Did you know that operating a bed and breakfast (B&B) can involve navigating a maze of legal requirements? Bed and breakfast legal considerations are crucial for anyone looking to start or manage a small hospitality business. A bed and breakfast is a small lodging establishment that offers overnight accommodation and breakfast, usually in a home-like setting. But before you hang that “Welcome” sign, it’s vital to understand the legal landscape that governs these charming inns.

Here are a few essential points to keep in mind:

- Zoning laws dictate where you can operate your B&B.

- Licensing and permits are often required to legally host guests.

- Understanding insurance needs can protect you from potential liabilities.

- Compliance with health and safety regulations is a must.

- Tax implications can vary widely depending on your location.

Understanding Zoning Laws for Your B&B

When it comes to starting a bed and breakfast, zoning laws are your first hurdle. These laws determine where you can legally operate a B&B and can vary significantly between cities and rural areas. For instance, in some neighborhoods, running a B&B might be completely allowed, while in others, it could be strictly prohibited.

Take my friend Sarah, who thought she could easily convert her family home into a B&B. She learned the hard way that her suburban neighborhood had strict zoning laws against short-term rentals. It’s essential to check with your local zoning office before making any moves. Understanding these laws not only helps you avoid fines but also assists in planning your business effectively. Knowing where you can operate means you can target your marketing and services to the right audience without worrying about legal repercussions.

Another advantage of understanding zoning laws is that it allows you to align your business with community expectations. If your neighborhood is known for its quiet, residential vibe, you might consider catering to guests looking for a peaceful getaway rather than a party atmosphere. This alignment can foster good relationships with your neighbors, which is invaluable in maintaining a good reputation and avoiding complaints.

| Zoning Type | Description |

|---|---|

| Residential | Typically allows B&Bs if specific criteria are met. |

| Commercial | May have more lenient regulations for B&Bs. |

| Mixed-Use | Often allows for both residential and commercial operations. |

- Always check local zoning regulations.

- Consult with neighbors to gauge community sentiment.

- Consider the impact of zoning on your business plan.

“The best way to predict the future is to create it.” - Peter Drucker

Licensing Requirements for Operating a B&B

Once you’ve figured out zoning, you’ll need to look into the licensing requirements. Every state has different rules regarding what licenses you need to operate a bed and breakfast legally. Generally, you might need a business license, a health department permit, and possibly a food service license if you’re serving breakfast.

I remember when I started my first B&B, I thought I could skip some of these licenses. Big mistake! The local health department showed up for an inspection, and I quickly learned that operating without a proper permit could lead to hefty fines or even shutdowns. Securing the necessary licenses not only protects you legally but also enhances your credibility with guests. When guests see that you have all the required licenses, it builds trust and confidence in your establishment.

Another advantage of understanding licensing requirements is that it can differentiate your B&B from others that may not be compliant. In a competitive market, being fully licensed can become a selling point that attracts guests who value safety and legality in their travel experiences.

| License Type | Purpose |

|---|---|

| Business License | Legal authorization to operate. |

| Health Department Permit | Ensures compliance with health standards. |

| Food Service License | Required if serving prepared meals. |

- Research your state’s specific licensing requirements.

- Keep all licenses updated to avoid penalties.

- Be prepared for inspections from local authorities.

“Success usually comes to those who are too busy to be looking for it.” - Henry David Thoreau

Insurance Needs for Your B&B

Insurance is another vital aspect of bed and breakfast legal considerations. Operating a B&B exposes you to various risks, from property damage to guest injuries. You’ll want to ensure you have the right coverage to protect your business.

For example, a friend of mine faced a lawsuit when a guest slipped on a wet floor. Thankfully, she had liability insurance that covered her legal fees and any damages. It’s crucial to talk to an insurance agent who understands the unique needs of B&B owners. Having the right insurance not only protects you financially but also allows you to focus on providing a great experience for your guests without the constant worry of potential legal issues.

