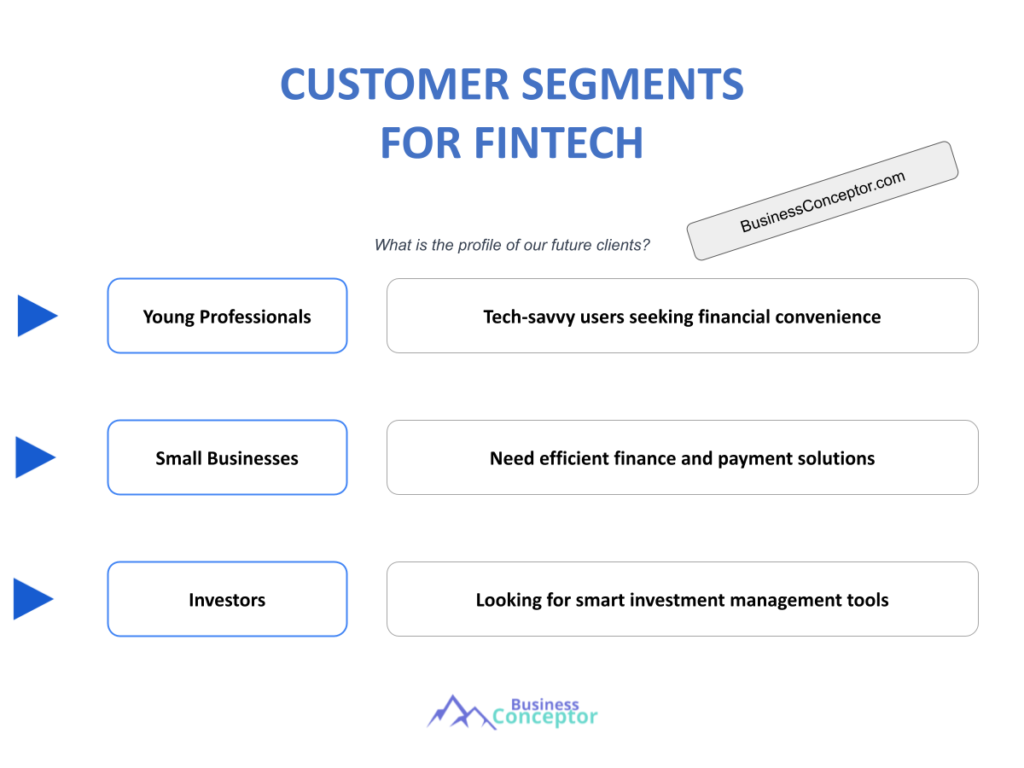

Did you know that understanding fintech customer segments can dramatically improve how companies tailor their products? Fintech customer segments refer to the diverse groups of individuals or businesses that use financial technology services, each with unique needs and preferences. By identifying these segments, fintech companies can create targeted marketing strategies and personalized services that resonate with their audience. The benefits are profound and can lead to increased customer satisfaction, loyalty, and ultimately, higher revenue. Here’s what you need to know:

- Different customer segments exist in the fintech landscape, including millennials, Gen Z, small businesses, and the unbanked.

- Each segment has distinct preferences and behaviors that influence their financial decisions.

- Understanding these segments can enhance customer satisfaction and loyalty.

Types of Fintech Customer Segments

When diving into the world of fintech, it’s crucial to recognize the various customer segments that exist. Each segment plays a significant role in the overall success of fintech companies. Understanding these segments not only helps in product development but also in crafting effective marketing strategies that resonate with specific audiences.

One of the most prominent segments includes millennials and Gen Z. These younger generations have grown up with technology and are more inclined to adopt digital financial solutions. They prefer mobile apps and digital wallets over traditional banking. For example, companies like Cash App and Venmo have gained immense popularity among this demographic due to their ease of use and social features. These platforms allow users to send money quickly, split bills, and even invest, making financial transactions more interactive and engaging.

Another important segment is small business owners. This group often seeks tailored financial solutions that help streamline operations, manage cash flow, and access funding. Fintech platforms like Square and Kabbage cater to these needs by providing payment processing and loan services designed specifically for small businesses. The convenience of receiving funds instantly and managing expenses through intuitive apps is a game-changer for entrepreneurs who often juggle multiple responsibilities.

