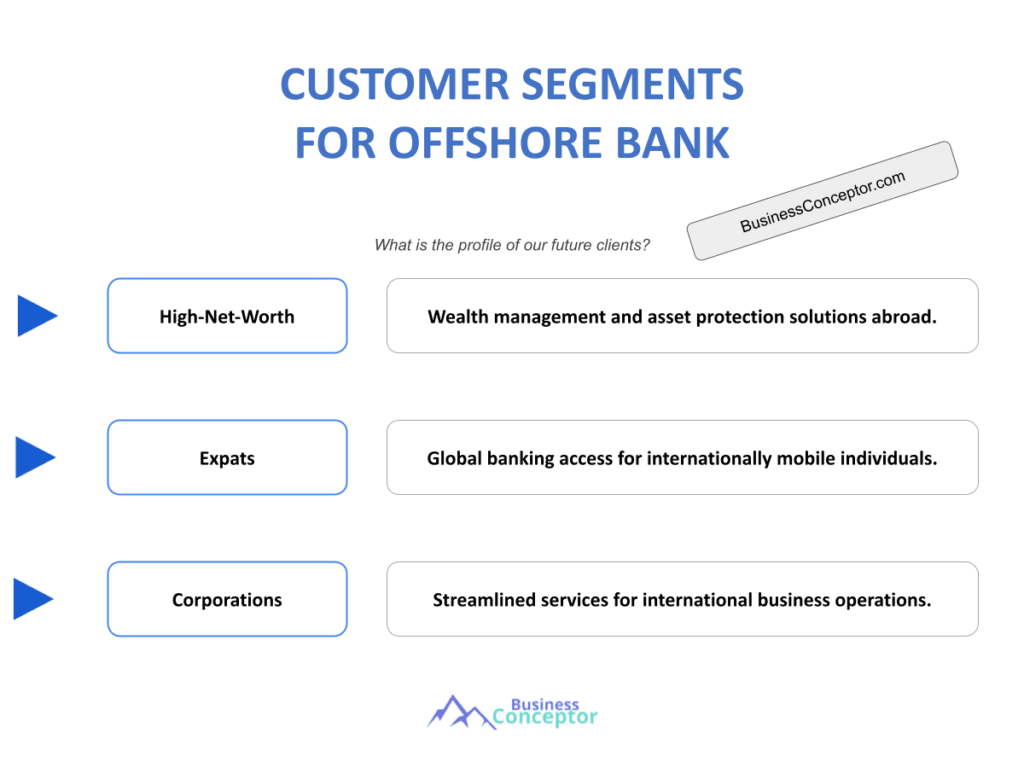

Did you know that over 40% of high-net-worth individuals consider offshore banking as a means to secure their wealth? Offshore Bank Customer Segments are essential to understanding the landscape of international finance. These segments include various groups, each with unique needs and goals, from wealthy individuals seeking tax optimization to businesses looking for global banking solutions. By identifying these segments, banks can tailor their offerings, ensuring they meet the specific demands of their clients.

- Overview of offshore banking and its importance.

- Key customer segments for offshore banks.

- Characteristics of high-net-worth individuals.

- The role of expatriates in offshore banking.

- The significance of businesses in offshore banking.

- Understanding the needs of family offices.

- The impact of regulatory compliance on customer segments.

- Strategies for attracting and retaining offshore clients.

- Future trends in offshore banking customer segments.

- Conclusion and call to action.

Understanding Offshore Banking

Offshore banking refers to the banking services offered by financial institutions outside a client’s country of residence. This section introduces the concept of offshore banking and its relevance in today’s global economy. With increasing globalization, individuals and businesses alike seek offshore banking solutions for various reasons, including asset protection, tax optimization, and privacy.

For instance, high-net-worth individuals (HNWIs) often leverage offshore accounts to manage their wealth more effectively, benefiting from favorable tax laws and enhanced privacy. Similarly, expatriates may use these services to maintain financial stability while living abroad. Banks must understand these diverse motivations to effectively cater to their clients.

In summary, understanding offshore banking is crucial for identifying the key customer segments. The next section will explore the characteristics and needs of high-net-worth individuals, a significant group in offshore banking.

| Aspect | Description |

|---|---|

| Definition | Banking services outside a client’s home country |

| Purpose | Asset protection, tax optimization, privacy |

- Offshore banking is crucial for wealth management.

- High-net-worth individuals seek privacy and tax benefits.

