Did you know that around 90% of startups fail, and one of the leading reasons is the lack of proper financial planning? Startup costs are the expenses incurred when creating a new business, and understanding them is crucial for anyone looking to launch a successful venture. These costs can vary dramatically based on the industry, location, and the nature of the business itself. Without a clear grasp of your startup costs, you may find yourself facing unexpected financial hurdles that could jeopardize your business before it even gets off the ground.

Here’s what you need to know:

- Startup costs can include everything from legal fees to marketing expenses.

- Knowing how to estimate your costs can save you from financial headaches later.

- There are various strategies to reduce startup costs without sacrificing quality.

Understanding Startup Costs

Getting a grip on what startup costs are is the first step to successfully launching your business. Typically, startup costs encompass all expenses needed to get your business up and running. These can range from tangible assets like equipment and inventory to intangible costs like licenses and permits. Understanding these categories not only helps you budget effectively but also aids in setting realistic expectations for your business journey.

For example, if you’re starting a coffee shop, your costs may include:

- Rent for the location, which can be a significant monthly expense.

- Equipment like espresso machines, grinders, and furniture.

- Initial inventory of coffee, pastries, and other supplies.

- Licensing and permits to operate legally in your area.

As you can see, the breakdown can get quite detailed. Each type of cost can have a profound impact on your overall budget. Understanding these categories can help you map out your financial journey more effectively. It also allows you to prioritize essential expenses and defer non-critical ones until your business is more stable.

| Cost Category | Examples |

|---|---|

| Equipment | Coffee machines, furniture |

| Legal Fees | Business licenses, permits |

| Marketing | Website, advertising materials |

| Operational Expenses | Rent, utilities |

Key Points:

- Startup costs vary widely by industry, so it’s essential to research your specific market.

- A thorough breakdown helps in budget planning and can prevent future financial stress.

- Identifying fixed and variable costs is essential for financial stability and growth.

“The secret of getting ahead is getting started.” 🚀

Typical Startup Expenses

When you’re planning to launch a startup, knowing typical expenses can help you prepare for what’s ahead. Understanding these startup expenses is essential, as they can significantly affect your overall budget and financial health. Expenses usually fall into a few major categories, and being aware of these can help prevent unexpected financial burdens that might arise during your entrepreneurial journey.

Common startup expenses include:

- Office Space: Depending on your business, this could be a home office, co-working space, or a commercial lease. The location can greatly influence your rent, so it’s essential to choose wisely.

- Technology: This includes computers, software subscriptions, and communication tools, which are vital for daily operations and efficiency.

- Marketing: Costs associated with developing a website, branding, and promotional materials are crucial for attracting customers and establishing your market presence.

For instance, a tech startup might face high costs for software development and server hosting, while a retail startup could have significant inventory costs upfront. Understanding these differences can help you tailor your budget accordingly, ensuring that you allocate enough funds to each category without overspending.

| Expense Type | Estimated Cost |

|---|---|

| Office Space | $500 – $5,000/month |

| Technology | $1,000 – $10,000+ |

| Marketing | $500 – $5,000+ |

Key Points:

- Identifying typical expenses helps in accurate forecasting and prevents unexpected costs from derailing your plans.

- Costs can vary greatly based on business type, so research is crucial.

- Early budgeting can lead to better financial management and reduce stress as your business grows.

“A goal without a plan is just a wish.” 🌟

How to Estimate Startup Costs

Estimating startup costs can seem daunting, but it’s a vital part of the process. The first step is to create a comprehensive list of potential expenses. This can include everything from office supplies to insurance premiums. A detailed estimate helps you avoid financial pitfalls later on, allowing you to focus on growing your business rather than worrying about unexpected costs.

One practical way to estimate these costs is to use a startup cost calculator. These tools allow you to input various parameters related to your business and receive a clearer picture of what you might need to spend. By providing insights into both fixed and variable costs, these calculators can help you make informed decisions about your financial planning.

Here’s a quick method to estimate your costs:

- List all necessary expenses: Think about every aspect of your business. From rent to marketing, every cost should be accounted for.

