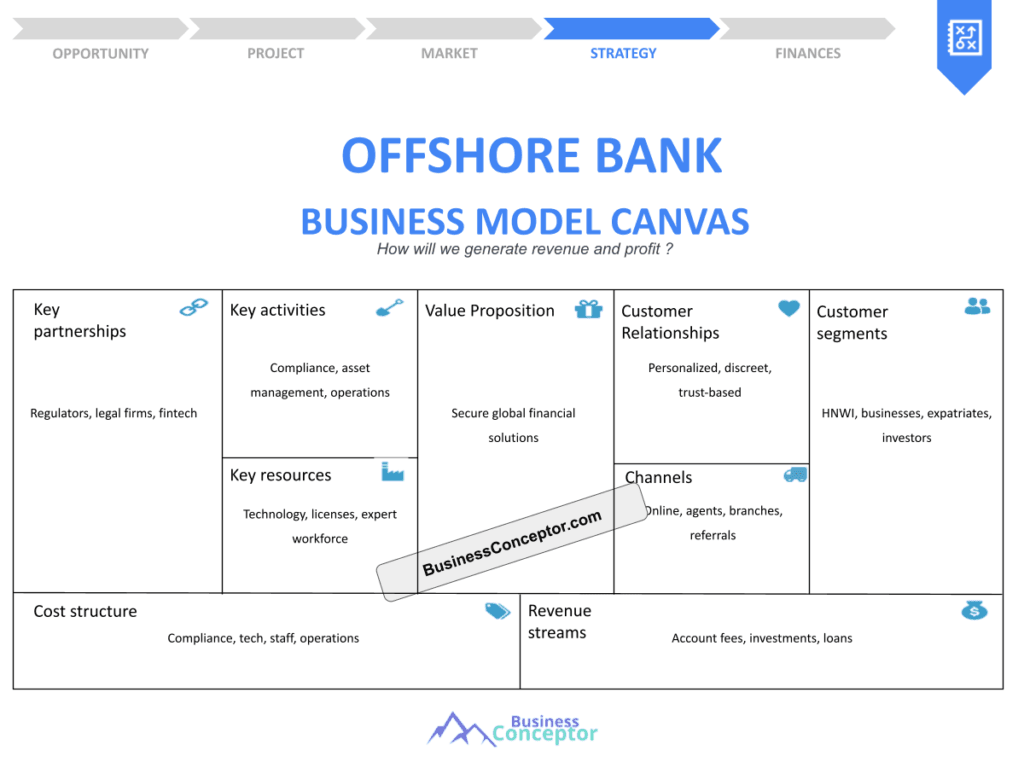

Did you know that over 70% of global wealth is held in offshore accounts? The Offshore Bank Business Model Canvas is essential for anyone looking to tap into this lucrative market. In essence, a business model canvas is a strategic management tool that provides a visual framework for developing, refining, and communicating your business model. It allows you to see the big picture of your offshore banking venture while focusing on critical components like value propositions, customer segments, and revenue streams.

- Understanding the offshore banking landscape.

- Key components of a business model canvas.

- The importance of customer segmentation.

- Strategies for building a strong value proposition.

- Identifying key partners and activities.

- Revenue streams and cost structure considerations.

- Regulatory compliance challenges.

- Real-life examples of successful offshore banks.

- Actionable steps to create your business model canvas.

- Tips for ongoing evaluation and adaptation.

Understanding Offshore Banking and Its Opportunities

Offshore banking can be a game-changer for those looking to diversify their financial portfolio. It offers unique benefits, including asset protection, tax optimization, and access to global markets. The offshore banking landscape is constantly evolving, and understanding its nuances is crucial for success.

For example, many individuals and businesses turn to offshore banking for privacy and security. Countries like Switzerland and the Cayman Islands are known for their robust banking systems and favorable tax laws. These features attract clients seeking to safeguard their wealth and maximize returns.

In summary, grasping the basics of offshore banking sets the stage for crafting your business model canvas. The next section will dive deeper into the elements that make up a successful banking strategy.

| Opportunity | Description |

|---|---|

| Asset Protection | Safeguarding wealth from local risks. |

| Tax Optimization | Utilizing favorable tax laws. |

| Global Access | Entering international markets. |

- Offshore banking offers privacy and security.

- It provides asset protection and tax benefits.

- Countries like Switzerland are popular offshore locations.

