Did you know that financing a condo hotel can unlock an incredible investment opportunity in the booming hospitality market? Condo Hotel Funding Options can be the key to transforming a property into a lucrative rental. In this article, we’ll explore the diverse funding options available for condo hotels, from traditional loans to innovative financing methods. Understanding these options can help you navigate the complex world of real estate investment, making it easier to secure the funding you need.

- Overview of condo hotel funding options.

- Types of loans available for condo hotels.

- Importance of understanding financing options.

- How to evaluate the best funding source.

- Factors affecting loan eligibility.

- Risks associated with condo hotel investments.

- Steps to secure funding for your condo hotel.

- Alternative financing methods.

- Tips for managing funding effectively.

- Future trends in condo hotel financing.

Understanding Condo Hotel Financing Options

When diving into the world of condo hotel financing, it’s essential to grasp the various options available. From traditional bank loans to alternative financing methods, the landscape is rich with choices. This section will break down the most common funding sources, helping you understand how each one works and what to consider when choosing the right path for your investment.

For instance, traditional bank loans often come with competitive interest rates and longer repayment terms, making them an attractive option for many investors. However, the application process can be lengthy and requires a solid credit score. On the other hand, hard money loans provide quick access to cash but typically come with higher interest rates. Knowing the pros and cons of each option can be the difference between a successful investment and a financial setback.

As we delve deeper into the specifics of each funding option, it’s vital to connect these insights with the factors that influence your eligibility for these loans. Understanding what lenders look for will equip you with the knowledge to make informed decisions as we move forward.

| Funding Source | Key Features |

| Traditional Loans | Lower interest rates, longer terms |

| Hard Money Loans | Quick access, higher interest rates |

| SBA Loans | Government-backed, lower down payment |

| Alternative Funding | Flexible terms, varies by lender |

- Traditional bank loans offer competitive rates.

- Hard money loans provide quick cash but at a cost.

- SBA loans can help with lower down payments.

- Alternative funding varies widely in terms and conditions.

- "In the world of real estate, knowledge is your greatest asset."

Evaluating Your Financing Needs

Determining your financing needs is crucial before approaching lenders. Assessing how much capital you require and how you plan to use it can significantly influence the type of funding you pursue. This section will guide you through the process of evaluating your financial needs and setting clear goals for your condo hotel investment.

For example, if you’re looking to purchase a condo hotel that needs renovations, you might need a larger loan amount to cover both the purchase and the renovation costs. On the flip side, if you’re simply looking to invest in a fully operational property, your financing needs may be lower. Having a well-defined plan will not only help you in securing funding but also in managing your investment effectively.

As we continue, we’ll explore the specific steps to take when applying for funding, ensuring you’re fully prepared to meet lender requirements and present your investment in the best light.

- Assess your total funding needs.

- Define your investment goals.

- Create a budget for property acquisition and renovations.

- The above steps must be followed rigorously for optimal success.

The Role of Credit in Funding

Your credit score plays a significant role in the funding process. Lenders often use it to gauge your financial reliability and ability to repay loans. In this section, we’ll discuss how your credit score can impact your financing options and what steps you can take to improve it if necessary.

For instance, a higher credit score can qualify you for lower interest rates and better loan terms, which can save you thousands over the life of the loan. Conversely, a low credit score may limit your options to higher interest loans or even result in loan denials. Understanding the importance of your credit score is essential in preparing for the funding process.

As we move forward, we’ll look at specific actions you can take to enhance your creditworthiness and make yourself a more attractive candidate for lenders.

| Factor | Impact on Funding |

| Credit Score | Affects interest rates and loan terms |

| Credit History | Influences loan eligibility |

| Debt-to-Income Ratio | Determines repayment ability |

- A high credit score can lower your interest rates.

- Credit history influences loan eligibility.

- Regularly check your credit report for accuracy.

- "To succeed, always move forward with a clear vision."

Navigating the Loan Application Process

Once you’ve assessed your financing needs and credit status, it’s time to navigate the loan application process. This step can often feel daunting, but understanding what to expect can make it manageable. This section will outline the key steps involved in applying for a condo hotel loan.

Typically, the application process involves gathering necessary documentation, such as financial statements, tax returns, and property details. Each lender may have specific requirements, so it’s crucial to be prepared and organized. Failing to provide adequate information can lead to delays or even rejection of your application.

As we transition to the next section, we’ll delve into common pitfalls to avoid during the application process, ensuring you’re equipped to present the best case for your funding needs.

| Application Step | Description |

| Gather Documentation | Collect financial and property information |

| Submit Application | Fill out forms and submit to lender |

| Await Approval | Wait for lender’s decision |

- Gather necessary documents.

- Complete the application form.

