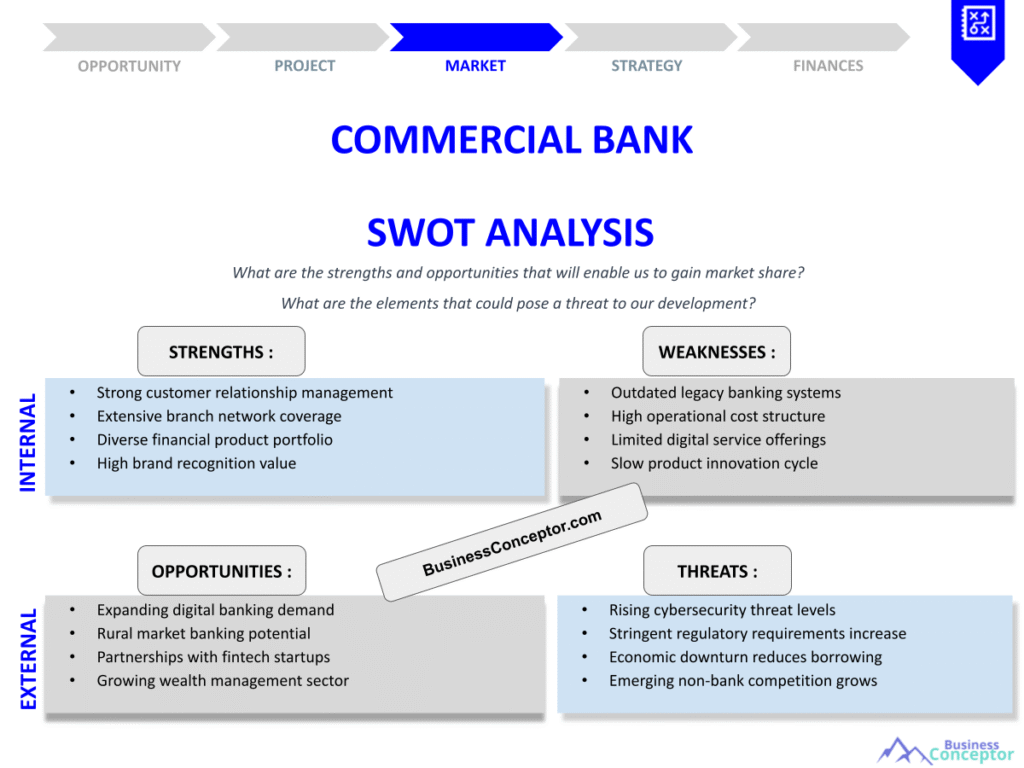

Did you know that over 80% of banks fail to capitalize on their strengths in the marketplace? Commercial Bank SWOT Analysis provides a vital framework for understanding how financial institutions can navigate the complexities of the banking landscape. This analysis examines the strengths, weaknesses, opportunities, and threats facing commercial banks today. By understanding these aspects, banks can develop robust strategies that lead to market success.

- Overview of the SWOT analysis framework

- Importance of SWOT for commercial banks

- Examination of strengths in banking

- Analysis of weaknesses that hinder growth

- Opportunities available in the financial market

- Potential threats to banking stability

- Strategic recommendations for improvement

- Case studies of successful banks

- Future trends in commercial banking

- Conclusion and actionable insights

Understanding SWOT Analysis in Banking

SWOT analysis is a strategic planning tool that helps organizations identify their internal strengths and weaknesses, along with external opportunities and threats. In the banking sector, this framework allows institutions to assess their market position and formulate strategies that align with their goals. By understanding the unique dynamics of the banking industry, commercial banks can leverage their strengths and address weaknesses effectively.

For instance, a bank may identify its strong customer service as a key strength, while recognizing outdated technology as a weakness. This insight can guide the bank to invest in digital transformation initiatives, capitalizing on the growing trend of online banking. Moreover, understanding external factors, like emerging fintech companies, can help banks spot opportunities for collaboration rather than competition.

By conducting a thorough SWOT analysis, banks not only gain clarity on their current standing but also create a roadmap for future growth. This analysis serves as a foundation for strategic decision-making, ensuring that banks remain competitive in an ever-evolving landscape.

| Key Elements | Description |

|---|---|

| Strengths | Internal advantages, like customer loyalty |

| Weaknesses | Internal limitations, such as outdated technology |

- Strengths drive competitive advantage

- Weaknesses can hinder growth

- Opportunities arise from market trends

“Understanding your SWOT is the first step to success.”

