Starting a digital entrepreneur business can be a game changer, but many are shocked to learn that the costs can vary widely. Understanding digital entrepreneur costs is crucial for anyone looking to dive into the online business world. Essentially, these costs include everything from initial investments to ongoing expenses. It’s not just about the startup fees; there are hidden costs that can sneak up on you. When I first ventured into the realm of digital entrepreneurship, I thought I could launch my business on a shoestring budget, but I quickly learned that the financial landscape is much more complex. Having a clear picture of what to expect can help you avoid pitfalls and set yourself up for success.

Here’s what you need to know about the costs involved:

- Startup Costs: Initial investments required to set up your business.

- Running Costs: Ongoing expenses needed to maintain your business.

- Hidden Costs: Unforeseen expenses that can impact your budget.

- Budgeting Tips: How to plan your finances effectively.

Understanding Startup Costs for Digital Entrepreneurs

Getting a handle on startup costs is the first step for any aspiring digital entrepreneur. From website creation to marketing, these initial expenses can quickly add up. When I started my first online business, I was amazed at how quickly the costs piled up, and I had to learn the hard way about budgeting. It’s crucial to be aware of what you need to spend before you even launch your business.

For instance, setting up a basic website can cost anywhere from a few hundred to several thousand dollars depending on whether you hire a professional or use a DIY website builder. Plus, you’ll need to consider costs for domain registration, hosting, and branding materials. I once underestimated these costs and ended up scrambling to find funds to cover my expenses. It’s important to have a clear breakdown of what you will need to invest initially to avoid financial stress later on.

| Expense Type | Estimated Cost |

|---|---|

| Website Development | $500 – $3,000 |

| Domain Registration | $10 – $50 |

| Hosting Fees | $5 – $50/month |

| Branding Materials | $100 – $1,000 |

| Marketing Budget | $200 – $2,000 |

- Key Points:

- Initial costs can vary significantly.

- Website creation is usually the biggest expense.

- Don’t forget about branding and marketing.

“Success doesn’t just happen; it’s built on smart investments!” 💰

As you can see, the costs associated with starting your digital business are quite diverse. Planning for these expenses not only sets a solid foundation for your business but also helps you avoid unexpected financial setbacks. Whether you’re creating a freelance business, launching a content creation platform, or building a personal brand, understanding your digital entrepreneur startup costs can make all the difference in achieving long-term success.

In summary, the startup phase is filled with excitement and potential, but it can also be daunting if you’re not prepared for the financial implications. By taking the time to understand and plan for these costs, you can embark on your journey as a digital entrepreneur with confidence. Remember, every successful business starts with a solid plan and the right resources, so don’t overlook the importance of budgeting and financial planning.

Ongoing Running Costs for Your Digital Business

Once your digital business is up and running, you’ll face ongoing costs that are essential for its success. Understanding these running costs is crucial for any digital entrepreneur. I learned the hard way that these expenses can sneak up on you if you’re not keeping track. For example, monthly subscriptions to software tools and marketing services can add up quickly, and if you’re not careful, you might find yourself overspending.

Consider the costs associated with digital marketing tools, content management systems, and customer relationship management software. These tools are necessary to maintain and grow your business. I remember when I first started; I didn’t realize how much I would need to invest in tools to manage my customer relationships and streamline my marketing efforts. I ended up paying for multiple subscriptions that I didn’t fully utilize, which was a costly mistake.

| Expense Type | Estimated Monthly Cost |

|---|---|

| Software Subscriptions | $50 – $300 |

| Marketing & Ads | $100 – $1,000 |

| Payment Processing Fees | 2% – 5% per transaction |

| Maintenance & Updates | $50 – $200 |

- Key Points:

- Regular expenses can add up quickly.

- Track software subscriptions and marketing costs.

- Payment processing fees vary by platform.

“Keep your eyes on the cash flow, and you’ll stay in the game!” 💸

To give you a better understanding, let’s dive deeper into some of these ongoing costs. For instance, software subscriptions can cover everything from accounting tools to graphic design applications. Investing in reliable software can enhance your productivity and efficiency, but it’s essential to choose wisely. I’ve found that by opting for all-in-one platforms, I could save both time and money. Tools like QuickBooks for accounting and Canva for design have become invaluable to my daily operations.

