Did you know that nearly 80% of banking customers feel that their needs are not fully met by their financial institutions? Retail Bank Customer Segments are essential in helping banks understand and cater to different types of clients, from millennials to retirees. This article will delve into the various customer segments within retail banking and provide actionable strategies to effectively engage these diverse groups.

- Understanding customer demographics in banking

- Importance of market segmentation

- Tailoring banking products to customer needs

- The role of technology in customer engagement

- Examples of successful customer segmentation

- Strategies for enhancing customer loyalty

- Addressing the needs of niche markets

- Impact of digital banking on customer segments

- Future trends in retail banking

- Recommendations for banks to adapt

Understanding Customer Demographics in Retail Banking

The foundation of effective retail banking lies in understanding customer demographics. By identifying who their customers are, banks can tailor their services and products to meet specific needs. This demographic information includes age, income, education, and lifestyle preferences, all of which play a vital role in defining customer segments.

For instance, younger customers might prefer mobile banking options, while older clients may value personal interactions and in-branch services. A bank that recognizes these differences can create targeted marketing campaigns and product offerings that resonate with each segment. Additionally, using data analytics can help banks gain insights into customer behavior, enhancing their ability to serve diverse needs.

By understanding customer demographics, banks can create a more personalized experience, which is essential for building loyalty and trust. This sets the stage for exploring specific strategies to engage these segments in the following section.

| Demographic Factor | Importance in Banking |

|---|---|

| Age Group | Tailors services to life stages |

| Income Level | Determines product accessibility |

| Education | Influences financial literacy and product understanding |

| Lifestyle Choices | Affects banking preferences and engagement methods |

- Recognizing diverse age groups

- Understanding income levels for product offerings

- Considering education and financial literacy

“The key to success in banking is knowing your customers.”

The Importance of Market Segmentation in Banking

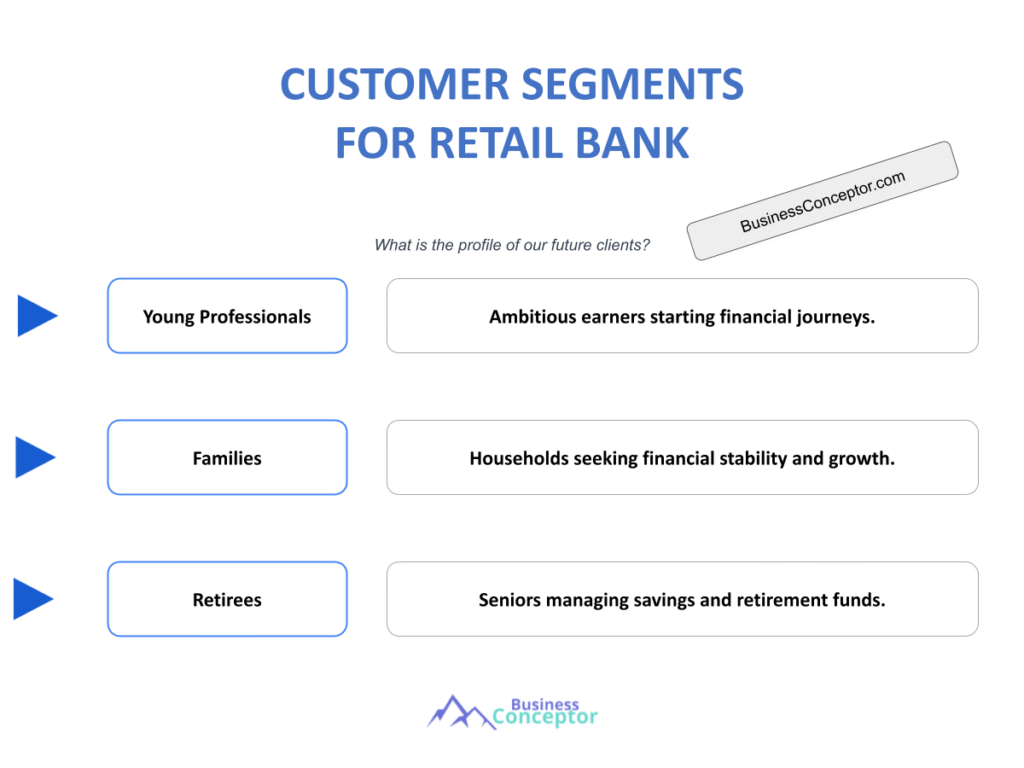

Market segmentation is crucial for retail banks aiming to enhance customer satisfaction and profitability. By dividing the broader market into smaller, manageable segments, banks can develop targeted strategies that address the unique needs of each group.

