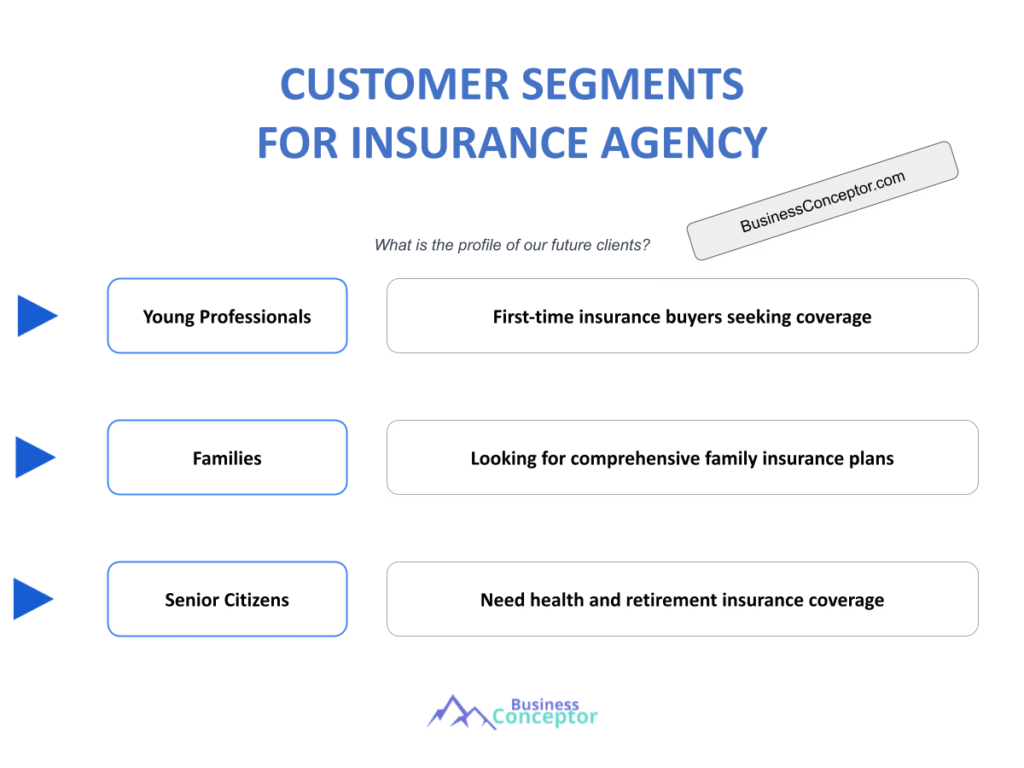

Insurance Agency Customer Segments are essential for any agency looking to tailor its services effectively. Did you know that agencies that segment their customer base see a significant increase in client satisfaction and retention? By understanding who your customers are, you can create targeted marketing strategies and develop relationships that cater to their specific needs. This not only enhances the overall customer experience but also boosts your agency’s bottom line. Customer segmentation in insurance allows agencies to identify and classify clients based on common characteristics, leading to better service and satisfaction.

- What are Insurance Agency Customer Segments?

- Grouping clients based on common characteristics.

- Helps tailor marketing strategies and product offerings.

- Enhances customer experience and satisfaction.

Understanding Insurance Agency Customer Segments can drive agency success. Different segments require different approaches, and personalization is key to retaining clients. By identifying these segments, agencies can effectively meet the unique needs of each group, leading to increased loyalty and trust.

Types of Insurance Customer Segments

When we talk about the types of insurance customer segments, it’s all about recognizing the various groups based on criteria like demographics, psychographics, and behaviors. By understanding these segments, insurance agencies can create targeted strategies to reach potential clients effectively. For instance, you might find segments based on age groups buying insurance, income levels, or even lifestyle choices. Each of these segments has unique preferences and requirements.

For example, younger clients, such as Millennials and Gen Z, may prioritize digital interactions and quick online quotes. They are often tech-savvy and prefer using mobile apps for managing their policies. In contrast, older clients, like Baby Boomers, might value face-to-face consultations and detailed explanations of their policies. They often appreciate the personal touch and reassurance that comes with traditional service methods. Agencies that can identify and address these preferences will likely see better engagement and conversion rates.

