The startup world is a wild ride, and one of the most critical components to success is having a solid startup financial plan. It’s like your roadmap, guiding you through the twists and turns of launching and growing your business. A startup financial plan is a comprehensive overview of your business’s financial health, detailing projections, budgets, and strategies to manage resources effectively. Having a well-structured financial plan not only helps you stay on track but also increases your chances of attracting investors and securing funding. Here’s what you need to know to set yourself up for success:

- Understand the components of a startup financial plan.

- Learn how to create financial projections.

- Discover tips for avoiding common financial pitfalls.

- Explore examples and templates for practical insights.

- Gain insights into investor expectations regarding financial plans.

Understanding the Components of a Startup Financial Plan

When diving into a startup financial plan, it’s essential to know the key components that make it effective. Think of it as building a house; without a solid foundation, everything else could come crumbling down. One of the first elements you need to consider is your income statement, which details your revenue and expenses over a specific period. This helps you see how much money you’re bringing in versus what you’re spending. For instance, if you notice that your expenses are consistently outpacing your income, you can take immediate action to address this imbalance.

Then there’s the balance sheet, showing what you own (assets) versus what you owe (liabilities). This gives a snapshot of your financial position at a point in time. A healthy balance sheet can be a powerful tool when seeking investors, as it reflects your company’s stability and financial strength. Next up is the cash flow statement, which tracks the flow of cash in and out of your business. This is crucial because even if you’re profitable on paper, poor cash flow can sink your startup. By monitoring your cash flow, you can identify periods of surplus and deficit, allowing you to plan accordingly.

Finally, don’t forget about financial projections. These are estimates of your future income, expenses, and profitability. They help you plan for growth and can be a vital tool for attracting investors. Investors often want to see how you plan to scale your business, and detailed projections can demonstrate that you have a clear vision and strategy in place. In summary, the components of a startup financial plan work together to provide a comprehensive picture of your financial health, guiding you toward informed decision-making.

| Component | Purpose |

|---|---|

| Income Statement | Shows revenue vs. expenses |

| Balance Sheet | Snapshot of assets vs. liabilities |

| Cash Flow Statement | Tracks cash movement |

| Financial Projections | Estimates future financial performance |

- Key Takeaways:

- Know your income statement, balance sheet, cash flow statement, and projections.

- Each component serves a specific purpose in understanding your financial health.

- Proper documentation can attract potential investors.

“A budget is telling your money where to go instead of wondering where it went.” 💰

Crafting Effective Financial Projections for Startups

Creating financial projections can feel like trying to predict the weather. You want to be as accurate as possible, but there are so many variables. The good news is that with a systematic approach, you can make educated estimates that will serve your startup well. Start by gathering historical data if available. If you’re a new startup, look at industry benchmarks. For example, if you’re in the SaaS space, researching typical growth rates and customer acquisition costs can provide a solid foundation for your projections.

Once you have your data, it’s time to project your revenue. Think about different scenarios: optimistic, realistic, and pessimistic. This will help you create a range of projections rather than a single number. It’s important to include factors such as market trends, seasonality, and your marketing strategy. This comprehensive approach allows you to anticipate potential challenges and prepare for them. For instance, if you expect a surge in sales during a particular season, you can ramp up your marketing efforts ahead of time to capitalize on that opportunity.

Next, project your expenses. This includes fixed costs like rent and salaries, and variable costs like marketing and supplies. Be realistic; it’s easy to underestimate costs, especially in the early stages. Consider all aspects of your business, including operational expenses, marketing budgets, and any unexpected costs that may arise. Once you have both revenue and expense projections, calculate your break-even point. This is the moment when your income equals your expenses, and knowing this number can help you understand how much you need to sell to stay afloat.

| Financial Projection | Description |

|---|---|

| Revenue Forecast | Estimated income from sales |

| Expense Forecast | Estimated costs of operations |

| Break-even Analysis | Point where income equals expenses |

- Key Insights:

- Use historical data and industry benchmarks for accurate projections.

- Calculate your break-even point to understand your sales targets.

- Regularly update your projections as your business evolves.

“Planning is bringing the future into the present so that you can do something about it now.” ⏳

Avoiding Common Financial Pitfalls in Startups

Every startup faces challenges, but understanding common financial pitfalls can help you steer clear of them. One major mistake is failing to keep accurate financial records. Without proper documentation, you can easily lose track of your financial health, leading to poor decision-making. Implementing a robust accounting system can save you time and headaches in the long run. For example, using cloud-based accounting software can automate many tasks and provide real-time insights into your finances.

