Funding your dropshipping business can feel like a daunting task, especially when you’re just starting out. But did you know that there are various dropshipper funding options available that can make the process much smoother? A dropshipper funding option refers to the different ways you can secure capital to launch or grow your dropshipping business. This article will explore a variety of funding strategies, from traditional loans to innovative financing solutions, to help you navigate the financial landscape of e-commerce.

Key Takeaways:

– Different funding options available for dropshippers.

– Tips for choosing the right funding strategy.

– Real-life examples of successful dropshippers securing funding.

Understanding Dropshipper Funding Options

Securing funding is often one of the biggest hurdles for new dropshippers. It’s essential to know your options, whether you’re looking for startup capital for dropshipping or ways to scale your business. Dropshipper funding options can vary widely, so understanding what’s out there is crucial.

Many entrepreneurs start with personal savings, but that’s not the only route. You can explore business loans, grants, or even crowdfunding. Each option has its pros and cons, and what works for one person may not work for another.

Let’s dive deeper into some of the most popular funding options available for dropshippers:

| Funding Type | Description |

|---|---|

| Personal Savings | Using your own money to fund your business. |

| Business Loans | Loans specifically for small businesses. |

| Grants | Financial aid that doesn’t require repayment. |

| Crowdfunding | Raising money through small contributions from many people. |

| Investor Funding | Bringing in investors to finance your business. |

- Personal savings are a common starting point.

- Business loans can provide significant capital but require repayment.

- Grants are a great option if you can qualify.

- Crowdfunding can be a way to gauge interest in your product.

“Funding is the fuel that powers your entrepreneurial journey! 🚀”

Let’s explore these options a bit further. Starting with personal savings, many dropshippers use their own money as a bootstrap method. This approach is straightforward and doesn’t involve debt, which is a significant advantage. However, using your savings can be risky if the business doesn’t take off as expected. It’s crucial to weigh the risks and ensure you have enough set aside for personal expenses.

Business loans represent another robust option for dropshippers looking for capital. These loans can be particularly beneficial because they often come with lower interest rates than personal loans. Traditional banks typically offer these loans, but they may require a solid credit score and a detailed business plan. Alternatively, online lenders provide quicker access to cash and more flexible terms, making them appealing to new entrepreneurs who might not have established credit histories. But remember, loans must be repaid, so it’s vital to have a plan for how you will generate revenue to cover these costs.

Then we have grants. Unlike loans, grants do not require repayment, which makes them highly sought after. Various organizations, including government entities, offer grants to support small businesses, especially those that can contribute to local economies. While applying for grants can be competitive, the payoff can be significant. For instance, if you can secure a grant specifically aimed at e-commerce startups, you can fund your initial inventory without the pressure of repayment.

Another exciting option is crowdfunding. Platforms like Kickstarter and Indiegogo allow you to present your business idea to the public and raise funds through small contributions. This method not only provides funding but also validates your product before launch. Engaging your audience early can create a loyal customer base and generate buzz around your brand. However, success in crowdfunding requires a well-thought-out marketing strategy to attract backers.

Lastly, there’s investor funding. Bringing in investors can help you scale your business rapidly, especially if you have a compelling business model. This route can provide substantial capital but often requires giving up some equity in your business. Understanding the implications of bringing on investors is crucial, as it can affect your control over business decisions.

Ultimately, knowing your dropshipper funding options can empower you to make informed decisions about how to finance your business. Each funding method has its strengths, and choosing the right one will depend on your unique situation, goals, and risk tolerance.

Exploring Business Loans for Dropshippers

Business loans are a popular choice among dropshippers looking for capital to kickstart or expand their operations. The appeal of these loans lies in their ability to provide substantial funding, which can be crucial for purchasing inventory, investing in marketing, and managing operational costs. Understanding the various types of business loans available is essential for any dropshipper aiming to secure financial support.

One of the primary advantages of business loans is the potential for large sums of money. Unlike personal loans, which might be limited in amount, business loans can often provide tens of thousands of dollars, allowing you to make significant investments in your business. For example, if you plan to launch a new product line or scale your marketing efforts, having access to sufficient capital can make all the difference.