Identifying Strengths in Commercial Banks

Strengths are the positive attributes and resources that give a bank a competitive edge. These can include strong brand recognition, a loyal customer base, and financial stability. Identifying these strengths allows banks to leverage them effectively in their marketing strategies and service offerings.

For example, a bank known for exceptional customer service may use this as a selling point to attract new clients. Statistics show that banks with high customer satisfaction ratings enjoy a 10-20% increase in customer retention. This highlights the importance of maintaining strengths and continuously improving them.

Recognizing strengths is not just about celebrating success; it’s about building on them. By analyzing their strengths, banks can create targeted strategies that enhance their market position and further engage their customer base.

- Assess brand recognition

- Evaluate customer satisfaction

- Analyze financial stability

The above steps must be followed rigorously for optimal success.

Analyzing Weaknesses in Banking

Weaknesses are internal factors that can hinder a bank’s performance. These might include poor technology infrastructure, high operational costs, or a lack of innovation. Identifying these weaknesses is crucial for banks to develop strategies that address them.

For instance, banks that rely heavily on traditional banking methods may struggle to compete with more agile fintech companies. According to recent studies, banks that invest in modern technology see a significant increase in customer engagement and operational efficiency.

By acknowledging their weaknesses, banks can take proactive steps to improve their services and operational processes. This could involve investing in new technologies or restructuring their service delivery models.

- Identify operational inefficiencies

- Address customer service gaps

- Invest in technology upgrades

“To succeed, always move forward with a clear vision.”

Opportunities in the Banking Sector

Opportunities are external factors that banks can exploit to their advantage. These might include emerging markets, technological advancements, or changes in regulations that favor banking innovation. Recognizing these opportunities is essential for growth and sustainability.

For example, the rise of digital banking has opened new avenues for banks to reach customers. A study found that banks investing in digital channels experience a 30% increase in customer acquisition. This opportunity allows banks to broaden their reach and improve service delivery.

By identifying and capitalizing on these opportunities, banks can enhance their service offerings and create new revenue streams. This proactive approach can lead to sustained growth and market leadership.

| Opportunities | Description |

|---|---|

| Digital Banking | Expanding online services to attract customers |

| Emerging Markets | Tapping into new geographical markets |

- Explore digital transformation

- Assess new market entries

- Adapt to regulatory changes

The above steps must be followed rigorously for optimal success.

Understanding Threats in Banking

Threats are external challenges that can impact a bank’s performance negatively. These could include economic downturns, increased competition, or regulatory changes. Identifying these threats is crucial for banks to develop contingency plans.

For instance, the entry of fintech companies poses a significant threat to traditional banks. Research indicates that nearly 50% of banking customers would consider switching to fintech for lower fees and better service. This competitive pressure can erode market share for established banks.

By recognizing potential threats, banks can develop strategies to mitigate their impact. This may involve enhancing customer service, diversifying offerings, or investing in technology to stay competitive.

| Threats | Description |

|---|---|

| Economic Downturn | Risk of reduced lending and increased defaults |

| Fintech Competition | Challenge from innovative financial services |

- Monitor economic indicators

- Analyze competitive landscape

- Develop risk management strategies

Implementing Strategic Recommendations

To effectively leverage the insights gained from a SWOT analysis, banks must implement strategic recommendations that address their unique circumstances. These strategies should align with the bank’s overall vision and market conditions.

For instance, a bank may choose to enhance its digital offerings by investing in a robust mobile banking platform. This aligns with the opportunity presented by digital banking trends and addresses the threat posed by fintech competitors.

Additionally, ongoing training and development programs for staff can help address weaknesses in customer service, ultimately leading to improved customer satisfaction and loyalty. By focusing on these strategic recommendations, banks can position themselves for long-term success.

| Strategic Recommendations | Description |

|---|---|

| Invest in Technology | Enhance digital offerings to attract customers |

| Staff Development | Improve customer service through training |

- Create a technology upgrade plan

- Implement customer feedback systems

- Foster a culture of innovation

The above steps must be followed rigorously for optimal success.

Continuous Monitoring and Adaptation

The banking landscape is constantly changing, and continuous monitoring of the internal and external environment is essential for sustained success. Banks must remain vigilant in assessing their SWOT elements regularly.

For example, a bank might establish a task force dedicated to monitoring industry trends and competitor actions. This proactive approach can help the bank adapt quickly to changes in the market, ensuring they remain competitive.

By fostering a culture of adaptability, banks can not only survive but thrive in an ever-evolving financial landscape. Regular SWOT assessments can become a vital part of the bank’s strategic planning process, enabling them to pivot as necessary.

| Continuous Monitoring | Description |

|---|---|

| Regular SWOT Assessments | Ensure timely adaptations to market changes |

- Establish a monitoring team

- Schedule regular SWOT reviews

- Adapt strategies based on findings

Future Trends in Commercial Banking

As we look to the future, several trends are likely to shape the commercial banking landscape. Understanding these trends is crucial for banks aiming to maintain their competitive edge.