“Opportunities don’t happen, you create them.” – Chris Grosser

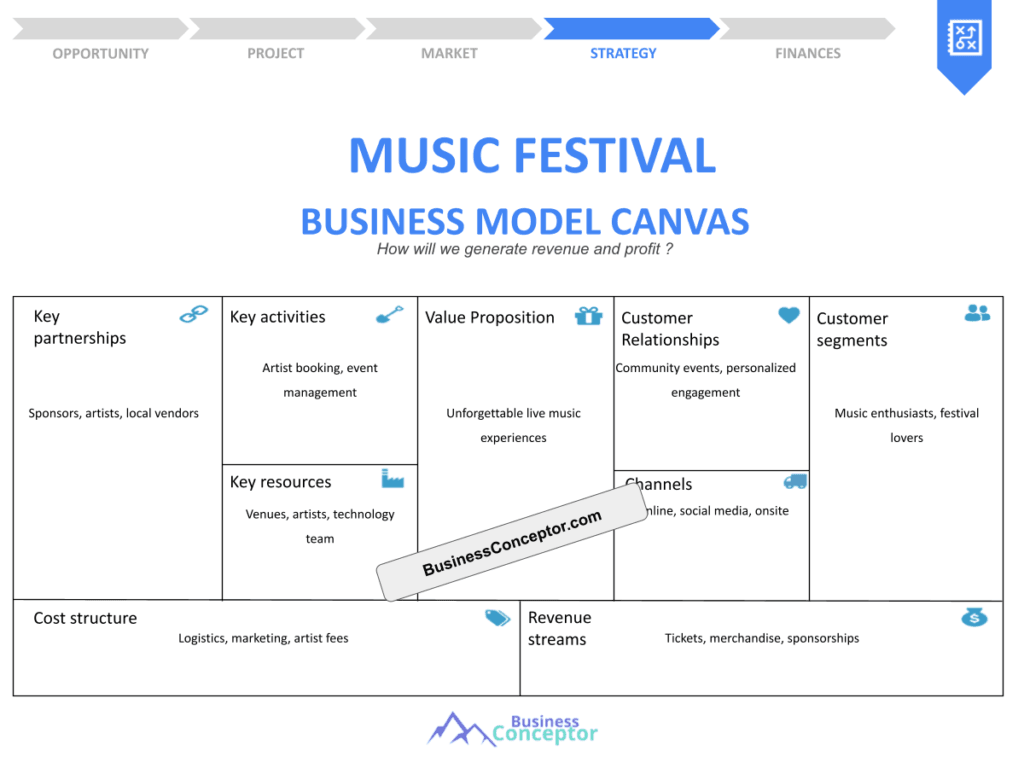

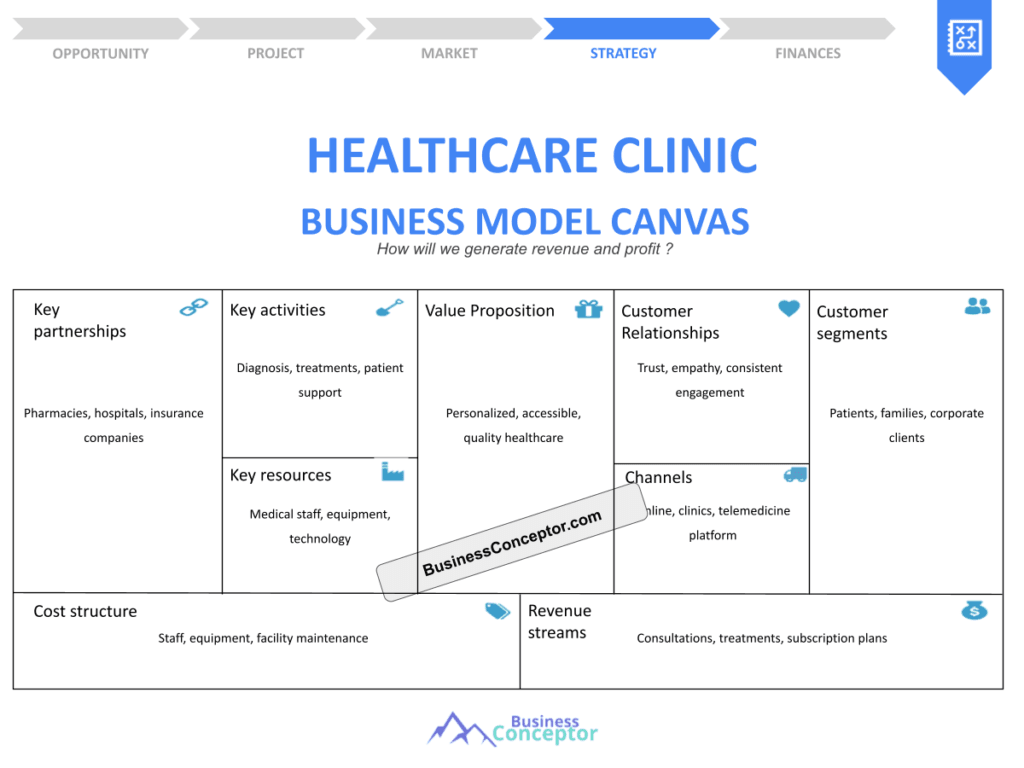

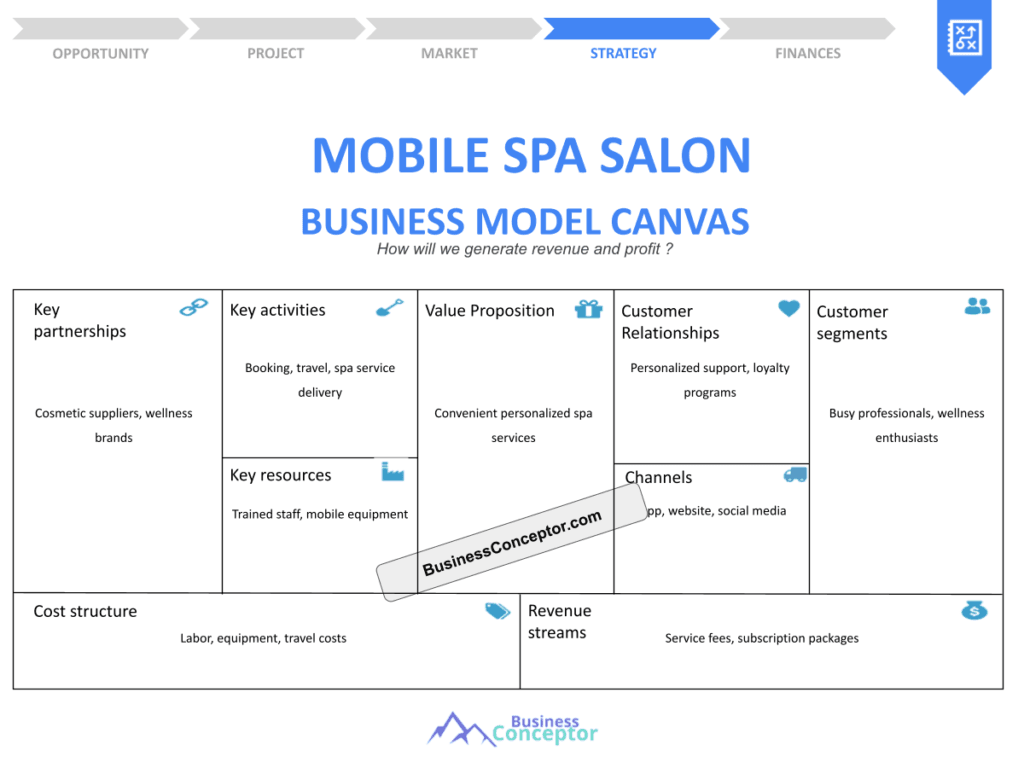

The Business Model Canvas Framework

The Business Model Canvas is a powerful tool for visualizing and structuring your business model. It breaks down complex ideas into nine essential components, allowing you to see how they interconnect. This framework is particularly useful in the banking sector, where clarity and precision are vital.

Each of the nine components plays a crucial role. For instance, the value proposition defines what makes your offshore bank unique. It addresses client needs and differentiates your services from competitors. Understanding how these components work together is key to building a successful offshore banking model.

Having a clear grasp of these components is crucial for creating a robust strategy. In the following section, we’ll discuss customer segmentation and why it matters in the context of an offshore bank.

- Value Proposition

- Customer Segments

- Channels

- Customer Relationships

- Revenue Streams

- Key Resources

- Key Activities

- Key Partnerships

- Cost Structure

The above steps must be followed rigorously for optimal success.

Customer Segmentation in Offshore Banking

Customer segmentation is vital for identifying and targeting the right clientele for your offshore bank. By understanding who your customers are, you can tailor your services to meet their specific needs. This targeted approach enhances client satisfaction and drives business growth.

For example, high-net-worth individuals may require different services than small business owners. A successful offshore bank will analyze demographics, financial goals, and risk tolerance to create distinct customer profiles. This tailored approach not only increases customer satisfaction but also improves retention rates.