When considering business loans, it’s important to explore different types available. Traditional bank loans are one option. These loans typically offer lower interest rates and longer repayment terms, making them attractive for established businesses with a solid credit history. However, the application process can be lengthy, and banks often have strict requirements, including a detailed business plan and financial projections.

On the other hand, online lenders have emerged as a popular alternative for new entrepreneurs seeking fast approval business loans online. These lenders often provide a more streamlined application process, enabling you to access funds quickly. While the interest rates may be higher compared to traditional banks, the flexibility and speed can be advantageous for dropshippers who need immediate cash flow.

Another appealing aspect of business loans is the ability to build your business credit. By taking out a loan and making timely repayments, you can improve your credit score, which may help you secure better financing options in the future. This can be especially beneficial as your business grows and your funding needs increase.

However, it’s crucial to approach business loans with caution. Debt can become a burden if not managed properly. Before committing to a loan, it’s important to assess your revenue projections and ensure you have a solid plan for repayment. Conducting a thorough analysis of your cash flow can help you determine how much debt your business can comfortably handle.

Overall, business loans can be a powerful tool for dropshippers looking to scale their operations. With careful planning and a clear understanding of the loan process, you can leverage this funding option to achieve your business goals.

Grants and Financial Aid for E-commerce

Grants represent an exciting funding avenue for dropshippers, offering financial support that does not require repayment. This makes them a highly sought-after option for entrepreneurs looking to minimize their financial risk. Various organizations, including government agencies and non-profits, provide grants specifically aimed at supporting small businesses and e-commerce startups.

The primary advantage of grants is that they can provide substantial funding without the burden of debt. For instance, if you qualify for a grant through a local government program, you could receive thousands of dollars to invest in your dropshipping business. This capital can be used for a variety of purposes, such as purchasing inventory, enhancing your website, or launching marketing campaigns.

Applying for grants can be competitive, but the effort is often worth it. Many grants are designed to encourage innovation and support local economies. For example, the Small Business Administration (SBA) offers various grant programs that can assist e-commerce entrepreneurs in getting their businesses off the ground. These grants often come with fewer strings attached compared to loans, allowing you to focus on growing your business rather than worrying about repayment.

Moreover, grants can also provide credibility to your business. Being awarded a grant can serve as a validation of your business idea and model, which can be beneficial when seeking additional funding or attracting customers. This added credibility can help you stand out in a crowded market, giving you a competitive edge.

However, it’s essential to be aware of the application process for grants. Each grant will have specific eligibility criteria and requirements, which may include submitting a detailed business plan, financial statements, and even progress reports if awarded the grant. Taking the time to thoroughly research available grants and preparing a strong application can significantly increase your chances of success.

In conclusion, grants are an invaluable resource for dropshippers seeking financial support without the burden of repayment. By exploring available grant opportunities and preparing compelling applications, you can secure funding that propels your business forward. With the right approach, grants can provide the financial boost you need to turn your dropshipping dreams into reality.

Crowdfunding: A Modern Funding Solution

Crowdfunding has gained tremendous popularity in recent years, becoming a viable option for dropshippers looking to secure funding for their businesses. This method allows entrepreneurs to raise money from a large number of people, typically through online platforms like Kickstarter and Indiegogo. One of the most significant advantages of crowdfunding is that it not only provides financial support but also helps validate your business idea before you even launch.

When you create a crowdfunding campaign, you present your product or business idea to the public. This exposure can generate interest and excitement around your brand, which is essential in the competitive world of dropshipping. If potential customers are willing to invest in your idea, it’s a strong indicator that there is a market for your product. This validation can be incredibly reassuring as you embark on your entrepreneurial journey.

Another advantage of crowdfunding is the flexibility it offers in terms of funding amounts. You can set your funding goal based on your specific needs, whether it’s to cover initial inventory costs, marketing expenses, or website development. Additionally, many crowdfunding platforms operate on an all-or-nothing basis, meaning you only receive the funds if you meet your goal. This can create a sense of urgency and motivate backers to contribute, as they want to see your project succeed.