For instance, the rise of artificial intelligence in banking is transforming customer interactions. Banks that embrace AI can enhance personalization and improve operational efficiency, setting themselves apart from competitors. A recent study found that banks using AI-driven chatbots have seen customer engagement increase by over 30%.

Additionally, the focus on sustainability and ethical banking practices is becoming increasingly important. Consumers are more likely to choose banks that align with their values, making it essential for banks to adopt responsible practices. Embracing these trends not only attracts customers but also builds long-term loyalty.

| Future Trends | Description |

|---|---|

| Artificial Intelligence | Enhancing customer service through technology |

| Sustainability | Aligning banking practices with consumer values |

- Invest in AI technologies

- Develop sustainable banking initiatives

- Monitor consumer preferences

The above steps must be followed rigorously for optimal success.

Final Thoughts on Commercial Bank SWOT Analysis

In conclusion, conducting a Commercial Bank SWOT Analysis is essential for any bank aiming to achieve market success. By understanding their strengths, weaknesses, opportunities, and threats, banks can develop targeted strategies that enhance their competitiveness.

Moreover, continuous monitoring and adaptation to market trends will ensure that banks remain relevant and responsive to consumer needs. This proactive approach will not only safeguard existing market share but also open doors to new opportunities.

As the banking landscape evolves, those who embrace change and leverage their SWOT insights will be best positioned for success in the future.

| Key Takeaways | Action Steps |

|---|---|

| Leverage strengths | Develop marketing strategies |

| Address weaknesses | Invest in technology upgrades |

- Conduct regular SWOT analyses

- Invest in technology and innovation

- Foster a customer-centric culture

Conclusion

In summary, the insights gained from a Commercial Bank SWOT Analysis are invaluable for navigating the complexities of the banking industry. By taking action on the identified strengths, weaknesses, opportunities, and threats, banks can chart a course toward market success.

We encourage you to explore more resources to enhance your understanding and implementation of effective banking strategies. For a comprehensive guide, check out the Commercial Bank Business Plan Template. Additionally, consider reading our articles that provide further insights into various aspects of commercial banking:

- Commercial Bank Profitability: Tips for Financial Success

- How to Create a Business Plan for Your Commercial Bank: Example Included

- Developing a Financial Plan for Commercial Bank: Key Steps (+ Template)

- How to Build a Commercial Bank: Complete Guide with Example

- Begin Your Commercial Bank Marketing Plan with These Examples

- How to Begin Crafting a Business Model Canvas for Commercial Bank

- Understanding Customer Segments for Commercial Banks: Examples Included

- How Much Does It Cost to Operate a Commercial Bank?

- Commercial Bank Feasibility Study: Essential Guide

- Commercial Bank Risk Management: Essential Guide

- Commercial Bank Competition Study: Essential Guide

- Commercial Bank Legal Considerations: Ultimate Guide

- Commercial Bank Funding Options: Ultimate Guide

- How to Scale a Commercial Bank with Effective Growth Strategies

FAQ Section

What is a SWOT analysis in banking?

A SWOT analysis in banking is a strategic tool that helps identify the strengths, weaknesses, opportunities, and threats faced by a bank in its operational environment.

How can banks leverage their strengths?

Banks can leverage their strengths by emphasizing them in marketing campaigns and improving customer engagement through tailored services.

What are common weaknesses in commercial banks?

Common weaknesses include outdated technology, high operational costs, and inefficiencies in customer service.

What opportunities exist for banks today?

Opportunities include the rise of digital banking, expansion into emerging markets, and favorable regulatory changes that encourage innovation.

What threats do commercial banks face?

Threats include economic downturns, increased competition from fintech companies, and evolving consumer expectations.

How often should banks conduct SWOT analyses?

Banks should conduct SWOT analyses regularly to adapt to changing market conditions and customer needs.

What role does technology play in banking SWOT analysis?

Technology can be both a strength and a weakness in banking, as it enhances services but requires significant investment to maintain.

Can small banks benefit from SWOT analysis?

Absolutely! Small banks can identify niche markets and growth areas through a well-executed SWOT analysis.

What is the impact of customer satisfaction on bank performance?

High customer satisfaction directly correlates with increased retention rates, referrals, and overall profitability for banks.

How can banks prepare for future trends?

Banks can prepare for future trends by investing in innovation, staying informed about industry developments, and adjusting their strategies accordingly.