- Expatriates use offshore banks for financial stability.

“In a globalized world, offshore banking is a strategic necessity.”

High-Net-Worth Individuals as Key Clients

High-net-worth individuals (HNWIs) are a primary customer segment for offshore banks. These clients typically possess substantial assets and seek banking solutions that offer personalized services and privacy. HNWIs are often looking for ways to protect their wealth from market volatility and taxation. Understanding their motivations is essential for banks aiming to attract and retain this valuable segment.

According to recent studies, HNWIs are increasingly turning to offshore banks for diversified investment opportunities. For example, a significant percentage of these individuals allocate their wealth to offshore investment funds and real estate, seeking to mitigate risks and maximize returns. This trend emphasizes the need for banks to develop specialized offerings tailored to the unique financial goals of HNWIs.

Understanding the specific needs of HNWIs allows offshore banks to tailor their services accordingly. The next section will delve into the unique needs of expatriates, another vital customer segment for offshore banks.

- Identify HNWIs as a target segment.

- Offer personalized wealth management services.

- Provide access to diversified investment options.

- The above steps must be followed rigorously for optimal success.

The Role of Expatriates in Offshore Banking

Expatriates represent another significant customer segment for offshore banks. These individuals often face unique financial challenges, such as currency fluctuations, international regulations, and the need for cross-border financial solutions. Understanding their specific needs can help banks develop products that cater to this growing segment.

For instance, expatriates may require foreign currency accounts to manage their income and expenses effectively. Moreover, they often seek banking services that facilitate easy access to funds while ensuring compliance with local regulations. With the rise of remote work and globalization, the number of expatriates is expected to increase, making it crucial for banks to adapt their offerings.

By recognizing the needs of expatriates, offshore banks can develop tailored products that address their specific challenges. In the next section, we will explore the importance of family offices in offshore banking.

- Expatriates need tailored banking solutions.

- Currency management is crucial for expatriates.

- Compliance with local regulations is essential.

“Understanding expatriates’ needs can enhance banking relationships.”

Family Offices and Their Financial Needs

Family offices are increasingly becoming prominent clients in the offshore banking sector. These entities manage the wealth of high-net-worth families and require comprehensive financial services, including investment management, tax planning, and estate planning. The needs of family offices are complex and demand a tailored approach from banks.

Family offices often seek offshore banking solutions for asset protection and privacy. They benefit from specialized services that cater to their unique financial situations, such as customized investment strategies and risk management solutions. Additionally, the ability to access global markets can significantly enhance their investment opportunities.

Recognizing the role of family offices in offshore banking can help banks tailor their offerings effectively. The next section will discuss the impact of regulatory compliance on customer segments.

| Aspect | Description |

|---|---|

| Definition | Entities managing high-net-worth family wealth |

| Services | Investment management, tax planning, estate planning |

- Develop specialized services for family offices.

- Focus on asset protection strategies.

- Enhance privacy measures for clients.

“To succeed, always move forward with a clear vision.”

Regulatory Compliance and Customer Segments

Regulatory compliance is a critical aspect of offshore banking that affects customer segments. As governments tighten regulations surrounding offshore accounts, banks must adapt their services to ensure compliance while still meeting client needs. This balancing act is essential for maintaining trust and credibility in the industry.

For instance, the implementation of the Common Reporting Standard (CRS) requires banks to report information on foreign account holders. This has led to increased scrutiny of offshore banking practices, affecting how banks market their services to potential clients. As a result, banks must educate their clients about the importance of compliance and its implications for their financial strategies.

Understanding the implications of regulatory compliance can help offshore banks navigate challenges and maintain client trust. The next section will focus on strategies for attracting and retaining offshore clients.

| Aspect | Description |

|---|---|

| Regulatory Framework | Compliance with international laws |

| Impact on Clients | Affects marketing and client relations |

- Compliance is essential for maintaining trust.

- Regulatory changes can impact customer segmentation.

- Banks must adapt to evolving laws.

Strategies for Attracting Offshore Clients

Attracting offshore clients requires a strategic approach that addresses their specific needs and preferences. Banks must focus on building strong relationships and offering tailored solutions to capture this market segment effectively. Understanding the motivations and challenges faced by potential clients is essential for developing effective marketing strategies.

For example, banks can host exclusive events or webinars that educate potential clients about the benefits of offshore banking. By positioning themselves as experts in the field, banks can enhance their credibility and attract more clients. Additionally, offering personalized consultations can help establish trust and demonstrate a commitment to understanding individual client needs.