Successful crowdfunding campaigns often include attractive rewards for backers, such as early access to products, exclusive merchandise, or special discounts. This not only incentivizes people to contribute but also fosters a sense of community around your brand. Engaging with your backers and keeping them updated throughout the process can lead to long-lasting relationships and loyal customers.

However, launching a successful crowdfunding campaign requires careful planning and execution. You’ll need to create compelling content, including a captivating video, to grab the attention of potential backers. Additionally, a solid marketing strategy is crucial to drive traffic to your campaign page. Utilizing social media, email marketing, and even partnerships with influencers can help amplify your message and reach a broader audience.

In summary, crowdfunding can be a powerful tool for dropshippers looking to fund their business while simultaneously building a customer base. By effectively leveraging this funding option, you can not only secure the necessary capital but also validate your business idea and create a community of supporters eager to see your success.

Investor Funding: Bringing in Partners

Investor funding is another significant avenue for dropshippers looking to accelerate their business growth. This involves bringing in external investors who provide capital in exchange for equity in your business. While this route can be highly advantageous, it’s essential to understand the implications of sharing ownership and decision-making power.

One of the primary benefits of investor funding is the substantial amount of capital that investors can provide. Unlike loans, which require repayment, investor funding can give you the financial resources you need to scale your operations quickly. This can be particularly beneficial if you have ambitious growth plans or if you need to invest in inventory, marketing, or technology to enhance your business.

In addition to funding, investors often bring valuable expertise and networks to the table. Many investors have experience in the e-commerce space and can provide guidance on strategy, marketing, and scaling your business. Their connections can also open doors to new partnerships and opportunities that might otherwise be out of reach for a new entrepreneur.

However, it’s important to approach investor funding with caution. When you bring on investors, you are essentially giving up a portion of your business and decision-making authority. This means that you’ll need to align your vision with your investors’ expectations and be prepared for potential disagreements. Conducting thorough due diligence on potential investors is crucial to ensure they share your values and goals for the business.

Another consideration is the time and effort required to secure investor funding. The process often involves pitching your business to multiple investors, which can be time-consuming and competitive. You’ll need to prepare a compelling business plan and presentation to convince potential investors of your business’s viability and growth potential.

Ultimately, investor funding can be a game-changer for dropshippers looking to scale rapidly. By carefully selecting the right investors and maintaining clear communication, you can leverage their capital and expertise to propel your business forward. If you’re ready to take your dropshipping venture to the next level, exploring investor funding might be the right path for you.

Managing Your Finances as a Dropshipper

Once you’ve secured funding for your dropshipping business, managing your finances becomes crucial. Effective financial management is key to sustaining growth and ensuring your business remains profitable. Many new dropshippers make the mistake of mixing personal and business finances, which can lead to confusion and potential issues down the road.

One of the first steps in managing your finances is to establish separate accounts for your business. By creating a dedicated business bank account, you can easily track income and expenses related to your dropshipping operations. This separation not only simplifies bookkeeping but also provides clarity when it comes time to file taxes. Having clear records can help you identify areas where you can cut costs or invest more efficiently.

Utilizing accounting software can further streamline your financial management. Programs like QuickBooks or Xero can help you keep track of sales, expenses, and cash flow in real-time. These tools often come with features that allow you to generate financial reports, which can provide insights into your business’s performance. Understanding your financial health is essential for making informed decisions about future investments and growth strategies.

Moreover, budgeting is a vital aspect of managing your finances. Creating a budget can help you allocate funds wisely and avoid overspending. Consider your fixed costs, such as website hosting, subscription fees for dropshipping platforms, and marketing expenses. Additionally, factor in variable costs like inventory purchases and shipping fees. A well-structured budget will allow you to plan for the future and ensure that you have enough working capital to keep your business running smoothly.

Another important aspect of financial management is monitoring your cash flow. Cash flow refers to the money coming in and going out of your business, and maintaining a positive cash flow is critical for sustainability. If you find that expenses are consistently outpacing income, it may be time to reevaluate your pricing strategy or marketing efforts. Regularly reviewing your cash flow can help you identify trends and make necessary adjustments before they become significant issues.

In summary, effective financial management is essential for dropshippers looking to build a successful business. By separating personal and business finances, utilizing accounting software, budgeting wisely, and monitoring cash flow, you can create a solid financial foundation that supports your growth and helps you achieve your business goals.