In addition, the unbanked and underbanked populations present a unique opportunity for fintech companies. These individuals often lack access to traditional banking services and may rely on alternative financial solutions like microloans or peer-to-peer lending. Companies like Grameen Bank have successfully targeted this segment, providing microfinance services to help lift individuals out of poverty. By focusing on this underserved market, fintech companies can not only achieve business success but also contribute to social equity.

Here’s a summary of the types of fintech customer segments:

| Customer Segment | Characteristics |

|---|---|

| Millennials & Gen Z | Tech-savvy, prefer mobile solutions |

| Small Business Owners | Seek tailored financial solutions |

| Unbanked/Underbanked | Require access to alternative financial services |

– Millennials and Gen Z are more likely to engage with fintech apps.

– Small business owners need specific tools for cash flow management.

– The unbanked segment presents opportunities for microfinance solutions.

“Understanding your audience is the first step to success!” 🌟

Behavioral Segmentation in Fintech

Behavioral segmentation is a powerful tool for fintech companies looking to understand their customers better. By analyzing user behaviors and preferences, companies can tailor their offerings to meet specific needs, leading to higher satisfaction and retention rates. This approach goes beyond basic demographics, focusing on how customers interact with financial products and services.

For instance, consider the different usage patterns of digital wallets. Some users may utilize these services for everyday purchases, while others might use them primarily for sending money to friends and family. By recognizing these behaviors, fintech companies can design features that cater to each group’s specific needs. For example, a user who frequently sends money to friends might benefit from a social sharing feature, while someone who uses the wallet for shopping might prefer integration with loyalty programs.

Another example is the growing trend of buy now, pay later (BNPL) services. Users who frequently opt for BNPL solutions often do so due to their desire for flexible payment options. Companies like Afterpay and Klarna have tapped into this behavior by offering easy-to-use platforms that allow users to spread out payments without incurring interest. This flexibility appeals to younger consumers who may not have access to traditional credit or prefer to manage their cash flow more effectively.

By implementing behavioral segmentation, fintech companies can create personalized marketing campaigns that resonate with specific user groups. This not only improves customer engagement but also drives conversion rates. For example, targeted advertisements highlighting specific features based on user behavior can lead to higher click-through rates and increased usage of the app.

Here’s a summary of behavioral segmentation in fintech:

| Behavioral Segment | Characteristics |

|---|---|

| Everyday Users | Use digital wallets for routine transactions |

| BNPL Users | Prefer flexible payment options |

– Understanding user behaviors can lead to better product offerings.

– BNPL services are gaining traction among users seeking flexibility.

