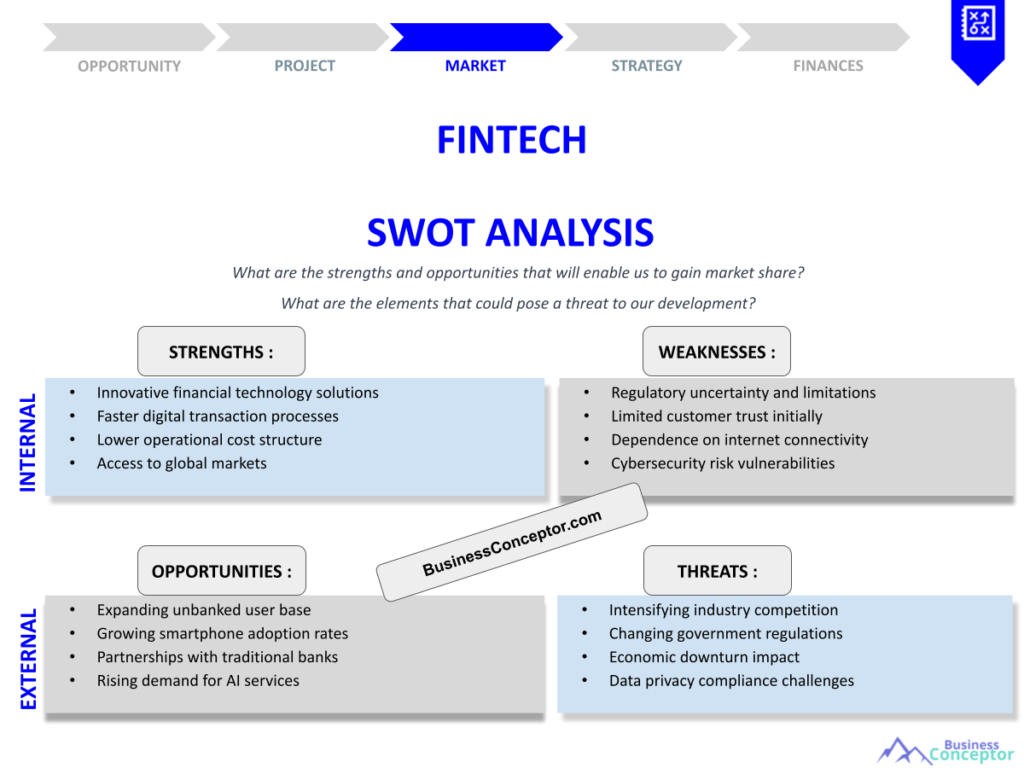

Did you know that the **fintech** industry has revolutionized the way we manage our money, making financial services more accessible and efficient? A Fintech SWOT Analysis is an essential tool for understanding the strengths, weaknesses, opportunities, and threats that shape this dynamic sector. In this article, we’ll explore the various facets of fintech through a comprehensive SWOT analysis, diving into the current trends and insights that are driving the industry forward.

- Strengths: Innovative technologies, customer-centric services, and operational efficiencies.

- Weaknesses: Regulatory challenges, cybersecurity risks, and market competition.

- Opportunities: Expanding digital banking, emerging markets, and advancements in AI.

- Threats: Traditional banks, evolving regulations, and economic instability.

Understanding Fintech: A Comprehensive Overview

Fintech, or financial technology, refers to the integration of technology into offerings by financial services companies to improve their use of financial services. This includes everything from mobile banking apps to blockchain technology. As the fintech landscape continues to evolve, understanding its core components becomes crucial for stakeholders.

The rise of fintech has led to a transformation in how consumers interact with financial services. For instance, traditional banks are now competing with agile fintech startups that leverage technology to offer better user experiences. This shift has resulted in a more competitive marketplace, where innovation is the key to success. The advantages of fintech are manifold, ranging from cost efficiency to enhanced customer experiences.

One of the most significant advantages of fintech is its ability to provide services at a fraction of the cost of traditional banking. By eliminating the need for physical branches, fintech companies can pass on these savings to consumers in the form of lower fees. Companies like Chime and Revolut have capitalized on this strength, providing efficient and user-friendly services to millions of customers.