Additionally, understanding your insurance needs can help you identify gaps in coverage that might expose you to risk. Regularly reviewing your policies ensures you are adequately protected against new threats, such as changes in local laws or increased liability risks due to rising guest numbers. This proactive approach not only safeguards your investment but can also be a significant selling point when marketing your B&B.

| Insurance Type | Coverage |

|---|---|

| Liability Insurance | Protects against guest injuries or damages. |

| Property Insurance | Covers damage to your property or contents. |

| Business Interruption Insurance | Protects income lost during unforeseen closures. |

- Assess your specific risks and needs.

- Consult with an insurance expert.

- Regularly review and update your coverage.

“The only thing we have to fear is fear itself.” - Franklin D. Roosevelt

Health and Safety Regulations for B&Bs

Health and safety regulations are non-negotiable when running a bed and breakfast. These laws ensure that your establishment is safe for guests and compliant with local standards. Depending on your location, you may need to comply with fire safety codes, food safety standards, and building codes.

I once visited a B&B that didn’t meet fire safety regulations, and it was a bit alarming. They had no smoke detectors, and the exits were blocked. Imagine the liability they faced if something went wrong! Ensuring compliance with health and safety regulations not only protects your guests but also shields your business from legal action.

Another advantage of adhering to these regulations is that it enhances your reputation. Guests are more likely to choose a B&B that prioritizes their safety and well-being. When your establishment is known for being safe and compliant, it can lead to positive reviews, repeat customers, and even referrals, which are invaluable for business growth.

| Regulation Type | Description |

|---|---|

| Fire Safety Codes | Requirements for smoke detectors and exits. |

| Food Safety Standards | Guidelines for food preparation and storage. |

| Building Codes | Ensures your property is structurally safe. |

- Conduct regular safety inspections.

- Stay updated on local health regulations.

- Train staff on emergency procedures.

“Safety brings first aid to the uninjured.” - Charles Dickens

Understanding Tax Implications

Running a bed and breakfast comes with its own set of tax implications. Depending on your location, you might be liable for occupancy taxes, sales taxes, and income taxes. It’s vital to keep accurate records of your income and expenses to make tax time less stressful.

When I first started, I didn’t realize how much I would owe in taxes. I ended up scrambling to find receipts and documents at the last minute! Understanding the tax landscape not only helps you avoid penalties but also allows you to plan your finances better. For instance, knowing about deductions available to B&B owners can significantly reduce your taxable income.

Another advantage of being aware of your tax obligations is that it allows you to set aside the right amount of money throughout the year, so you’re not hit with a massive bill all at once. This proactive approach can alleviate stress and give you a clearer picture of your business’s financial health.

| Tax Type | Description |

|---|---|

| Occupancy Tax | A tax charged on short-term rentals. |

| Sales Tax | Applicable to services and goods sold. |

| Income Tax | Tax on profits earned from your B&B. |

- Keep meticulous records of all transactions.

- Consult with a tax professional familiar with B&Bs.

- Understand your local tax obligations.

“The best way to find yourself is to lose yourself in the service of others.” - Mahatma Gandhi

Local Permits Required for Your B&B

Beyond zoning and licensing, you may need specific local permits to operate your B&B. This can include permits for signage, renovations, or even outdoor activities like pools or gardens.

I remember my neighbor had to apply for a permit just to put up a sign for her B&B. It seemed tedious at the time, but it helped her avoid fines and ensured her business was compliant with local regulations. Obtaining the necessary permits not only protects you legally but also establishes your B&B as a legitimate business in the eyes of the community.

Understanding the local permit landscape can also enhance your marketing efforts. When guests see that you have all the required permits, it can build trust and confidence. They are more likely to choose a B&B that is transparent about its compliance with local laws, as it demonstrates a commitment to quality and safety.

| Permit Type | Purpose |

|---|---|

| Signage Permit | Allows for advertising your B&B. |

| Renovation Permit | Required for any structural changes. |

| Special Use Permit | Needed for unique amenities (e.g., pools). |

- Check with local government for required permits.