“Tailoring your approach can lead to unexpected success!” 🚀

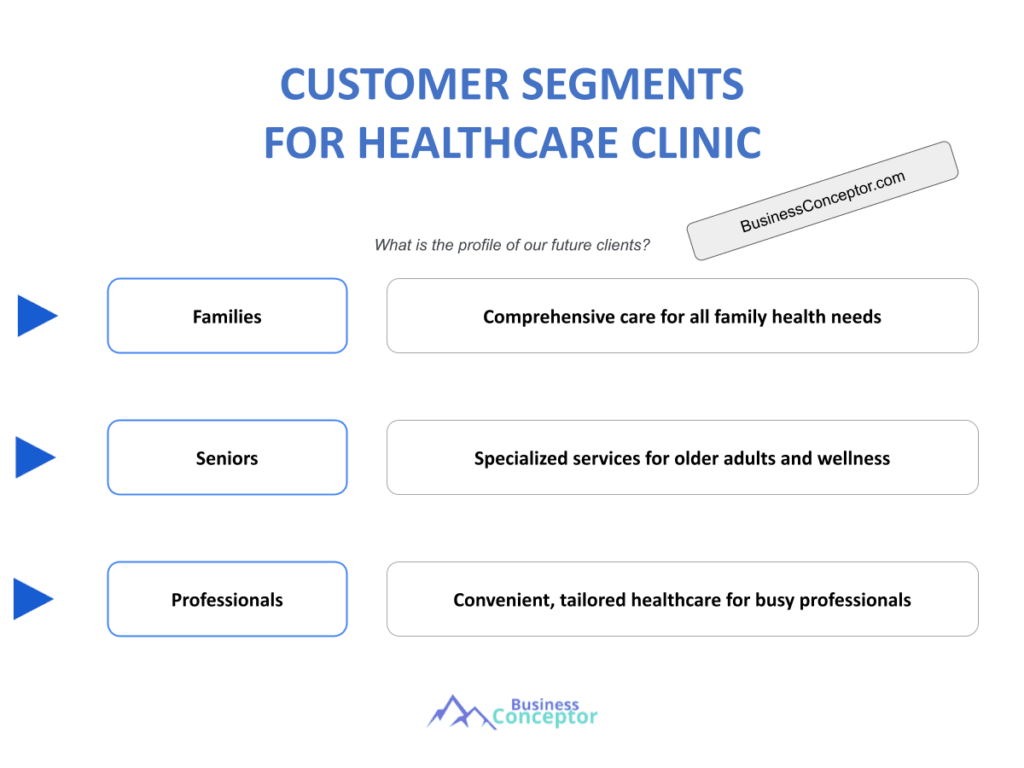

Fintech Customer Demographics

Demographics play a significant role in identifying customer segments within the fintech space. By understanding the age, income level, and geographic location of their users, fintech companies can better tailor their services to meet the specific needs of different groups.

For example, younger users, particularly Gen Z and millennials, are more likely to engage with mobile banking apps. They value convenience and accessibility, which makes them prime targets for neobanks like Chime and Revolut. These platforms offer user-friendly interfaces, instant account setup, and features that align with the tech-savvy nature of younger consumers. As a result, they can attract a large user base looking for straightforward banking solutions.

On the other hand, older generations may be more hesitant to embrace fintech. However, they are beginning to adopt these solutions, especially when they offer advantages like higher interest rates on savings accounts or lower fees. Companies that can address the concerns of older users, such as security and ease of use, will likely see increased adoption in this demographic. For instance, platforms that provide educational resources on how to use their services can help bridge the gap for older users who might feel intimidated by technology.

Income level is another crucial demographic factor. High-income individuals may seek premium financial services, while lower-income groups might look for basic banking solutions or microloans. Fintech companies that can cater to these varying income levels will likely find success in attracting a broader audience. For example, a platform that offers financial planning tools alongside low-cost investment options can appeal to both affluent users looking for wealth management and budget-conscious individuals seeking to grow their savings.

Here’s a summary of fintech customer demographics:

| Demographic Factor | Characteristics |

|---|---|

| Age | Younger users prefer mobile banking solutions |

| Income Level | High-income individuals seek premium services |

– Younger generations drive the adoption of mobile banking.

– Income level influences the type of financial services sought.

“Demographics can help you hit the bullseye with your marketing!” 🎯

Fintech for Small Business Owners

Small business owners represent a significant customer segment within the fintech landscape. This group often faces unique challenges when it comes to managing finances, and fintech solutions can provide the necessary support to help them thrive. Understanding the specific needs of small business owners can lead to the development of tailored services that enhance their operational efficiency and financial stability.

For instance, tools like QuickBooks and FreshBooks help small business owners manage their accounting and invoicing needs. These platforms simplify financial management, allowing owners to focus on growing their businesses rather than getting bogged down in paperwork. By automating tasks such as invoicing, expense tracking, and tax preparation, these solutions save valuable time and reduce the likelihood of errors. This efficiency is crucial for small business owners who often juggle multiple responsibilities and limited resources.

Additionally, payment processors like Square offer comprehensive solutions that include point-of-sale systems and online payment options. This is particularly beneficial for small businesses that operate both in physical locations and online. With integrated payment solutions, owners can easily manage transactions, track sales, and gain insights into customer preferences. This data is invaluable for making informed business decisions, such as adjusting inventory or launching targeted marketing campaigns.