- Submit to the lender.

- The above steps must be followed rigorously for optimal success.

Understanding Loan Terms and Conditions

Understanding the terms and conditions of your loan is vital to your long-term success. This section will explore common loan terms associated with condo hotel financing and what they mean for you as an investor.

For example, the loan-to-value (LTV) ratio is a critical factor that lenders consider when determining how much they will lend you. A lower LTV ratio means you will need a larger down payment, which can affect your cash flow. Familiarizing yourself with these terms will help you negotiate better and make informed decisions.

Next, we’ll discuss how to interpret these terms in the context of your investment strategy and how to ensure that the financing you choose aligns with your goals.

| Term | Description |

| Loan-to-Value (LTV) | Ratio of loan amount to property value |

| Interest Rate | Cost of borrowing expressed as a percentage |

| Amortization Period | Timeframe over which loan is repaid |

- Understand your LTV ratio for better loan offers.

- Know the interest rate and its impact on payments.

- Familiarize yourself with amortization schedules.

- "Success comes to those who persevere."

Alternative Funding Sources

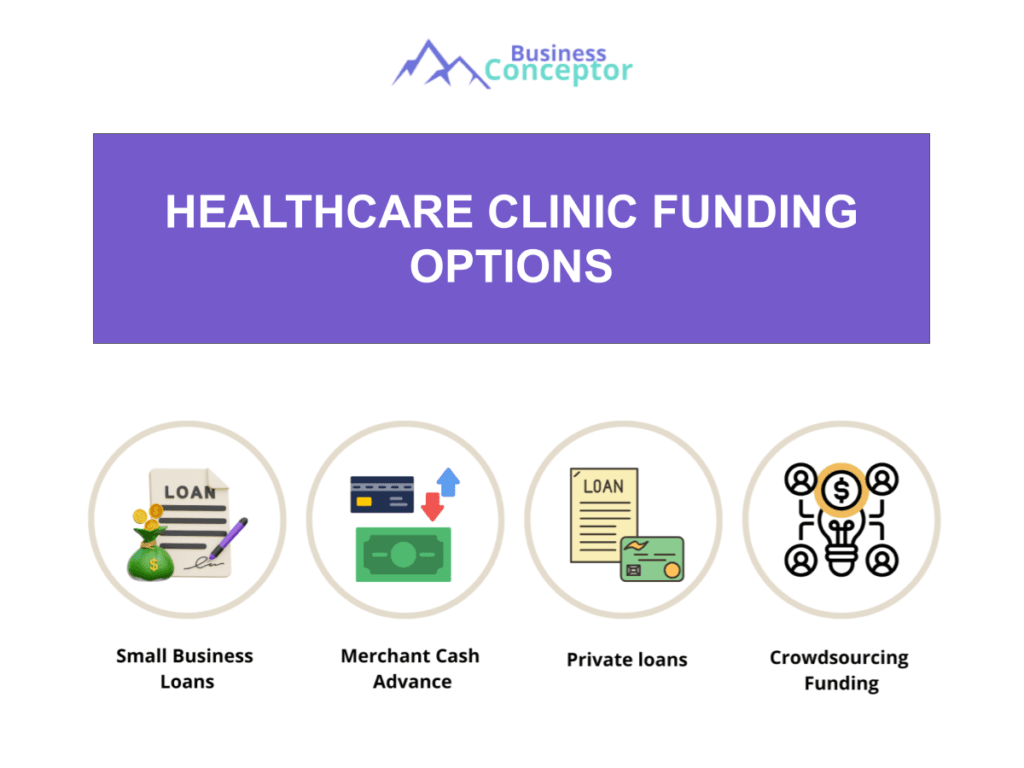

While traditional financing is a popular route, alternative funding sources can offer flexibility and unique advantages. This section will explore various alternative funding options available for condo hotels, such as crowdfunding and private equity.

Crowdfunding, for instance, allows you to pool resources from multiple investors, making it easier to secure the necessary capital without relying solely on a bank. This method can be particularly beneficial for first-time investors who may lack the substantial funds required for a down payment. Additionally, private equity firms can provide significant funding in exchange for equity stakes in your property, which can be advantageous if you’re looking to scale quickly.

As we wrap up this section, it’s essential to consider the potential risks associated with alternative funding and how they compare to traditional methods. This understanding will guide you in making the best choices for your condo hotel investment.

| Funding Source | Key Features |

| Crowdfunding | Pooled resources from multiple investors |

| Private Equity | Significant funding in exchange for equity |

| Peer-to-Peer Lending | Direct loans from individual investors |

- Research crowdfunding platforms.

- Approach private equity firms.

- Explore peer-to-peer lending options.

- The above steps must be followed rigorously for optimal success.