- Keep all permits on hand and up to date.

- Don’t skip the fine print!

“The future depends on what you do today.” - Mahatma Gandhi

Business Structures for Your B&B

Choosing the right business structure is crucial for your bed and breakfast. Whether you opt for a sole proprietorship, partnership, LLC, or corporation, each has its own legal implications, tax responsibilities, and liability protections.

When I started my B&B, I went with an LLC, which helped protect my personal assets from business liabilities. It was a smart move that paid off when I faced an unexpected legal challenge. Selecting an appropriate business structure not only impacts your legal exposure but also influences your tax obligations. For instance, LLCs often provide flexibility in how profits are taxed, which can lead to significant savings.

Another advantage of choosing the right structure is that it can enhance your credibility with guests and partners. A well-defined business structure signals professionalism and stability, which can be attractive to potential guests and investors. It also facilitates smoother operations, making it easier to secure financing, hire employees, or collaborate with local businesses.

| Business Structure | Pros | Cons |

|---|---|---|

| Sole Proprietorship | Simple to set up, full control. | Personal liability for debts. |

| Partnership | Shared responsibilities and resources. | Potential for disputes between partners. |

| LLC | Limited liability, flexible tax options. | More paperwork and fees involved. |

- Evaluate your options carefully.

- Consult with a business attorney for guidance.

- Consider your long-term goals and risks.

“The secret of getting ahead is getting started.” - Mark Twain

Understanding Guest Privacy Laws

As a bed and breakfast owner, you’ll also need to understand guest privacy laws. These laws protect your guests’ personal information and ensure a safe environment. In today’s digital age, where data breaches are common, guests are increasingly concerned about how their information is handled.

For example, I once had a guest who was very concerned about their data being shared. By having a clear privacy policy and adhering to it, I was able to reassure them and provide a comfortable stay. Understanding privacy laws not only helps you comply with legal standards but also enhances guest trust. When guests feel secure about their privacy, they are more likely to leave positive reviews and return for future stays.

Another advantage of being knowledgeable about guest privacy laws is that it helps you avoid potential legal issues. Violating privacy laws can lead to hefty fines and damage your reputation. By implementing robust data protection measures and clearly communicating your privacy policy, you can create a positive experience for your guests while safeguarding your business from legal repercussions.

| Privacy Concern | Description |

|---|---|

| Data Protection | Guidelines on how to handle guest information. |

| Confidentiality | Ensuring guest details are kept private. |

- Develop a clear privacy policy.

- Train staff on confidentiality practices.

- Regularly review your compliance with privacy laws.

“What we fear doing most is usually what we most need to do.” - Tim Ferriss

Navigating Local Council Rules

Lastly, understanding local council rules is essential. Different councils may have specific regulations regarding noise, parking, and the number of guests allowed. These rules can vary widely, and being unaware of them can lead to fines or even forced closure of your B&B.

I learned this the hard way when a neighbor complained about noise from my B&B. It turned out I didn’t have a clear understanding of local noise ordinances, which led to some tense conversations! Understanding these rules not only helps you avoid conflicts with neighbors but also contributes to a better guest experience. For instance, if your area has strict noise regulations, you might focus on attracting guests looking for a peaceful retreat rather than those seeking a lively party atmosphere.

Another advantage of being knowledgeable about local council rules is that it allows you to be proactive in your operations. By knowing the limits on parking or guest capacity, you can design your marketing and services accordingly, ensuring you remain compliant while maximizing your business potential. This proactive approach not only protects you legally but also enhances your reputation as a responsible business owner.

| Council Rule | Description |

|---|---|

| Noise Ordinances | Limits on noise levels during specific hours. |

| Parking Regulations | Guidelines on guest parking availability. |

- Familiarize yourself with your local council’s rules.