For example, affluent clients may seek wealth management services, while small business owners require tailored commercial banking solutions. Research indicates that banks that implement effective market segmentation strategies see a significant increase in customer retention and acquisition rates. Understanding the distinct preferences and pain points of each segment allows banks to offer relevant products and services, making them more appealing to potential clients.

Recognizing the importance of segmentation can lead to more strategic product development and marketing efforts. This insight will seamlessly transition us into exploring specific strategies for addressing the needs of these segments in the next section.

- Identify key customer segments

- Analyze their specific needs and preferences

- Develop tailored products and marketing strategies

– The above steps must be followed rigorously for optimal success.

Tailoring Banking Products to Customer Needs

To effectively serve diverse customer segments, banks must tailor their products to meet the unique needs of each group. This approach not only enhances customer satisfaction but also fosters loyalty and retention.

For instance, banks can offer specialized savings accounts for students or investment options for retirees. Additionally, understanding the life cycle of customers allows banks to introduce relevant products at the right time, ensuring that clients feel valued and understood. This level of personalization is essential in today’s competitive banking environment.

This customer-centric approach highlights the importance of flexibility in product offerings, which will lead us to examine how technology can facilitate these tailored solutions in the next section.

- Specialized products for different demographics

- Timely introduction of relevant financial services

- Flexibility in adapting product offerings

“To succeed, always move forward with a clear vision.”

The Role of Technology in Customer Engagement

Technology plays a pivotal role in enhancing customer engagement in retail banking. With the rise of digital banking, customers now expect seamless and convenient access to their financial services, making it essential for banks to adapt to these new demands.

For example, banks can utilize mobile apps to provide personalized banking experiences, such as tailored recommendations based on spending habits. Furthermore, data analytics can help banks predict customer needs, allowing for proactive engagement. By employing these technological advancements, banks can create a more satisfying and relevant experience for each customer segment.

As technology continues to evolve, banks must stay ahead of the curve to meet customer expectations and retain their competitive edge. This leads us to consider how banks can effectively implement these technologies in the next section.

| Technology | Impact on Banking |

|---|---|

| Mobile Banking | Increases accessibility and convenience |

| Data Analytics | Enhances personalization and proactive service |

| Chatbots | Improves customer service availability |

- Implement user-friendly mobile banking solutions

- Leverage data analytics for personalized service

- Integrate chatbots for 24/7 customer support

– The above actions will ensure banks remain competitive and responsive to customer needs.

Examples of Successful Customer Segmentation

Examining real-world examples can provide valuable insights into successful customer segmentation strategies in retail banking. Many banks have effectively tailored their offerings to meet the needs of specific segments, demonstrating the power of targeted approaches.

For instance, a regional bank may have developed a loyalty program specifically for small business owners, offering perks such as lower fees or dedicated account managers. Such initiatives illustrate how targeted approaches can yield positive results, leading to increased customer satisfaction and retention. By analyzing these success stories, other banks can gain inspiration and practical ideas for implementing their own customer segmentation strategies.

This understanding of successful examples will lead us to discuss how banks can enhance customer loyalty in the next section.

| Bank/Company | Strategy Implemented |

|---|---|

| Regional Bank | Loyalty program for small businesses |

| Online Bank | Tailored financial products for millennials |

- Focus on specific customer needs

- Develop targeted marketing campaigns

- Measure success through customer feedback

Strategies for Enhancing Customer Loyalty

Building customer loyalty is essential for retail banks, as loyal customers are more likely to recommend the bank to others and utilize multiple products. Establishing strong relationships with clients can significantly impact a bank’s overall success.

To foster loyalty, banks can implement personalized marketing strategies, such as sending tailored offers or providing exclusive access to new products. Additionally, creating a seamless customer experience across all banking channels can significantly enhance satisfaction. For example, a bank might utilize data to anticipate customer needs and proactively offer solutions, which can make clients feel valued and appreciated.