Another significant ongoing cost is your marketing budget. This includes everything from social media advertising to email marketing campaigns. Depending on your business model, you might find that investing in ads pays off in the long run, but you need to monitor your spending closely. I once set a budget for Facebook ads without properly analyzing the return on investment, which led to wasted funds. Learning to track your ad performance and adjusting your strategy accordingly can make a substantial difference in your overall profitability.

Hidden Costs of Starting an Online Business

One of the biggest surprises for new digital entrepreneurs is the hidden costs that can arise during the business journey. These can include unexpected fees for software, costs for additional training, or even the expense of hiring freelancers. I’ve had my fair share of surprises that forced me to rethink my budget. For instance, while you might find a cheap website builder, the costs for premium features or plugins can quickly escalate.

Similarly, if you decide to outsource any work, such as graphic design or content writing, these costs can accumulate. I remember thinking I could handle everything myself, but I quickly learned that delegating tasks often saves money in the long run. Hiring a freelancer to design my logo was one of the best investments I made, as it allowed me to focus on other critical areas of my business.

| Hidden Cost Type | Estimated Cost |

|---|---|

| Premium Software Features | $10 – $200/month |

| Freelance Services | $20 – $150/hour |

| Training & Courses | $50 – $500 |

| Unexpected Expenses | Varies |

- Key Points:

- Hidden costs can derail your budget.

- Outsourcing may be more cost-effective than doing everything yourself.

- Always have a buffer in your budget for surprises.

“Plan for the unexpected, and you’ll be ready for anything!” ⚡

Hidden costs can truly derail your financial plans if you’re not prepared. For example, the need for additional training can arise as you grow your business. Whether it’s learning new software or improving your marketing skills, investing in your education can yield significant returns. I’ve taken several online courses that enhanced my skills and directly impacted my business success.

Moreover, unexpected expenses can arise from various sources. Equipment failures, software updates, or even changes in regulations can all lead to additional costs. Having a financial buffer or emergency fund can be a lifesaver in these situations. I’ve learned to always set aside a portion of my income for unforeseen circumstances, and it has helped me navigate tough times with ease.

Budgeting Tips for Digital Entrepreneurs

Budgeting is essential for any digital entrepreneur. After making some costly mistakes early on, I realized the importance of having a solid financial plan. A well-structured budget helps you manage your expenses and ensures you’re not caught off guard by unexpected costs. When I first began, I thought I could keep track of everything in my head, but I quickly learned that this approach was not sustainable.

Start by creating a detailed list of all your anticipated costs, both startup and ongoing. This includes everything from software subscriptions to marketing budgets. I found using budgeting software incredibly helpful, as it allowed me to track expenses in real-time. Tools like Mint or YNAB (You Need A Budget) can provide you with a clear overview of where your money is going, making it easier to adjust as necessary. Another tip is to review your budget regularly; I make it a point to check mine at the end of every month to see where I can cut back or where I need to invest more.

| Budgeting Category | Recommended Percentage |

|---|---|

| Startup Costs | 20% |

| Running Costs | 50% |

| Marketing & Growth | 30% |

- Key Points:

- Create a detailed budget to manage expenses.

- Use budgeting software for real-time tracking.

- Regularly review and adjust your budget.

“A budget is telling your money where to go instead of wondering where it went!” 📊

In addition to using budgeting software, I’ve found that setting specific financial goals can help keep me focused. For instance, if I know I want to allocate a certain percentage of my budget to marketing, I can plan campaigns accordingly. This not only helps in tracking expenses but also ensures that I’m investing in areas that drive growth. When I set a goal to increase my monthly ad spend by 10%, I noticed a corresponding increase in my sales, which proved the effectiveness of a well-planned budget.

Another key aspect of budgeting is understanding the difference between essential and non-essential expenses. As a digital entrepreneur, you’ll come across various tools and services that promise to make your life easier. While many of these can be beneficial, it’s important to evaluate whether they are necessary for your current stage of business. I once signed up for multiple premium services that I ended up not using, which drained my budget unnecessarily. Learning to prioritize spending on what truly matters has been one of the most valuable lessons in my entrepreneurial journey.