Choosing the Right Funding Option for Your Business

Choosing the right funding option for your dropshipping business is a critical decision that can significantly impact your success. With so many different dropshipper funding options available, it’s essential to consider your specific needs, business goals, and financial situation before making a choice. Each funding method comes with its own set of advantages and challenges, and understanding these can help you make an informed decision.

One of the first things to consider is the amount of funding you need. If you’re just starting out and require a small amount of capital for initial inventory or marketing, personal savings or crowdfunding might be sufficient. These options allow you to maintain full control over your business without incurring debt. On the other hand, if you plan to scale quickly or invest in a larger inventory, you may want to explore business loans or investor funding to secure the necessary capital.

Another important factor to evaluate is your willingness to take on debt. While business loans can provide significant funding, they also come with the responsibility of repayment. If you prefer to avoid debt, grants or crowdfunding could be more appealing. Grants, in particular, offer financial assistance without the burden of repayment, making them a highly attractive option for many dropshippers.

Additionally, consider the level of control you wish to retain over your business. Bringing on investors can provide substantial funding and valuable expertise, but it also means sharing ownership and decision-making power. If you’re passionate about maintaining your vision and direction, you may want to approach funding options that don’t require giving up equity, such as business loans or grants.

Lastly, think about the time and effort you’re willing to invest in securing funding. Some options, like crowdfunding, require a significant amount of preparation and marketing to be successful. Conversely, business loans may have a more straightforward application process, especially with online lenders. Understanding the time commitment associated with each funding option will help you choose the one that aligns best with your business timeline.

In conclusion, selecting the right funding option for your dropshipping business is a crucial step in your entrepreneurial journey. By considering your funding needs, willingness to take on debt, desire for control, and the time you can invest, you can choose a path that supports your business goals and sets you up for long-term success. Remember, the right funding can be the catalyst that propels your dropshipping venture to new heights!

Utilizing Business Credit Cards for Dropshipping

Business credit cards can be an excellent financial tool for dropshippers looking to manage expenses and build credit. These cards not only provide a convenient way to make purchases but also offer rewards and benefits that can enhance your overall business operations. Understanding how to effectively utilize business credit cards can lead to significant advantages for your dropshipping venture.

One of the primary benefits of using a business credit card is the ability to separate your personal and business expenses. This separation is crucial for accurate bookkeeping and financial management. By using a dedicated card for your dropshipping expenses, you can easily track purchases related to inventory, marketing, and operational costs. This clarity can be particularly beneficial during tax season, as it simplifies the process of compiling business expenses.

Moreover, many business credit cards come with rewards programs that can help you save money over time. For instance, some cards offer cash back on purchases, while others provide points that can be redeemed for travel or discounts on business-related expenses. By strategically using your credit card for regular business purchases, you can effectively turn your spending into savings, which can be a significant advantage for a growing dropshipping business.

Another important aspect of business credit cards is the ability to build your business credit. Establishing a solid credit history is vital for any entrepreneur, as it can open doors to better financing options in the future. By using a business credit card responsibly—making payments on time and keeping your credit utilization low—you can improve your credit score. This can be especially beneficial when you’re looking to secure larger funding amounts through loans or investor funding down the line.

However, it’s crucial to manage your business credit card wisely. While the convenience of credit can be tempting, overspending can lead to high-interest debt. It’s essential to create a budget that accounts for credit card payments and to avoid using credit for unnecessary purchases. By maintaining discipline in your spending habits, you can reap the benefits of a business credit card without falling into debt.

In summary, business credit cards can be a valuable asset for dropshippers when used effectively. They offer a way to manage expenses, earn rewards, and build credit, all of which can contribute to the success of your business. By understanding how to leverage these financial tools, you can enhance your dropshipping operations and set yourself up for long-term growth.

Exploring Alternative Financing Options for Dropshippers

When traditional funding sources don’t meet your needs, exploring alternative financing options can be a game-changer for dropshippers. These alternatives can provide the necessary capital to help you grow your business without the stringent requirements often associated with conventional loans. Understanding the various types of alternative financing available can empower you to make informed decisions that align with your business goals.

