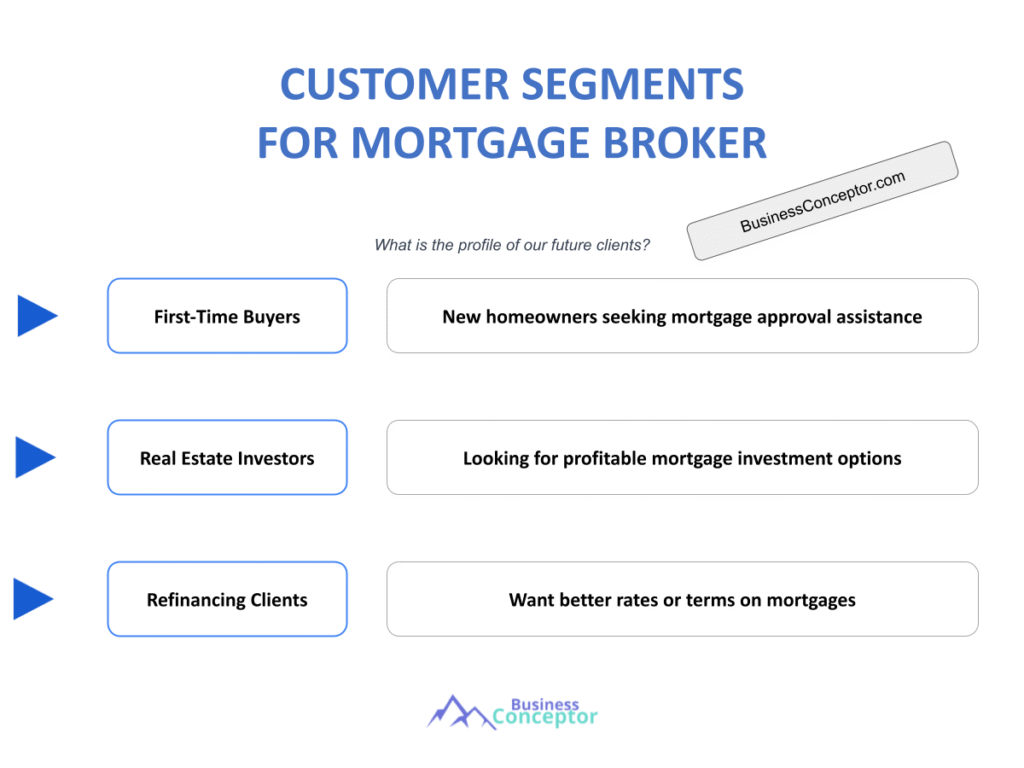

Did you know that understanding mortgage broker customer segments can significantly boost your business? Mortgage Broker Customer Segments refer to the various categories of clients that seek mortgage services, ranging from first-time homebuyers to seasoned investors. Knowing who your potential clients are is crucial for tailoring your services and marketing strategies effectively. This knowledge not only enhances your ability to serve clients but also increases your chances of closing deals and growing your business.

- Mortgage brokers cater to diverse client needs.

- Identifying customer segments helps in personalized marketing.

- Different demographics have unique mortgage requirements.

- Understanding these segments can lead to higher conversion rates.

Understanding the Types of Mortgage Broker Clients

When it comes to mortgage brokers, not all clients are created equal. Each segment has distinct needs and expectations. For instance, first-time homebuyers may seek guidance through the entire process, while seasoned investors might prioritize speed and efficiency. Understanding these nuances is key to providing exceptional service and building lasting relationships with clients.

Take first-time homebuyers, for example. They often feel overwhelmed by the mortgage process, which can be complex and intimidating. They need education on the types of loans available, understanding credit scores, and assistance with paperwork. This is where a knowledgeable broker can step in and make a significant difference. On the flip side, investors are typically more knowledgeable about the real estate market. They might be looking for specific loan types that fit their investment strategies, like lower interest rates or quicker processing times. Understanding these differences allows brokers to tailor their services accordingly, ensuring that they meet the unique needs of each client.