Moreover, fintech companies have the agility to innovate rapidly. They can quickly adapt to changing consumer needs and market trends, a flexibility that traditional banks often lack due to their size and legacy systems. This adaptability allows fintech firms to introduce new products and features faster than their competitors, meeting the demands of a tech-savvy customer base. For example, the advent of mobile payment solutions like Venmo and Cash App has changed how people transfer money, making it instantaneous and convenient.

Additionally, the focus on customer-centric services is a hallmark of the fintech industry. By utilizing data analytics and machine learning, fintech companies can personalize their offerings, providing tailored financial solutions that cater to individual preferences. This level of personalization not only enhances customer satisfaction but also fosters loyalty, as users feel valued and understood.

| Core Components | Description |

|---|---|

| Digital Payments | Mobile wallets, peer-to-peer transfers, etc. |

| Lending Platforms | Online loan applications, peer-to-peer lending |

| Investment Services | Robo-advisors, trading platforms |

| Blockchain Solutions | Cryptocurrencies, smart contracts |

- Key Takeaways:

- Fintech encompasses a wide range of services.

- Technology is central to fintech innovation.

- The industry is highly competitive and rapidly evolving.

“Innovation distinguishes between a leader and a follower.” – Steve Jobs

The Strengths of Fintech Companies

Fintech companies have several strengths that set them apart from traditional financial institutions. Their ability to innovate rapidly is a significant advantage. For example, many fintech firms utilize machine learning algorithms to personalize financial advice for their users. This capability allows them to offer tailored solutions that resonate with consumer needs. The customization of services is not just a trend; it’s becoming an expectation among users who desire a more personal touch in their financial dealings.

Moreover, fintech companies often have lower operational costs compared to traditional banks. This is due to their digital-first approach, which eliminates the need for physical branches. By leveraging technology, these companies can streamline processes and reduce overhead expenses. For instance, companies like Chime and Revolut have capitalized on this strength by providing efficient and user-friendly services that cater to millions of customers. This cost efficiency translates into lower fees and better interest rates for consumers, making fintech an attractive option.

Another significant strength of fintech is its agility in responding to market demands. Unlike traditional banks, which can be bogged down by bureaucracy, fintech companies can pivot quickly to adapt to new trends and technologies. This flexibility allows them to introduce innovative products and features that meet the evolving needs of consumers. For instance, the rapid rise of mobile payment solutions like Apple Pay and Google Pay showcases how fintech firms can seize opportunities in the market, offering consumers seamless payment experiences.

| Strengths | Examples |

|---|---|

| Cost Efficiency | Lower fees for services |

| Innovative Solutions | Advanced tech integration |

| Customer-Centric | Tailored user experiences |

- Key Insights:

- Fintech companies leverage technology to reduce costs.

- Personalized services enhance customer satisfaction.

- Innovation drives market differentiation.

“The best way to predict the future is to create it.” – Peter Drucker

Weaknesses Facing the Fintech Industry

Despite their strengths, fintech companies face several weaknesses that can hinder their growth. One of the most pressing issues is the regulatory landscape. Navigating compliance can be challenging, especially as laws vary significantly across regions. Companies like Robinhood have faced scrutiny over their practices, highlighting the importance of adhering to regulations. The complexity of these regulations can lead to increased operational costs, as fintech firms often need to invest heavily in compliance infrastructure.

Additionally, cybersecurity risks pose a significant threat to fintech firms. Data breaches can severely damage customer trust and lead to financial losses. The 2020 cyberattack on the payment platform Wirecard is a prime example of how vulnerabilities can have devastating effects on a company’s reputation. Fintech companies must prioritize cybersecurity measures to protect sensitive customer data and maintain consumer confidence. This requires not only technological investments but also a commitment to ongoing staff training and awareness.

Furthermore, the competitive landscape of the fintech industry can create pressure on profit margins. As more startups enter the market, the fight for consumer attention intensifies. Established companies like PayPal and traditional banks are also ramping up their digital offerings to compete with fintech firms, making it challenging for new entrants to gain traction. This competition can lead to price wars, where companies lower their fees to attract customers, ultimately affecting profitability.

| Weaknesses | Implications |

|---|---|

| Regulatory Challenges | Increased compliance costs |

| Cybersecurity Risks | Potential data breaches |

| Market Competition | Pressure on profit margins |

- Important Notes:

- Regulatory compliance is a significant hurdle.

- Cybersecurity is critical for maintaining trust.