- Research costs: Look up prices for each item or service. This will help you create a realistic budget.

- Create a budget: Organize your expenses into fixed and variable costs, allowing for better financial tracking.

| Step | Action |

|---|---|

| List Expenses | Identify all potential costs |

| Research Costs | Find current market prices |

| Create Budget | Organize into categories |

Key Points:

- A detailed list helps avoid overlooked expenses that could lead to financial strain.

- Research is essential for accurate budgeting; knowing the market can save you money.

- Categorizing costs aids in financial planning and makes it easier to track spending.

“Success is where preparation and opportunity meet.” 🔑

Common Hidden Business Expenses

When starting a business, it’s easy to overlook hidden expenses that can add up quickly. These hidden costs can derail your financial planning if not accounted for properly. Understanding these common hidden business expenses is crucial for maintaining a healthy budget and ensuring the long-term viability of your startup.

Some common hidden expenses include:

- Insurance: Liability, property, and health insurance can be significant. It’s essential to factor these costs into your budget, as they protect your business from unforeseen circumstances that could lead to financial ruin.

- Utilities: Electricity, water, and internet costs can be higher than anticipated, especially in the early stages when you might not have a clear understanding of your operational needs.

- Taxes: Local taxes and fees may apply depending on your business structure and location. Not accounting for these can lead to unexpected financial burdens that could jeopardize your operations.

For example, a restaurant might underestimate the costs of utilities during peak hours or fail to budget for health inspections. These unexpected costs can put a strain on your finances if you’re not prepared. Identifying these hidden expenses early on allows you to allocate funds accordingly, ensuring you have a cushion for any surprise costs that may arise.

| Hidden Expense | Example Cost |

|---|---|

| Insurance | $500 – $2,000/year |

| Utilities | $100 – $1,000/month |

| Taxes | Varies by location and structure |

Key Points:

- Hidden expenses can significantly impact your budget if not planned for.

- Regularly review your expenses to catch any surprises that could derail your financial plans.

- Anticipating these costs can save you from financial stress and help you allocate resources more effectively.

“Don't let the fear of the unknown hold you back.” 🌈

Reducing Startup Costs

Finding ways to reduce startup costs is a smart move for any entrepreneur. There are several strategies you can employ to save money while still launching your business effectively. Implementing these strategies not only helps in managing your budget but also allows you to invest more in growth opportunities.

One effective method is to consider bootstrapping. This means using your own savings and resources to fund your startup, which can help you avoid debt and retain full control over your business. By being frugal and resourceful, you can stretch your funds further and ensure that every dollar is spent wisely.

Additionally, you can explore shared office spaces to reduce rent costs. Many entrepreneurs find that co-working spaces provide not only lower costs but also networking opportunities that can lead to valuable partnerships. Furthermore, you can leverage free tools for tasks like accounting and marketing. There are numerous free resources available that can help you get started without breaking the bank.

Here are some practical tips to consider when looking to reduce startup costs:

- Outsource wisely: Hire freelancers for short-term projects instead of full-time employees. This approach allows you to save on salaries and benefits while still getting the expertise you need.

- Network: Connect with other entrepreneurs for shared resources and advice. Collaborating can lead to cost savings and innovative solutions that you might not have considered on your own.

- Negotiate with suppliers: Don’t hesitate to ask for better deals or discounts. Building a good relationship with your suppliers can lead to favorable terms that save you money in the long run.

| Cost-Reduction Strategy | Description |

|---|---|

| Bootstrapping | Fund your startup with personal savings |

| Shared Office Space | Reduce overhead costs while networking |

| Free Tools | Utilize free resources for various business functions |

Key Points:

- Bootstrapping can lead to greater financial freedom and control over your business.

- Networking can provide valuable resources and support that you might not find on your own.

- Exploring cost-reduction strategies can lead to better financial health and more funds available for growth initiatives.

“Frugality is the mother of all virtues.” 💰

Funding Your Startup Costs

Understanding how to fund your startup costs is crucial for success. There are numerous options available, and choosing the right one can set your business on the path to success. Each funding source has its own set of advantages and disadvantages, and knowing these can help you make an informed decision about which option best suits your needs.