Each client type can be further broken down into sub-segments. For instance, millennials may prefer online communication and digital solutions, while older generations might value face-to-face interactions and personalized service. Recognizing these preferences can help you customize your approach, ensuring that you connect with clients on a level that resonates with them. This personalization not only enhances the client experience but also fosters trust and loyalty, which are essential for long-term success in the mortgage industry.

| Client Type | Key Characteristics |

|---|---|

| First-time homebuyers | Seek guidance, need education |

| Investors | Focused on efficiency, knowledgeable |

| Self-employed | Require flexible options, documentation |

| Seniors | Prefer personalized service, slower pace |

- First-time homebuyers need education and support.

- Investors prioritize speed and efficiency.

- Self-employed clients look for flexible solutions.

- Seniors appreciate personalized, slower-paced service.

“Understanding your clients is the first step to serving them better!” 😊

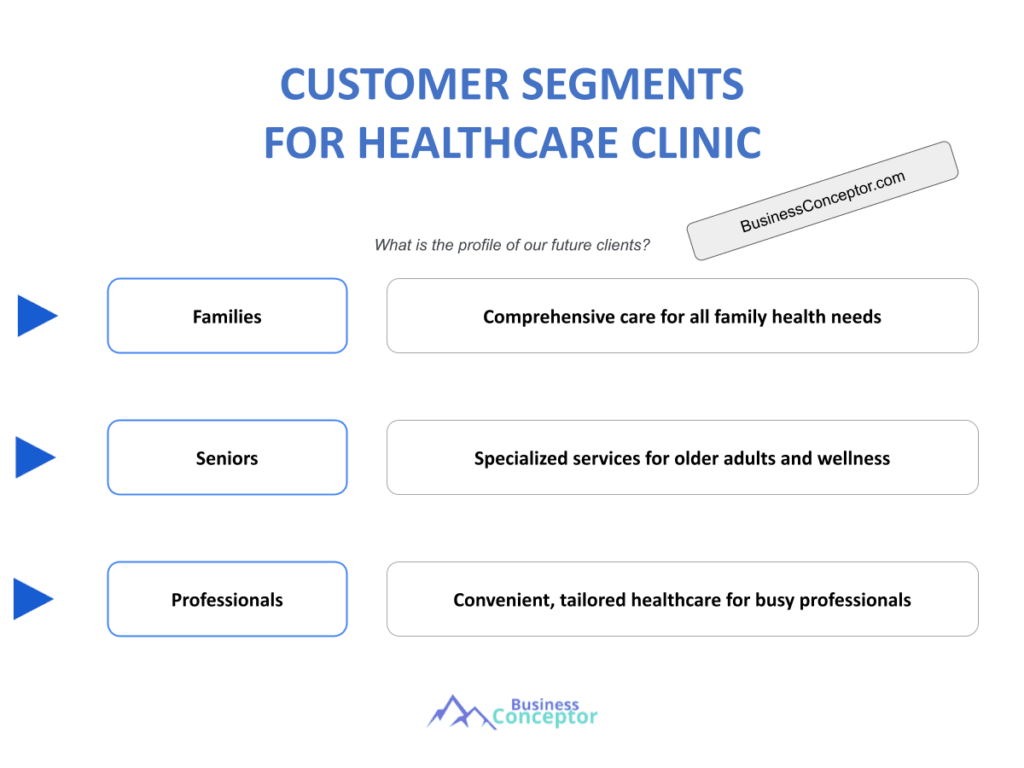

Identifying Mortgage Broker Demographic Analysis

Demographic analysis is a powerful tool for mortgage brokers seeking to understand their market. By examining factors such as age, income, and location, brokers can tailor their services to meet the specific needs of their target audience. This not only enhances client satisfaction but also increases the likelihood of closing deals.

For example, millennials are entering the housing market in droves. This generation often prefers digital solutions, such as online applications and virtual consultations. They are tech-savvy and value convenience, which means that brokers who embrace technology can streamline their processes and cater to this demographic effectively. On the other hand, baby boomers may lean towards more traditional methods and personalized services. They might appreciate face-to-face interactions and detailed explanations about the mortgage process. Recognizing these trends can help brokers position themselves effectively to serve a diverse clientele.