Moreover, small business owners often seek access to funding for growth. Fintech companies like Kabbage provide quick and easy loan applications, allowing owners to secure financing without the lengthy processes associated with traditional banks. This access to capital can be a game-changer, enabling businesses to invest in new equipment, hire additional staff, or expand their offerings. By catering to the financial needs of small business owners, fintech companies can foster growth and contribute to the overall economy.

Here’s a summary of fintech solutions for small business owners:

| Solution Type | Characteristics |

|---|---|

| Accounting Tools | Simplify financial management |

| Payment Processors | Offer comprehensive payment solutions |

– Small business owners value tools that save time and simplify finances.

– Access to quick funding is a critical need for growth.

“Empowering small businesses is the key to driving economic growth!” 💼

Fintech Adoption Across Age Groups

Fintech adoption varies significantly across different age groups, and understanding these differences can help fintech companies develop targeted strategies to engage their audiences effectively. Each generation has its preferences and comfort levels when it comes to adopting new financial technologies, and recognizing these can enhance marketing efforts and product development.

Younger generations, such as millennials and Gen Z, are more likely to adopt fintech solutions. They are comfortable with technology and often seek out mobile-first options. Companies like Robinhood have gained popularity among younger users by offering commission-free trading through a user-friendly app. This ease of access appeals to younger individuals who may not have significant investment experience but are eager to learn and grow their financial portfolios.

In contrast, older generations may be more hesitant to embrace fintech. However, they are beginning to adopt these solutions, especially when they offer advantages like higher interest rates on savings accounts or lower fees. Fintech companies that can address the concerns of older users, such as security and ease of use, will likely see increased adoption in this demographic. For instance, platforms that provide educational resources on how to use their services can help bridge the gap for older users who might feel intimidated by technology.

Furthermore, it’s important to consider how different age groups prefer to interact with fintech services. While younger users may favor mobile apps and social media for engagement, older users might prefer more traditional methods such as email or direct customer service. Understanding these preferences allows companies to tailor their communication strategies effectively, ensuring that they reach each audience in a manner that resonates with them.

Here’s a summary of fintech adoption across age groups:

| Age Group | Adoption Rate |

|---|---|

| Millennials & Gen Z | High adoption of mobile fintech solutions |

| Older Generations | Growing adoption as benefits are highlighted |

– Younger generations drive fintech innovation and adoption.

– Older users may require more education on the benefits of fintech.

“Age is just a number; innovation knows no bounds!” 🌍

The Role of AI in Customer Segmentation

Artificial Intelligence (AI) is revolutionizing how fintech companies understand and segment their customers. By leveraging AI technology, companies can analyze vast amounts of data to gain insights into user behaviors and preferences. This capability not only enhances the accuracy of customer segmentation but also drives more effective marketing strategies and product offerings.

For instance, AI can help identify patterns in spending habits, allowing fintech companies to create personalized recommendations for users. By analyzing transaction data, AI algorithms can suggest tailored financial products that align with individual user needs. This level of customization enhances user experience and increases customer loyalty. Imagine receiving a notification about a savings account that offers a higher interest rate based on your spending behavior—this is the power of AI in action.

Additionally, AI-driven predictive analytics can help fintech companies anticipate customer needs and preferences. By understanding what users are likely to want in the future, companies can proactively develop products and services that cater to these expectations. For example, if AI identifies a trend in users frequently applying for personal loans during specific seasons, a company could launch targeted marketing campaigns or promotional rates during those times. This proactive approach not only improves customer satisfaction but also boosts conversion rates.

Moreover, AI can enhance customer service through chatbots and virtual assistants. These tools can provide instant support, answer common queries, and guide users through processes, such as setting up an account or applying for a loan. This level of immediate assistance helps to improve the overall customer journey, making users feel valued and understood. As a result, companies that integrate AI into their customer service strategies can foster stronger relationships with their clients.

Here’s a summary of the role of AI in customer segmentation:

| AI Application | Benefits |

|---|---|

| Data Analysis | Provides insights into user behaviors |

| Predictive Analytics | Anticipates future customer needs |

– AI enhances personalization in fintech services.

– Predictive analytics can drive product development and marketing strategies.

