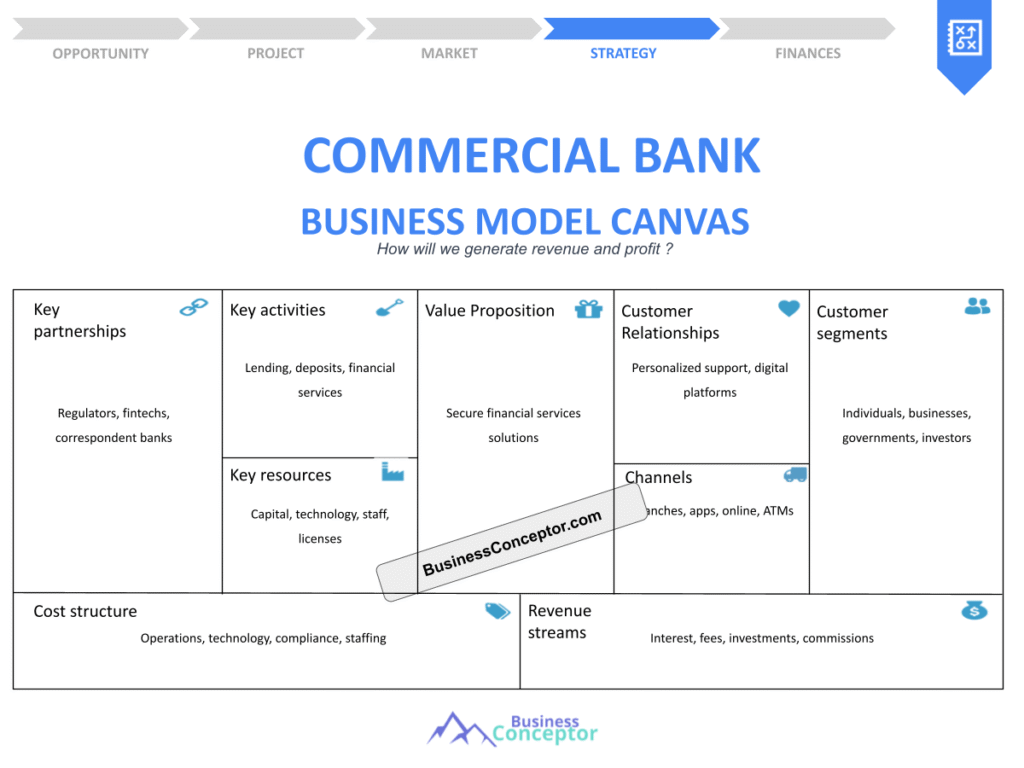

Did you know that nearly 60% of new commercial banks fail within their first five years? It’s a shocking statistic, but it underscores the importance of having a solid foundation, like a Commercial Bank Business Model Canvas, to navigate the complexities of the banking sector. A Commercial Bank Business Model Canvas is a strategic management tool that provides a visual framework for developing, refining, and innovating a bank’s business model. It outlines critical elements such as customer segments, value propositions, and revenue streams, helping banks align their strategies with market demands.