Another crucial aspect of demographic analysis is income level. High-income clients may seek luxury properties and require specialized mortgage products tailored to their financial situations. They are often interested in investment opportunities and may need guidance on the best mortgage options for their portfolios. Conversely, low-income borrowers might look for government-backed loans or assistance programs that help them achieve homeownership. By understanding these income brackets, brokers can offer the right products and services to each segment, ensuring that they meet their clients’ specific financial needs.

| Demographic Factor | Insights |

|---|---|

| Age | Different preferences based on generational trends |

| Income Level | Tailored services for high vs. low income clients |

| Location | Regional variations in mortgage needs |

- Millennials prefer digital solutions and online communication.

- Baby boomers value personalized service and traditional methods.

- High-income clients seek luxury mortgage options.

- Low-income borrowers may need assistance programs.

“Demographics matter; they shape the way clients interact with brokers!” 📊

Exploring Homebuyer Segmentation for Brokers

Homebuyer segmentation is essential for mortgage brokers to effectively market their services. By categorizing potential clients based on their specific needs and preferences, brokers can design targeted campaigns that resonate with each group. This approach not only improves the efficiency of marketing efforts but also enhances client engagement and satisfaction.

Consider the various types of homebuyers: first-time homebuyers, repeat buyers, and investors. First-time homebuyers often need more guidance and education about the mortgage process. They may be particularly sensitive to interest rates and fees, making it crucial for brokers to provide clear and accessible information. On the other hand, repeat buyers might have different priorities, such as speed and efficiency, as they are already familiar with the process. They may be looking for quick pre-approvals and streamlined applications. Investors, on the other hand, are focused on returns and may look for specific loan types that align with their investment strategies, such as lower interest rates or flexible terms.

By understanding these segments, brokers can create tailored marketing messages and offers that address the specific pain points of each group. For instance, a first-time homebuyer campaign might focus on educational resources and supportive materials, while an investor-focused campaign could highlight market trends and investment strategies. This targeted approach not only enhances customer satisfaction but also increases conversion rates, as clients feel that their unique needs are being recognized and addressed.

| Homebuyer Segment | Key Needs and Priorities |

|---|---|

| First-time buyers | Education, lower fees |

| Repeat buyers | Speed, familiarity |

| Investors | ROI focus, specific loan types |

- First-time buyers need education on the mortgage process.

- Repeat buyers value speed and efficiency.

- Investors focus on ROI and specific loan products.

“Segment your market to connect better with your clients!” 🎈

Analyzing Mortgage Needs by Age Group

Age plays a crucial role in determining mortgage needs. Each generation approaches homebuying differently, influenced by their unique experiences and economic circumstances. Understanding these generational differences is essential for mortgage brokers to effectively cater to their clients.

Younger generations, like millennials and Gen Z, may be more inclined to seek flexible mortgage options that accommodate their evolving lifestyles. They often prioritize low down payments and competitive interest rates, as many are still building their financial foundations. Additionally, this demographic values technology; they prefer online applications and digital communication, which makes it essential for brokers to adopt these tools to enhance their service delivery.

In contrast, older generations, such as Gen X and baby boomers, may focus on stability and long-term investments. These clients might prefer traditional mortgage products that offer fixed rates and predictable payments. They often have different financial priorities, such as retirement planning, and may be more cautious in their borrowing decisions. Recognizing these distinctions allows brokers to tailor their offerings, ensuring they meet the specific needs of each age group.

| Age Group | Mortgage Preferences |

|---|---|

| Gen Z | Flexibility, low down payments |

| Millennials | Competitive rates, digital tools |

| Gen X | Balance of stability and flexibility |

| Baby Boomers | Fixed rates, predictability |

- Younger generations prefer flexibility and low down payments.

- Older generations value stability and predictability.

- Tailored strategies can meet the unique needs of each age group.