Moreover, understanding these segments allows agencies to develop targeted marketing campaigns that resonate with each group. For instance, a campaign aimed at young families may focus on life insurance options that ensure financial security for their children, while a campaign for retirees might emphasize health coverage and long-term care options. This level of customization not only attracts clients but also builds lasting relationships.

| Segment Type | Characteristics |

|---|---|

| Age Groups | Millennials, Gen Z, Baby Boomers |

| Income Levels | Low, Middle, High |

| Business Types | Small Businesses, Corporations |

| Lifestyle Choices | Health-conscious, Pet owners |

- Key Insights:

- Age influences buying behavior.

- Income levels dictate insurance needs.

- Different lifestyles require tailored coverage.

“Knowing your customer is half the battle!” 😊

In summary, understanding insurance customer segments not only helps agencies tailor their marketing strategies but also enhances the overall customer experience. By recognizing the specific needs of different segments, agencies can offer products and services that genuinely resonate with their clients. This ultimately leads to increased satisfaction and loyalty, which are critical for long-term success in the insurance industry.

How Insurance Agencies Segment Clients

Understanding how insurance agencies segment clients is crucial for effectively reaching and serving different customer groups. Segmentation can be achieved through various methods, including demographic data, psychographics, and behavioral analysis. By employing these strategies, agencies can create tailored marketing campaigns that resonate with each client segment.

For instance, demographic segmentation involves categorizing clients based on factors like age, gender, occupation, and income. This approach allows agencies to identify specific needs within each demographic group. For example, younger clients may be more interested in affordable health insurance plans that cater to their active lifestyles, while older clients might prioritize comprehensive coverage options that address chronic health conditions.

On the other hand, psychographic segmentation dives deeper into the emotional and psychological aspects of clients. This includes understanding their values, interests, and lifestyles. For instance, an agency that recognizes that many of its clients are environmentally conscious can tailor its offerings to include eco-friendly insurance options. By doing so, they not only attract clients who align with these values but also enhance customer loyalty.

Another important method is behavioral segmentation, which focuses on clients’ purchasing behaviors and interactions with the agency. By analyzing data on how often clients engage with their services or the types of products they prefer, agencies can create personalized experiences. For instance, if an agency notices that a specific client frequently inquires about travel insurance, they can proactively offer tailored packages that meet those needs.

| Segmentation Method | Description |

|---|---|

| Demographic | Age, gender, occupation |

| Psychographic | Values, interests, lifestyles |

| Behavioral | Purchase history, interaction frequency |

- Key Insights:

- Different segmentation methods yield different insights.

- Tailored marketing strategies enhance engagement.

- Understanding behaviors can improve retention.

“Segmenting clients is like finding the right puzzle piece!” 🧩

In conclusion, effective segmentation allows insurance agencies to identify specific client needs and preferences. By employing a combination of demographic, psychographic, and behavioral methods, agencies can develop targeted marketing strategies that resonate with their audience. This not only enhances client satisfaction but also drives loyalty and boosts overall agency performance.

Demographics of Insurance Buyers

The demographics of insurance buyers play a significant role in shaping how agencies approach their marketing and product offerings. Understanding the various demographic factors can lead to more effective strategies that cater to the unique needs of each group. Factors such as age, gender, income, and geographic location can significantly influence purchasing behavior and insurance preferences.

For instance, younger individuals, particularly Millennials and Gen Z, often seek affordable insurance options that offer flexibility. They are typically more inclined to use digital platforms for research and purchasing, valuing convenience and speed. Insurance agencies that can provide seamless online experiences, such as instant quotes and easy policy management, are likely to attract this demographic.

On the other hand, older clients, such as Baby Boomers, may prioritize comprehensive coverage and personalized service. They often appreciate the reassurance of speaking with an agent who can answer their questions and guide them through complex policy details. Agencies that focus on building relationships with these clients can foster loyalty and encourage long-term partnerships.

Moreover, income levels significantly impact insurance needs. High-income individuals may seek premium products that provide extensive coverage, while low-income clients might prioritize basic plans that offer essential protection. Understanding these differences allows agencies to tailor their offerings and marketing messages accordingly.

| Demographic Factor | Typical Needs |

|---|---|

| Age | Young adults prefer low-cost options |

| Gender | Women may focus on family coverage |

| Income | High-income clients seek luxury plans |

- Key Insights:

- Demographics guide product development.

- Marketing strategies must align with demographic trends.

- Awareness of demographic needs enhances client satisfaction.