Common funding sources include:

- Personal Savings: Using your own money can be a straightforward way to fund your startup. It allows you to maintain full control without owing anyone else. However, this can also put your personal finances at risk, so it’s important to assess your situation carefully.

- Loans: Small business loans from banks or credit unions can provide the necessary capital. These loans typically come with lower interest rates than personal loans, making them a more affordable option for many entrepreneurs. However, you will need to repay the loan with interest, which can add financial pressure.

- Investors: Seeking out angel investors or venture capitalists can help secure funding in exchange for equity in your business. This option provides substantial funding and can also bring valuable expertise and connections to your startup. However, it often means giving up a portion of ownership, which may not be ideal for every entrepreneur.

Each funding option has its pros and cons, so it’s important to weigh them carefully. For example, taking out a loan means you’ll have to repay it with interest, while seeking investors may dilute your ownership. Understanding your long-term goals will help you determine which funding route aligns best with your vision for your business.

| Funding Source | Pros | Cons |

|---|---|---|

| Personal Savings | Full control | Risk to personal finances |

| Loans | No equity loss | Repayment obligation |

| Investors | Large sums available | Potential loss of control |

Key Points:

- Different funding sources have unique advantages and disadvantages that can impact your business.

- Assessing your business needs will help determine the best funding option.

- Planning for repayment or ownership dilution is essential for maintaining control over your business.

“Funding is the fuel that drives your startup.” 🔥

Final Thoughts on Startup Costs

Navigating startup costs can feel overwhelming, but with the right knowledge and planning, you can set yourself up for success. Understanding what costs to expect, how to estimate them, and where to find funding can make a world of difference. By being proactive about your financial planning, you can avoid common pitfalls that many entrepreneurs face.

Take the time to research and plan out your expenses carefully. This will help you launch your startup with confidence and keep you on the path to achieving your business goals. Remember, a well-thought-out budget is not just a list of numbers; it’s a roadmap that guides your business decisions and strategies.

Moreover, seeking guidance from mentors or financial advisors can provide valuable insights that can enhance your understanding of startup costs. Engaging with others in your industry can also reveal hidden expenses and strategies to manage costs effectively. Networking is not just about finding investors; it’s about building relationships that can support your business in various ways.

| Final Considerations | Action Steps |

|---|---|

| Research Thoroughly | Understand all potential costs |

| Budget Wisely | Keep track of expenses |

| Seek Guidance | Connect with mentors |

Key Points:

- Planning and research are key to managing startup costs.

- Creating a budget will help keep your finances in check and guide your spending decisions.

- Learning from others can provide valuable insights and strategies for navigating your financial landscape.

“Start where you are. Use what you have. Do what you can.” 🌟

Evaluating Startup Costs for Long-Term Success

Evaluating startup costs is not just about getting your business off the ground; it’s about ensuring its sustainability and growth in the long run. As an entrepreneur, understanding the financial landscape of your startup will help you navigate challenges and make informed decisions. This evaluation involves more than just listing expenses; it requires a comprehensive analysis of how these costs affect your business model and overall profitability.

One effective approach to evaluate your startup costs is to conduct a thorough financial analysis. This involves reviewing all anticipated expenses and categorizing them into fixed and variable costs. Fixed costs, like rent and salaries, remain constant regardless of your sales volume, while variable costs, such as inventory and marketing, fluctuate with your business activity. By understanding these categories, you can better predict cash flow and prepare for potential downturns.

Moreover, it’s important to regularly revisit and update your cost evaluations. Market conditions change, and so do the costs associated with running a business. For example, an increase in raw material prices can significantly impact your production costs. By keeping your financial assessments current, you can adapt your strategies to mitigate risks associated with rising expenses.

| Evaluation Method | Description |

|---|---|

| Financial Analysis | Review and categorize expenses into fixed and variable costs |

| Regular Updates | Keep cost evaluations current to adapt to market changes |

Key Points:

- Evaluating startup costs helps in understanding the financial health of your business.

