Did you know that nearly 90% of startups fail, often due to a lack of profitability? Startup profitability refers to the ability of a new business to generate more revenue than its expenses over time. Achieving profitability is crucial for survival and growth in a competitive landscape. Here are some key points to consider:

- Understanding profitability metrics is essential for measuring success.

- Financial planning and management can significantly impact profitability.

- Sustainable growth strategies are vital for long-term success.

- Adopting effective revenue models can enhance profit margins.

Understanding Startup Profitability Metrics

In the world of startups, knowing your numbers is everything. Profitability metrics help you gauge your business’s financial health. From gross profit margin to net income, these metrics tell a story about your financial viability. Understanding these figures not only helps in strategic planning but also builds credibility with potential investors.

To break it down, let’s look at some crucial metrics:

– Gross Profit Margin: This shows how much money you keep after covering the cost of goods sold. A high margin indicates effective pricing strategies and operational efficiency. For example, if your startup generates $200,000 in revenue with $150,000 in expenses, its gross profit margin is 25%. This means they keep 25 cents for every dollar earned, which is a healthy sign for potential investors.

– Net Income: This is your total revenue minus total expenses. A positive net income is a clear indicator of profitability. It reflects how well you manage costs and generate income, which is crucial for sustainability.

– Burn Rate: This metric reveals how quickly your startup is using its capital. Keeping a close eye on your burn rate can help you avoid running out of cash, which is a common pitfall for many startups.

Understanding and analyzing these metrics regularly allows you to make informed decisions. For instance, if you notice that your gross profit margin is declining, it may prompt you to reassess your pricing strategy or look for ways to reduce costs. This proactive approach can save your startup from potential financial trouble down the line.

| Metric | Definition |

|---|---|

| Gross Profit Margin | Revenue minus cost of goods sold |

| Net Income | Total revenue minus total expenses |

| Burn Rate | Monthly cash expenditure |

- Key Takeaways:

- Understanding these metrics helps in decision-making.

- Regularly monitor these figures to stay on track.

- Use these metrics to communicate your startup’s health to potential investors.

“Profitability is not just about making money; it's about making smart financial decisions.” 💡

Effective Financial Planning for Startups

Financial planning is like a roadmap for your startup. It guides you through uncertain terrains and helps you allocate resources wisely. A solid financial plan includes budgeting, forecasting, and cash flow management. By laying out a detailed plan, you can set realistic goals and create strategies to achieve them.

Take budgeting, for instance. A detailed budget outlines your expected income and expenses, helping you identify potential shortfalls. For example, if your startup plans to launch a new product, estimating costs accurately ensures you have enough funds to support your marketing efforts. A well-thought-out budget acts as a safety net, allowing you to pivot when necessary without derailing your entire operation.

Moreover, cash flow management is crucial. Many startups fail because they run out of cash before they can turn a profit. Keeping track of cash inflows and outflows ensures you can meet your obligations on time. If your startup receives payments late, it could jeopardize your ability to pay suppliers, leading to a negative spiral of debt. Implementing strict payment terms and sending timely invoices can significantly improve your cash flow situation.

Another vital component is financial forecasting. This involves predicting your revenues and expenses over a set period, allowing you to plan for growth and unforeseen challenges. By analyzing past performance and market trends, you can create realistic projections that inform your strategic decisions. For instance, if you forecast a dip in sales during a certain season, you can prepare by cutting unnecessary expenses or ramping up marketing efforts ahead of time.

| Planning Element | Importance |

|---|---|

| Budgeting | Helps in anticipating expenses and revenues |

| Cash Flow Management | Ensures timely payments and operations |

| Financial Forecasting | Predicts future revenues and expenses |

- Key Takeaways:

- A robust financial plan is essential for success.

- Regularly review and adjust your budget as needed.

- Monitor cash flow to avoid financial pitfalls.

“Failing to plan is planning to fail.” 📊

Sustainable Growth Strategies for Startups

Sustainable growth is all about scaling your business without compromising quality. It’s not just about making quick profits; it’s about building a business that can thrive over the long haul. The key to achieving this is focusing on strategies that ensure your growth is both manageable and beneficial in the long run.

