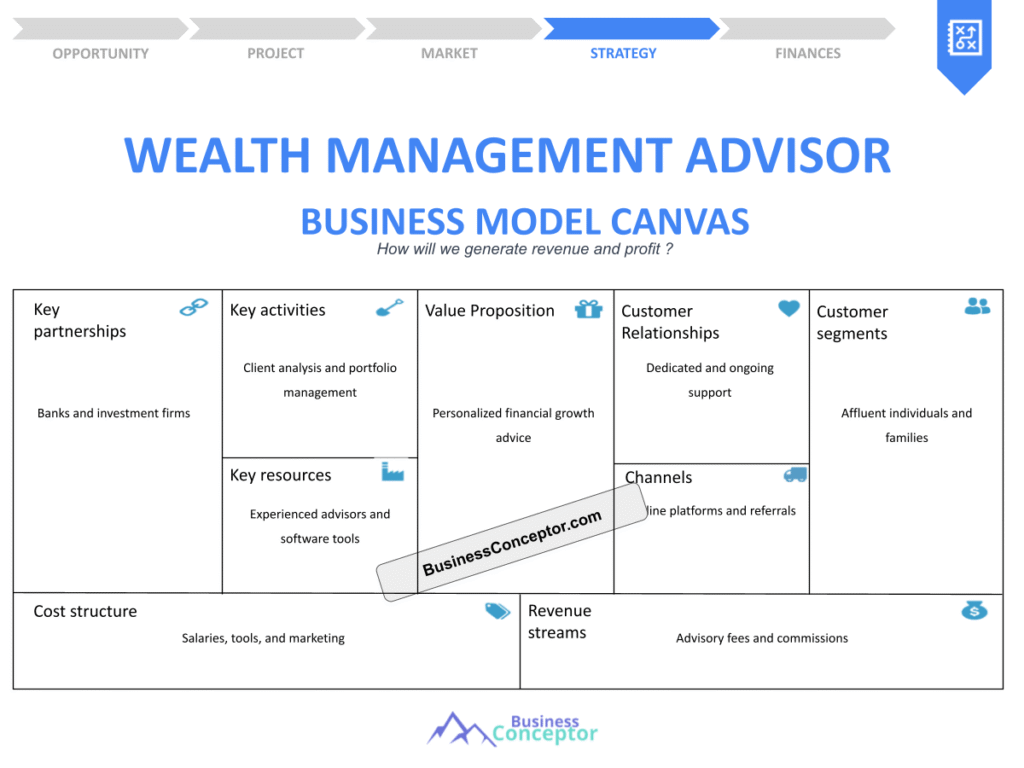

The Wealth Management Advisor Business Model Canvas is an essential framework that helps financial professionals visualize and strategize their business operations effectively. This tool allows advisors to break down complex business structures into manageable sections, fostering a clearer understanding of how to deliver value to clients while achieving their financial goals. Interestingly, many advisors overlook the importance of having a structured approach to their business model, which can lead to missed opportunities and inefficiencies. By utilizing the business model canvas, wealth management advisors can not only streamline their processes but also enhance their overall service delivery.

The business model canvas consists of nine key components that outline how wealth management advisors create value, maintain relationships with clients, and generate revenue. By defining each of these elements, advisors can develop a comprehensive strategy that aligns with their business objectives. Here’s a brief overview of what you can expect to learn:

- Understanding the components of the business model canvas.

- Examples of successful wealth management advisor business models.

- Tips for creating a customized business model canvas.

- Insights on revenue streams, customer segments, and key activities.

- The impact of digital tools and fintech on wealth management.

Understanding the Wealth Management Advisor Business Model Canvas

Creating a business model canvas for a wealth management advisor starts with understanding its core components. The canvas is divided into nine sections that detail how the advisor delivers value to clients, generates revenue, and manages resources effectively. One of the most critical elements is the value proposition. This defines what makes your services unique and why clients should choose you over competitors. For example, a wealth management advisor might focus on personalized financial planning, offering tailored solutions that fit individual client needs, such as retirement planning or estate management.