- Competition can squeeze profit margins.

“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.” – Peter Drucker

Opportunities in the Fintech Landscape

The fintech industry is ripe with opportunities for growth and innovation. One of the most exciting areas is the expansion of digital banking services. As more consumers shift to online banking, fintech companies have a unique chance to capture market share by offering superior services. This trend is largely driven by changing consumer preferences, especially among younger generations who are accustomed to using technology in every aspect of their lives.

Moreover, emerging markets present a wealth of opportunities. Countries with limited access to traditional banking services can benefit greatly from fintech solutions. For instance, mobile money services in Africa have transformed the financial landscape, enabling millions to access banking services for the first time. Companies like M-Pesa have demonstrated the power of mobile technology in increasing financial inclusion, providing services such as money transfers and savings accounts to populations that were previously unbanked.

In addition, advancements in artificial intelligence (AI) and machine learning are opening up new possibilities for fintech firms. These technologies can enhance customer experiences by providing personalized financial advice and automating routine tasks. For example, robo-advisors can analyze a user’s financial situation and recommend investment strategies tailored to their goals. This not only improves the user experience but also makes financial planning more accessible to the average consumer.

| Opportunities | Potential Impact |

|---|---|

| Digital Banking Growth | Increased customer base |

| Emerging Markets | Access to unbanked populations |

| AI and Automation | Improved efficiency and insights |

- Growth Potential:

- Digital banking is set for significant expansion.

- Emerging markets provide vast opportunities.

- AI can enhance operational efficiencies.

“Opportunities don't happen. You create them.” – Chris Grosser

Threats to the Fintech Sector

As promising as the fintech landscape may be, it is not without its threats. Traditional banks are ramping up their digital offerings to compete with fintech firms, often leveraging their established customer bases and trust. This competition can make it challenging for fintech startups to gain traction. For instance, large banks like JP Morgan Chase and Bank of America are investing heavily in their own digital platforms to retain existing customers and attract new ones. This level of competition can create significant barriers to entry for newer companies.

Additionally, evolving regulations can pose a threat. As governments adapt to the changing landscape, new regulations could stifle innovation or impose heavy compliance burdens on fintech companies. The unpredictability of regulatory changes can create an unstable environment for growth. For example, recent discussions around stricter regulations for cryptocurrency exchanges have led to uncertainty in the market, making it harder for fintech companies to plan long-term strategies.

Furthermore, economic instability can have a direct impact on consumer spending and investment behavior. During economic downturns, consumers may tighten their budgets, leading to decreased usage of financial services. This was evident during the recent global economic challenges, where many fintech companies saw a drop in transaction volumes. Such fluctuations can threaten profitability and sustainability for these firms.

| Threats | Consequences |

|---|---|

| Traditional Banks | Increased competition |

| Regulatory Changes | Potential for increased costs |

| Economic Instability | Reduced consumer spending |

- Key Challenges:

- Traditional banks are formidable competitors.

- Regulatory changes can impact operations.

- Economic conditions influence consumer behavior.

“In the middle of every difficulty lies opportunity.” – Albert Einstein

Future Trends in Fintech

The fintech sector is continually evolving, with several trends poised to shape its future. One significant trend is the increasing use of artificial intelligence and machine learning. These technologies are being utilized to enhance customer service, streamline operations, and improve decision-making processes. For instance, AI can analyze vast amounts of data to identify patterns in consumer behavior, allowing fintech companies to tailor their offerings more effectively. This level of personalization not only improves customer satisfaction but also drives engagement, as users feel that their unique needs are being met.

Moreover, the rise of open banking is set to redefine how consumers interact with financial services. By allowing third-party developers to build applications around banks, open banking fosters innovation and competition, ultimately benefiting consumers. This trend empowers users to take control of their financial data, enabling them to choose services that best meet their needs. For example, apps that aggregate various financial accounts into one platform can provide users with a comprehensive view of their financial health, making it easier to manage budgets and savings.

Another trend gaining traction is the integration of blockchain technology in fintech. Blockchain offers enhanced security and transparency, making it an attractive solution for various financial applications, from payment processing to identity verification. Companies leveraging blockchain can provide faster transaction times and reduced costs, as they eliminate the need for intermediaries. This technology is particularly relevant in the realm of cryptocurrencies, where firms like Coinbase are leading the charge in making digital currencies accessible to the masses.

| Trends | Impact on Fintech |

|---|---|

| AI and Machine Learning | Enhanced efficiency and personalization |

| Open Banking | Increased collaboration and innovation |

| Blockchain Technology | Improved security and transparency |

- Emerging Trends:

- AI is revolutionizing customer interactions.