- Engage with neighbors to maintain good relationships.

- Adjust your operations to comply with local regulations.

“Good fences make good neighbors.” - Robert Frost

Recommendations

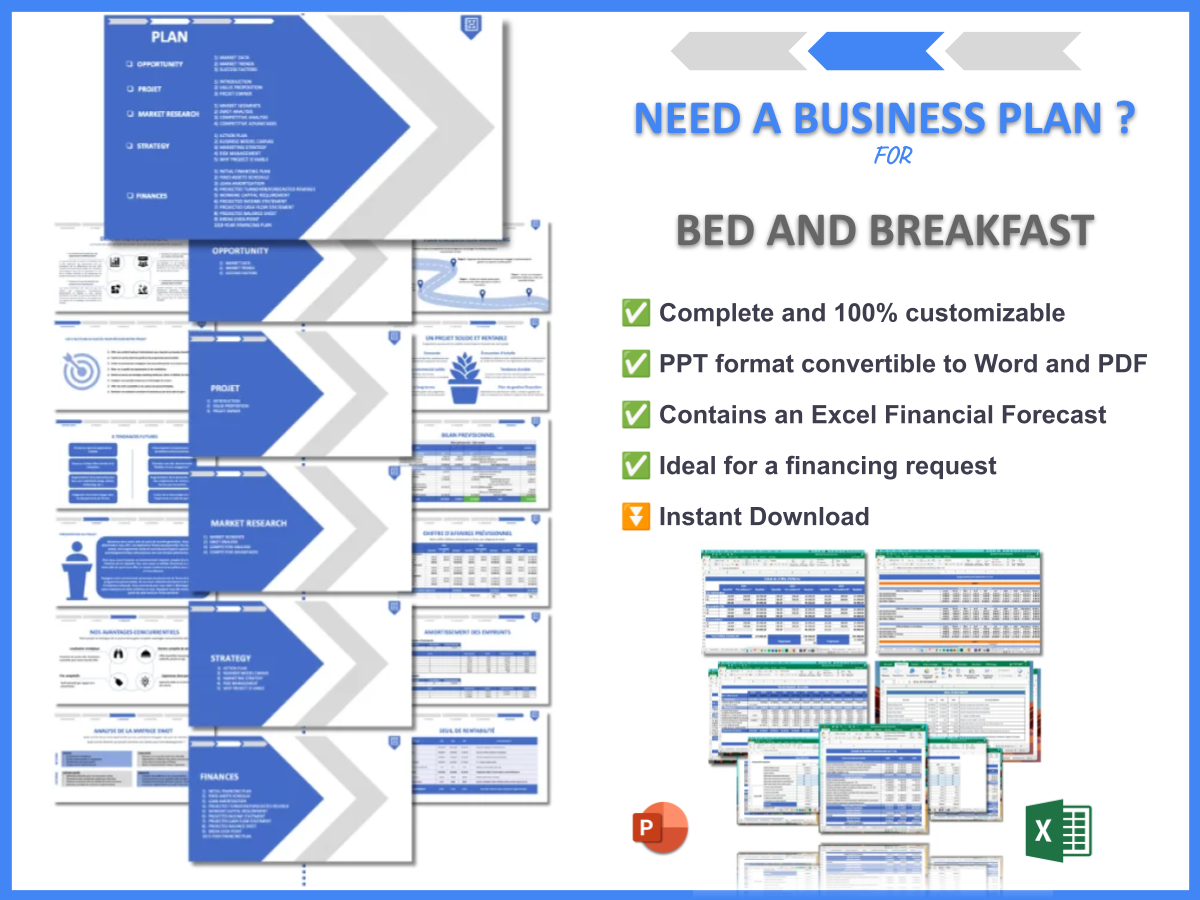

In summary, navigating the legal considerations of running a bed and breakfast is crucial for success. From understanding zoning laws to securing the necessary licensing and insurance, each step is vital in ensuring your B&B operates smoothly and legally. For those looking to streamline their planning process, we recommend checking out this Bed And Breakfast Business Plan Template. This template can guide you in outlining your business strategy effectively.