“AI is the future of personalized customer experiences!” 🤖

Fintech Trends Shaping Customer Segments

The fintech landscape is constantly evolving, influenced by emerging trends that shape customer segments. Staying ahead of these trends is essential for fintech companies looking to succeed in a competitive market. Understanding these trends not only helps companies adapt their offerings but also enables them to better serve their customers.

One notable trend is the rise of digital wallets. As more consumers opt for cashless transactions, companies like PayPal and Google Pay are becoming increasingly popular. This shift is particularly evident among younger generations, who prioritize convenience and security. Digital wallets allow users to make quick payments, store loyalty cards, and even track spending—all from their mobile devices. This seamless integration of financial services into daily life is reshaping how consumers manage their money.

Another trend is the growing focus on sustainability. Consumers are becoming more conscious of their financial choices and are seeking out fintech solutions that align with their values. Companies that emphasize ethical practices and offer green financial products are likely to attract a loyal customer base. For instance, platforms that provide sustainable investment options or environmentally friendly banking practices can appeal to socially responsible consumers. This trend not only fosters customer loyalty but also helps companies differentiate themselves in a crowded marketplace.

Moreover, the integration of blockchain technology is also shaping fintech trends. Blockchain offers enhanced security and transparency, making it an attractive option for financial transactions. Companies exploring blockchain solutions can provide customers with greater confidence in the security of their funds. This is particularly important for younger users who are often wary of traditional banking institutions.

Here’s a summary of fintech trends shaping customer segments:

| Trend | Impact on Customer Segments |

|---|---|

| Rise of Digital Wallets | Increased adoption among younger consumers |

| Focus on Sustainability | Attracts ethically conscious customers |

– Digital wallets are reshaping how consumers manage money.

– Sustainability is becoming a key factor in financial decisions.

“Trends are the pulse of the market; stay ahead to thrive!” 🌱

Customer Journey in Fintech Apps

Understanding the customer journey in fintech apps is crucial for optimizing user experience and increasing retention rates. The customer journey refers to the steps users take when interacting with a fintech product, from discovery to usage. Each stage of this journey presents opportunities for fintech companies to engage with their customers effectively and ensure they feel supported throughout their experience.

One critical stage in the customer journey is the onboarding process. A seamless and user-friendly onboarding experience can significantly impact a user’s decision to continue using the app. For example, if a user can easily set up an account, link their bank details, and understand the app’s features without feeling overwhelmed, they are more likely to remain engaged. Companies like Revolut have invested heavily in creating intuitive onboarding processes that guide users through account setup and feature exploration. This approach not only reduces drop-off rates but also enhances overall user satisfaction.

Moreover, ongoing engagement is vital for retention. Fintech companies that utilize push notifications, personalized content, and regular updates can keep users engaged and informed about new features or promotions. For instance, sending personalized messages that remind users of their spending habits or suggest budgeting tips based on their transaction history can foster a sense of connection and support. This ongoing interaction can transform a one-time user into a loyal customer.

Additionally, customer feedback plays a significant role in refining the customer journey. By actively seeking input from users about their experiences, fintech companies can identify pain points and areas for improvement. Implementing changes based on user feedback not only enhances the app’s functionality but also shows customers that their opinions are valued. This responsiveness can lead to higher customer loyalty and advocacy, as users are more likely to recommend services that they feel genuinely cater to their needs.

Here’s a summary of the customer journey in fintech apps:

| Journey Stage | Importance |

|---|---|

| Onboarding | Critical for user retention |

| Ongoing Engagement | Keeps users informed and engaged |

– A smooth onboarding experience is key to user retention.

– Engagement strategies can enhance customer loyalty.

“Every step of the journey matters; make it count!” 🗺️

Fintech Marketing Solutions

To effectively reach and engage various customer segments, fintech companies must employ targeted marketing solutions. These solutions can help businesses tailor their messaging and outreach efforts to specific audiences, ultimately driving user acquisition and retention. Understanding the unique needs and behaviors of different customer segments is essential for developing effective marketing strategies.

For instance, social media marketing is an effective way to connect with younger audiences. Platforms like Instagram and TikTok allow fintech companies to showcase their products in engaging ways. Creative content, such as short videos demonstrating app features or infographics explaining financial concepts, can capture the attention of younger users who are accustomed to consuming information quickly and visually. By utilizing these platforms, companies can build brand awareness and foster a community around their services.