Another common issue is underestimating expenses. It’s tempting to be overly optimistic about costs, but reality often hits hard. Always include a buffer in your budget for unexpected expenses, which can arise at any moment. This is particularly crucial in the early stages when uncertainties abound. Additionally, regularly reviewing your financial statements can help you identify discrepancies and adjust your budget accordingly.

Cash flow management is also critical. Many startups run into trouble because they don’t have enough cash to cover short-term expenses. Make sure to monitor your cash flow closely and plan for lean periods. Creating a cash flow forecast can help you anticipate when you might run low on cash and allow you to make adjustments ahead of time. Lastly, don’t ignore investor expectations. If you’re seeking funding, be prepared to present a well-structured financial plan that demonstrates your understanding of the business landscape. Investors are looking for startups that not only have a great idea but also a solid plan to manage their finances effectively.

| Common Pitfalls | Solutions |

|---|---|

| Poor record-keeping | Implement accounting software |

| Underestimating expenses | Include buffers for unexpected costs |

| Cash flow mismanagement | Regularly monitor cash flow |

| Ignoring investor needs | Develop a clear, professional financial plan |

- Important Points:

- Maintain accurate financial records for informed decision-making.

- Always include a buffer for unexpected expenses.

- Monitor cash flow closely to avoid shortfalls.

“An investment in knowledge pays the best interest.” 📈

The Importance of a Startup Budget Template

A startup budget template can be a lifesaver, especially when you’re just starting. It provides a structured way to organize your financial data and ensures you don’t miss any critical components. Creating a budget is like drawing a map for your business’s financial journey; it helps you navigate through both predictable and unforeseen challenges. When setting up your budget template, categorize your expenses into fixed and variable costs. Fixed costs remain constant, like rent, while variable costs can fluctuate, such as marketing expenses. This categorization helps you see where you can cut back if needed, allowing for better financial control.

Moreover, a good budget template allows for flexibility. As your startup grows, your budget should evolve too. Regularly revisit your budget to adjust for changes in revenue or unexpected expenses. This is particularly important in the dynamic world of startups, where things can change rapidly. For instance, if you secure a new client that significantly increases your revenue, you may want to allocate more funds toward scaling your operations or enhancing your marketing efforts. On the flip side, if a major expense arises, you can quickly adjust your budget to ensure you stay on track.

Another advantage of using a startup budget template is the ability to track your financial performance over time. By comparing your actual spending to your budgeted amounts, you can identify trends and make informed decisions. This ongoing analysis not only keeps you accountable but also provides insights that can inform future budgeting decisions. For example, if you notice that your marketing costs are consistently higher than budgeted, it may be time to re-evaluate your marketing strategy or explore more cost-effective channels.

| Budget Component | Description |

|---|---|

| Fixed Costs | Expenses that remain constant |

| Variable Costs | Expenses that can fluctuate |

| Budget Adjustments | Regular updates based on actual performance |

- Key Features:

- Organize expenses into fixed and variable categories.

- Allow flexibility for adjustments as the business grows.

- Regularly review and update the budget for accuracy.

“Budgeting isn’t about limiting yourself—it’s about making the things that excite you possible.” 🌟

Exploring Financial Modeling Tools for Startups

In today’s tech-driven world, leveraging financial modeling tools can give your startup a competitive edge. These tools help you visualize your financial data, making it easier to make informed decisions. One popular tool is Excel, which offers templates for creating financial models tailored to startups. Excel is user-friendly and allows for customization, making it an excellent choice for entrepreneurs who want to build their own models. However, if Excel isn’t your thing, there are specialized software options designed specifically for startups. These tools often come with built-in templates for income statements, balance sheets, and cash flow projections.

When selecting a tool, consider ease of use, scalability, and customer support. The right tool should grow with your startup and provide resources to help you understand your financial position better. For instance, tools like QuickBooks or FreshBooks offer not only financial modeling but also comprehensive accounting features that can save you time and reduce errors. Additionally, many of these tools integrate with other business applications, allowing for seamless data transfer and reporting.

Using financial modeling tools also enhances collaboration within your team. When everyone has access to the same financial data, it fosters transparency and encourages collective decision-making. For example, if your marketing team can see the budget allocated for their campaigns, they can plan more effectively and justify their spending based on the financial forecasts. Furthermore, these tools often provide visual representations of your data, such as graphs and charts, making it easier to communicate financial information to stakeholders or potential investors.

| Tool Type | Features |

|---|---|

| Excel Templates | Customizable financial models |

| Specialized Software | Built-in templates for various financial statements |

| User Support | Access to help and resources for using the tool |

- Tool Insights:

- Use Excel for customizable financial models.