Essential Tools for Managing Costs

To effectively manage your digital entrepreneur costs, using the right tools can make a huge difference. There are countless software options out there, but finding the ones that fit your needs and budget is key. I’ve tried various tools, and some have proven invaluable for keeping my finances in check. The right tools can save you time and money, allowing you to focus on growing your business.

For example, using accounting software helped me track my income and expenses seamlessly. I started with QuickBooks, and it made a world of difference. It allowed me to categorize expenses, generate reports, and even send invoices—all in one place. Additionally, project management tools like Trello or Asana have allowed me to keep my projects organized and on budget. Investing in the right tools upfront can save you a lot of headaches down the road.

| Tool Type | Examples |

|---|---|

| Accounting Software | QuickBooks, FreshBooks |

| Project Management Tools | Trello, Asana |

| Budgeting Apps | Mint, YNAB |

- Key Points:

- The right tools can streamline your financial management.

- Invest in accounting and project management software.

- Regularly review tool effectiveness.

“The right tools can turn a daunting task into a breeze!” 🛠️

Moreover, cloud-based tools are becoming increasingly popular among digital entrepreneurs for their flexibility and accessibility. Services like Google Workspace allow you to collaborate in real-time with team members, making it easier to manage projects without the hassle of back-and-forth emails. I can’t stress enough how much this has improved my workflow, allowing me to focus on strategy rather than logistics.

Finally, always keep an eye on new tools entering the market. The digital landscape is constantly evolving, and staying updated can give you a competitive edge. I often attend webinars or read articles to discover new tools that can help streamline my operations or reduce costs. Investing time in researching and finding the right resources can pay off significantly in the long run.

Creating a Business Plan for Financial Success

Creating a solid business plan is vital for any digital entrepreneur aiming for financial success. A well-crafted business plan not only outlines your business goals but also serves as a roadmap for your financial decisions. When I first started my journey, I thought I could wing it without a detailed plan. However, I quickly realized that having a clear strategy helped me navigate challenges and seize opportunities.

Your business plan should include a detailed breakdown of your startup costs, ongoing expenses, and projected income. This is where you can outline your digital entrepreneur costs in a structured manner. I found that by creating a financial projection, I could identify potential cash flow issues before they became problematic. This proactive approach allowed me to make informed decisions about investments and savings.

| Plan Component | Description |

|---|---|

| Executive Summary | Overview of your business and goals. |

| Market Analysis | Understanding your target audience and competitors. |

| Financial Projections | Estimated revenue, expenses, and profitability. |

| Funding Requirements | How much capital you need and how you plan to use it. |

- Key Points:

- A clear business plan serves as your financial roadmap.

- Detailed projections help identify cash flow issues early.

- Include a market analysis to understand your audience.

“Failing to plan is planning to fail!” 📈

Additionally, your business plan should be a living document that you revisit and update regularly. As your business grows and the market changes, your financial needs may evolve as well. I’ve learned that staying flexible and adapting my plan has been crucial to maintaining financial health. For instance, when I noticed a shift in my audience’s preferences, I adjusted my marketing strategy accordingly, which ultimately improved my bottom line.

Furthermore, having a business plan can also be beneficial when seeking funding. Investors and lenders often want to see a comprehensive plan that demonstrates your understanding of the market and your strategy for profitability. I remember presenting my business plan to potential investors, and it significantly increased their confidence in my ability to manage my finances effectively. This not only secured the funding I needed but also laid the foundation for a successful partnership.

Exploring Funding Options for Digital Entrepreneurs

As a digital entrepreneur, understanding your funding options is crucial for sustaining and growing your business. Whether you’re just starting or looking to expand, having access to capital can significantly impact your success. I’ve explored various funding sources throughout my journey, and each has its own set of advantages and challenges.