One popular alternative financing option is merchant cash advances. This type of funding allows you to receive a lump sum of cash in exchange for a percentage of your future credit card sales. For dropshippers with consistent sales, this can be a quick way to access capital without the long application process of traditional loans. However, it’s essential to be cautious, as merchant cash advances often come with higher fees and interest rates compared to other financing options.

Another alternative to consider is revenue-based financing. This method involves securing funds based on your business’s revenue. Investors provide capital in exchange for a percentage of your monthly sales until a predetermined amount is paid back. This option can be particularly appealing for dropshippers who experience fluctuating sales, as repayments are tied to revenue. This flexibility can ease the financial burden during slower months.

Additionally, crowdfunding can be classified as an alternative financing option, as it allows you to raise money from a large pool of individuals. Platforms like Kickstarter and Indiegogo enable you to present your business idea to potential backers, who can contribute funds in exchange for rewards or early access to products. This method not only provides financial support but also serves as a marketing tool to gauge interest in your product before launch.

Lastly, consider peer-to-peer lending platforms, which connect borrowers directly with individual lenders. This type of financing often comes with lower interest rates compared to traditional bank loans, as it cuts out the middleman. Many peer-to-peer platforms cater specifically to small businesses and startups, making them a viable option for dropshippers seeking funding.

In conclusion, exploring alternative financing options can provide dropshippers with the flexibility and capital needed to thrive in the competitive e-commerce landscape. By understanding the various options available—from merchant cash advances to peer-to-peer lending—you can choose the right financing strategy that aligns with your business goals and financial situation. With the right approach to funding, you can set your dropshipping venture on the path to success.

Recommendations

In summary, securing the right funding is essential for dropshippers looking to grow and sustain their businesses. From business loans and grants to crowdfunding and investor funding, understanding the various dropshipper funding options can empower you to make informed financial decisions. Whether you are just starting or looking to scale, leveraging the right financial strategies can set you on the path to success.