Meanwhile, email marketing can be an effective strategy for reaching older demographics who may prefer more traditional communication channels. Personalized email campaigns that provide valuable content, such as financial tips or updates on new features, can keep older users engaged and informed. Additionally, segmenting email lists based on user behavior allows fintech companies to deliver relevant content that resonates with each audience.

Furthermore, content marketing plays a crucial role in educating potential customers about fintech solutions. By creating informative blog posts, videos, and infographics, companies can build trust and establish themselves as industry leaders. For example, a fintech company that offers budgeting tools might publish articles on effective budgeting strategies, attracting users who are looking for help managing their finances. This educational approach not only positions the company as an expert but also drives organic traffic to its website.

Here’s a summary of fintech marketing solutions:

| Marketing Solution | Target Audience |

|---|---|

| Social Media Marketing | Engages younger audiences |

| Content Marketing | Educates potential customers |

– Targeted marketing strategies can enhance customer engagement.

– Content marketing builds trust and authority.

“Marketing is about connecting with your audience!” 📣

Recommendations

In this article, we explored the various fintech customer segments and how understanding these segments can significantly enhance marketing strategies and product offerings. By recognizing the unique needs of different customer groups, such as millennials, small business owners, and the unbanked, fintech companies can create tailored solutions that foster customer loyalty and satisfaction. To assist you further in your fintech journey, consider utilizing the Fintech Business Plan Template. This comprehensive template can guide you in structuring your business plan effectively.

Additionally, we invite you to explore more articles related to fintech that can provide valuable insights and strategies for your business:

- Fintech SWOT Analysis: Insights & Trends

- Fintech: Strategies for Maximizing Profitability

- Fintech Business Plan: Template and Tips

- Fintech Financial Plan: A Detailed Guide

- Comprehensive Guide to Launching a Fintech Business: Tips and Examples

- Create a Marketing Plan for Your Fintech Business (+ Example)

- Starting a Fintech Business Model Canvas: A Comprehensive Guide

- How Much Does It Cost to Establish a Fintech Business?

- What Are the Steps for a Successful Fintech Feasibility Study?

- What Are the Key Steps for Risk Management in Fintech?

- Fintech Competition Study: Comprehensive Analysis

- Fintech Legal Considerations: Comprehensive Guide

- How to Secure Funding for Fintech?

- Fintech Growth Strategies: Scaling Examples

FAQ

What are the main types of fintech customers?

The main types of fintech customers include millennials, small business owners, and the unbanked population. Each group has distinct financial needs and preferences that fintech companies must understand to tailor their services effectively. Millennials often prefer mobile solutions, while small business owners seek tools that simplify financial management.

How can fintech companies segment their customers effectively?

Fintech companies can segment their customers effectively by utilizing behavioral and demographic data. Analyzing user interactions, spending habits, and demographic information allows businesses to create targeted marketing strategies and personalized offerings that resonate with different customer segments.

What role does AI play in fintech customer segmentation?

AI plays a significant role in fintech customer segmentation by analyzing large datasets to identify patterns and trends. This technology enables companies to predict customer needs and preferences, leading to more personalized experiences and improved customer satisfaction.

Why is understanding customer demographics important in fintech?

Understanding customer demographics is crucial in fintech because it helps companies identify the specific needs and preferences of various user groups. This knowledge allows for the development of tailored products and services that cater to different age groups, income levels, and financial behaviors, ultimately enhancing customer engagement.

How do fintech trends impact customer segments?

Fintech trends impact customer segments by shaping their preferences and behaviors. For instance, the rise of digital wallets and a focus on sustainability have changed how consumers manage their finances and what they expect from fintech solutions. Companies that adapt to these trends can better meet customer demands and foster loyalty.

What strategies can fintech companies use to enhance customer engagement?

To enhance customer engagement, fintech companies can employ strategies such as personalized marketing, educational content, and proactive customer support. Utilizing social media, email campaigns, and in-app notifications can keep users informed and engaged, fostering a stronger connection with the brand.