- Open banking encourages competition and innovation.

- Blockchain enhances security and efficiency.

“The only way to do great work is to love what you do.” – Steve Jobs

Conclusion: Navigating the Fintech Landscape

As the fintech industry continues to grow and evolve, understanding its strengths, weaknesses, opportunities, and threats becomes essential for stakeholders. By leveraging insights from a comprehensive SWOT analysis, companies can position themselves for success in this competitive landscape. The key to thriving in fintech lies in embracing innovation and staying adaptable to the ever-changing market dynamics.

Furthermore, collaboration within the industry will be crucial for driving forward-thinking solutions. Partnerships between fintech firms and traditional banks can create synergies that enhance service offerings and expand market reach. For instance, banks can benefit from fintech’s technological expertise, while fintech companies can gain from banks’ established customer bases and regulatory knowledge.

Ultimately, the future of fintech looks promising, filled with potential for growth and transformation. Stakeholders who remain agile and responsive to trends will be well-positioned to capitalize on emerging opportunities, ensuring their relevance in this fast-paced environment. As consumers continue to demand better, faster, and more personalized financial services, the fintech landscape will undoubtedly keep evolving, paving the way for a new era in financial services.

| Final Thoughts | Key Considerations |

|---|---|

| Innovation is crucial for success | Adaptability to regulatory changes is vital |

| Collaboration can enhance growth | Focus on customer-centric solutions |

- Final Insights:

- Continuous innovation is essential for staying competitive.

- Partnerships can lead to enhanced service offerings.

- Consumer demand will drive future developments.

“Success is not the key to happiness. Happiness is the key to success.” – Albert Schweitzer

Understanding the Competitive Landscape in Fintech

The competitive landscape in the fintech industry is dynamic and multifaceted, reflecting the rapid evolution of technology and consumer expectations. One of the most significant aspects of this landscape is the presence of both traditional financial institutions and innovative startups vying for market share. Traditional banks, with their established reputations and customer bases, are increasingly investing in digital transformation to compete with agile fintech firms. This has led to a wave of innovation as banks adopt new technologies and business models to enhance their offerings.

Fintech startups, on the other hand, often operate with lower overhead costs and greater flexibility, allowing them to introduce innovative solutions quickly. Companies like Stripe and Square have disrupted traditional payment processing by offering user-friendly platforms that cater to small businesses and entrepreneurs. Their ability to simplify complex financial processes has made them popular choices among users looking for efficiency and convenience. This competition drives all players in the industry to continuously innovate, which ultimately benefits consumers.

Moreover, the rise of digital-only banks, or neobanks, has further intensified competition. These banks, such as N26 and Monzo, operate entirely online, offering services without the need for physical branches. They provide customers with seamless banking experiences through mobile apps, often featuring lower fees and better interest rates compared to traditional banks. This shift towards digital-first banking has forced established institutions to rethink their strategies, often leading to partnerships with fintech companies to enhance their digital offerings.

| Competitive Dynamics | Implications for Consumers |

|---|---|

| Traditional Banks vs. Fintech Startups | Enhanced services and lower costs |

| Rise of Neobanks | Increased accessibility and convenience |

| Collaborative Partnerships | Broader service offerings |

- Key Insights:

- Competition drives innovation in the fintech sector.

- Neobanks offer unique advantages over traditional banks.

- Partnerships can enhance service offerings for consumers.

“The greatest asset of a company is its people.” – Jorge Paulo Lemann

Investment Opportunities in Fintech

The fintech industry presents a plethora of investment opportunities for those looking to capitalize on its rapid growth. Investors are increasingly recognizing the potential of fintech to reshape the financial landscape, making it a hotbed for venture capital and private equity funding. One of the most compelling reasons to invest in fintech is the sector’s resilience and adaptability in the face of economic challenges. For instance, during economic downturns, fintech companies often find ways to thrive by offering cost-effective solutions that appeal to budget-conscious consumers.