Implementing these strategies can significantly increase the bank’s client base. In the next section, we will explore future trends in offshore banking customer segments and how they may impact the industry.

- Host educational events for potential clients.

- Offer personalized consultations.

- Leverage digital marketing strategies.

- These strategies must be continuously refined for success.

Future Trends in Offshore Banking Customer Segments

The offshore banking landscape is continuously evolving, with emerging trends shaping customer segments. As technology advances, banks must adapt to the changing needs and expectations of their clients. Staying informed about these trends is crucial for maintaining a competitive edge in the market.

For instance, the rise of digital banking and fintech solutions is transforming how clients interact with offshore banks. Customers now seek seamless online experiences and access to innovative financial products. This shift towards digital services presents both challenges and opportunities for banks aiming to attract tech-savvy clients.

By staying ahead of these trends, offshore banks can better serve their clients and remain competitive in the market. The final section will summarize the key points discussed in the article and provide actionable recommendations for banks.

| Trend | Description |

|---|---|

| Digital Banking | Increasing demand for online services |

| Fintech Solutions | Emergence of innovative financial products |

- Technology is reshaping client expectations.

- Digital banking offers convenience and efficiency.

- Fintech solutions enhance service offerings.

Summarizing Key Customer Segments

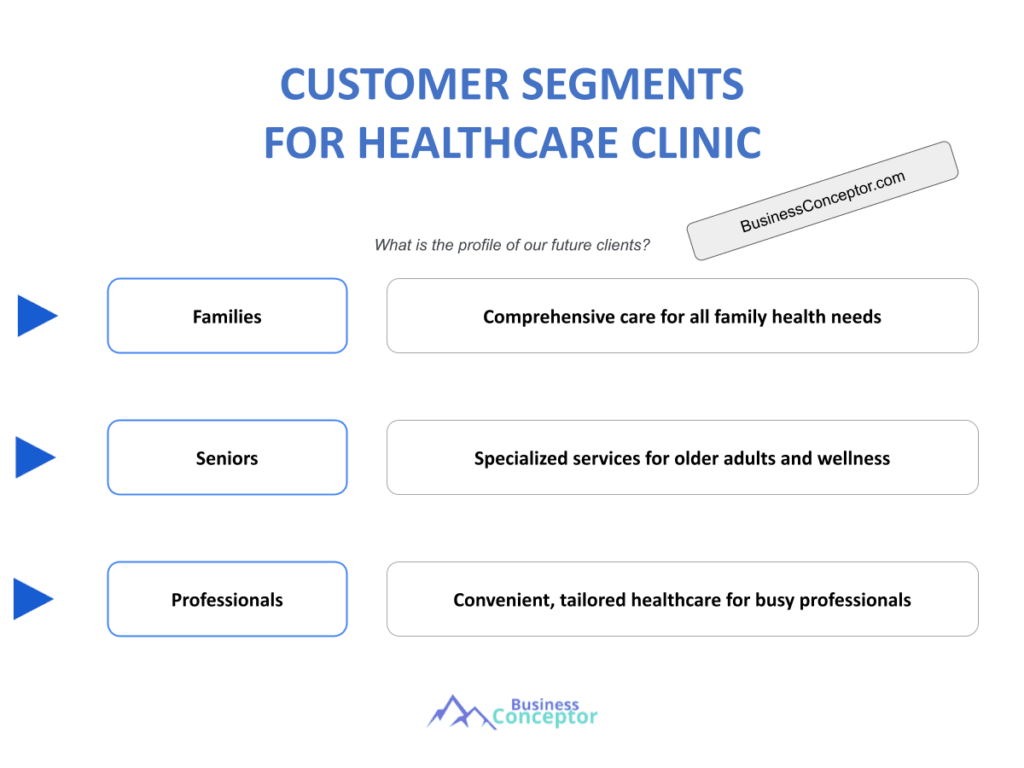

Understanding offshore bank customer segments is crucial for banks looking to thrive in the competitive financial landscape. Each segment presents unique needs and opportunities that banks must address. From high-net-worth individuals seeking asset protection to expatriates requiring tailored banking solutions, recognizing these segments allows banks to create customized offerings.

As we have discussed, staying informed about trends and regulatory changes is essential for adapting to client needs. The insights gained from understanding each segment can significantly enhance customer satisfaction and loyalty. This is particularly important in a market where competition is fierce and clients have numerous options for their banking needs.

In summary, a comprehensive approach that focuses on the unique requirements of each customer segment can lead to greater success in offshore banking. The next section will provide final recommendations and actionable steps for banks to consider.

| Segment | Key Needs |

|---|---|

| HNWIs | Wealth management, privacy |

| Expatriates | Currency management, compliance |

| Family Offices | Investment strategies, estate planning |

- Tailoring services to client needs is vital.

- Understanding segments enhances customer satisfaction.

- Continuous adaptation is necessary for success.

Final Recommendations and Actions

To effectively serve offshore bank customer segments, banks must prioritize understanding and addressing their clients’ unique needs. This involves ongoing education, personalized service, and adaptability to change. By implementing a client-centered approach, banks can foster stronger relationships and improve client retention.

Practical advice includes investing in technology to streamline services, offering educational resources, and ensuring compliance with regulations. By doing so, banks can position themselves as trusted partners for their clients, enhancing their overall banking experience.

By implementing these recommendations, banks can position themselves as leaders in offshore banking. The focus should always be on meeting the specific needs of each customer segment, ensuring that the bank remains relevant and competitive in the ever-evolving financial landscape.

“Success comes to those who persevere.”

- Invest in technology for better service.

- Provide educational resources for clients.

- Ensure compliance with international regulations.

Conclusion

In summary, understanding offshore bank customer segments is vital for banks aiming to thrive in the competitive financial landscape. By recognizing the unique needs of high-net-worth individuals, expatriates, and family offices, banks can tailor their offerings and enhance customer satisfaction. As discussed, staying informed about trends and regulatory changes is essential for adapting to client needs and ensuring long-term success.

To further assist you in establishing a successful offshore banking venture, consider using the Offshore Bank Business Plan Template. Additionally, you might find these articles helpful for expanding your knowledge on offshore banking:

- SWOT Analysis for Offshore Banks: Financial Strategies and Market Opportunities

- Offshore Bank Profitability: Key Considerations

- Offshore Bank Business Plan: Template and Tips

- How to Create a Financial Plan for Your Offshore Bank: Step-by-Step Guide (+ Example)

- Launching an Offshore Bank: Complete Guide and Examples

- Crafting a Marketing Plan for Your Offshore Bank (+ Example)

- Start Your Offshore Bank Right: Crafting a Business Model Canvas with Examples

- How Much Does It Cost to Establish an Offshore Bank?

- Offshore Bank Feasibility Study: Essential Guide

- Cafe Risk Management: Detailed Analysis

- How to Analyze Competition for Offshore Bank?

- Essential Legal Considerations for Offshore Bank

- Cafe Funding Options: Expert Insights

- Offshore Bank Growth Strategies: Scaling Examples

FAQ

What are offshore bank customer segments?

Offshore bank customer segments refer to distinct groups of clients, including high-net-worth individuals, expatriates, and family offices, each with unique financial needs and preferences.

Why do high-net-worth individuals choose offshore banking?

High-net-worth individuals often select offshore banking for asset protection, tax optimization, and enhanced privacy in managing their wealth.

How can expatriates benefit from offshore banks?

Expatriates benefit from offshore banks by accessing foreign currency accounts, tailored financial solutions, and maintaining financial stability while living abroad.

What services do family offices require from offshore banks?

Family offices seek comprehensive financial services, including investment management, tax planning, and estate planning, to effectively manage their wealth.

How does regulatory compliance affect offshore banking?

Regulatory compliance affects offshore banking by requiring banks to adhere to international laws, which impacts how they market their services and maintain client relationships.

What strategies can banks implement to attract offshore clients?

Banks can attract offshore clients by hosting educational events, offering personalized consultations, and leveraging digital marketing strategies.

What future trends are emerging in offshore banking?

Emerging trends in offshore banking include the rise of digital banking, fintech solutions, and increasing demand for personalized financial services.

How can banks ensure they meet client needs in offshore banking?

Banks can ensure they meet client needs in offshore banking by continuously researching market trends, adapting to regulatory changes, and offering tailored financial solutions.

What are the primary customer segments in offshore banking?

The primary customer segments in offshore banking include high-net-worth individuals, expatriates, family offices, and businesses seeking global banking solutions.

How can banks build trust with their offshore clients?

Banks can build trust with offshore clients by maintaining transparency, ensuring compliance with regulations, and providing exceptional customer service.