Risks Associated with Condo Hotel Investments

Investing in condo hotels can be lucrative, but it’s not without risks. This section will highlight the potential risks associated with condo hotel investments, ensuring you’re prepared to mitigate them.

Market fluctuations can impact occupancy rates and revenue, and unexpected expenses can arise during renovations or management transitions. For instance, if the local tourism market declines, your condo hotel may struggle to attract guests, leading to reduced income. Understanding these risks will help you develop a robust investment strategy that incorporates contingency plans.

As we continue, we’ll discuss strategies to minimize these risks and protect your investment, ensuring that you’re well-equipped to navigate the condo hotel landscape.

| Risk | Description |

| Market Fluctuations | Changes in demand affecting revenue |

| Unexpected Expenses | Costs arising from renovations or repairs |

| Management Issues | Challenges with property management |

- Monitor market trends closely.

- Budget for unexpected expenses.

- Choose a reliable property management team.

- "Success comes to those who persevere."

Tips for Securing the Best Funding

Securing the best funding for your condo hotel requires strategic planning and preparation. This section will provide practical tips to help you navigate the funding landscape effectively.

Building relationships with lenders can open doors to better financing options. Networking with professionals in the real estate industry can also provide valuable insights into available funding sources. Additionally, presenting a well-prepared business plan can demonstrate your commitment and understanding of the market, making you a more attractive candidate for funding.

As we approach the conclusion of this article, these tips will serve as a foundation for your funding journey, ensuring you’re well-equipped to make informed decisions.

| Tip | Description |

| Build Relationships | Cultivate connections with potential lenders |

| Prepare a Business Plan | Showcase your investment strategy clearly |

| Stay Informed | Keep up with industry trends and financing options |

- Cultivate relationships with lenders.

- Prepare a comprehensive business plan.

- Stay informed on market trends.

- The above steps must be followed rigorously for optimal success.

Conclusion

In conclusion, exploring the various condo hotel funding options is essential for anyone looking to invest in this lucrative market. By understanding the different financing methods, evaluating your needs, and preparing effectively, you can position yourself for success. Whether you choose traditional loans, alternative funding sources, or a mix of both, being informed will help you make the right decisions.

For a solid foundation in your investment journey, consider utilizing a Condo Hotel Business Plan Template to help outline your strategy. Additionally, we invite you to explore our other articles that provide valuable insights into managing and growing your condo hotel investment:

- SWOT Analysis for Condo Hotel: Key Strategies for Success

- Writing a Business Plan for Your Condo Hotel: Template Included

- Financial Planning for Your Condo Hotel: A Comprehensive Guide (+ Example)

- Ultimate Guide to Starting a Condo Hotel: Step-by-Step with Example

- Crafting a Marketing Plan for Your Condo Hotel: A Step-by-Step Guide with Examples

- Crafting a Business Model Canvas for Your Condo Hotel: A Step-by-Step Guide

- Identifying Customer Segments for Your Condo Hotel: Examples and Strategies

- Condo Hotel Profitability: Strategies for Success

- How Much Does It Cost to Start a Condo Hotel?

- How to Conduct a Feasibility Study for Condo Hotel?

- How to Conduct a Competition Study for Condo Hotel?

- How to Implement Effective Risk Management for Condo Hotel?

- What Legal Considerations Should You Know for Condo Hotel?

- Scaling Condo Hotel: Essential Growth Strategies

FAQ Section

What are the most common funding options for condo hotels?

Common funding options include traditional bank loans, hard money loans, SBA loans, and alternative funding sources like crowdfunding.

How does my credit score affect my condo hotel funding options?

A higher credit score can lead to lower interest rates and better loan terms, while a lower score may limit your options to higher rates.

What documents do I need to apply for condo hotel funding?

You typically need financial statements, tax returns, property details, and a well-prepared business plan.

Are there risks associated with condo hotel investments?

Yes, risks include market fluctuations, unexpected expenses, and management challenges.

How can I improve my chances of securing funding?

Build relationships with lenders, prepare a strong business plan, and stay informed about market trends.

What is the loan-to-value (LTV) ratio?

The LTV ratio is the ratio of the loan amount to the appraised value of the property, impacting your financing options.

Can I use crowdfunding to finance my condo hotel?

Yes, crowdfunding allows you to pool resources from multiple investors to secure funding.

What alternative funding options exist for condo hotels?

Alternative options include private equity, peer-to-peer lending, and real estate crowdfunding.

How important is a business plan in securing funding?

A well-prepared business plan demonstrates your understanding of the market and commitment to the investment, making you a more attractive candidate.

What steps should I take to assess my financing needs?

Evaluate your total funding needs, define your investment goals, and create a budget for property acquisition and renovations.