- Importance of a Business Model Canvas in banking

- Key components of the canvas

- Steps to develop a canvas

- Examples of successful banking models

- Role of technology in modern banking

- Understanding customer needs

- Importance of stakeholder engagement

- Strategies for competitive advantage

- How to adapt to market changes

- Future trends in commercial banking

Understanding the Business Model Canvas

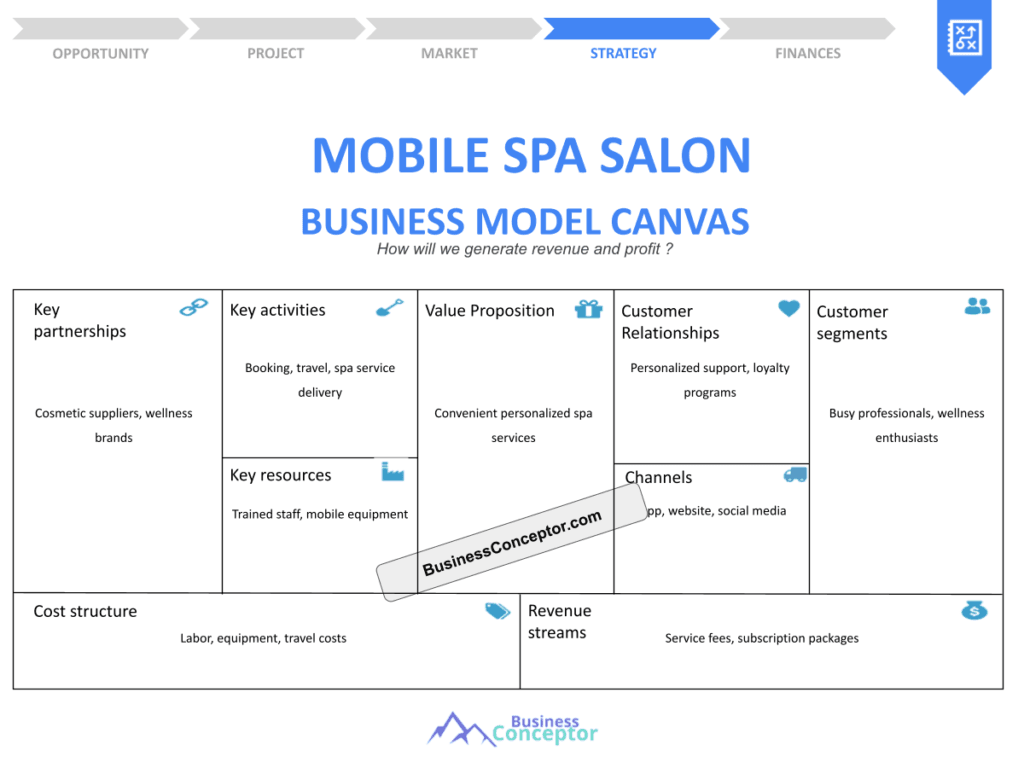

The Business Model Canvas is a visual chart that outlines the essential components of a business. For commercial banks, it serves as a blueprint that guides strategy and decision-making. It helps clarify how the bank creates value for its customers, how it structures its operations, and how it generates revenue. Understanding these elements is crucial for success in a competitive landscape.

For instance, a bank’s value proposition might focus on personalized customer service or innovative digital banking solutions. By defining these aspects within the canvas, banks can identify their target customer segments and tailor their services accordingly. This clarity aids in streamlining operations and optimizing resources.

In summary, a well-structured Business Model Canvas can provide a roadmap for banks to navigate their strategic landscape effectively. It sets the stage for further exploration into specific components, such as customer relationships and revenue streams.

| Component | Description |

|---|---|

| Value Proposition | What value do we deliver to the customer? |

| Customer Segments | Who are our customers? |

| Revenue Streams | How do we earn revenue? |

| Key Activities | What activities are essential? |

| Key Partners | Who are our partners? |

| Cost Structure | What are the major costs? |

- Understanding the Business Model Canvas is crucial for commercial banks.

- It outlines key components like customer segments and revenue streams.

- A clear value proposition enhances competitive advantage.

“The best way to predict the future is to create it.” – Peter Drucker

Building Your Canvas

To start crafting a Business Model Canvas for a commercial bank, you must first gather insights about your target market. This involves thorough research into customer demographics, needs, and preferences. By understanding who your customers are, you can tailor your offerings to meet their expectations.

For example, if your bank targets millennials, consider incorporating mobile banking features and digital customer service options. Statistics show that 73% of millennials prefer managing their finances via mobile apps. This insight can guide your bank’s strategic decisions, ensuring that the services you offer resonate with your audience.

Once you have a clear understanding of your customers, you can move on to defining your value proposition. This will connect seamlessly to the next section, where we’ll explore how to identify revenue streams that align with your bank’s mission.

- Conduct market research to identify target customer segments.

- Define the bank’s value proposition based on customer needs.

- Identify potential revenue streams linked to your offerings.

– The above steps must be followed rigorously for optimal success.

Defining Revenue Streams

Revenue streams are vital to the sustainability of any commercial bank. They represent the income generated from various services and products offered to customers. Understanding these streams allows banks to assess their financial health and make informed decisions.

Common revenue streams in commercial banking include interest income from loans, fees for services, and investment income. For instance, banks often charge fees for account maintenance or transaction services. These can be significant sources of revenue, especially when paired with strong customer service that encourages client retention.