One common option is bootstrapping, which means funding your business using your own savings or revenue generated from your operations. This approach allows you to maintain complete control over your business without incurring debt. However, it can also limit your growth potential if your personal finances are tight. I initially started with bootstrapping, and while it was challenging, it taught me valuable lessons about managing my expenses wisely.

| Funding Option | Advantages |

|---|---|

| Bootstrapping | Full control, no debt. |

| Small Business Loans | Access to larger capital amounts. |

| Angel Investors | Expert advice and networking opportunities. |

| Crowdfunding | Validation of your business idea. |

- Key Points:

- Bootstrapping allows for complete control but may limit growth.

- Small business loans can provide necessary capital.

- Angel investors can offer mentorship along with funding.

“Funding is the fuel that drives your business forward!” 🚀

Another popular option is obtaining small business loans. These can provide a significant amount of capital, allowing you to invest in necessary resources like software tools, marketing campaigns, and even hiring staff. However, it’s important to carefully consider the terms and interest rates associated with loans. I’ve had friends who took out loans without fully understanding the repayment terms, which led to financial stress later on. Always do your homework before committing to any loan agreement.

Angel investors are another viable funding option. These individuals invest their personal funds into startups in exchange for equity or convertible debt. The advantage of working with an angel investor is not just the capital but also the expertise and mentorship they can provide. I was fortunate enough to partner with an angel investor early on, and their guidance helped me navigate the early stages of my business more effectively.

Lastly, crowdfunding has become increasingly popular for digital entrepreneurs. Platforms like Kickstarter or Indiegogo allow you to present your business idea to the public and raise funds from individuals who believe in your vision. This approach not only provides capital but also validates your business concept. When I launched my crowdfunding campaign, the feedback I received helped refine my product before it hit the market.

In conclusion, understanding your funding options is critical to navigating the financial landscape as a digital entrepreneur. Whether you choose to bootstrap, seek loans, partner with investors, or explore crowdfunding, each path has its advantages. The key is to align your funding strategy with your business goals and ensure you’re prepared for the financial responsibilities that come with it.

Managing Cash Flow as a Digital Entrepreneur

Managing cash flow is one of the most critical aspects of running a successful digital business. As a digital entrepreneur, you might find that income can be unpredictable, especially in the early stages. I learned this lesson the hard way when I faced a cash crunch due to inconsistent sales. Understanding how to effectively manage your cash flow can mean the difference between thriving and merely surviving in the competitive online marketplace.

To start, it’s essential to create a cash flow statement that tracks your income and expenses over time. This statement will help you visualize how much money is coming in versus how much is going out. I recommend using accounting software like QuickBooks or Xero to automate this process. These tools not only simplify tracking but also provide insights into your financial health. When I began using these platforms, I was able to spot trends in my cash flow and adjust my spending accordingly.

| Cash Flow Component | Description |

|---|---|

| Income | Money coming into the business. |

| Expenses | Money going out for operations. |

| Net Cash Flow | Income minus expenses over a period. |

| Forecasting | Predicting future cash flow based on trends. |

- Key Points:

- Creating a cash flow statement is essential for tracking finances.

- Use accounting software to automate and simplify cash flow management.

- Regularly review and forecast cash flow to avoid surprises.

“Cash flow is the lifeblood of your business!” 💵

Another crucial aspect of cash flow management is forecasting. By predicting your future cash flow based on historical data and market trends, you can prepare for potential shortfalls. For instance, if you notice that sales typically dip during certain months, you can adjust your spending and save during the peak months. I started implementing cash flow forecasting, and it allowed me to build a financial cushion that helped me navigate slower periods without stress.

Additionally, maintaining a cash reserve is vital. I recommend setting aside a percentage of your profits into a savings account specifically for emergencies. This fund can help you cover unexpected expenses, such as software upgrades or sudden drops in sales. Having this safety net has saved me more than once, allowing me to focus on growth rather than worrying about immediate financial obligations. The peace of mind that comes from knowing you have funds to fall back on is invaluable.

Evaluating Financial Performance and Adjusting Strategies

As a digital entrepreneur, regularly evaluating your financial performance is essential for long-term success. It’s not enough to set a budget and forget about it; you need to continually assess how well you’re adhering to your financial goals. I’ve made it a habit to review my financial statements monthly, and this practice has provided me with valuable insights into my business’s health.