By prioritizing customer loyalty, banks not only increase their customer base but also create a more stable revenue stream. This emphasizes the importance of understanding customer segments in building lasting relationships, leading us to explore how banks can effectively address the needs of niche markets in the next section.

| Strategy | Benefit |

|---|---|

| Personalized Offers | Increases customer engagement |

| Seamless Experience | Enhances customer satisfaction |

- Implement personalized marketing strategies

- Create a seamless banking experience

- Gather feedback to improve services

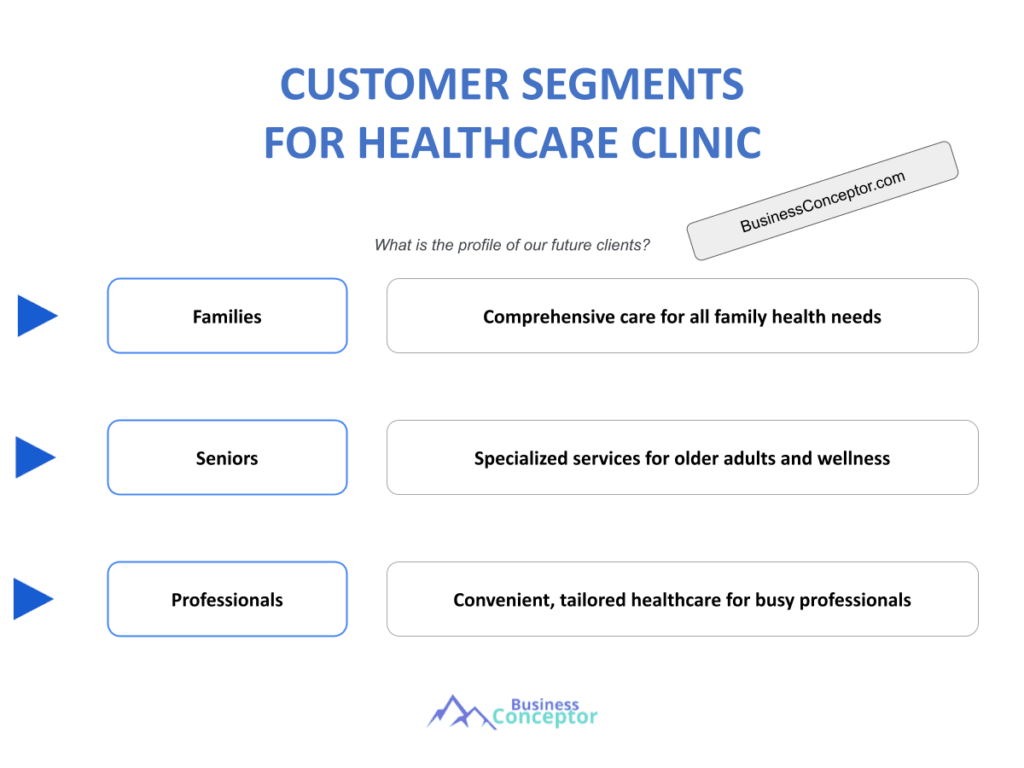

Addressing the Needs of Niche Markets

Niche markets represent a unique opportunity for retail banks to differentiate themselves from competitors. By focusing on specific segments, banks can develop specialized products and services that cater to unique needs, ultimately enhancing their market position.

For example, banks could target expatriates with tailored international banking services or develop products for specific professions, such as healthcare workers. Understanding these niche markets allows banks to create value and establish a loyal customer base, as clients appreciate the attention to their specific needs and challenges.

This targeted approach not only enhances customer satisfaction but also positions the bank as a leader in serving underrepresented segments. As we move forward, we will explore how banks can leverage digital banking to better serve these diverse customer segments in the next section.

- Identify niche market opportunities

- Develop specialized products for targeted segments

- Position the bank as a leader in niche services

The Impact of Digital Banking on Customer Segments

Digital banking has revolutionized the way customers interact with financial institutions, significantly impacting customer segments. As more consumers shift to online banking, understanding their digital preferences becomes crucial for banks aiming to stay relevant.

For instance, younger customers may prefer mobile banking apps that allow them to manage their finances on-the-go, while older customers might still favor in-person interactions for their banking needs. Banks must adapt to these preferences to ensure they meet the needs of all customer segments effectively. Implementing user-friendly interfaces and offering comprehensive online support can greatly enhance the banking experience for all age groups.