“Understanding demographics is like having a roadmap!” 🗺️

In essence, recognizing the demographics of insurance buyers allows agencies to tailor their marketing strategies and product offerings effectively. By understanding the unique needs of each demographic group, agencies can create targeted campaigns that resonate with clients, ultimately leading to improved satisfaction and loyalty. This strategic approach not only enhances customer relationships but also drives agency success in a competitive market.

Psychographics in Insurance Marketing

Psychographics in insurance marketing is a powerful tool that delves beyond the surface of demographics to understand the motivations, values, and lifestyles of clients. By utilizing psychographic data, agencies can create more personalized marketing strategies that resonate deeply with their target audience. This level of insight allows for a more tailored approach to customer engagement, which can significantly enhance client satisfaction and retention.

For instance, clients who prioritize sustainability may be more inclined to choose insurance providers that offer eco-friendly policies or promote green initiatives. By understanding these values, insurance agencies can craft marketing messages that highlight their commitment to environmental responsibility, thus attracting clients who share those beliefs. This not only helps in acquiring new customers but also fosters loyalty among existing ones who feel their values are aligned with those of the agency.

Moreover, psychographic segmentation can help agencies identify unique product offerings that cater to specific interests. For example, a travel enthusiast may require specialized travel insurance that covers adventure sports or international health care. By recognizing these interests, agencies can offer tailored solutions that meet the unique needs of their clients, enhancing the overall customer experience.

| Psychographic Factor | Typical Preferences |

|---|---|

| Values | Eco-friendliness, community support |

| Lifestyle | Active, travel-oriented, family-focused |

| Interests | Health, technology, finance |

- Key Insights:

- Psychographics shape targeted marketing.

- Understanding values leads to better engagement.

- Tailoring offers based on interests enhances sales.

“Get to the heart of your clients with psychographics!” ❤️

In summary, leveraging psychographics in insurance marketing allows agencies to connect with clients on a more personal level. By understanding their motivations and values, agencies can create targeted campaigns that resonate with potential and existing clients. This approach not only improves engagement and satisfaction but also drives long-term loyalty, making it a crucial strategy for success in the competitive insurance market.

Targeting Small Business Insurance Clients

Targeting small business insurance clients presents a unique opportunity for insurance agencies to cater to a vital segment of the market. Small businesses often face distinct challenges that require specialized insurance solutions. By understanding these challenges, agencies can develop tailored offerings that resonate with small business owners, enhancing their overall experience and satisfaction.

For example, small business owners typically require coverage that protects against various risks, including liability, property damage, and employee injuries. Agencies that can provide comprehensive packages that address these specific needs are more likely to attract and retain small business clients. Additionally, offering flexible payment plans and customizable policies can further enhance the appeal of insurance products for this segment.

Moreover, small businesses often appreciate personalized service and support. By establishing strong relationships with small business owners, insurance agencies can better understand their evolving needs and provide timely solutions. Regular check-ins, educational resources, and tailored advice can create a sense of partnership that fosters loyalty and trust.

| Business Type | Typical Coverage Required |

|---|---|

| Restaurants | Liability, property, workers’ comp |

| Tech Startups | Cyber liability, professional liability |

| Retail Stores | Property, theft, liability |

- Key Insights:

- Small businesses require specialized coverage.

- Understanding their challenges enhances client relationships.

- Tailored offerings can lead to increased sales.

“Small businesses are the backbone of our economy!” 💪

In conclusion, effectively targeting small business insurance clients involves understanding their unique challenges and providing tailored solutions that meet their needs. By fostering strong relationships and offering personalized service, insurance agencies can build loyalty and trust within this vital market segment. This approach not only enhances client satisfaction but also drives growth and success for the agency in a competitive landscape.