Start by analyzing key performance indicators (KPIs) such as gross profit margin, net profit margin, and return on investment (ROI). Understanding these metrics can help you identify areas where you may need to cut costs or invest more. For example, if you notice that your marketing ROI is low, it might be time to reassess your marketing strategy. When I first analyzed my ROI, I discovered that certain advertising channels were not yielding results, which prompted me to reallocate my budget to more effective platforms.

| Financial Metric | Importance |

|---|---|

| Gross Profit Margin | Indicates profitability before expenses. |

| Net Profit Margin | Shows overall profitability after expenses. |

| Return on Investment (ROI) | Measures profitability of investments. |

| Cash Flow Statement | Tracks money coming in and out. |

- Key Points:

- Regularly evaluate financial performance to stay on track.

- Analyze key performance indicators to identify areas for improvement.

- Adjust your strategies based on financial insights.

“What gets measured gets improved!” 📊

Moreover, adjusting your strategies based on financial insights is crucial. If you find that certain products or services are underperforming, it may be time to pivot your offerings. For instance, I once had a product line that wasn’t selling well. After analyzing the data, I decided to discontinue those products and focus on my best-sellers, which led to a significant increase in revenue. Flexibility is key in the ever-changing digital landscape, and being willing to adapt based on financial performance can lead to greater success.

In conclusion, effectively managing cash flow and regularly evaluating financial performance are vital practices for any digital entrepreneur. By creating cash flow statements, forecasting future income, maintaining a cash reserve, and analyzing financial metrics, you can ensure that your business remains financially healthy. The insights gained from these practices will empower you to make informed decisions, adjust your strategies, and ultimately drive your business toward success.

