Did you know that over 2 billion people globally now use online banking services? That’s a staggering figure that illustrates just how vital the Internet Bank Business Model Canvas is in today’s financial landscape. This article aims to guide you through the intricate process of creating a business model canvas specifically tailored for internet banks, ensuring you grasp not only the structure but also the underlying strategies that can drive your digital banking success.

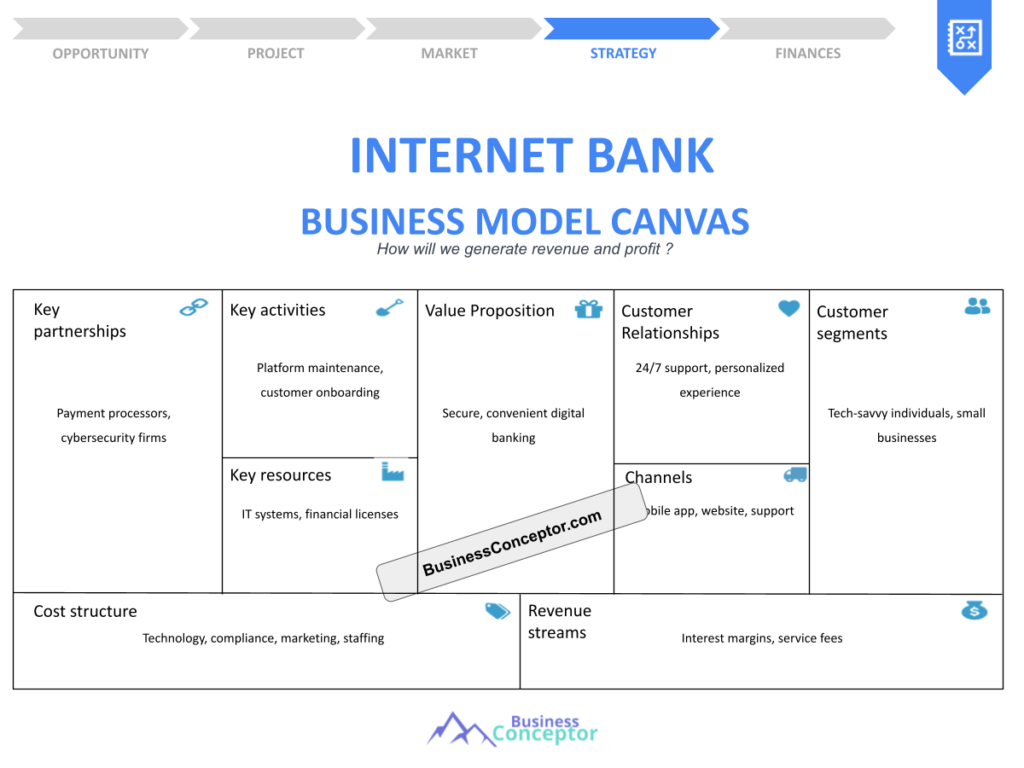

In essence, the Internet Bank Business Model Canvas is a strategic management tool that allows you to visualize and outline your bank’s value propositions, customer segments, revenue streams, and more. This canvas helps you systematically assess how your internet banking services can meet customer needs while maintaining profitability.

- Understand the importance of a business model canvas for internet banks.

- Learn the key components of the business model canvas.

- Explore real-world examples of successful internet banking models.

- Discover how to identify your target customer segments.

- Examine various revenue streams for internet banks.

- Analyze the cost structure of running an internet bank.

- Gain insights into key activities and partnerships.

- Understand the importance of customer relationships in banking.

- Learn how to adapt your business model to changing market trends.

- Get practical tips for implementing your business model canvas.