One effective strategy is to focus on customer retention. Acquiring new customers is often more expensive than keeping existing ones. By providing exceptional service and engaging with your customers, you can foster loyalty and encourage repeat business. For instance, a startup offering a subscription service might implement a rewards program for long-term subscribers, incentivizing them to stay while also attracting new customers through positive word-of-mouth.

Another strategy is diversifying your revenue streams. Instead of relying solely on one product or service, explore additional offerings that complement your main business. For example, a fitness app might offer personalized training plans or nutrition advice to enhance user experience and increase revenue. This approach not only mitigates risk but also opens up new market opportunities, making your startup more resilient against economic downturns.

Additionally, investing in your brand can significantly contribute to sustainable growth. Building a strong brand identity and reputation can lead to increased customer trust and loyalty. Startups that effectively communicate their values and mission can create a lasting emotional connection with their audience, leading to higher customer retention rates and referrals.

| Strategy | Description |

|---|---|

| Customer Retention | Focusing on keeping existing customers happy |

| Revenue Diversification | Offering complementary products or services |

| Quality Over Quantity | Prioritizing sustainable growth over rapid scaling |

- Key Takeaways:

- Sustainable growth leads to long-term profitability.

- Invest in customer relationships for better retention.

- Explore new revenue opportunities to reduce risk.

“Growth is not just about size; it’s about sustainability.” 🌱

Revenue Models for Startup Profitability

Understanding various revenue models can significantly impact your startup’s profitability. The right model aligns with your business goals and customer needs, driving revenue effectively. Choosing the appropriate revenue model not only influences your financial outcomes but also shapes your marketing strategies and customer engagement efforts.

For example, a subscription model provides predictable revenue. Companies like Netflix thrive on this model because it encourages customer loyalty and consistent cash flow. By charging customers a recurring fee, you can create a steady income stream that allows for better financial planning. This model also fosters long-term relationships with customers, as they are more likely to stay engaged with your product or service when they have ongoing access.

On the other hand, a pay-per-use model can attract customers who prefer to pay only for what they use. This flexibility can be particularly appealing in industries where customers are hesitant to commit to long-term contracts. For instance, a cloud storage provider might offer a pay-per-use model, allowing users to pay only for the storage they actually utilize. This approach can lead to higher customer acquisition rates, especially among those wary of upfront costs.

Consider how your product fits into these models. If your startup is a SaaS (Software as a Service), a tiered pricing model could cater to different customer segments, maximizing revenue potential. By offering various levels of service at different price points, you can appeal to both budget-conscious consumers and those willing to pay more for premium features. This strategy not only diversifies your revenue streams but also enhances customer satisfaction by providing options that meet varying needs.

| Revenue Model | Description |

|---|---|

| Subscription | Recurring payments for ongoing service |

| Pay-Per-Use | Customers pay for each usage |

| Tiered Pricing | Different pricing levels for various features |

- Key Takeaways:

- Choose a revenue model that aligns with customer behavior.

- Evaluate and adapt your model as your business evolves.

- Test different pricing strategies to find what works best.

“The right revenue model can transform your startup’s financial landscape.” 💰

Cash Flow Management for Startups

Cash flow is the lifeblood of any startup. It’s vital to ensure that your inflows exceed your outflows, allowing you to operate smoothly. Effective cash flow management involves monitoring, forecasting, and controlling cash movements. Without a clear understanding of your cash flow, even the most promising startups can find themselves in dire straits.

Start by creating a cash flow statement. This document tracks all cash coming in and going out over a specific period. It helps you identify patterns and anticipate cash shortages. For example, if you notice a dip in cash flow during certain months, you can plan ahead to avoid cash crunches. This proactive approach enables you to make informed decisions about spending and investments, ensuring that you have enough liquidity to cover operational costs.

Additionally, consider implementing payment terms that favor your cash flow. Offering discounts for early payments or setting clear payment deadlines can improve your cash inflows. For instance, if you operate a B2B service, incentivizing clients to pay invoices within a specific timeframe can significantly enhance your cash flow position. Furthermore, negotiating better payment terms with your suppliers can extend your cash outflow timeline, providing more breathing room.