- Explore specialized software designed for startups.

- Choose tools that offer scalability and support.

“The only limit to our realization of tomorrow will be our doubts of today.” 🚀

Preparing Investor-Ready Financials for Startups

If you’re aiming to attract investors, having investor-ready financials is crucial. Investors want to see a clear, professional financial plan that outlines your business’s potential. Start by ensuring your financial statements are accurate and up-to-date. This includes your income statement, balance sheet, and cash flow statement. Make sure to highlight key metrics like your burn rate and customer acquisition costs. These metrics not only provide insights into your business’s operational efficiency but also show investors that you understand the financial dynamics of your startup.

Next, include a detailed financial projection. This should cover at least three to five years and illustrate how you plan to grow and achieve profitability. Be transparent about your assumptions and provide supporting data to back your claims. For example, if you project a 20% growth in revenue due to increased marketing efforts, include data on past growth rates and market trends that support this assumption. Investors appreciate when entrepreneurs back up their projections with solid reasoning and data.

Another critical aspect of preparing investor-ready financials is to tailor your presentation to your audience. Different investors may be interested in different aspects of your financials. For instance, venture capitalists might focus more on growth potential and scalability, while angel investors might be more interested in your current financial health. Understanding what each type of investor values can help you highlight the most relevant information. Additionally, practicing your pitch can make a significant difference in how confidently you present your financials, further increasing your chances of securing funding.

| Investor-Ready Financials | Key Components |

|---|---|

| Accurate Financial Statements | Up-to-date income, balance sheet, and cash flow |

| Detailed Financial Projections | Three to five-year growth plan |

| Clear Presentation | Practice your pitch for confidence |

- Preparation Tips:

- Keep your financial statements accurate and up-to-date.

- Provide detailed projections with clear assumptions.

- Practice presenting your financials to gain confidence.

“Success usually comes to those who are too busy to be looking for it.” 🌟

Understanding the Role of a Startup CFO

Having a startup CFO can be a game changer for your business. A Chief Financial Officer is not just a number cruncher; they play a vital role in shaping your company’s financial strategy and ensuring sustainable growth. In the early stages, many entrepreneurs might overlook the need for a CFO, thinking they can handle the financial aspects themselves. However, as your startup grows, the complexity of financial management increases, making the role of a CFO indispensable.

A startup CFO brings a wealth of experience and knowledge that can help you navigate financial challenges more effectively. They can assist with financial forecasting, cash flow management, and budgeting, ensuring that your financial plan aligns with your overall business strategy. For instance, if you’re considering expanding your product line, a CFO can analyze the financial implications of this decision, helping you understand the potential return on investment and the risks involved.

Moreover, a CFO can also be instrumental in fundraising efforts. They can prepare investor-ready financials, conduct valuations, and create financial models that demonstrate your startup’s potential. Having a CFO by your side can significantly increase your credibility with investors, as it shows that you are serious about financial management. Additionally, they can help you develop a robust financial strategy that aligns with your business goals, ensuring long-term success.

| Role of a Startup CFO | Responsibilities |

|---|---|

| Financial Strategy | Shaping the overall financial direction of the company |

| Cash Flow Management | Ensuring sufficient cash flow for operations |

| Fundraising Support | Preparing investor-ready financials and valuations |

- Key Advantages:

- Navigate financial challenges with expertise.

- Prepare robust financial strategies for growth.

- Enhance credibility with investors and stakeholders.

“The best way to predict the future is to create it.” 🚀

Leveraging Financial Forecasting for Startup Growth

Financial forecasting is a crucial element in the toolbox of any entrepreneur aiming to achieve sustainable growth. By leveraging financial forecasting, startups can make informed decisions based on anticipated future performance rather than relying solely on historical data. This proactive approach allows businesses to identify trends, allocate resources effectively, and prepare for potential challenges. One of the primary benefits of financial forecasting is that it enables startups to set clear financial goals and objectives, giving them a target to aim for as they grow.

When creating a financial forecast, it’s essential to consider various factors that could impact your business. This includes market trends, economic conditions, and even potential regulatory changes. For example, if you anticipate an economic downturn, your forecasting should reflect a more conservative estimate of revenue and potentially increased costs. This level of foresight can help you avoid financial pitfalls and adapt your business strategy accordingly. Additionally, by regularly updating your forecasts based on actual performance, you can refine your understanding of your business dynamics, which leads to better decision-making.