By articulating a strong value proposition, advisors can attract the right customer segments and build long-lasting relationships. It sets the stage for everything else in the business model. Understanding your target audience and their specific needs is crucial. If you can demonstrate how your services can solve their problems or enhance their financial well-being, you are on the right path to building a successful practice.

Let’s delve deeper into the nine key components of the business model canvas:

| Component | Description |

|---|---|

| Value Proposition | Unique offerings that attract clients. |

| Customer Segments | Target market for services. |

| Revenue Streams | Ways the advisor generates income. |

| Key Activities | Essential operations to deliver services. |

| Key Resources | Assets required to execute the business model. |

| Key Partnerships | Collaborations that enhance service delivery. |

| Cost Structure | Major costs associated with running the business. |

| Customer Relationships | How the advisor interacts with clients. |

| Channels | Methods used to reach and communicate with clients. |

By understanding these components, wealth management advisors can create a robust framework that guides their strategic decisions. The canvas not only aids in planning but also allows for flexibility and adaptation as market conditions change. Regularly revisiting and refining each section ensures that advisors remain relevant and responsive to client needs. This proactive approach can lead to increased client satisfaction and loyalty, ultimately driving business growth.

As you embark on developing your business model canvas, keep in mind that it is not a static document. It should evolve as your practice grows and as you gain insights into your clients’ needs and preferences. The more you understand your market and your unique value, the better equipped you will be to navigate the complexities of the financial landscape.

“Your business model is your map; it guides you through the financial landscape.” 🚀

Crafting Your Value Proposition

The value proposition is arguably the most critical element of your Wealth Management Advisor Business Model Canvas. It serves as the foundation upon which your entire business is built. A well-crafted value proposition clearly articulates what makes your services unique and why potential clients should choose you over your competitors. This is particularly vital in the wealth management industry, where trust and credibility are paramount. For instance, if you focus on sustainable investing, your value proposition could highlight how you help clients grow their wealth while also making a positive impact on the environment.

When developing your value proposition, consider the following key elements:

- Client Needs: Understand what your clients are looking for in a financial advisor. Are they seeking personalized service, transparency, or innovative investment strategies?

- Unique Offerings: Identify what sets you apart from other advisors. This could be your specialized knowledge in a niche market, your commitment to ongoing education, or your unique approach to client relationships.

- Clear Communication: Use straightforward language that resonates with your audience. Avoid jargon that might confuse potential clients and instead focus on how you can solve their problems.

By emphasizing these elements, you can create a value proposition that not only attracts clients but also builds lasting relationships. For example, if you can demonstrate how your expertise in tax-efficient investing can save clients money, you are likely to gain their trust and business. This focus on client-centric solutions is what will ultimately drive your success in the competitive landscape of wealth management.

| Key Considerations | Details |

|---|---|

| Client Needs | Understanding pain points and aspirations. |

| Unique Offerings | Differentiating factors that enhance your appeal. |

| Clear Communication | Ensuring your message is easily understood. |

A strong value proposition not only attracts clients but also helps you retain them. When clients feel understood and valued, they are more likely to remain loyal and refer others to your practice. In a world where competition is fierce, having a compelling value proposition can be the difference between thriving and merely surviving.

“A strong value proposition is the heart of your advisory business.” 💡

Identifying Your Customer Segments

Identifying your customer segments is another crucial step in creating a successful Wealth Management Advisor Business Model Canvas. Each client is unique, with different financial goals, challenges, and needs. By understanding these differences, you can tailor your services to meet the specific requirements of each segment. This targeted approach not only enhances client satisfaction but also increases the likelihood of referrals and repeat business.

To effectively identify your customer segments, consider the following factors:

- Demographics: Age, income level, profession, and family situation can all influence a client’s financial needs and goals. For example, young professionals may prioritize saving for retirement, while retirees may focus on income generation and estate planning.