- Categorizing costs allows for better cash flow predictions and risk management.

- Regular updates ensure that you remain agile and responsive to market fluctuations.

“An investment in knowledge pays the best interest.” 📈

Preparing for Unexpected Startup Costs

Every entrepreneur knows that no business plan is foolproof. Preparing for unexpected startup costs is a crucial part of being a successful business owner. These unexpected expenses can arise from various sources, such as equipment failures, sudden market changes, or even regulatory changes that require additional compliance costs. Being prepared for these surprises can mean the difference between thriving and barely surviving.

One effective strategy to prepare for unforeseen costs is to create a contingency fund. This fund should be a percentage of your overall budget dedicated to covering unexpected expenses. A common recommendation is to set aside 10-20% of your total startup costs for this purpose. Having this buffer allows you to navigate financial bumps in the road without derailing your entire business.

Another valuable approach is to maintain flexibility in your budget. This means being open to adjusting your spending as circumstances change. For instance, if you find that certain marketing strategies are not yielding the expected results, reallocating funds to more effective channels can help you maximize your return on investment.

| Preparation Strategy | Description |

|---|---|

| Contingency Fund | Set aside 10-20% of your budget for unexpected costs |

| Flexible Budgeting | Adjust spending as needed to respond to changing circumstances |

Key Points:

- Preparing for unexpected costs can safeguard your business’s financial health.

- A contingency fund provides a safety net that can ease financial stress during tough times.

- Flexible budgeting allows you to adapt and thrive in a dynamic business environment.