“Age is more than just a number; it shapes financial decisions!” 🎉

Understanding Mortgage Borrowing Behavior

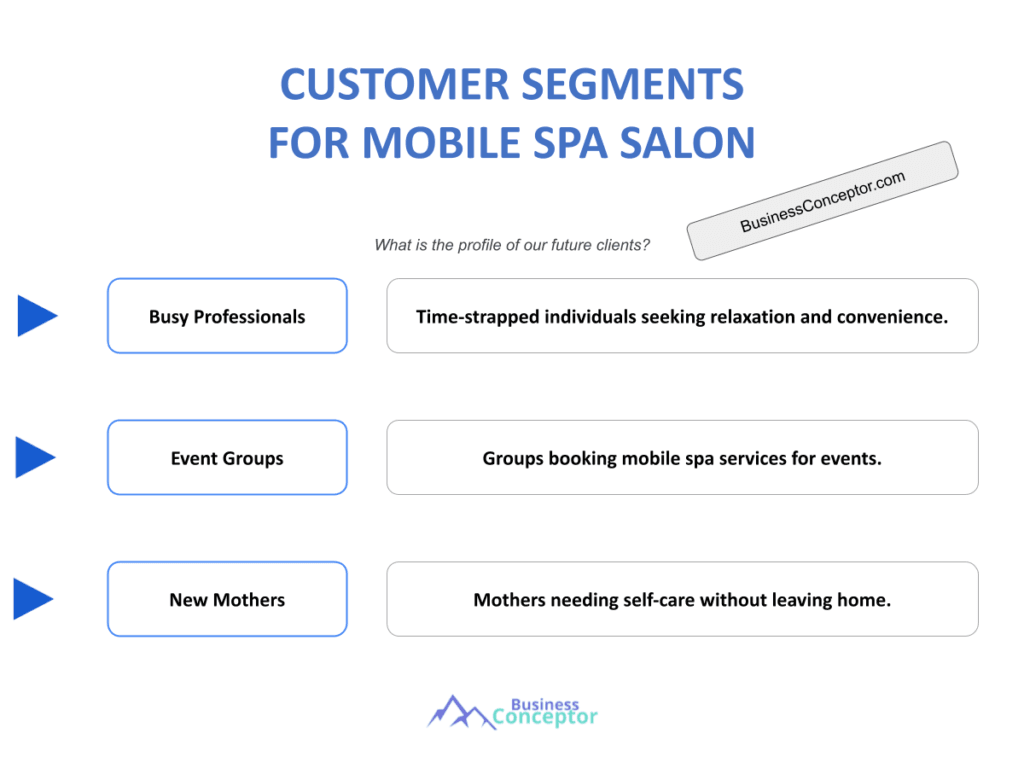

Mortgage borrowing behavior is a key factor in understanding your client segments. Different clients have varying motivations for borrowing, and recognizing these can help brokers tailor their services effectively. This understanding not only enhances the client experience but also increases the likelihood of securing a successful transaction.

For example, some clients may be driven by the desire to own a home for the first time, while others may seek refinancing options to lower their monthly payments. First-time homebuyers often require more support and education about the mortgage process. They may be particularly interested in programs that offer down payment assistance or favorable interest rates. On the other hand, existing homeowners looking to refinance may be motivated by a desire to reduce their monthly expenses or tap into their home equity for other financial needs.

Additionally, clients’ credit scores significantly influence their borrowing behavior. Those with high credit scores often seek the best interest rates and terms available, while clients with lower scores might need assistance finding suitable options that meet their financial situations. By understanding these behaviors, brokers can provide targeted advice and support, ensuring that clients feel informed and confident in their decisions.

| Borrowing Behavior | Key Influencing Factors |

|---|---|

| First-time buyers | Desire for homeownership |

| Refinancers | Interest in lowering monthly payments |

| Credit score impact | Access to loan options and interest rates |

- First-time buyers seek homeownership.

- Refinancers aim to lower their monthly payments.

- Credit scores impact borrowing options.

“Understanding borrowing behavior leads to better client relationships!” 🏡

Recognizing Mortgage Broker Trends

The mortgage industry is constantly evolving, and staying updated on the latest trends is essential for mortgage brokers. Emerging technologies, changing regulations, and shifting consumer preferences all play a significant role in shaping the landscape. By recognizing these trends, brokers can adapt their strategies and enhance their services to meet the ever-changing needs of their clients.