Additionally, if you’re interested in expanding your knowledge about the bed and breakfast industry, consider reading the following articles:

- Article 1 on Bed-and-Breakfast-SWOT Analysis Essentials

- Article 2 on Bed and Breakfast Business: How to Maximize Profits

- Article 3 on Bed And Breakfast Business Plan: Template and Examples

- Article 4 on Bed And Breakfast Financial Plan: Step-by-Step Guide

- Article 5 on Building a Bed And Breakfast: A Complete Guide with Practical Examples

- Article 6 on Building a Bed And Breakfast Marketing Plan: Step-by-Step Guide with Examples

- Article 7 on Crafting a Business Model Canvas for a Bed And Breakfast: Step-by-Step Guide

- Article 8 on Bed And Breakfast Customer Segments: Who Are They and How to Reach Them?

- Article 9 on How Much Does It Cost to Operate a Bed And Breakfast?

- Article 10 on Bed And Breakfast Feasibility Study: Comprehensive Guide

- Article 11 on Bed And Breakfast Risk Management: Essential Guide

- Article 12 on How to Start a Competition Study for Bed And Breakfast?

- Article 13 on What Funding Options Should You Consider for Bed And Breakfast?

- Article 14 on Bed And Breakfast Growth Strategies: Scaling Examples

FAQ

What are the zoning laws for a bed and breakfast?

Zoning laws are regulations that dictate where you can operate a bed and breakfast. These laws vary by location and can determine whether you can legally run a B&B in a residential area or if you need to be in a commercial zone. It’s essential to check with your local zoning office to ensure compliance.

What licenses do I need to operate a bed and breakfast?

To legally operate a bed and breakfast, you may need several licenses, including a business license, a health department permit, and a food service license if you serve meals. Each state has different requirements, so it’s crucial to research the specific licenses needed in your area.

What insurance is necessary for a bed and breakfast?

Insurance is a vital aspect of bed and breakfast legal considerations. You should consider obtaining liability insurance to protect against guest injuries, property insurance for damage to your property, and business interruption insurance to safeguard against income loss during unforeseen circumstances.

What health and safety regulations must I follow?

Health and safety regulations for a bed and breakfast often include compliance with fire safety codes, food safety standards, and general building codes. Ensuring that your establishment meets these regulations is crucial for the safety of your guests and to avoid potential legal issues.

What are the tax implications of running a bed and breakfast?

Running a bed and breakfast can involve various tax implications, including occupancy taxes, sales taxes, and income taxes. It’s important to keep accurate records of your income and expenses and consult with a tax professional familiar with the hospitality industry to navigate these obligations effectively.

What local permits do I need for my bed and breakfast?

Local permits required for a bed and breakfast can vary by location but often include permits for signage, renovations, and special use permits for unique amenities. It’s essential to check with your local government to ensure you have all the necessary permits to operate legally.

What business structure is best for a bed and breakfast?

The best business structure for a bed and breakfast depends on your specific circumstances. Common options include sole proprietorships, partnerships, and LLCs. An LLC is often recommended as it provides limited liability protection, helping to safeguard your personal assets from business-related risks.

How can I ensure guest privacy at my bed and breakfast?

Ensuring guest privacy involves implementing robust data protection measures and having a clear privacy policy in place. This not only helps you comply with privacy laws but also builds trust with your guests, making them feel secure in sharing their personal information.

What local council rules should I be aware of for my bed and breakfast?

Local council rules can dictate various aspects of running a bed and breakfast, including noise ordinances and parking regulations. Understanding these rules is crucial to maintaining good relationships with neighbors and ensuring your B&B operates within legal boundaries.