“Failing to prepare is preparing to fail.” 💡

Recommendations

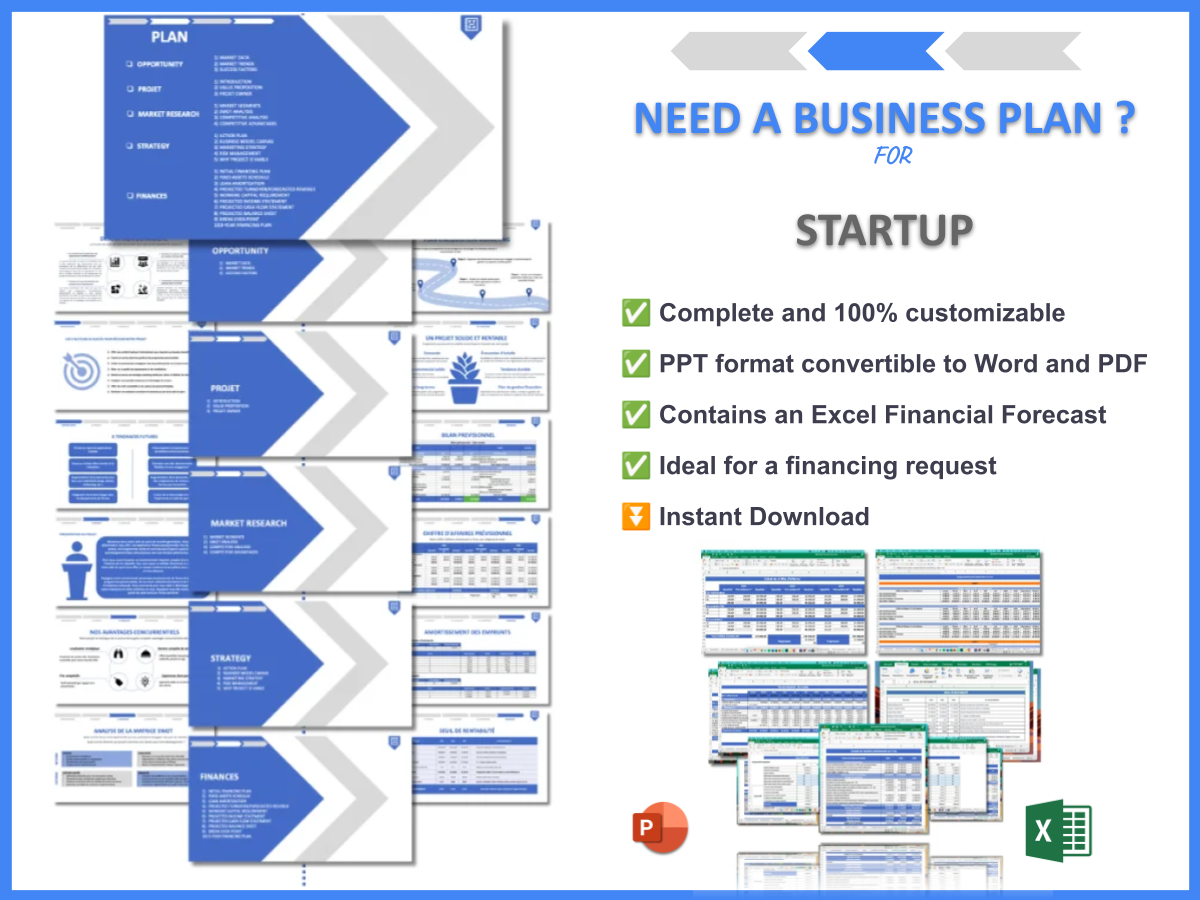

In summary, understanding startup costs is essential for any entrepreneur looking to launch a successful business. By thoroughly evaluating expenses, estimating costs accurately, and planning for unexpected financial challenges, you can set a solid foundation for your startup. To assist you further in your journey, consider using our Startup Business Plan Template. This resource will help you create a comprehensive plan that addresses all aspects of your business, ensuring you are well-prepared for the road ahead.

Additionally, we have a range of informative articles related to startups that can provide you with valuable insights:

- Article 1 on Startup SWOT Analysis: Key Insights for Success

- Article 2 on Startups: Strategies for High Profitability

- Article 3 on Startup Business Plan: Template and Tips

- Article 4 on Financial Planning for Startups: A Detailed Guide with Examples

- Article 5 on Starting a Startup: The Complete Guide with Practical Examples

- Article 6 on Create a Winning Marketing Plan for Your Startup (+ Example)

- Article 7 on Start Your Startup Right: Crafting a Business Model Canvas with Examples

- Article 8 on Key Customer Segments for Startups: Examples and Analysis

- Article 9 on Ultimate Startup Feasibility Study: Tips and Tricks

- Article 10 on Ultimate Guide to Startup Risk Management

- Article 11 on Ultimate Guide to Startup Competition Study

- Article 12 on Essential Legal Considerations for Startup

- Article 13 on Exploring Funding Options for Startup

- Article 14 on How to Implement Growth Strategies for Startups

FAQ

What are startup costs?

Startup costs refer to the expenses incurred when launching a new business. These can include a wide range of expenses such as legal fees, equipment purchases, marketing costs, and operational expenses. Understanding these costs is crucial for effective financial planning.

How can I estimate startup costs?

Estimating startup costs involves creating a detailed list of all potential expenses associated with your business. This includes researching prices for necessary items, categorizing costs into fixed and variable expenses, and using tools like a startup cost calculator to refine your estimates.

What are typical startup expenses?

Typical startup expenses can include rent for office space, technology and equipment, initial inventory, marketing and advertising costs, and legal fees for permits and licenses. It’s essential to account for these expenses in your budgeting process.

How can I reduce startup costs?

To reduce startup costs, consider options like bootstrapping, which involves using personal savings, or leveraging shared office spaces to lower rent. Additionally, utilizing free tools for marketing and accounting, outsourcing tasks instead of hiring full-time staff, and negotiating with suppliers can help keep costs down.

What are some common hidden business expenses?

Common hidden business expenses can include insurance premiums, utility bills, and unexpected maintenance costs. Many entrepreneurs overlook these expenses during their initial budgeting, which can lead to financial strain if not properly planned for.

What funding options are available for startups?

Funding options for startups include personal savings, small business loans, and seeking investors or venture capitalists. Each option has its advantages and disadvantages, and it’s important to evaluate which funding source aligns best with your business goals and financial situation.