By leveraging digital tools and platforms, banks can create tailored experiences that resonate with each segment, ultimately enhancing customer satisfaction and loyalty. This focus on digital engagement leads us to consider the future trends in retail banking that will shape how banks operate and interact with their customers.

| Customer Segment | Preferred Banking Method |

|---|---|

| Millennials | Mobile apps |

| Baby Boomers | In-person banking |

- Analyze customer preferences for digital tools

- Develop user-friendly mobile banking solutions

- Enhance online customer service capabilities

– The above actions will ensure banks remain competitive and responsive to customer needs in the digital landscape.

Future Trends in Retail Banking

As the retail banking landscape continues to evolve, staying informed about future trends is essential for success. Emerging technologies and changing consumer preferences will shape how banks engage with their customer segments.

For example, the rise of artificial intelligence and machine learning can enhance personalization in banking, allowing banks to predict customer needs more accurately. Additionally, sustainability and ethical banking practices are becoming increasingly important to consumers, pushing banks to adopt more socially responsible approaches. By aligning their strategies with these trends, banks can better meet the evolving needs of their clients.

By anticipating these trends, banks can proactively adjust their strategies to meet the evolving needs of their customer segments. This awareness will be vital in maintaining competitiveness in the retail banking sector and ensuring long-term success.

“Success comes to those who persevere.”

- Stay informed about industry trends

- Embrace emerging technologies

- Adapt strategies to meet changing consumer needs

Conclusion

In summary, understanding Retail Bank Customer Segments is crucial for tailoring products and services that meet diverse customer needs. By leveraging technology, analyzing demographics, and implementing targeted strategies, banks can enhance customer satisfaction and loyalty. As you navigate the complexities of the banking landscape, consider utilizing a comprehensive Retail Bank Business Plan Template to streamline your efforts and ensure success.

- Article 1: SWOT Analysis for Retail Bank: Maximizing Business Potential

- Article 2: Retail Bank Profitability: Strategies for a Profitable Business

- Article 3: Developing a Business Plan for Your Retail Bank: Comprehensive Guide

- Article 4: Crafting a Financial Plan for Your Retail Bank: Essential Steps (+ Example)

- Article 5: How to Start a Retail Bank: Complete Guide with Example

- Article 6: Building a Retail Bank Marketing Plan: Strategies and Examples

- Article 7: How to Create a Business Model Canvas for a Retail Bank: Step-by-Step Guide

- Article 8: How Much Does It Cost to Operate a Retail Bank?

- Article 9: How to Calculate the Feasibility Study for Retail Bank?

- Article 10: How to Calculate Risks in Retail Bank Management?

- Article 11: How to Analyze Competition for Retail Bank?

- Article 12: How to Address Legal Considerations in Retail Bank?

- Article 13: How to Choose the Right Funding for Retail Bank?

- Article 14: How to Implement Growth Strategies for Retail Bank

FAQ

What are retail bank customer segments?

Retail bank customer segments refer to the different categories of customers that banks focus on based on their unique characteristics, preferences, and needs.

Why is market segmentation important in banking?

Market segmentation allows banks to tailor their offerings and marketing strategies to meet the specific needs of different customer demographics, enhancing overall satisfaction and loyalty.

How can technology improve customer engagement in retail banking?

Technology can enhance customer engagement by providing personalized experiences, streamlining services, and facilitating better communication between banks and their clients.

What are some examples of customer segments in retail banking?

Examples include millennials, affluent clients, small business owners, and niche markets such as expatriates.

How can banks address the needs of niche markets?

Banks can develop specialized products and services tailored to the unique needs of niche markets, positioning themselves as leaders in those specific areas.

What role does customer loyalty play in retail banking?

Customer loyalty is crucial as it leads to repeat business, referrals, and a more stable revenue stream, which are all essential for long-term success in the banking industry.

What trends are shaping the future of retail banking?

Key trends include digital transformation, sustainability, and the adoption of artificial intelligence to enhance personalization and customer service.

How can banks leverage data analytics for customer segmentation?

Data analytics can help banks identify customer behavior patterns and preferences, enabling more effective segmentation and targeted marketing efforts.

What are the benefits of personalized banking services?

Personalized banking services lead to increased customer satisfaction, loyalty, and engagement, as clients feel recognized and valued.

How can banks enhance their product offerings for different customer segments?

Banks can analyze customer demographics and preferences to create tailored products that effectively meet the specific needs of each segment.