Understanding the Business Model Canvas

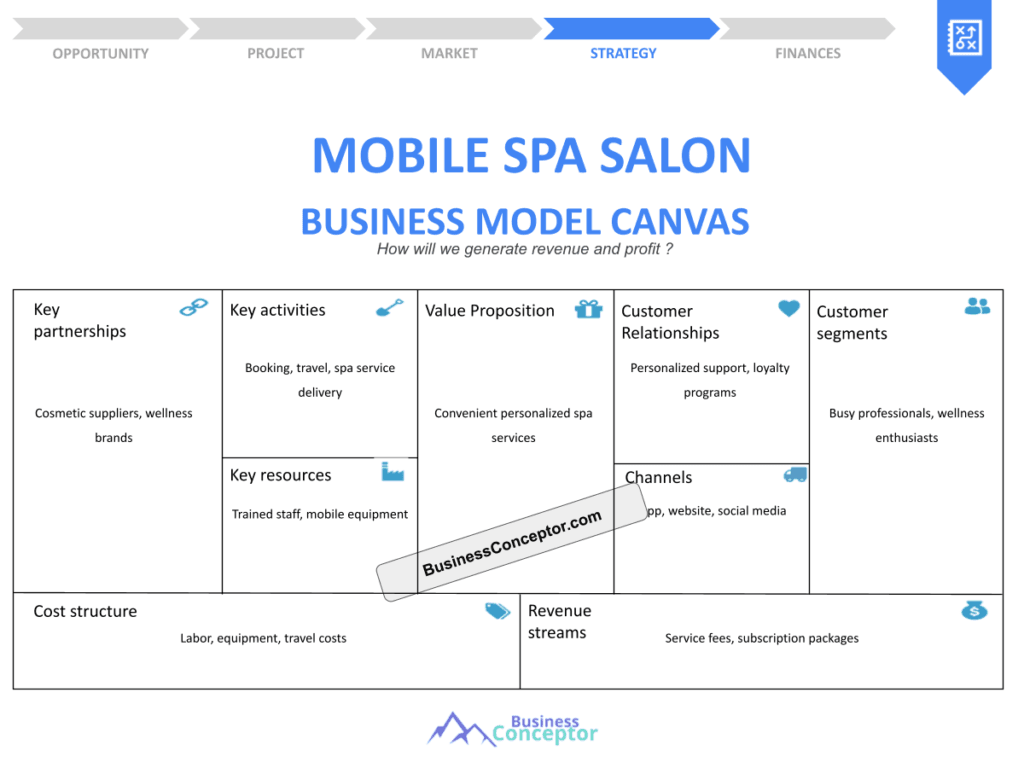

The Business Model Canvas is a visual tool that simplifies the process of developing new or existing business models. For internet banks, it’s crucial to have a clear and structured approach to outline how your services deliver value. The canvas comprises nine essential building blocks that capture the core aspects of your business model, allowing you to see the bigger picture and make informed strategic decisions.

Each section of the canvas serves a specific purpose. For instance, the value proposition block defines what makes your bank unique—such as lower fees, enhanced security, or superior customer service. Customer segments focus on who your bank serves, while channels describe how you deliver your services. By clearly defining these elements, you can streamline operations and effectively meet customer expectations.

Understanding the Business Model Canvas is the first step toward creating a successful internet bank. This foundational knowledge will set the stage for exploring each of the nine components in detail. The insights you gain will empower you to craft a robust strategy that aligns with your bank’s mission and goals.

| Component | Description |

|---|---|

| Value Proposition | Unique offerings of your internet bank |

| Customer Segments | Target audiences for your banking services |

| Revenue Streams | Sources of income for your bank |

| Channels | Methods of delivering banking services |

| Customer Relationships | Interactions with clients |

| Key Activities | Essential operations for running your bank |

| Key Resources | Assets required to deliver value |

| Key Partnerships | Collaborations that enhance your service |

| Cost Structure | Expenses incurred in operating your bank |

- The Business Model Canvas is essential for strategic planning.

- It consists of nine components crucial for internet banks.

- Clear definitions enhance operational efficiency…

– “A business model is like a map; it shows you where to go and how to get there.”

Defining Your Value Proposition

Your value proposition is arguably the most critical element of your business model canvas. It defines why customers should choose your internet bank over competitors. This proposition should articulate the unique benefits your bank provides, such as innovative technology, user-friendly interfaces, or personalized financial advice.

For example, consider how a bank might offer a unique mobile app that allows users to manage their finances seamlessly. By focusing on user experience and providing features like instant money transfers or budgeting tools, the bank can differentiate itself in a crowded marketplace. Understanding customer pain points is vital for crafting a compelling value proposition that resonates with your target audience.

As you refine your value proposition, keep in mind the importance of adaptability. The banking landscape is continually evolving, so being responsive to market changes and customer feedback will help you maintain a competitive edge. This sets the stage for the next section, where we will explore identifying your target customer segments.

- Identify customer pain points.

- Research competitor offerings.

- Articulate your unique benefits.

- Test your proposition with real customers.

- Refine based on feedback.