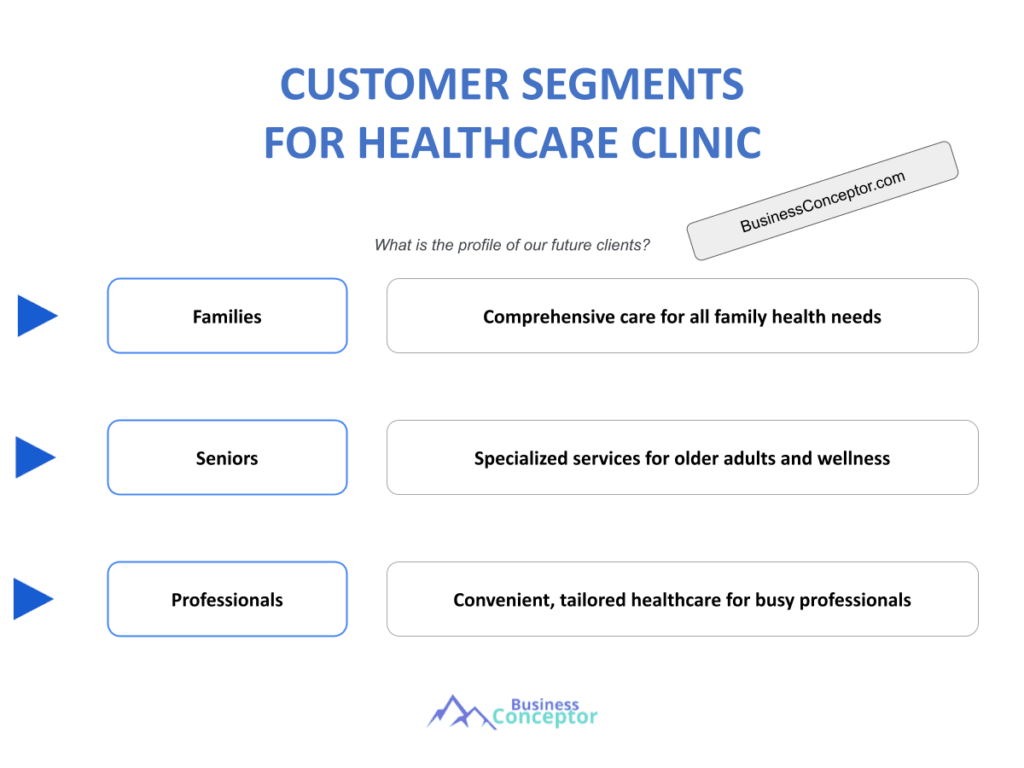

Health Insurance User Personas

Creating health insurance user personas is an essential strategy for insurance agencies aiming to enhance their offerings and marketing efforts. User personas represent the different types of clients an agency serves, providing insights into their needs, preferences, and behaviors. By developing these personas, agencies can tailor their services and marketing messages to better align with the specific requirements of each group, ultimately leading to improved client satisfaction and retention.

For instance, consider the persona of a young professional who is health-conscious and values preventive care. This individual might be interested in health insurance plans that offer wellness programs, gym memberships, or discounts for healthy lifestyle choices. By recognizing these preferences, agencies can design products that cater specifically to this demographic, making their offerings more appealing and relevant.

Similarly, an agency might create a persona for families with children who prioritize comprehensive coverage. This persona would likely seek health insurance that includes pediatric care, vaccinations, and specialist visits. By understanding the unique needs of this group, agencies can develop family-oriented health plans that resonate with these clients, enhancing their overall experience.

Moreover, older adults may have different healthcare needs, focusing more on chronic condition management and specialist consultations. By creating user personas for these clients, agencies can ensure that their health insurance products address the specific concerns of older demographics, such as long-term care options and medication management.

| Persona Type | Typical Characteristics |

|---|---|

| Active Young Adults | Focus on fitness, preventive care |

| Families | Need for comprehensive family coverage |

| Seniors | Prioritize chronic care management |

- Key Insights:

- User personas guide product development.

- Tailored marketing strategies improve engagement.

- Understanding client needs leads to better retention.

“Create personas to connect with your clients!” 🎯

In summary, developing health insurance user personas allows agencies to better understand and serve their clients. By tailoring products and marketing messages to meet the specific needs of each persona, agencies can enhance client satisfaction and loyalty. This strategic approach not only improves engagement but also drives long-term success in the competitive health insurance market.

Age Groups Buying Insurance

Understanding the age groups buying insurance is crucial for insurance agencies aiming to tailor their marketing strategies and product offerings effectively. Different age demographics exhibit distinct behaviors, preferences, and needs when it comes to purchasing insurance. By recognizing these differences, agencies can create targeted campaigns that resonate with each age group.

For example, younger clients, such as Millennials and Gen Z, often prefer digital-first experiences. They are typically tech-savvy and seek convenience in managing their insurance policies. This demographic is more likely to engage with online platforms for quotes and policy management. Insurance agencies that can provide user-friendly mobile apps and online services will likely attract this audience, as they value speed and efficiency.