Moreover, effective financial forecasting can be a powerful tool in securing investment. Investors are often keen to see how a startup plans to achieve its financial goals. A well-prepared forecast demonstrates that you have a clear vision and understand the financial landscape of your industry. It can also help you communicate your business’s potential in a compelling way, increasing your chances of attracting funding. For instance, if your forecast indicates significant growth potential in the coming years, investors may be more inclined to support your venture, seeing it as a promising opportunity.

| Financial Forecasting Benefits | Details |

|---|---|

| Informed Decision-Making | Anticipate future performance and challenges |

| Clear Financial Goals | Set targets for growth and resource allocation |

| Attracting Investment | Demonstrate potential for growth to investors |

- Key Takeaways:

- Utilize forecasting to set clear financial goals.

- Regularly update forecasts based on actual performance.

- Use forecasts to attract potential investors.

“Success is where preparation and opportunity meet.” 🌟

Creating a Comprehensive Business Plan with Financials

Developing a comprehensive business plan that includes detailed financials is vital for any startup looking to succeed. A well-structured business plan not only outlines your vision and goals but also provides a roadmap for achieving them. The financial section is particularly critical, as it offers insights into how you plan to manage your resources, generate revenue, and ultimately achieve profitability. This section should include your startup financial plan, financial projections, and an overview of your funding requirements.

When creating the financial section of your business plan, it’s essential to include several key components. Start with your income statement, which outlines your expected revenue and expenses over time. This gives potential investors a clear picture of your financial health and operational efficiency. Next, include a cash flow statement that illustrates how cash will flow in and out of your business. This is crucial for demonstrating that you can meet your financial obligations and avoid cash flow issues.

Additionally, your business plan should feature a balance sheet that provides a snapshot of your company’s assets, liabilities, and equity. This helps investors understand your financial position at a specific point in time. Furthermore, consider including a break-even analysis to show when your startup is expected to become profitable. This analysis not only aids in financial planning but also reassures investors that you have a clear understanding of your business’s financial trajectory.

| Business Plan Financial Section | Key Components |

|---|---|

| Income Statement | Expected revenue and expenses |

| Cash Flow Statement | Cash inflows and outflows |

| Balance Sheet | Snapshot of assets, liabilities, and equity |

| Break-even Analysis | When the startup becomes profitable |

- Essential Points:

- Include detailed financial statements in your business plan.

- Provide a clear overview of your funding requirements.

- Use financial analysis to reassure investors of your strategy.