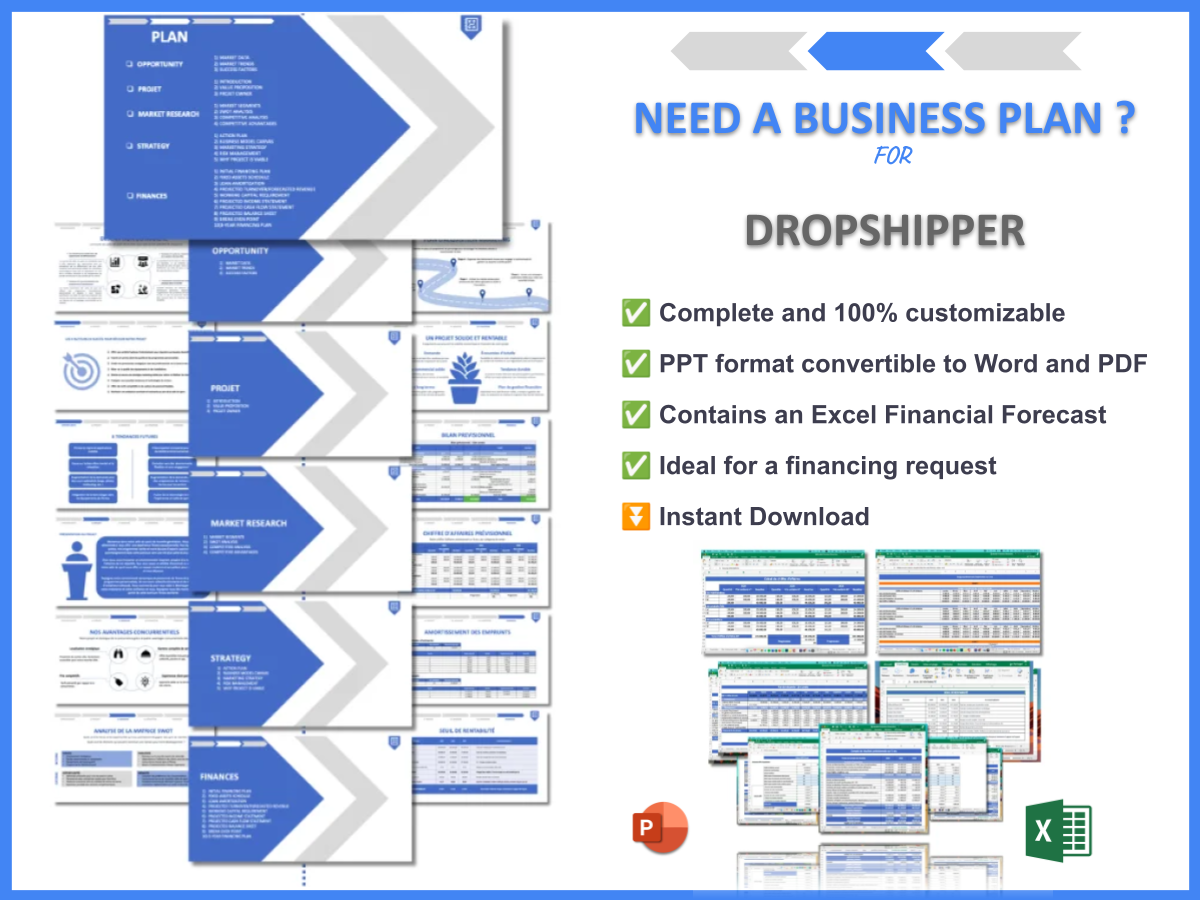

To further assist you in your entrepreneurial journey, we recommend checking out the Dropshipper Business Plan Template. This comprehensive template can help you outline your business strategy, making it easier to secure funding and plan for future growth.

Additionally, you may find these related articles on dropshipping helpful:

- Article 1 on Dropshipper SWOT Analysis – Key Insights Revealed

- Article 2 on Dropshippers: How to Achieve High Profits

- Article 3 on Dropshipper Business Plan: Comprehensive Guide with Examples

- Article 4 on Dropshipper Financial Plan: Step-by-Step Guide with Template

- Article 5 on The Ultimate Guide to Starting a Dropshipping Business: Step-by-Step Example

- Article 6 on Crafting a Marketing Plan for Your Dropshipper Business (+ Example)

- Article 7 on Create a Business Model Canvas for Dropshipper: Examples and Tips

- Article 8 on Customer Segments for Dropshippers: Examples and Analysis

- Article 9 on How Much Does It Cost to Start a Dropshipper Business?

- Article 10 on Dropshipper Feasibility Study: Detailed Analysis

- Article 11 on Dropshipper Risk Management: Detailed Analysis

- Article 12 on Ultimate Guide to Dropshipper Competition Study

- Article 13 on How to Navigate Legal Considerations in Dropshipper?

- Article 14 on Dropshipper Growth Strategies: Scaling Success Stories

FAQ

How can I fund a dropshipping business?

There are several ways to fund a dropshipping business, including personal savings, business loans, grants, crowdfunding, and investor funding. Each option has its advantages, and the best choice depends on your specific financial situation and business goals.

What are the best funding options for new dropshippers?

The best funding options for new dropshippers typically include grants, which do not require repayment, and crowdfunding, which allows you to gauge interest in your product while raising funds. Additionally, business loans from online lenders can provide quick access to capital.

Do I need a loan to start dropshipping?

No, you do not necessarily need a loan to start dropshipping. Many successful dropshippers begin with personal savings or bootstrapping. However, securing a loan can provide additional capital to help scale your business more quickly.

What are the risks of borrowing money for dropshipping?

Borrowing money for dropshipping can involve risks such as high-interest rates, the pressure of repayment, and potential impacts on your personal credit. It’s important to assess your cash flow and ensure you have a solid plan for generating revenue to cover loan repayments.

How much capital is needed to start dropshipping?

The amount of capital needed to start dropshipping can vary widely based on your business model and goals. Generally, you should expect to invest in website development, marketing, and initial inventory, which can range from a few hundred to several thousand dollars.

Are there any grants available for e-commerce entrepreneurs?

Yes, there are various grants available for e-commerce entrepreneurs. Many local governments and organizations offer grants to support small businesses and innovation in the e-commerce sector. Researching available programs can help you find suitable opportunities.