- Psychographics: Understanding clients’ values, interests, and financial goals can help you connect with them on a deeper level. Clients who prioritize social responsibility may be more interested in sustainable investments, while those focused on wealth accumulation may prefer high-growth strategies.

- Behavioral Factors: Analyzing investment habits and risk tolerance can provide insights into how to best serve your clients. For instance, a risk-averse client may benefit from a conservative investment strategy, while a more aggressive investor might appreciate higher-risk opportunities.

By segmenting your market in this way, you can design marketing strategies that resonate with each group. For instance, a targeted campaign highlighting your expertise in retirement planning might attract older clients, while a social media campaign focused on investment education could engage younger audiences.

| Customer Segment | Characteristics |

|---|---|

| High-Net-Worth Clients | Require personalized wealth management solutions. |

| Young Professionals | Interested in retirement planning and investment basics. |

| Families | Focused on education funding and long-term security. |

Tailoring your services to meet the specific needs of each customer segment can significantly enhance client relationships and business growth. By understanding and addressing the unique challenges and goals of your clients, you create a more personalized experience that fosters loyalty and trust.

“Know your clients, and you can serve them better.” 🌟

Exploring Revenue Streams

In the world of wealth management, understanding your revenue streams is vital for sustaining and growing your business. The Wealth Management Advisor Business Model Canvas highlights various ways in which advisors can generate income, and knowing these avenues allows you to create a robust financial strategy. Typically, wealth management advisors earn money through a combination of fees, commissions, and asset management. Each of these streams has its own advantages and challenges, and a diversified approach can help mitigate risks and enhance profitability.

Let’s break down some common revenue streams for wealth advisors:

- Fee-Only Services: This model charges clients directly for financial planning and advisory services. It is transparent and aligns the advisor’s interests with those of the client. Since there are no commissions involved, clients often feel more secure knowing that their advisor is focused on their best interests.

- Assets Under Management (AUM): Advisors can earn a percentage of the assets they manage for clients. This model incentivizes advisors to grow their clients’ portfolios, as their income increases with the value of the assets managed. It creates a strong alignment of interests, encouraging advisors to work diligently to enhance investment performance.

- Commissions: Advisors may receive payments from product providers for selling financial products, such as mutual funds or insurance policies. While this model can be lucrative, it may lead to conflicts of interest, as advisors could be incentivized to recommend products that may not be in the best interest of the client.

Diversifying your revenue streams is crucial for stability and growth. Relying on a single income source can expose your business to risks, especially in volatile markets. For instance, if you depend solely on commissions, a downturn in the market could significantly impact your income. By incorporating multiple revenue streams, you can create a more resilient business model that can weather economic fluctuations.

| Revenue Stream | Description |

|---|---|

| Fee-Only Services | Direct fees for advisory services provide transparency. |

| AUM Fees | Earnings based on the assets managed align interests. |

| Commissions | Payments from financial product sales can create conflicts. |

Additionally, exploring innovative revenue models can set you apart from competitors. For example, some advisors are adopting subscription-based models, where clients pay a flat fee for ongoing access to financial planning services. This approach can enhance client relationships, as it fosters a continuous advisory engagement rather than a transactional one. By understanding the diverse ways to generate income, you can position your practice for long-term success and adaptability in an ever-evolving industry.

“Multiple income streams are the safety net for your advisory business.” 💰

Key Activities for Success

The key activities of a wealth management advisor are the actions taken to deliver exceptional services and ensure client satisfaction. These activities form the backbone of your Wealth Management Advisor Business Model Canvas, as they determine how effectively you can meet client needs and achieve business goals. Focusing on essential activities not only enhances service quality but also drives business growth.

Here are some of the key activities that wealth management advisors should prioritize:

- Client Meetings: Regular check-ins with clients are crucial for understanding their evolving financial goals and concerns. These meetings foster strong relationships and allow you to provide personalized advice. Whether it’s an annual review or a quarterly check-in, maintaining consistent communication is key.

- Market Research: Staying informed about market trends and economic conditions is essential for making informed investment decisions. Advisors who proactively research and analyze market data can provide timely advice that aligns with client objectives, ensuring that they are always positioned for success.