One of the most notable trends is the increasing demand for digital solutions. Many clients now prefer online applications and virtual consultations over traditional face-to-face meetings. This shift towards technology is particularly evident among younger generations, such as millennials and Gen Z, who are comfortable with digital communication. Brokers who embrace these technologies can streamline their processes, reduce paperwork, and improve client experiences, ultimately leading to higher satisfaction rates.

Another important trend is the rise of personalization in mortgage services. Clients today expect tailored solutions that meet their specific needs and preferences. This means that brokers must go beyond generic offerings and take the time to understand their clients’ unique situations. By providing personalized advice and recommendations, brokers can build trust and rapport with their clients, increasing the likelihood of referrals and repeat business.

| Industry Trend | Impact on Brokers |

|---|---|

| Digital solutions | Streamlined processes, enhanced experience |

| Personalization | Stronger client relationships and loyalty |

| Regulatory changes | Adjustments in loan offerings and advice |

- Digital solutions enhance client experiences and improve efficiency.

- Personalization builds stronger relationships and loyalty.

- Regulatory changes require brokers to adapt their offerings.

“Adaptability is the secret sauce in the mortgage industry!” 🔑

Tailoring Marketing Personas for Mortgage Brokers

Creating marketing personas is a valuable strategy for mortgage brokers. By developing detailed profiles of their ideal clients, brokers can create targeted marketing campaigns that resonate with specific segments. This tailored approach not only increases the effectiveness of marketing efforts but also enhances client engagement and satisfaction.

For instance, a persona for a first-time homebuyer might include characteristics such as age, income, and preferred communication methods. This information can help brokers craft messages that speak directly to their needs and concerns. Additionally, understanding the pain points of each persona can inform the types of content and resources brokers provide. For example, first-time homebuyers may benefit from educational materials about the mortgage process, while investors might appreciate insights on market trends and investment strategies.

By leveraging these marketing personas, brokers can ensure that their marketing efforts are relevant and impactful. This targeted messaging not only increases engagement but also enhances conversion rates, as clients feel that their unique needs are being recognized and addressed. Furthermore, maintaining an ongoing relationship with clients through personalized communication can lead to long-term loyalty and repeat business.

| Marketing Persona | Key Characteristics |

|---|---|

| First-time Homebuyer | Age, income, preferred communication |

| Investor | Investment focus, market knowledge |

- Marketing personas help tailor campaigns effectively.

- Understanding pain points informs content creation.

- Targeted messaging increases engagement and conversion.

“Create personas to connect better with your audience!” 🎯

Understanding Mortgage Rate Comparison Tools

In today’s competitive market, having access to mortgage rate comparison tools is essential for both mortgage brokers and their clients. These tools allow borrowers to compare different mortgage products, interest rates, and terms from various lenders. By utilizing these resources, brokers can help clients make informed decisions that best suit their financial needs.

One of the significant advantages of using mortgage rate comparison tools is the ability to identify the most favorable interest rates available. Clients often find themselves overwhelmed by the multitude of options in the market. With these tools, brokers can simplify the process by presenting clients with clear comparisons, highlighting the differences in rates, fees, and terms. This transparency not only builds trust but also empowers clients to choose a mortgage that aligns with their financial goals.

Moreover, rate comparison tools can save clients time and effort. Instead of having to research each lender individually, clients can quickly see a range of options in one place. This efficiency is particularly beneficial for first-time homebuyers, who may be unfamiliar with the mortgage process and need guidance to navigate the complexities involved. By providing easy access to this information, brokers can enhance the client experience and facilitate a smoother transaction process.

| Tool Type | Benefits |

|---|---|

| Online Comparators | Quick access to multiple lenders |

| Mobile Apps | Convenience and real-time updates |

| Custom Calculators | Personalized estimates based on user inputs |

- Mortgage rate comparison tools empower clients to make informed decisions.

- They save time by consolidating options into one accessible platform.

- These tools enhance the client experience by providing transparency.

“Empower your clients with the right tools for success!” 💪

Mortgage Consultant Packages and Their Value

In the competitive landscape of the mortgage industry, offering mortgage consultant packages can set brokers apart from their competition. These packages often include a variety of services designed to meet the diverse needs of clients, providing a comprehensive approach to mortgage brokerage.