By focusing on customer segmentation, you can enhance your marketing strategies and improve customer satisfaction. Next, we’ll explore the importance of crafting a strong value proposition for your offshore banking services.

- Customer segmentation helps tailor services.

- Different segments require unique strategies.

- Analyzing demographics is crucial for success.

“The more you know your customers, the better you can serve them.”

Crafting a Strong Value Proposition

A compelling value proposition is the cornerstone of any successful business, including offshore banking. It’s what attracts customers and encourages them to choose your bank over others. Creating a strong value proposition requires a deep understanding of your target market and their specific needs.

Consider what sets your offshore bank apart. Do you offer lower fees, superior customer service, or unique investment opportunities? Highlighting these aspects can make a significant difference in customer acquisition. A well-defined value proposition not only attracts new clients but also helps retain existing ones by reinforcing why they chose your services in the first place.

Having a clear value proposition not only helps in attracting customers but also aids in retaining them. In the next section, we’ll discuss how to identify key partners and activities essential for your banking operation.

| Element | Description |

|---|---|

| Unique Offerings | Distinct services that meet client needs. |

| Competitive Pricing | Lower fees compared to competitors. |

| Exceptional Service | High-quality customer support. |

- A strong value proposition attracts customers.

- Highlighting unique services is crucial.

- Customer retention is enhanced with clarity.

“To succeed, you must first believe that you can.”

Key Partners and Activities for Success

Key partners and activities are integral to the functioning of an offshore bank. These include relationships with financial institutions, regulatory bodies, and technology providers. Building strong partnerships can enhance your service offerings and improve operational efficiency.

For example, forming strategic alliances with fintech companies can enhance service delivery and operational efficiency. These partnerships can also help navigate the complex regulatory landscape that often accompanies offshore banking. Collaborating with established players can provide valuable resources and expertise, enabling your bank to flourish.

Identifying and cultivating these relationships is essential for long-term success. The next section will focus on understanding revenue streams and cost structure for your offshore bank.

| Partner | Role |

|---|---|

| Financial Institutions | Provide funding and services. |

| Regulatory Bodies | Ensure compliance with laws. |

| Technology Providers | Enhance banking operations through tech. |

- Strategic alliances improve service delivery.

- Regulatory compliance is crucial for operations.

- Technology partners enhance efficiency.

“Success is best when shared.”

Understanding Revenue Streams and Cost Structure

A clear understanding of revenue streams and cost structure is crucial for the sustainability of your offshore bank. Different revenue streams may include fees for services, interest on loans, and investment returns. Analyzing these streams helps forecast financial performance and plan for growth.

For instance, an offshore bank may charge fees for account maintenance, wire transfers, and investment management. Identifying these streams allows you to determine which services are most profitable and where adjustments may be necessary. Balancing revenue streams against costs is vital for maintaining profitability.

Understanding both revenue streams and cost structure is essential for creating a viable business plan. In the next section, we’ll explore the regulatory landscape that impacts offshore banking and how to navigate these challenges effectively.

| Revenue Stream | Description |

|---|---|

| Service Fees | Charges for various banking services. |

| Interest Income | Earnings from loans provided to clients. |

| Investment Returns | Profits from managed investment portfolios. |

- Diverse revenue streams enhance profitability.

- Understanding costs is crucial for success.

- Service fees play a significant role.

“Financial freedom is available to those who learn about it and work for it.”

Navigating Regulatory Challenges

Operating an offshore bank comes with its share of regulatory challenges. Understanding these regulations is crucial for compliance and operational success. Each jurisdiction has its own set of laws and regulations that govern offshore banking, and staying informed is essential.

For instance, many jurisdictions require banks to adhere to strict anti-money laundering (AML) laws. Failure to comply can result in severe penalties and loss of reputation. Developing a robust compliance framework will help mitigate risks and ensure your bank operates within legal boundaries.

Staying informed about regulatory changes and building a strong compliance framework can mitigate risks. The next section will discuss how to continuously evaluate and adapt your business model to stay competitive in the offshore banking industry.

| Regulation | Description |

|---|---|

| Anti-Money Laundering | Laws to prevent financial crimes. |

| Tax Compliance | Adherence to local and international tax laws. |

| Data Protection | Regulations on customer data security. |

- Regulatory compliance is critical for operations.

- Non-compliance can lead to severe consequences.

- Staying informed is key to success.