– The above steps must be followed rigorously for optimal success.

Identifying Customer Segments

Knowing your customer segments is essential for tailoring your services effectively. Different demographics and psychographics will have unique needs and preferences, which means your internet bank must cater to various customer profiles.

For instance, millennials might prioritize mobile banking features and low fees, while older generations may value personalized customer service. By segmenting your customers, you can develop targeted marketing strategies and service offerings that align with their specific requirements.

Additionally, understanding your customer segments will guide your channel strategy, determining how best to reach and engage them. This foundational knowledge sets the stage for exploring revenue streams in the next section.

- Customer segments define your target market.

- Different demographics require tailored services.

- Understanding segments enhances marketing efforts…

– “To succeed, always move forward with a clear vision.”

Exploring Revenue Streams

Revenue streams are the lifeblood of your internet bank. Understanding where your income will come from is crucial for financial sustainability. This can include various models such as transaction fees, subscription services, or interest from loans.

For example, some internet banks may adopt a freemium model, offering basic services for free while charging for premium features. This approach can attract a larger customer base while generating revenue from those who opt for enhanced services. By exploring diverse revenue streams, you can mitigate risks and enhance profitability.

Additionally, it’s essential to regularly evaluate and adapt your revenue models as market conditions and customer preferences change. This proactive approach ensures that your bank remains competitive and financially viable. Understanding these dynamics will help you make informed decisions as you prepare to delve into the key activities that drive your bank’s operations.

| Revenue Stream Type | Description |

|---|---|

| Transaction Fees | Charges for processing transactions |

| Subscription Services | Monthly or yearly fees for premium features |

| Interest Income | Earnings from loans and credit products |

- Evaluate potential revenue models.

- Test pricing strategies with customers.

- Monitor industry trends…

Key Activities for Success

Key activities refer to the essential actions and processes that your internet bank must perform to deliver value. This includes technology development, customer service, marketing, and compliance with regulations.

For instance, maintaining a robust cybersecurity framework is a key activity that not only protects customer data but also builds trust. Regularly updating software and training staff on security protocols are essential for safeguarding your bank’s reputation and assets. Furthermore, efficient customer support is crucial in addressing client inquiries and enhancing overall satisfaction.

Identifying and optimizing these key activities will ensure that your bank operates efficiently and meets customer expectations. This understanding leads us to the importance of key resources in the next section, where we will explore what assets are necessary for your bank’s success.

| Key Activity | Importance |

|---|---|

| Technology Development | Essential for service delivery |

| Customer Support | Builds customer loyalty |

- Prioritize key activities for operational success.

- Invest in technology and training.

- Continuously improve customer service…

Identifying Key Resources

Key resources are the assets required to deliver your value proposition. These can include physical, intellectual, human, and financial resources. Identifying what you need is crucial for operational effectiveness.

For example, having a skilled IT team is a significant resource for an internet bank, as they ensure your technology functions smoothly and securely. Additionally, intellectual resources like patents or proprietary algorithms can provide a competitive advantage. Furthermore, financial resources are essential for investing in technology and marketing initiatives that attract and retain customers.

By understanding your key resources, you can make informed decisions about where to invest and how to allocate resources effectively. This knowledge will also help you forge key partnerships, which we will explore in the next section.

| Key Resource | Description |

|---|---|

| Skilled Workforce | Essential for service delivery |

| Technology Infrastructure | Necessary for operational efficiency |

- Assess your resource needs.

- Invest in training and technology.

- Develop intellectual assets…

Building Key Partnerships

Key partnerships are critical for enhancing your internet bank’s capabilities. Collaborating with fintech companies, payment processors, and even regulatory bodies can provide valuable resources and knowledge.

For instance, partnering with a cybersecurity firm can bolster your security measures, ensuring customer trust and compliance with regulations. Additionally, strategic alliances can lead to shared resources and lower operational costs. By leveraging partnerships, you can also expand your service offerings and reach new customer segments.

Developing a robust partnership strategy is essential for long-term success. As you identify potential partners, consider how these relationships can enhance your value proposition and customer experience. This proactive approach will ultimately contribute to the overall effectiveness of your business model canvas.

| Key Partnership | Benefit |

|---|---|

| Fintech Collaborations | Access to innovative technology |

| Regulatory Alliances | Ensures compliance and operational efficiency |

- Identify potential partners.

- Negotiate mutually beneficial agreements.