One of the primary advantages of mortgage consultant packages is the added value they provide to clients. By bundling services such as loan pre-approval, personalized consultations, and ongoing support, brokers can create a seamless experience for clients. This not only enhances customer satisfaction but also fosters long-term relationships. Clients are more likely to return for future needs or refer friends and family when they feel they have received exceptional service.

Additionally, these packages can be tailored to specific client segments, such as first-time homebuyers, investors, or those seeking refinancing options. For instance, a package for first-time homebuyers might include educational resources about the mortgage process, assistance with paperwork, and access to down payment assistance programs. By catering to the unique needs of each segment, brokers can position themselves as trusted advisors, ultimately leading to increased referrals and repeat business.

| Package Type | Included Services |

|---|---|

| First-Time Homebuyer Package | Education, pre-approval, support |

| Investor Package | Market insights, tailored loan options |

| Refinancing Package | Rate analysis, personalized consultation |

- Mortgage consultant packages provide added value and comprehensive services.

- They foster long-term client relationships and loyalty.

- Packages can be tailored to meet the specific needs of different client segments.

“Tailored packages create lasting client relationships!” 🤝

Recommendations

In summary, understanding mortgage broker customer segments is essential for effectively catering to the diverse needs of clients in the mortgage industry. By identifying and analyzing different client types, brokers can tailor their services, improve client satisfaction, and ultimately drive business growth. For those looking to establish or enhance their mortgage brokerage, we recommend checking out the Mortgage Broker Business Plan Template, which provides a comprehensive framework to guide your business strategy.

Additionally, you may find the following articles valuable for further insights into the world of mortgage brokers:

- Article 1 on Mortgage Broker SWOT Analysis Insights

- Article 2 on Mortgage Brokers: Secrets to High Profitability

- Article 3 on Mortgage Broker Business Plan: Essential Steps and Examples

- Article 4 on Mortgage Broker Financial Plan: Essential Steps and Example

- Article 5 on Building a Mortgage Broker Business: A Complete Guide with Practical Examples

- Article 6 on Crafting a Marketing Plan for Your Mortgage Broker Business (+ Example)

- Article 7 on Building a Business Model Canvas for Mortgage Broker: Examples and Tips

- Article 8 on How Much Does It Cost to Establish a Mortgage Broker Business?

- Article 9 on How to Conduct a Feasibility Study for Mortgage Broker?

- Article 10 on How to Implement Effective Risk Management for Mortgage Broker?

- Article 11 on Mortgage Broker Competition Study: Comprehensive Analysis

- Article 12 on Mortgage Broker Legal Considerations: Comprehensive Guide

- Article 13 on What Funding Options Are Available for Mortgage Broker?

- Article 14 on How to Scale a Mortgage Broker: Proven Growth Strategies

FAQ

What are the different types of mortgage broker clients?

There are various types of mortgage broker clients, including first-time homebuyers, seasoned investors, and clients looking to refinance. Each group has distinct needs and expectations that brokers must understand to provide effective service.

How can demographic analysis help mortgage brokers?

Demographic analysis allows mortgage brokers to understand the characteristics of their client base, including age, income level, and location. This insight enables brokers to tailor their marketing strategies and service offerings to meet the specific needs of different client segments.

What factors influence mortgage borrowing behavior?

Mortgage borrowing behavior is influenced by several factors, including a client’s financial situation, credit score, and the desire to achieve homeownership. Understanding these behaviors helps brokers provide tailored advice and suitable loan options.

Why is personalization important in mortgage brokerage?

Personalization is crucial in mortgage brokerage because clients expect tailored solutions that meet their specific needs. By providing personalized services, brokers can build trust, enhance customer satisfaction, and encourage repeat business.

How do mortgage rate comparison tools benefit clients?

Mortgage rate comparison tools benefit clients by allowing them to compare different mortgage products, interest rates, and terms from various lenders. This transparency empowers clients to make informed decisions and choose the best mortgage options for their financial situations.

What are the advantages of mortgage consultant packages?

Mortgage consultant packages offer added value by bundling various services such as loan pre-approval, personalized consultations, and ongoing support. This comprehensive approach enhances the client experience and fosters long-term relationships between brokers and their clients.