On the other hand, older clients, particularly Baby Boomers and seniors, may prioritize personalized service and comprehensive coverage. They often appreciate the reassurance of speaking with an agent who can answer their questions and guide them through complex policy details. This group may be more inclined to invest in long-term insurance products, such as life insurance and health coverage that addresses their unique needs. By focusing on building relationships with older clients, agencies can foster loyalty and trust.

| Age Group | Typical Preferences |

|---|---|

| Gen Z | Digital-first, value-driven |

| Millennials | Convenience, tech-savvy |

| Baby Boomers | Personal touch, comprehensive coverage |

- Key Insights:

- Age affects purchasing behavior.

- Tailored strategies enhance marketing effectiveness.

- Understanding preferences improves client relationships.

“Age is just a number, but preferences matter!” 🧓👶

In conclusion, understanding the age groups buying insurance enables agencies to tailor their marketing strategies and product offerings effectively. By recognizing the unique needs and preferences of different age demographics, agencies can create targeted campaigns that resonate with clients. This strategic approach not only enhances client satisfaction but also drives loyalty and long-term success in a competitive insurance landscape.

Insurance Consumer Behavior Trends

Staying ahead of insurance consumer behavior trends is crucial for agencies aiming to thrive in a competitive market. As technology evolves and consumer expectations change, understanding these trends can provide valuable insights for tailoring marketing strategies and product offerings. Agencies that adapt to these shifts not only enhance customer satisfaction but also position themselves as leaders in the industry.

One prominent trend is the increasing demand for digital interactions. Many consumers now prefer to research and purchase insurance online. This shift towards digital platforms means that agencies must invest in user-friendly websites and mobile applications that allow clients to obtain quotes, manage policies, and file claims with ease. By offering a seamless online experience, agencies can attract tech-savvy clients who prioritize convenience and efficiency.

Another significant trend is the rising importance of personalization. Consumers are no longer satisfied with one-size-fits-all solutions; they expect insurance products that cater specifically to their unique needs and preferences. Agencies that utilize data analytics to understand client behavior can create customized offerings that resonate with their audience. For example, if an agency identifies that a segment of clients frequently travels, they can offer tailored travel insurance packages that address their specific concerns.

| Trend | Implication for Agencies |

|---|---|

| Digital Interactions | Need for user-friendly online platforms |

| Personalization | Importance of tailored insurance solutions |

| Instant Access | Streamlined processes are essential |

- Key Insights:

- Consumer behavior trends drive market changes.

- Adapting to trends enhances competitiveness.

- Personalization is key to client retention.

“Stay ahead of trends to keep your clients happy!” 🚀

Furthermore, the trend towards instant access to information and services is reshaping the insurance landscape. Consumers now expect quick responses and easy access to their policies and claims. Agencies that streamline their processes, such as offering 24/7 customer support and real-time policy updates, will likely gain a competitive edge. By prioritizing speed and accessibility, agencies can meet consumer expectations and build trust with their clients.

In summary, understanding insurance consumer behavior trends allows agencies to adapt their marketing strategies and product offerings effectively. By recognizing the importance of digital interactions, personalization, and instant access, agencies can enhance client satisfaction and loyalty. This proactive approach not only drives growth but also positions agencies for long-term success in an ever-evolving market.

Marketing Strategies for Insurance Clients

Implementing effective marketing strategies for insurance clients is essential for agencies seeking to attract and retain customers in a competitive landscape. By understanding the unique needs of various client segments, agencies can create targeted campaigns that resonate with their audience and drive engagement.

One effective strategy is content marketing. By producing valuable and informative content, such as blog posts, videos, and webinars, agencies can establish themselves as thought leaders in the insurance industry. This not only builds trust with potential clients but also improves search engine visibility, driving more traffic to the agency’s website. For example, an agency could create a series of articles focused on understanding different types of insurance policies, helping consumers make informed decisions.

Another key strategy is leveraging social media platforms to engage with clients. Social media allows agencies to interact directly with their audience, respond to inquiries, and share valuable information. By creating engaging content that resonates with their target audience, agencies can build a loyal following and enhance brand awareness. For instance, sharing testimonials from satisfied clients or highlighting community involvement can foster a positive image and attract new customers.

| Strategy | Description |

|---|---|

| Content Marketing | Sharing valuable information to build trust |

| Social Media Engagement | Interacting with clients to foster loyalty |

| Personalized Outreach | Tailoring communication based on segments |

- Key Insights:

- Effective marketing fosters client relationships.