“In the middle of difficulty lies opportunity.” – Albert Einstein

Continuous Evaluation and Adaptation

Continuous evaluation and adaptation of your business model are essential in the ever-evolving offshore banking landscape. Regularly reviewing your business model canvas can help identify areas for improvement and ensure that your strategies remain relevant and effective.

For example, market trends may shift, requiring you to adapt your value proposition or customer segmentation. Keeping an eye on industry developments can position your bank for success. Additionally, soliciting client feedback can provide valuable insights into how well your services meet their needs.

By fostering a culture of adaptability, your offshore bank can thrive amidst challenges. The final section will wrap up the key points discussed throughout the article and encourage you to take actionable steps toward building your offshore banking venture.

| Key Metric | Purpose |

|---|---|

| Customer Satisfaction | Measure client happiness and loyalty. |

| Financial Performance | Assess profitability and growth. |

| Market Trends | Stay informed about industry changes. |

- Regular evaluation enhances adaptability.

- Market trends require proactive adjustments.

- Client feedback is crucial for improvement.

“Change is the only constant in life.” – Heraclitus

Practical Application of the Offshore Bank Model

Understanding the theory behind the offshore bank business model is one thing, but applying it practically is another. Real-life examples can provide valuable insights into effective implementation. Successful offshore banks often leverage digital technology to streamline operations and enhance customer experience.

For instance, a successful offshore bank may utilize advanced data analytics to better understand client behavior and preferences. This can lead to more personalized service offerings and improved customer satisfaction. Additionally, integrating secure online banking options can attract tech-savvy clients looking for convenience and efficiency.

As you apply these principles, remember to stay flexible and open to new ideas. Your willingness to adapt will ultimately determine your bank’s success. In the conclusion, we will summarize the main points and encourage you to take action on what you’ve learned.

“Success is where preparation and opportunity meet.” – Bobby Unser

- Conduct regular evaluations of your business model.

- Stay informed about market trends and regulations.

- Foster strong relationships with partners and clients.

Conclusion

In summary, crafting an Offshore Bank Business Model Canvas involves understanding the intricacies of offshore banking, defining your value proposition, identifying key partners, and adapting to regulatory challenges. Each component is interconnected, and success depends on a holistic approach. To help you get started, consider using an Offshore Bank Business Plan Template that offers a comprehensive framework for your venture.

- SWOT Analysis for Offshore Banks: Financial Strategies and Market Opportunities

- Offshore Bank Profitability: Key Considerations

- Offshore Bank Business Plan: Template and Tips

- How to Create a Financial Plan for Your Offshore Bank: Step-by-Step Guide (+ Example)

- Launching an Offshore Bank: Complete Guide and Examples

- Crafting a Marketing Plan for Your Offshore Bank (+ Example)

- Customer Segments for Offshore Banks: Who Are Your Ideal Clients?

- How Much Does It Cost to Establish an Offshore Bank?

- Offshore Bank Feasibility Study: Essential Guide

- Cafe Risk Management: Detailed Analysis

- How to Analyze Competition for Offshore Bank?

- Essential Legal Considerations for Offshore Bank

- Cafe Funding Options: Expert Insights

- Offshore Bank Growth Strategies: Scaling Examples

FAQ

What is an offshore bank?

An offshore bank is a financial institution located outside your home country, often providing benefits like privacy, asset protection, and favorable tax laws.

How do I create a business model canvas for my offshore bank?

Begin by outlining the nine components of the business model canvas: value proposition, customer segments, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure.

What are the benefits of offshore banking?

Benefits of offshore banking include asset protection, tax optimization, and access to international markets.

What regulatory challenges do offshore banks face?

Offshore banks must comply with strict regulations, including anti-money laundering (AML) laws and tax compliance, to ensure they operate legally.

How can I identify my target market for an offshore bank?

Analyze demographics, financial goals, and risk tolerance to create detailed customer profiles that guide your marketing strategies.

What are key revenue streams for offshore banks?

Common revenue streams for offshore banks include service fees, interest income from loans, and investment returns.

How important is customer segmentation in offshore banking?

Customer segmentation is crucial for tailoring services to meet the specific needs of different client groups, enhancing satisfaction and loyalty.

What role do partnerships play in offshore banking?

Strategic partnerships with financial institutions, regulatory bodies, and technology providers are essential for operational success and navigating compliance challenges.

How can I adapt my business model in offshore banking?

Regularly review your business model canvas, stay informed about market trends, and be willing to adjust your strategies based on customer feedback and industry changes.

What are the key components of a business model canvas?

The key components include value proposition, customer segments, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure.