Did you know that the apartment development sector has seen a surge in funding opportunities recently? Apartments Development Funding Options are vital for anyone looking to dive into this lucrative market. Whether you’re a seasoned investor or just starting, understanding your financing choices can make or break your project. In essence, funding options are the various avenues available for raising capital to develop or renovate apartment buildings, ensuring you have the necessary resources to bring your vision to life.

- The apartment development market is booming.

- Understanding funding options is crucial for success.

- Various types of financing exist, each with its pros and cons.

- Government grants can support affordable housing projects.

- Crowdfunding has emerged as a popular choice for investors.

- Private investors can provide quick funding solutions.

- Equity financing involves sharing ownership with investors.

- Debt financing includes loans that must be repaid with interest.

- Knowing the right funding mix can maximize your investment.

- Successful projects often combine multiple funding sources.

Understanding Apartment Financing Options

When it comes to apartment development, knowing your financing options is key. From traditional bank loans to modern crowdfunding platforms, there’s a whole world of choices out there. Each option has its unique set of requirements, benefits, and potential drawbacks, which is why it’s essential to do your homework.

For instance, traditional bank loans are a common choice among developers. They usually offer lower interest rates but come with stringent requirements. On the other hand, crowdfunding has gained traction, allowing developers to raise money from multiple small investors through online platforms. This method can be more accessible, especially for smaller projects.

Ultimately, the right financing choice depends on your specific project needs and financial situation. As we explore various options, consider what aligns best with your goals.

| Financing Option | Pros/Cons |

|---|---|

| Bank Loans | Low rates, strict criteria |

| Crowdfunding | Accessible, less control |

| Private Investors | Quick funding, expensive |

| Government Grants | Supportive, limited scope |

- Traditional bank loans are reliable.

- Crowdfunding democratizes funding.

- Private investors can be flexible.

- "In finance, what’s dangerous is not to evolve." - Paul Valery

The Role of Equity Financing

Equity financing is a powerful tool in apartment development. Unlike debt financing, which requires repayment, equity financing allows you to raise capital by selling shares in your project. This can be particularly advantageous if you’re looking to minimize your financial risk. By attracting investors who share your vision, you can secure the necessary funds to move forward without the burden of immediate repayment.

For example, if you partner with an equity investor, they provide funds in exchange for a percentage of ownership in the property. This approach not only secures the necessary funds but also can bring in valuable expertise and networking opportunities. However, sharing ownership means you’ll have to split profits, which is a crucial consideration when planning your financial strategy.

Understanding the balance between equity and debt financing is essential. As we dive deeper into funding strategies, think about how you can leverage both to create a solid financial foundation for your project. Exploring this balance will prepare you for the next section, where we’ll discuss the various debt financing options available.

- Identify potential equity partners.

- Determine the percentage of ownership to offer.

- Negotiate terms that benefit both parties.

- The above steps must be followed rigorously for optimal success.

Exploring Debt Financing Options

Debt financing is another cornerstone of apartment development funding. This method involves borrowing money with the promise to repay it with interest over time. It’s crucial to understand the various types of debt financing available to make informed decisions. Knowing your options can help you choose the best fit for your project.

Hard money loans are one option, often provided by private lenders who focus more on the property value than the borrower’s creditworthiness. These loans can be a quick solution but usually come with higher interest rates. Conventional mortgages are another route, typically offering lower rates but requiring more documentation and longer approval times. Understanding these distinctions is vital for selecting the right financing path.

Choosing the right type of debt financing requires careful consideration of your project timeline and budget. The next section will delve into the role of government grants and how they can complement your funding strategy, providing further options to enhance your financial planning.

- Hard money loans are fast but costly.

- Conventional mortgages require thorough documentation.

- Balance debt with other financing options.

- "To succeed, always move forward with a clear vision."

Leveraging Government Grants

Government grants can be a game-changer for apartment development, especially for projects aimed at providing affordable housing. These grants often do not require repayment, making them an attractive option for developers. By securing these funds, you can significantly reduce the financial burden on your project and make it more feasible.

For example, the U.S. Department of Housing and Urban Development (HUD) offers various grants that support affordable housing initiatives. These funds can cover a significant portion of your development costs, helping you achieve your project goals. However, the application process can be competitive and time-consuming, requiring a well-prepared proposal that clearly outlines the benefits of your project.

Navigating the world of government funding requires diligence. As we explore alternative funding sources, consider how grants can fit into your overall financing strategy. They can complement other funding avenues, providing a solid foundation for your project’s financial health.

| Grant Type | Purpose |

|---|---|

| HUD Grants | Affordable housing support |

| State Grants | Local development funding |

- Research available grants in your area.

- Prepare a strong application.

- Follow up on grant status regularly.

- "In every project, there is a seed of hope waiting to blossom."

Innovative Funding Strategies

In today’s market, innovative funding strategies can set your apartment development apart. From crowdfunding to real estate investment trusts (REITs), the landscape is constantly evolving, offering new ways to secure funding. These strategies can provide unique opportunities to connect with investors and raise capital.

Crowdfunding platforms like Fundrise allow developers to showcase their projects and attract small investors. This method democratizes investment opportunities, enabling a wider range of people to participate in real estate. By presenting your project on a crowdfunding platform, you can raise substantial funding without giving up too much control or equity.

As we look at these innovative strategies, think about how you can incorporate them into your funding mix. The next section will focus on the importance of financial modeling in determining your funding needs and ensuring your project’s success.

| Strategy | Benefits |

|---|---|

| Crowdfunding | Broad investor base |

| REITs | Passive income opportunity |

- Explore crowdfunding platforms.

- Assess potential REIT partnerships.

- Analyze your funding needs with innovative strategies.

The Importance of Financial Modeling

Financial modeling is crucial for understanding your funding needs and potential returns. By creating a detailed financial model, you can forecast cash flow, expenses, and profits, helping you make informed decisions about your funding strategy. This tool serves as a roadmap, guiding you through the complexities of apartment development.

This model should include various scenarios, allowing you to see how different funding options impact your bottom line. For instance, you might compare the costs of using equity financing versus debt financing under different market conditions. By analyzing these scenarios, you can identify the most advantageous funding mix for your project.

A solid financial model not only aids in securing funding but also serves as a roadmap for your project’s financial health. As we wrap up our exploration of funding options, consider how financial modeling can enhance your investment strategy and prepare you for the challenges ahead.

| Component | Purpose |

|---|---|

| Cash Flow Projections | Forecasting income |

| Expense Analysis | Identifying costs |

- Develop a comprehensive financial model.

- Analyze different funding scenarios.

- Regularly update your model as conditions change.

Final Considerations for Funding

When considering funding options for apartment development, it’s essential to weigh all factors carefully. The right mix of equity, debt, and innovative funding can set the stage for a successful project. Taking the time to understand these options will empower you to make decisions that align with your goals.

Keep in mind that market conditions, project size, and your personal financial situation will all influence your choices. Don’t hesitate to consult with financial advisors or experienced developers to guide your decisions. Their insights can provide valuable perspectives that may enhance your approach to securing funding.

As you embark on your funding journey, remember that flexibility is key. Adapting your strategy based on changing circumstances can help you navigate the complexities of apartment development funding effectively. The next section will summarize the main points and offer final recommendations for moving forward.

| Factor | Impact |

|---|---|

| Market Conditions | Influences funding options |

| Project Size | Affects funding needs |

- Stay informed on market trends.

- Seek advice from industry experts.

- Be open to adjusting your strategy as needed.

Conclusion

In summary, exploring Apartments Development Funding Options is vital for any developer looking to succeed in the competitive real estate market. By understanding the variety of funding sources available—from bank loans and equity financing to government grants and crowdfunding—you can set your project up for success. Each funding avenue offers unique benefits and challenges that can significantly impact your project’s viability and profitability.

As you plan your apartment development, remember to leverage financial modeling to forecast your funding needs accurately. This practice will not only help you secure the necessary funds but also provide a clear picture of your project’s financial health. By combining different funding strategies, you can optimize your financial position and navigate potential risks more effectively.

Don’t wait—start your funding journey today! Explore your options, connect with potential investors, and bring your apartment development dreams to life. By being proactive and informed, you can create a robust financial strategy that supports your vision and goals.

| Summary of Key Points | Action Steps |

|---|---|

| Explore multiple funding avenues. | Research and connect with investors. |

| Balance equity and debt financing. | Develop a comprehensive financial model. |

| Utilize government grants where possible. | Prepare strong applications for funding. |

FAQ Section

What are the best funding options for apartment development?

The best options include bank loans, equity financing, and crowdfunding, depending on your project’s needs.

How can I apply for government grants for housing?

Research available grants, prepare a strong application, and stay persistent in follow-ups.

What is equity financing?

Equity financing involves raising capital by selling shares in your project, reducing debt obligations.

Are hard money loans a good option?

Hard money loans provide quick funding but come with higher interest rates and should be approached cautiously.

How does crowdfunding work for real estate?

Crowdfunding allows developers to raise small amounts from many investors through online platforms.

What role do financial models play in funding?

Financial models help forecast cash flow and expenses, aiding in making informed funding decisions.

Can I combine different funding sources?

Yes, combining various sources can optimize your financial strategy and reduce risk.

What are the risks of using debt financing?

Risks include the obligation to repay loans with interest, which can strain cash flow if not managed properly.

How do I find private investors?

Networking, attending real estate events, and using online platforms can help you connect with potential investors.

What is the significance of loan-to-value ratio?

The loan-to-value ratio helps lenders assess risk by comparing the loan amount to the property’s value.

Conclusion

In conclusion, understanding Apartments Development Funding Options is essential for anyone looking to succeed in the real estate market. Throughout this article, we explored various funding avenues, including equity financing, debt financing, and government grants, highlighting the importance of a well-rounded financial strategy. By leveraging different funding sources and employing effective financial modeling, you can maximize your project’s potential and navigate challenges with confidence.

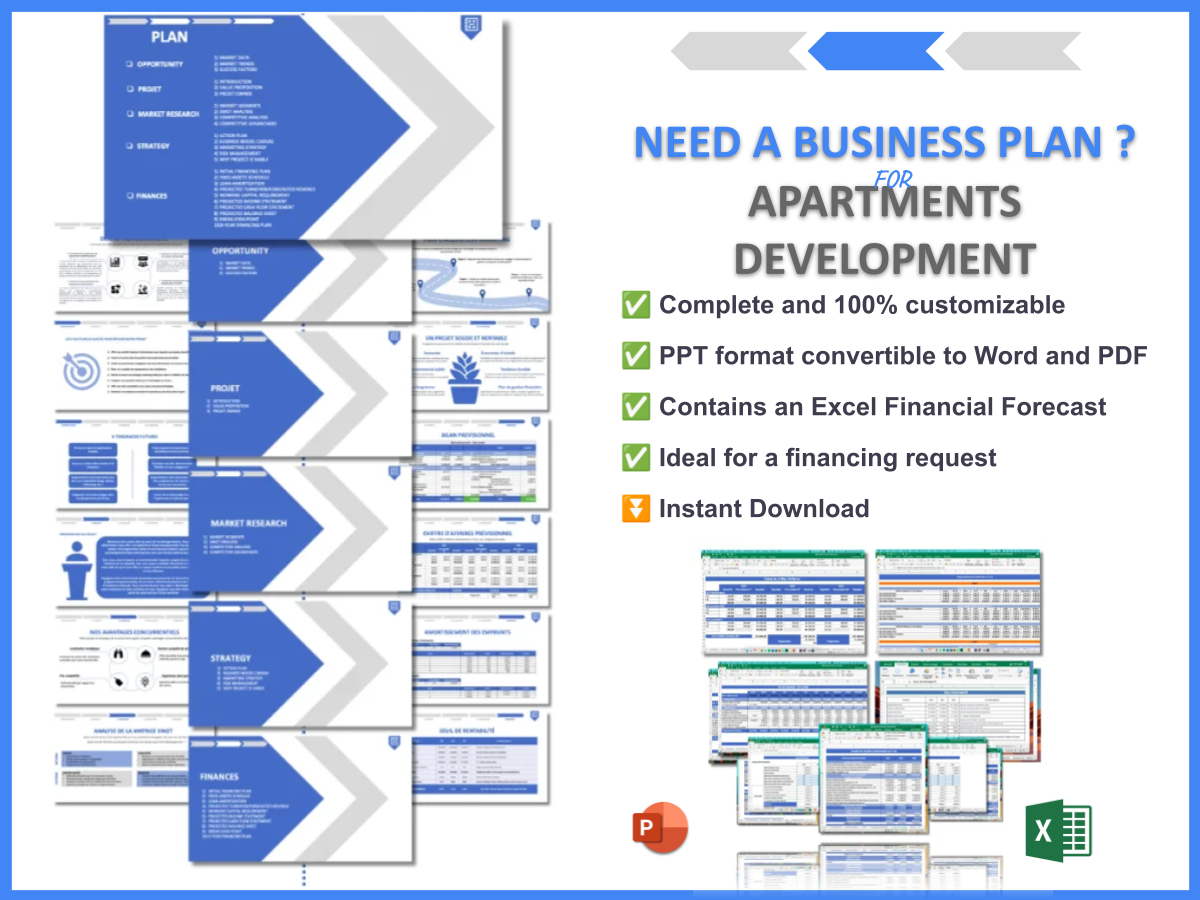

To further enhance your journey in apartment development, consider utilizing the Apartments Development Business Plan Template. This resource can help you create a comprehensive plan tailored to your project’s needs.

Additionally, check out our other articles that provide valuable insights and strategies for apartments development:

- SWOT Analysis for Apartments Development: Achieving Market Dominance

- Writing a Business Plan for Apartments Development: Template Included

- How to Create a Financial Plan for Your Apartments Development: Step-by-Step Guide (+ Example)

- Creating an Apartments Development Project: Complete Guide with Example

- Start Your Apartments Development Marketing Plan with This Example

- Creating a Business Model Canvas for Apartments Development: Examples and Tips

- Customer Segments for Apartments Development: Examples and Insights

- Apartments Development Profitability: What You Need to Know

- How Much Does It Cost to Develop an Apartments Complex?

- How to Calculate the Feasibility Study for Apartments Development?

- How to Analyze Competition for Apartments Development?

- Apartments Development Risk Management: Expert Insights

- Apartments Development Legal Considerations: Comprehensive Guide

- Apartments Development Growth Strategies: Scaling Success Stories

FAQ Section

What financing options are available for apartment development?

There are several options for financing apartments development, including construction loans, private investors, and crowdfunding platforms that allow for diversified funding sources.

How do I secure funding for my apartment project?

Securing funding involves researching various funding options, preparing a solid business plan, and presenting your project to potential investors or lenders.

What is the significance of a business plan in apartment development?

A business plan outlines your project’s objectives, funding needs, and strategies, making it easier to attract investors and secure financing.

What types of loans are best for apartment development?

Typically, commercial real estate loans, hard money loans, and construction loans are popular choices among developers.

Are there grants available for apartment developers?

Yes, various government grants support affordable housing initiatives and can significantly reduce your funding requirements.

What role does crowdfunding play in apartment financing?

Crowdfunding allows developers to gather small investments from a large number of people, providing an alternative to traditional financing methods.

How can I determine the feasibility of my apartment project?

Conducting a feasibility study helps assess the viability of your project by analyzing costs, potential revenue, and market demand.

What are the risks involved in apartment development?

Risks can include market fluctuations, regulatory changes, and construction delays, which can impact your project’s financial success.

How can I attract private investors for my apartment project?

Networking, presenting a strong business plan, and showcasing past success can help attract private investors to your apartment development.

What factors influence the cost of developing an apartment complex?

Factors include land acquisition, construction costs, financing options, and market conditions that affect demand.