- Continual Education: The financial landscape is constantly changing, with new regulations, products, and strategies emerging regularly. Advisors must commit to ongoing education and professional development to remain compliant and competitive. This could include attending workshops, obtaining certifications, or engaging in industry networking.

By prioritizing these key activities, you can enhance the overall client experience and drive better results. For instance, well-structured client meetings allow you to showcase your expertise, while thorough market research enables you to offer timely and relevant advice. Additionally, continual education ensures that you remain a trusted source of information, which is vital for building long-term client relationships.

| Key Activity | Purpose |

|---|---|

| Client Meetings | Building relationships and understanding needs. |

| Market Research | Identifying opportunities and risks. |

| Continued Education | Ensuring compliance and improving expertise. |

By focusing on these essential activities, wealth management advisors can create a dynamic and responsive practice that meets client needs effectively. The more you invest in your key activities, the better equipped you will be to navigate the complexities of the financial landscape, ultimately driving your practice toward greater success.

“Success is built on consistent and meaningful client interactions.” 📈

Leveraging Key Resources

In any business, including wealth management, understanding and effectively utilizing key resources is crucial for delivering high-quality services and achieving long-term success. The Wealth Management Advisor Business Model Canvas emphasizes the importance of identifying the resources necessary to execute your business model effectively. These resources can include technology, human capital, financial assets, and more, each playing a pivotal role in your practice’s operations.

Let’s explore some of the essential key resources that wealth management advisors should focus on:

- Technology Tools: In today’s digital age, having the right technology tools is indispensable. Customer Relationship Management (CRM) systems, financial planning software, and investment analysis platforms can streamline your operations and enhance client interactions. For instance, a robust CRM can help you track client interactions, manage schedules, and automate follow-ups, freeing up your time to focus on providing exceptional service.

- Skilled Team Members: Your team is one of your greatest assets. Having knowledgeable and experienced professionals, such as financial planners, analysts, and administrative staff, can significantly enhance your service delivery. A well-trained team can provide diverse perspectives and insights, ultimately benefiting your clients. Investing in employee training and development ensures that your team remains at the forefront of industry knowledge and best practices.

- Marketing Resources: Effective marketing is essential for attracting and retaining clients. This includes everything from branding and promotional materials to digital marketing strategies. By leveraging social media, email campaigns, and educational content, you can reach potential clients more effectively and establish yourself as a thought leader in the wealth management space.

Investing in these key resources can lead to improved operational efficiency and client satisfaction. For example, a well-implemented technology solution can save time and reduce errors, allowing you to focus more on strategic decision-making and client engagement. Additionally, a skilled team can help you navigate complex financial situations, providing clients with tailored solutions that meet their unique needs.

| Key Resource | Importance |

|---|---|

| Technology Tools | Streamlining operations and improving service delivery. |

| Skilled Team Members | Providing expertise and enhancing client interactions. |

| Marketing Resources | Attracting and retaining clients through effective branding. |

Furthermore, leveraging technology can create a more personalized experience for clients. For instance, utilizing data analytics tools allows you to gain insights into client behavior and preferences, enabling you to tailor your services accordingly. By understanding what your clients value most, you can enhance their experience and foster stronger relationships.

“The right resources can elevate your advisory practice.” 🛠️

Building Strategic Partnerships

Strategic partnerships are a powerful way to enhance the services you offer as a wealth management advisor. The Wealth Management Advisor Business Model Canvas highlights the importance of collaborating with other professionals to create a more comprehensive service offering. By forming alliances with accountants, attorneys, and investment firms, you can provide your clients with a holistic approach to their financial needs.

Here are some key benefits of building strategic partnerships:

- Enhanced Service Offerings: Collaborating with other professionals allows you to provide a wider range of services. For example, by partnering with an estate planning attorney, you can offer your clients comprehensive wealth management solutions that include legal advice on trusts and wills. This integrated approach can greatly enhance the value you provide to clients.