Moreover, the rise of digital currencies and blockchain technology has opened up new avenues for investment. Cryptocurrencies, such as Bitcoin and Ethereum, have gained traction among investors looking for alternative assets. The underlying blockchain technology also holds promise for various applications beyond cryptocurrencies, including supply chain management, smart contracts, and secure voting systems. Companies developing blockchain solutions, like Ripple, are attracting significant attention from investors eager to tap into this transformative technology.

Additionally, the demand for financial inclusion continues to grow, particularly in emerging markets. Investors who focus on fintech solutions that cater to unbanked populations can not only achieve financial returns but also contribute to positive social change. Companies that provide microloans or mobile banking services in regions with limited access to traditional banking can unlock substantial market potential while making a meaningful impact on communities.

| Investment Opportunities | Potential Benefits |

|---|---|

| Venture Capital in Fintech Startups | High growth potential |

| Blockchain Technology | Innovative solutions and market disruption |

| Financial Inclusion Initiatives | Social impact and economic growth |

- Key Considerations:

- Fintech offers resilience and adaptability for investors.

- Blockchain technology provides innovative investment avenues.

- Focus on financial inclusion can yield both profits and impact.

“Invest in yourself. Your career is the engine of your wealth.” – Paul Clitheroe

Recommendations

As we explored throughout this article, the fintech industry is characterized by rapid innovation, competitive dynamics, and significant opportunities for growth. Understanding the strengths, weaknesses, opportunities, and threats is crucial for anyone looking to navigate this exciting landscape. For those interested in launching a fintech venture, I highly recommend checking out the Fintech Business Plan Template, which provides a comprehensive framework to help you develop a solid business strategy.

Additionally, if you want to deepen your knowledge and skills in various aspects of the fintech sector, consider exploring these related articles:

- Fintech: Strategies for Maximizing Profitability

- Fintech Business Plan: Template and Tips

- Fintech Financial Plan: A Detailed Guide

- Comprehensive Guide to Launching a Fintech Business: Tips and Examples

- Create a Marketing Plan for Your Fintech Business (+ Example)

- Starting a Fintech Business Model Canvas: A Comprehensive Guide

- Identifying Customer Segments for Fintech Companies (with Examples)

- How Much Does It Cost to Establish a Fintech Business?

- What Are the Steps for a Successful Fintech Feasibility Study?

- What Are the Key Steps for Risk Management in Fintech?

- Fintech Competition Study: Comprehensive Analysis

- Fintech Legal Considerations: Comprehensive Guide

- How to Secure Funding for Fintech?

- Fintech Growth Strategies: Scaling Examples

FAQ

What is a fintech SWOT analysis?

A fintech SWOT analysis is a strategic tool that evaluates the strengths, weaknesses, opportunities, and threats associated with fintech companies. This analysis helps businesses identify internal and external factors that can impact their operations and growth strategies.

What are the strengths of fintech companies?

The strengths of fintech companies include their ability to leverage advanced technology for efficient service delivery, lower operational costs due to digital-first approaches, and a strong focus on customer-centric solutions. These advantages allow fintech firms to respond quickly to market changes and consumer demands.

What weaknesses do fintech firms face?

Despite their advantages, fintech firms often encounter several weaknesses, such as regulatory challenges, vulnerabilities to cybersecurity threats, and intense competition from traditional financial institutions. These factors can hinder their growth and operational efficiency.

What opportunities exist in the fintech sector?

There are numerous opportunities in the fintech sector, including the growth of digital banking, the rise of open banking initiatives, and the potential for blockchain technology to enhance security and efficiency. These trends present exciting avenues for innovation and market expansion.

What threats do fintech companies need to consider?

Fintech companies face various threats, such as increased competition from established banks, changing regulations that may impose additional compliance burdens, and economic instability that can affect consumer spending habits. Addressing these threats is crucial for sustainable growth.

How can fintech companies maximize profitability?

To maximize profitability, fintech companies should focus on enhancing customer experiences, optimizing operational efficiencies, and leveraging data analytics for informed decision-making. Additionally, exploring new revenue streams and partnerships can further boost profitability.

What is the importance of customer segmentation in fintech?

Customer segmentation is vital for fintech companies as it allows them to tailor their services to meet the specific needs of different user groups. By understanding customer preferences and behaviors, fintech firms can develop targeted marketing strategies and improve customer retention.