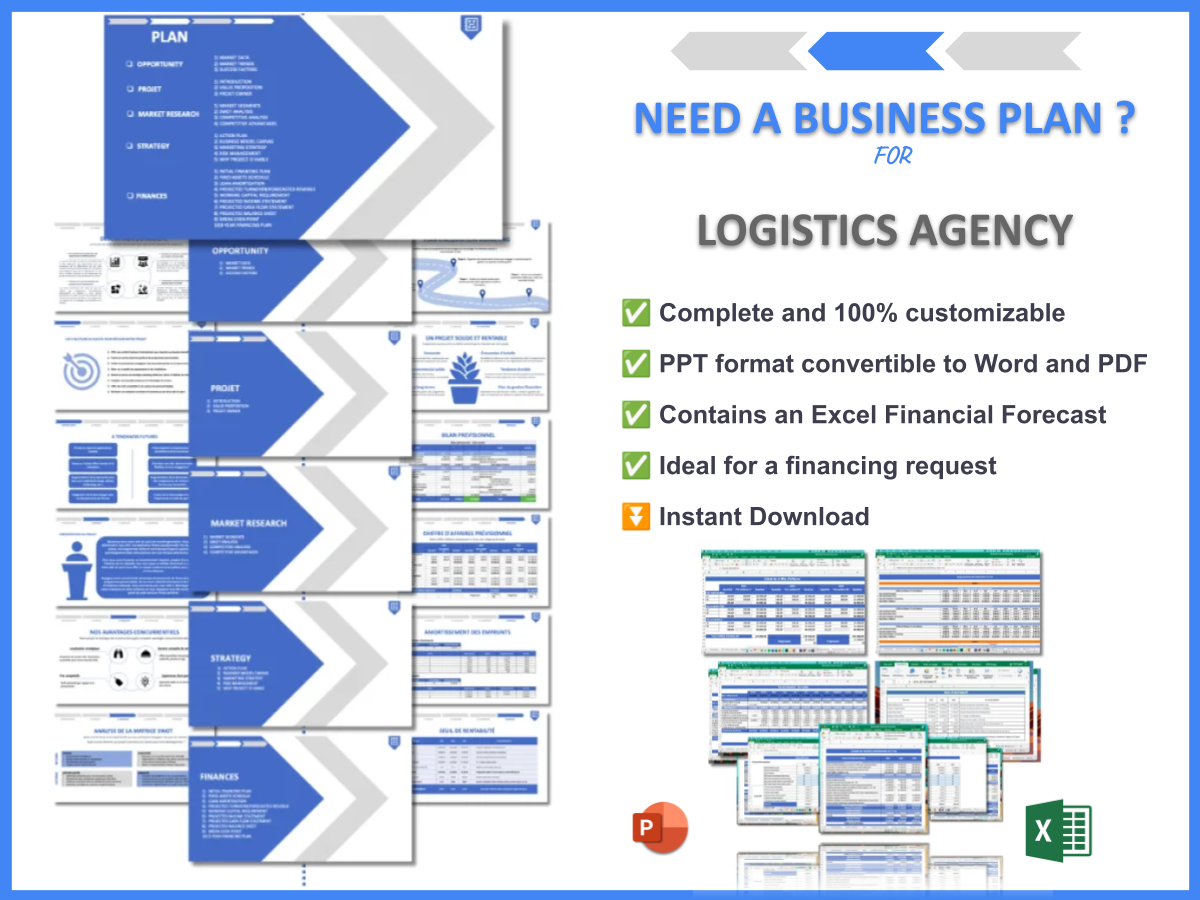

In conclusion, securing funding for your logistics agency involves a comprehensive understanding of various funding options, including traditional loans, alternative financing, and government grants. By preparing adequately, avoiding common pitfalls, and staying informed about future trends, you can successfully navigate the funding landscape. To further support your journey, consider utilizing a Logistics Agency Business Plan Template that can provide a solid foundation for your operations.

- Article 1: SWOT Analysis for Logistics Agency: Achieving Market Dominance

- Article 2: Developing a Business Plan for Your Logistics Agency: Comprehensive Guide

- Article 3: Crafting a Financial Plan for Your Logistics Agency: Essential Steps (+ Example)

- Article 4: Beginner’s Guide to Opening a Logistics Agency with Example

- Article 5: Begin Your Logistics Agency Marketing Plan with These Examples

- Article 6: How to Begin Crafting a Business Model Canvas for Logistics Agency

- Article 7: Identifying Customer Segments for Logistics Agencies: Examples and Strategies

- Article 8: Logistics Agency Profitability: Key Factors to Consider

- Article 9: How Much Does It Cost to Establish a Logistics Agency?

- Article 10: How to Start a Feasibility Study for Logistics Agency?

- Article 11: Logistics Agency Competition Study: Detailed Insights

- Article 12: How to Start Risk Management for Logistics Agency?

- Article 13: What Are the Key Legal Considerations for Logistics Agency?

- Article 14: Logistics Agency Growth Strategies: Scaling Examples

FAQ

What are the best funding sources for logistics agencies?

The best funding sources for logistics agencies include traditional bank loans, venture capital, government grants, and crowdfunding platforms. Each option has its unique advantages and suitability based on the agency’s needs.

How can I enhance my chances of getting a loan for my logistics agency?

To improve your chances of securing a loan, maintain accurate financial records, develop a strong business plan, and apply to multiple lenders to compare terms and conditions.

Are there specific grants available for logistics companies?

Yes, many states and federal programs offer grants aimed at supporting logistics companies that focus on sustainability, technology upgrades, and job creation.

What role does venture capital play in logistics funding?

Venture capital provides substantial funding in exchange for equity, enabling logistics startups to grow without the burden of immediate repayment, often supporting innovative solutions.

What are the common pitfalls to avoid when seeking funding?

Common pitfalls include inadequate preparation, unrealistic funding expectations, and not thoroughly researching potential funding sources. Being aware of these can help logistics agencies navigate the process more effectively.

How can I leverage invoice financing for my logistics agency?

Invoice financing allows you to borrow against outstanding invoices, providing immediate cash flow without waiting for customer payments, which is crucial for maintaining operational efficiency.

What future trends should logistics agencies watch for in funding?

Future trends include a focus on sustainable funding options, the rise of digital financing platforms, and collaborative funding models that may enhance access to capital for logistics agencies.

What are the essential steps for preparing a business plan?

Essential steps include defining your business goals, outlining your operational plan, conducting market research, and preparing financial projections that appeal to potential investors or lenders.

How can I identify the right customer segments for my logistics agency?

Identifying the right customer segments involves analyzing market data, understanding customer needs, and tailoring your services to meet those specific demands effectively.