- Personalization enhances engagement.

- Content-driven strategies build authority.

“Marketing is about relationships, not just sales!” 🤝

Personalized outreach is another effective marketing strategy that can significantly enhance client relationships. By utilizing data analytics to segment clients based on their preferences and behaviors, agencies can tailor their communication and offerings to meet specific needs. For example, sending personalized emails with relevant product recommendations or special offers can make clients feel valued and understood.

In conclusion, employing effective marketing strategies for insurance clients is vital for agencies looking to thrive in a competitive market. By leveraging content marketing, social media engagement, and personalized outreach, agencies can build strong relationships with their clients, improve satisfaction, and drive long-term success. This strategic approach not only enhances the agency’s reputation but also ensures sustained growth in a dynamic industry.

Recommendations

In this article, we explored the various insurance agency customer segments and the importance of understanding their unique needs and preferences. By implementing effective strategies for segmentation, agencies can enhance their marketing efforts and improve client satisfaction. To further support your journey in the insurance industry, we recommend utilizing the Insurance Agency Business Plan Template. This resource provides an excellent framework to help you develop a comprehensive business plan tailored specifically for your insurance agency.

Additionally, we encourage you to check out our related articles on Insurance Agency topics:

- Insurance Agency SWOT Analysis Essentials

- Insurance Agencies: How Profitable Can They Be?

- Insurance Agency Business Plan: Comprehensive Guide with Examples

- Insurance Agency Financial Plan: Essential Steps and Example

- Starting an Insurance Agency: A Comprehensive Guide with Examples

- Create a Marketing Plan for Your Insurance Agency (+ Example)

- Building a Business Model Canvas for an Insurance Agency: Examples and Tips

- How Much Does It Cost to Operate an Insurance Agency?

- What Are the Steps for a Successful Insurance Agency Feasibility Study?

- What Are the Key Steps for Risk Management in Insurance Agency?

- What Are the Steps for a Successful Insurance Agency Competition Study?

- How to Navigate Legal Considerations in Insurance Agency?

- How to Secure Funding for Insurance Agency?

- Insurance Agency Growth Strategies: Scaling Guide

FAQ

What are the types of insurance customer segments?

The types of insurance customer segments refer to the different categories into which clients can be classified based on shared characteristics. These segments may include demographics such as age, income, and business type, as well as psychographics like lifestyle and values. Understanding these segments helps agencies tailor their marketing strategies and product offerings to better meet client needs.

How do insurance agencies segment clients?

Insurance agencies segment clients using various methods, including demographic, psychographic, and behavioral analysis. By analyzing factors such as age, gender, purchasing behavior, and client preferences, agencies can create targeted marketing campaigns that resonate with specific client groups, ultimately leading to improved customer satisfaction and loyalty.

What are the demographics of insurance buyers?

The demographics of insurance buyers encompass various factors that influence their purchasing decisions, such as age, gender, income level, and geographic location. For instance, younger clients may prefer affordable and flexible insurance options, while older clients may prioritize comprehensive coverage and personalized service. Understanding these demographics allows agencies to tailor their offerings effectively.

What are the psychographics in insurance marketing?

Psychographics in insurance marketing involve analyzing clients’ values, interests, and lifestyles to create more personalized marketing strategies. By understanding what motivates clients and what they value, agencies can develop products and marketing messages that resonate deeply with their audience, enhancing engagement and satisfaction.

How can small businesses benefit from insurance?

Small businesses benefit from insurance by obtaining coverage that protects against various risks, such as liability, property damage, and employee injuries. Insurance provides financial security and peace of mind, allowing small business owners to focus on growing their operations without the constant worry of unforeseen events affecting their livelihood.

What are the key consumer behavior trends in insurance?

Key consumer behavior trends in insurance include the shift towards digital interactions, the demand for personalized products, and the expectation for instant access to information and services. Agencies that adapt to these trends by enhancing their digital platforms and personalizing their offerings will likely see increased client satisfaction and loyalty.

What marketing strategies are effective for insurance clients?

Effective marketing strategies for insurance clients include content marketing, social media engagement, and personalized outreach. By providing valuable information, engaging with clients through social media, and tailoring communication based on client segments, agencies can build strong relationships and improve overall client satisfaction.