- Monitor partnership effectiveness…

Understanding Cost Structure

The cost structure outlines all the costs incurred to operate your internet bank. Understanding these expenses is vital for budgeting and financial planning. Identifying your costs will help you determine how to allocate resources effectively while maintaining profitability.

Typical costs include technology development, marketing, staff salaries, and compliance expenses. By analyzing these costs, you can identify areas where efficiencies can be gained or where investments are necessary. For example, investing in automation can reduce operational costs in the long run while enhancing service delivery.

Maintaining a clear picture of your cost structure will help you make informed strategic decisions. This understanding is crucial as you prepare to wrap up the discussion and consider how all elements of your business model canvas work together to create a successful internet bank.

| Cost Type | Description |

|---|---|

| Technology Costs | Expenses related to software and infrastructure |

| Marketing Costs | Funds allocated for customer acquisition |

- Analyze your cost structure regularly.

- Identify areas for cost savings.

- Adjust budgets based on performance…

Integrating All Components

Once you’ve explored each component of the business model canvas, it’s time to integrate them into a cohesive strategy. This holistic approach ensures that all elements work together to create a successful internet bank.

Practical advice for integration includes aligning your value proposition with customer segments and ensuring that key activities support your revenue streams. Regularly revisiting and adjusting your canvas based on market feedback and changes will keep your strategy relevant.

By creating a dynamic and adaptable business model canvas, you can position your internet bank for sustained growth and success. This comprehensive understanding of how each component interacts will empower you to make strategic decisions that enhance your overall business performance.

– “Success comes to those who persevere.”

- Regularly update your business model canvas.

- Engage with customers for feedback.

- Stay informed about industry trends…

Conclusion

In summary, crafting an effective Internet Bank Business Model Canvas involves understanding and integrating various components like value proposition, customer segments, and revenue streams. By approaching your business model holistically, you can create a banking solution that resonates with customers and thrives in a competitive landscape.

Now is the time to take action! Consider utilizing our Internet Bank Business Plan Template to guide your planning process effectively.

Additionally, check out these insightful articles related to internet banking to further enhance your understanding and strategies:

- SWOT Analysis for Internet Bank: Maximizing Business Potential

- Internet Bank Profitability: Ensuring Financial Success

- How to Create a Business Plan for Your Internet Bank: Example Included

- Developing a Financial Plan for Internet Bank: Key Steps (+ Template)

- Guide to Starting an Internet Bank

- Create an Internet Bank Marketing Plan: Tips and Example

- Understanding Customer Segments for Internet Banks: Examples and Strategies

- How Much Does It Cost to Start an Internet Bank?

- Internet Bank Feasibility Study: Comprehensive Guide

- Internet Bank Risk Management: Comprehensive Strategies

- Internet Bank Competition Study: Comprehensive Analysis

- Internet Bank Legal Considerations: Comprehensive Guide

- Internet Bank Funding Options: Expert Insights

- Internet Bank Growth Strategies: Scaling Guide

FAQ

What is an Internet Bank Business Model Canvas?

An Internet Bank Business Model Canvas is a strategic framework that outlines the key components of an internet banking business, allowing you to visualize your value propositions, customer segments, and more.

Why is a business model canvas crucial for internet banks?

A business model canvas helps organize thoughts and strategies, ensuring all essential aspects of the business are considered for successful operation and growth.

What are the key components of the business model canvas?

The key components include value proposition, customer segments, revenue streams, channels, customer relationships, key activities, key resources, key partnerships, and cost structure.

How can I identify my target customer segments?

Analyze demographics, psychographics, and customer behaviors to create detailed profiles of your ideal customers.

What are common revenue streams for internet banks?

Common revenue streams include transaction fees, subscription services, and interest income from loans.

How do I ensure my value proposition stands out?

Focus on unique benefits that address specific customer pain points and differentiate your bank from competitors.

What key activities are essential for running an internet bank?

Key activities include technology development, customer support, regulatory compliance, and marketing.

Why are partnerships important for internet banks?

Partnerships enhance capabilities, reduce costs, and provide access to new markets or technologies.

How do I analyze my cost structure effectively?

Regularly review all expenses, identify fixed and variable costs, and look for opportunities to reduce unnecessary expenses.

What steps should I take to integrate all components of my business model canvas?

Align your value proposition with customer needs, ensure key activities support revenue generation, and adjust your strategy based on feedback and market changes.