By analyzing revenue streams, banks can identify opportunities for growth and expansion. This leads us to the next section, where we’ll discuss the importance of key partners and activities in supporting these revenue streams.

- Revenue streams are crucial for financial sustainability.

- Common streams include interest income and service fees.

- Strong customer service enhances revenue potential.

“To succeed, always move forward with a clear vision.”

Key Partners and Their Role

Key partners are essential for any commercial bank’s success. These include vendors, technology providers, and other financial institutions that contribute to the bank’s operations and service delivery. Identifying and maintaining these relationships is vital for enhancing operational efficiency.

For instance, partnering with a fintech company can provide banks with cutting-edge technology to improve customer experience. Research indicates that banks leveraging technology partnerships see up to a 30% increase in customer satisfaction. This collaboration not only enhances service delivery but also positions the bank as a modern and innovative institution.

Understanding the role of key partners will help you strengthen your bank’s business model. Next, we will explore the critical activities that ensure these partnerships are effective.

| Partner Type | Contribution |

|---|---|

| Technology Providers | Enhance service delivery through tech solutions. |

| Financial Institutions | Expand service offerings and market reach. |

| Vendors | Supply essential resources and services. |

- Identify potential key partners.

- Build strong relationships through regular communication.

- Evaluate partnerships for effectiveness and alignment.

“Success is not just about what you accomplish in your life, but what you inspire others to do.”

Key Activities for Success

Key activities refer to the crucial actions that a bank must undertake to deliver its value proposition and maintain its revenue streams. These activities range from customer service to compliance management, all of which play a role in the bank’s overall success.

For example, a bank that prioritizes customer service may invest in staff training programs to enhance employee skills. This focus on customer experience can lead to higher customer retention rates and increased referrals, which are essential for growth.

By identifying and optimizing key activities, banks can ensure that they are well-positioned to meet customer needs. This understanding will lead us to the final section, where we’ll discuss the cost structure and its implications.

| Activity | Importance |

|---|---|

| Customer Service | Enhances customer satisfaction. |

| Compliance Management | Reduces legal risks and liabilities. |

| Marketing | Attracts new customers and retains existing ones. |

- Regularly assess and improve customer service practices.

- Ensure compliance with banking regulations.

- Invest in marketing strategies that resonate with your target market.

Understanding Cost Structure

The cost structure outlines the expenses incurred in operating a commercial bank. Understanding these costs is crucial for maintaining profitability and ensuring that resources are allocated effectively.

Major costs typically include personnel expenses, technology investments, and operational overhead. For instance, banks often invest heavily in technology to remain competitive, which can significantly impact the cost structure. However, if managed well, these investments can lead to long-term savings and increased efficiency.

Analyzing the cost structure allows banks to identify areas for improvement and cost-saving opportunities. This analysis prepares us to explore how to adapt the business model in response to market changes.

| Cost Component | Description |

|---|---|

| Personnel Expenses | Salaries and benefits for staff. |

| Technology Costs | Investments in banking software and hardware. |

| Operational Overhead | General expenses for running the bank. |

- Regularly review and analyze operational costs.

- Seek technology solutions that offer cost savings.

- Implement cost-effective marketing strategies.

Adapting to Market Changes

The banking industry is constantly evolving, influenced by technological advancements, regulatory changes, and shifting consumer preferences. Therefore, it’s vital for banks to remain agile and adapt their business model canvas accordingly.

For example, the rise of digital banking has led many banks to rethink their service delivery channels. As more customers shift to online banking, traditional brick-and-mortar branches may need to adapt by enhancing their digital offerings. This shift can lead to new revenue opportunities and cost savings.

By staying attuned to market changes, banks can ensure their business model remains relevant and effective. This adaptability is crucial for long-term success in the competitive banking landscape.

| Strategy | Description |

|---|---|

| Embrace Digital Transformation | Invest in technology to enhance service delivery. |

| Customer Feedback | Use customer insights to drive changes. |

| Market Research | Regularly analyze market trends to stay ahead. |

- Conduct regular market research.

- Implement customer feedback mechanisms.

- Stay updated on regulatory changes.