- Access to New Client Bases: Strategic partnerships can open doors to new client segments. For instance, if you collaborate with a local accounting firm, you can tap into their existing client base, providing financial planning services to individuals who may not have considered working with a wealth management advisor before.

- Shared Expertise: Partnering with other professionals allows you to share knowledge and insights, which can lead to better decision-making and improved client outcomes. For example, a partnership with a tax advisor can help you stay informed about tax law changes, enabling you to provide timely advice to your clients.

Establishing these partnerships requires careful consideration and mutual understanding of each party’s goals and values. A successful collaboration is built on trust and shared objectives, ensuring that both parties benefit from the relationship. Regular communication and alignment on client service standards are essential to maintain a fruitful partnership.

| Partnership Type | Benefits |

|---|---|

| Accountants | Comprehensive financial services for clients. |

| Lawyers | Legal expertise for estate planning. |

| Investment Firms | Access to a broader range of investment products. |

By leveraging strategic partnerships, wealth management advisors can enhance their service offerings, access new markets, and provide more comprehensive solutions to their clients. These collaborations not only benefit your practice but also contribute to a more positive client experience, leading to increased loyalty and referrals.

“Collaboration is key to expanding your advisory reach.” 🤝

Understanding Cost Structure

Understanding your cost structure is essential for maintaining a profitable wealth management practice. The Wealth Management Advisor Business Model Canvas emphasizes the importance of knowing both fixed and variable costs that come with running your business. A well-defined cost structure allows you to price your services effectively and ensures that you can operate sustainably in a competitive environment.

Here are some key components of your cost structure to consider:

- Operational Expenses: These are the day-to-day costs involved in running your practice, including rent, utilities, office supplies, and salaries. Keeping a close eye on these expenses is crucial for ensuring profitability. Implementing cost-control measures, such as negotiating better lease terms or using technology to streamline operations, can help reduce these costs.

- Technology Costs: As technology plays a significant role in wealth management, your investment in software and tools can be substantial. CRM systems, financial planning software, and data analytics tools are essential for efficient operations. It’s important to evaluate the return on investment (ROI) for these tools to ensure they contribute positively to your bottom line.

- Marketing Expenses: Attracting new clients often requires a significant marketing budget. This includes advertising, digital marketing campaigns, and branding efforts. While these costs can be high, a well-executed marketing strategy can lead to increased client acquisition, making it a worthwhile investment.

By analyzing your cost structure, you can identify areas for improvement and optimize your pricing strategy. For example, if you find that operational costs are eating into your profits, you may consider adjusting your fee structure or finding ways to enhance efficiency. Understanding your costs is not just about tracking expenses; it’s about strategically managing them to maximize profitability.

| Cost Type | Description |

|---|---|

| Operational Expenses | Day-to-day costs of running the business. |

| Technology Costs | Investments in software and tools that enhance service delivery. |

| Marketing Expenses | Costs associated with attracting new clients and maintaining brand presence. |

Furthermore, a clear understanding of your cost structure enables you to create a sustainable business model that can adapt to changing market conditions. For instance, if you notice a trend toward fee-only services in your market, you can evaluate your current pricing and potentially pivot your model to meet client expectations. This proactive approach to managing costs can lead to long-term success and stability in your practice.

“A solid cost structure lays the foundation for profitability.” 💵

Final Thoughts on Your Business Model Canvas

Creating a business model canvas for a wealth management advisor is an essential step toward building a successful practice. The canvas serves as a dynamic tool that evolves with your business, helping you visualize how all the components work together to create value for your clients. By understanding the various elements, including your value proposition, customer segments, revenue streams, key activities, key resources, strategic partnerships, and cost structure, you can develop a comprehensive strategy that aligns with your business objectives.

Regularly revisiting and refining your business model canvas ensures that you remain competitive and responsive to client needs. This proactive approach allows you to identify new opportunities and adapt to market changes, ultimately driving business growth. For instance, if you notice a shift in client preferences toward digital solutions, you can adjust your offerings to include more technology-driven services.