Recommendations

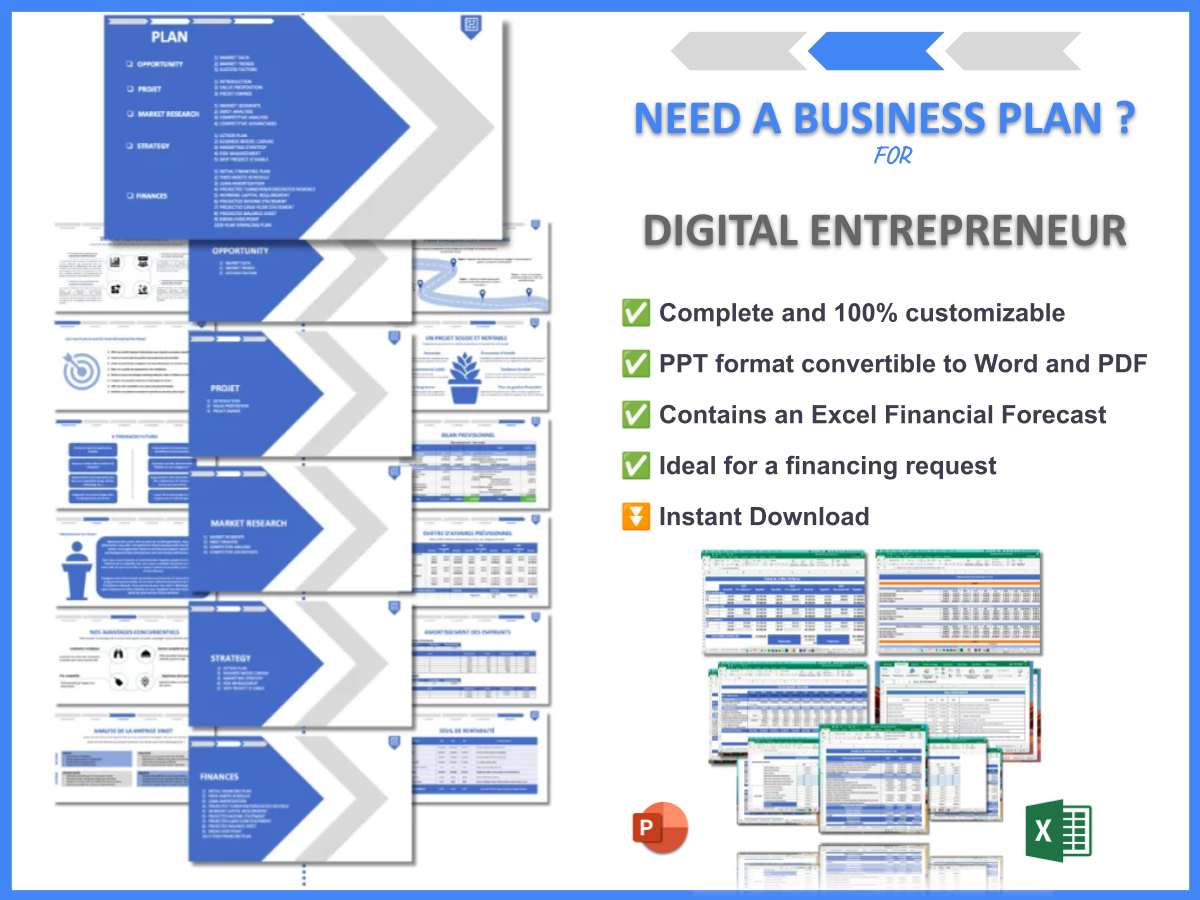

In summary, starting a digital entrepreneur business requires careful planning, understanding of costs, effective cash flow management, and a well-structured business strategy. To help you in your journey, we highly recommend using the Digital Entrepreneur Business Plan Template. This template will provide you with a solid foundation to outline your goals, strategies, and financial projections.

Additionally, we encourage you to explore our related articles on Digital Entrepreneur topics to further enhance your knowledge:

- Article 1 on Digital Entrepreneur SWOT Analysis Insights

- Article 2 on Digital Entrepreneurship: A Path to High Profits?

- Article 3 on Digital Entrepreneur Business Plan: Comprehensive Guide with Examples

- Article 4 on Digital Entrepreneur Financial Plan: Essential Steps and Example

- Article 5 on The Ultimate Guide to Starting a Digital Entrepreneurship: Step-by-Step Example

- Article 6 on Building a Marketing Plan for Digital Entrepreneur Services (+ Example)

- Article 7 on How to Build a Business Model Canvas for Digital Entrepreneur?

- Article 8 on Customer Segments for Digital Entrepreneurs: Who Are Your Potential Clients?

- Article 9 on Digital Entrepreneur Feasibility Study: Comprehensive Guide

- Article 10 on Digital Entrepreneur Risk Management: Comprehensive Strategies

- Article 11 on Digital Entrepreneur Competition Study: Essential Guide

- Article 12 on What Legal Considerations Should You Know for Digital Entrepreneur?

- Article 13 on Digital Entrepreneur Funding Options: Comprehensive Guide

- Article 14 on Digital Entrepreneur Growth Strategies: Scaling Success Stories

FAQ

How much does it cost to start a digital business?

The cost to start a digital business can vary widely based on the type of business and the resources required. Generally, you can expect to spend on website development, domain registration, and marketing. It’s crucial to outline your startup costs early on to avoid surprises down the road.

What are the typical expenses for digital entrepreneurs?

Typical expenses for digital entrepreneurs include software subscriptions, marketing costs, and operational expenses. These can add up quickly, so it’s important to have a detailed budget that outlines both your ongoing costs and any hidden costs that might arise.

What are hidden costs of starting an online business?

Hidden costs can include unexpected fees for software, additional training, or even outsourcing certain tasks. Many new digital entrepreneurs overlook these expenses, which can lead to financial strain. Always plan for the unexpected by setting aside a buffer in your budget.

What is a digital entrepreneur business plan?

A digital entrepreneur business plan is a strategic document that outlines your business goals, target market, financial projections, and operational plans. It serves as a roadmap for your business and is essential for attracting investors or securing loans.

How can I effectively manage cash flow as a digital entrepreneur?

To effectively manage cash flow, create a cash flow statement that tracks your income and expenses. Regularly forecast your cash flow based on past trends to anticipate potential shortfalls. Maintaining a cash reserve is also a smart strategy to handle unexpected expenses.

What funding options are available for digital entrepreneurs?

Digital entrepreneurs have several funding options, including bootstrapping, small business loans, angel investors, and crowdfunding. Each option has its pros and cons, and it’s important to choose the one that aligns with your business goals and financial needs.