“A goal without a plan is just a wish.” ✨

Recommendations

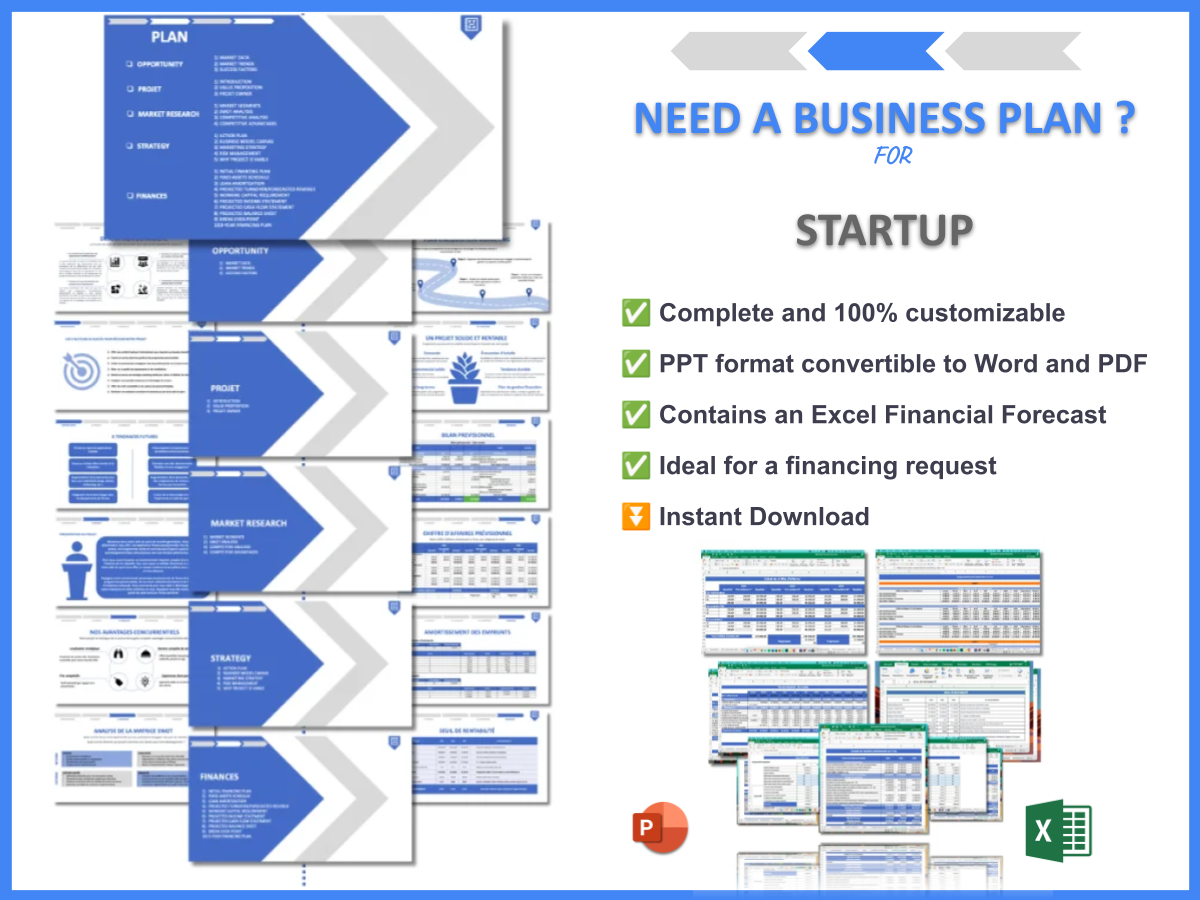

In summary, having a solid startup financial plan is essential for navigating the challenges of launching and growing your business. This guide has covered the critical components of financial planning, the importance of financial projections, budgeting, and preparing investor-ready financials. For those looking for an excellent resource to help you get started, check out the Startup Business Plan Template. This template will provide you with a structured approach to crafting a comprehensive business plan tailored to your startup’s needs.

Additionally, we encourage you to explore our related articles to further enhance your understanding and strategy for your startup:

- Startup SWOT Analysis: Key Insights for Success

- Startups: Strategies for High Profitability

- Startup Business Plan: Template and Tips

- Starting a Startup: The Complete Guide with Practical Examples

- Create a Winning Marketing Plan for Your Startup (+ Example)

- Start Your Startup Right: Crafting a Business Model Canvas with Examples

- Key Customer Segments for Startups: Examples and Analysis

- How Much Does It Cost to Launch a Startup?

- Ultimate Startup Feasibility Study: Tips and Tricks

- Ultimate Guide to Startup Risk Management

- Ultimate Guide to Startup Competition Study

- Essential Legal Considerations for Startup

- Exploring Funding Options for Startup

- How to Implement Growth Strategies for Startups

FAQ

What is a startup financial plan?

A startup financial plan is a comprehensive document that outlines your business’s financial goals, strategies, and projections. It serves as a roadmap for managing finances, helping startups understand their revenue streams, expenses, and overall financial health.

How do I create a financial projection for my startup?

To create a financial projection for your startup, gather historical data if available, or research industry benchmarks. Estimate your future revenue and expenses based on market trends, operational costs, and growth strategies. Regularly update these projections to reflect actual performance.

What are the common components of a startup financial plan?

The common components of a startup financial plan include the income statement, balance sheet, cash flow statement, and financial projections. Each of these elements provides insights into different aspects of your business’s financial health.

Why is cash flow management important for startups?

Cash flow management is vital for startups because it ensures that the business has enough liquidity to meet its obligations. Poor cash flow can lead to missed payments and financial instability, which can hinder growth and even threaten the survival of the business.

How can a budget template help my startup?

A budget template helps startups organize their financial data, categorize expenses, and set financial goals. It provides a structured approach to managing finances and can be adjusted as the business grows, allowing for better financial control and planning.

What role does a CFO play in a startup?

A startup CFO plays a crucial role in managing the company’s finances, developing financial strategies, and ensuring sustainable growth. They help with cash flow management, fundraising efforts, and preparing investor-ready financials, making them invaluable as the business scales.

How can financial forecasting benefit my startup?

Financial forecasting benefits startups by providing insights into future performance, helping to set clear financial goals, and preparing for potential challenges. It can also enhance credibility with investors, demonstrating that the business has a well-thought-out growth strategy.

What should be included in the financial section of a business plan?

The financial section of a business plan should include the income statement, cash flow statement, balance sheet, and a break-even analysis. These components provide a comprehensive overview of the startup’s financial health and funding requirements.