Future Trends in Commercial Banking

As we look to the future, several trends are shaping the landscape of commercial banking. Understanding these trends is essential for banks aiming to remain competitive and innovative.

One prominent trend is the increasing use of artificial intelligence (AI) in banking operations. AI can enhance customer service, improve fraud detection, and streamline processes. For example, chatbots powered by AI can handle customer inquiries 24/7, improving response times and customer satisfaction.

Keeping an eye on these trends allows banks to anticipate changes and adjust their business model accordingly. This proactive approach will be crucial for thriving in the future banking environment.

| Trend | Implication |

|---|---|

| AI and Automation | Enhanced efficiency and customer experience. |

| Digital Banking | Shift in service delivery methods. |

| Sustainability | Increasing demand for eco-friendly banking practices. |

- Invest in research and development for innovative solutions.

- Monitor industry trends and adapt strategies accordingly.

- Engage with customers to understand their evolving needs.

Practical Tips for Implementing Your Canvas

Implementing your Business Model Canvas requires careful planning and execution. It’s essential to communicate the canvas effectively to all stakeholders within the bank to ensure alignment and collaboration.

Practical advice includes conducting workshops to involve employees in the canvas development process. Engaging staff can foster a sense of ownership and commitment to the bank’s strategic goals. Additionally, regularly reviewing and updating the canvas is vital to keep it relevant.

By following these practical tips, banks can ensure that their Business Model Canvas is effectively implemented and serves as a valuable tool for strategic decision-making.

“Success comes to those who persevere.”

- Conduct staff workshops for canvas development.

- Regularly review and update the canvas.

- Ensure clear communication of the business model to all stakeholders.

Conclusion

In summary, crafting a Commercial Bank Business Model Canvas is an essential step for banks looking to thrive in a competitive landscape. By understanding the key components, including customer segments, revenue streams, and cost structures, banks can develop a robust strategy that aligns with market demands. If you’re ready to take the next step, consider utilizing a Commercial Bank Business Plan Template to streamline your planning process.

- SWOT Analysis for Commercial Bank: Achieving Market Success

- Commercial Bank Profitability: Tips for Financial Success

- How to Create a Business Plan for Your Commercial Bank: Example Included

- Developing a Financial Plan for Commercial Bank: Key Steps (+ Template)

- How to Build a Commercial Bank: Complete Guide with Example

- Begin Your Commercial Bank Marketing Plan with These Examples

- Understanding Customer Segments for Commercial Banks: Examples Included

- How Much Does It Cost to Operate a Commercial Bank?

- Commercial Bank Feasibility Study: Essential Guide

- Commercial Bank Risk Management: Essential Guide

- Commercial Bank Competition Study: Essential Guide

- Commercial Bank Legal Considerations: Ultimate Guide

- Commercial Bank Funding Options: Ultimate Guide

- How to Scale a Commercial Bank with Effective Growth Strategies

FAQ

What is a Commercial Bank Business Model Canvas?

A Commercial Bank Business Model Canvas is a strategic tool that outlines the key components of a bank’s business model, helping to visualize and innovate banking strategies.

Why is a Business Model Canvas important for banks?

It provides clarity on how a bank creates value for its customers, aligns operations, and generates revenue, which is crucial for strategic planning.

What are the main components of the canvas?

The main components include customer segments, value proposition, revenue streams, key activities, key partners, and cost structure.

How can banks identify their customer segments?

Banks can conduct market research to understand demographics, preferences, and behaviors of potential customers.

What is the role of technology in a bank’s business model?

Technology enhances service delivery, improves efficiency, and meets customer expectations, making it a critical component of modern banking strategies.

How often should a bank review its Business Model Canvas?

Regular reviews are recommended, at least annually, or whenever significant market changes occur.

Can a small bank benefit from using a Business Model Canvas?

Absolutely! A Business Model Canvas can help small banks clarify their strategy and identify growth opportunities.

What are common revenue streams for commercial banks?

Common revenue streams include interest income from loans, fees for services, and investment income.

How can banks adapt to changing market trends?

Banks should conduct regular market research, engage with customers for feedback, and stay updated on industry developments.

What is the future of commercial banking?

The future of commercial banking will likely involve increased digitalization, AI integration, and a focus on sustainability.