Additionally, leveraging insights from your business model canvas can enhance decision-making and strategic planning. By analyzing how each component interacts, you can make informed choices that benefit both your practice and your clients. This comprehensive understanding of your business model is essential for navigating the complexities of the wealth management industry.

| Final Considerations | Key Takeaways |

|---|---|

| Regular Review | Keep your business model updated to reflect current market conditions. |

| Client-Centric Focus | Always prioritize client needs to foster loyalty and satisfaction. |

| Continuous Improvement | Adapt and evolve based on insights gained from your business model. |

By applying the insights and strategies discussed, you can create a comprehensive business model that drives your success as a wealth management advisor. This framework not only helps you serve your clients better but also positions your practice for long-term sustainability and growth.

“Your business model is a living document; nurture it for growth.” 🌱

Recommendations

In summary, the Wealth Management Advisor Business Model Canvas provides a comprehensive framework for financial professionals looking to structure their business effectively. By understanding the key components such as value proposition, customer segments, revenue streams, and more, advisors can create a strategic plan that aligns with their goals and meets client needs. To help you further develop your business strategy, consider using the Wealth Management Advisor Business Plan Template, which offers an excellent starting point for your planning process.

Additionally, we invite you to explore our related articles that provide further insights and tips for wealth management advisors:

- Wealth Management Advisor SWOT Analysis Essentials

- Wealth Management Advisors: Profitability Tips

- Wealth Management Advisor Business Plan: Template and Tips

- Wealth Management Advisor Financial Plan: Step-by-Step Guide with Template

- How to Start a Wealth Management Advisor Business: A Detailed Guide with Examples

- Crafting a Marketing Plan for Your Wealth Management Advisor Business (+ Example)

- Customer Segments for Wealth Management Advisors: Examples and Analysis

- How Much Does It Cost to Start a Wealth Management Advisor Business?

- Travel Agency Feasibility Study: Detailed Analysis

- Travel Agency Risk Management: Detailed Analysis

- How to Analyze Competition for Wealth Management Advisor?

- How to Address Legal Considerations in Wealth Management Advisor?

- Wealth Management Advisor Funding Options: Expert Insights

- Wealth Management Advisor Growth Strategies: Scaling Success Stories

FAQ

What is a Wealth Management Advisor Business Model Canvas?

A Wealth Management Advisor Business Model Canvas is a strategic tool that helps advisors visualize and structure their business model. It includes key components such as value proposition, customer segments, revenue streams, and key resources, allowing advisors to develop a comprehensive plan for their practice.

How do Wealth Advisors make money?

Wealth advisors typically generate income through various revenue streams including fee-only services, commissions from financial products, and a percentage of assets under management (AUM). Diversifying these income sources can enhance profitability and stability.

What are the key activities for a Wealth Management Advisor?

The key activities for a wealth management advisor include regular client meetings, conducting market research, and engaging in continued education. These activities help advisors understand client needs, stay informed about market trends, and ensure compliance with regulations.

What resources are necessary for a Wealth Management Advisor?

Essential key resources for wealth management advisors include technology tools (like CRM systems), skilled team members (financial planners and analysts), and effective marketing resources. Utilizing these resources effectively can improve operational efficiency and client satisfaction.

How can strategic partnerships benefit Wealth Management Advisors?

Strategic partnerships can enhance a wealth management advisor’s service offerings by collaborating with professionals such as accountants and lawyers. These alliances allow advisors to provide more comprehensive solutions to clients and access new markets, ultimately benefiting their practice.

What should be considered in a Wealth Management Advisor’s cost structure?

A wealth management advisor’s cost structure should include operational expenses, technology costs, and marketing expenses. Understanding these costs is crucial for setting pricing strategies and ensuring long-term profitability.

Why is a value proposition important for Wealth Management Advisors?

The value proposition is critical as it defines what makes a wealth management advisor’s services unique. A strong value proposition helps attract clients, build trust, and foster long-term relationships, ultimately driving business growth.