Another critical aspect of cash flow management is maintaining a reserve fund. Having a cash cushion can help you navigate unexpected expenses or downturns in revenue. It acts as a safety net, allowing your startup to absorb shocks without jeopardizing operations. In times of uncertainty, this reserve can be the difference between survival and failure.

| Cash Flow Element | Description |

|---|---|

| Cash Flow Statement | Tracks cash inflows and outflows |

| Payment Terms | Influences cash inflow timing |

| Cash Flow Forecasting | Predicts future cash needs |

- Key Takeaways:

- Regularly monitor your cash flow to avoid surprises.

- Plan for seasonal fluctuations in revenue.

- Encourage timely payments to maintain healthy cash flow.

“Cash flow is king; manage it wisely.” 👑

The Importance of Startup Financial Health Indicators

Financial health indicators are critical for assessing your startup’s overall performance. These metrics provide insights into profitability, efficiency, and liquidity, helping you make informed decisions. Understanding these indicators not only allows you to track your startup’s progress but also helps you communicate its value to stakeholders and potential investors.

Key indicators include the current ratio, which measures your ability to pay short-term obligations. A ratio above 1 indicates good financial health. For instance, if your startup has $150,000 in current assets and $100,000 in current liabilities, your current ratio would be 1.5. This suggests that you have sufficient assets to cover your short-term debts, which can instill confidence in investors and creditors alike.

Another essential indicator is the return on investment (ROI), which measures the profitability of your investments. A higher ROI suggests more effective use of resources. For example, if you invest $10,000 in marketing and generate $50,000 in additional revenue, your ROI would be 400%. This kind of insight is invaluable for making future investment decisions and optimizing your marketing strategies.

Additionally, the debt-to-equity ratio is a crucial indicator that assesses financial leverage. A lower ratio indicates a more financially stable company, as it shows that you are not overly reliant on debt to fund your operations. For example, if your startup has $200,000 in equity and $50,000 in debt, your debt-to-equity ratio would be 0.25. This suggests that your business is well-capitalized, which can attract potential investors looking for a stable opportunity.

| Indicator | Importance |

|---|---|

| Current Ratio | Measures short-term financial stability |

| Return on Investment (ROI) | Evaluates the profitability of investments |

| Debt-to-Equity Ratio | Assesses financial leverage |

- Key Takeaways:

- Regularly review financial health indicators to gauge performance.

- Use these metrics to identify areas for improvement.

- Communicate your financial health to stakeholders effectively.

“Your financial health reflects your startup’s potential for growth.” 📈

Strategies for High Profitability in Startups

When it comes to achieving high profitability, there are several strategies that startups can implement to ensure they not only survive but thrive in a competitive environment. These strategies revolve around optimizing operations, enhancing customer engagement, and leveraging technology effectively.

One of the most effective strategies is to optimize your operational efficiency. This involves analyzing every aspect of your business to identify areas where you can reduce costs without sacrificing quality. For instance, if you notice that your supply chain has inefficiencies, addressing these issues can lead to significant savings. Streamlining processes can also enhance productivity, enabling your team to focus on growth-oriented tasks rather than getting bogged down in day-to-day operations.

Another crucial strategy is enhancing customer engagement. A satisfied customer is more likely to become a repeat buyer and refer others to your business. Implementing customer feedback mechanisms can help you understand their needs better and make necessary adjustments. For example, a simple survey can provide insights into what features customers value most, allowing you to prioritize those in your product development. Additionally, building a community around your brand can foster loyalty and create advocates who will promote your business organically.

Moreover, leveraging technology can significantly impact your startup’s profitability. Utilizing tools such as CRM systems, financial management software, and analytics platforms can automate tasks and provide valuable insights into your operations. For instance, using a CRM can help you manage customer relationships more effectively, leading to improved sales processes and higher conversion rates. Additionally, financial software can assist in tracking expenses and revenues in real-time, allowing you to make informed decisions quickly.

| Strategy | Description |

|---|---|

| Operational Efficiency | Analyzing and streamlining processes to reduce costs |

| Customer Engagement | Enhancing relationships to encourage repeat business |

| Leveraging Technology | Using tools to automate tasks and gain insights |

- Key Takeaways:

- Optimize operations for better cost management.

- Engage customers to foster loyalty and referrals.

- Use technology to streamline processes and improve decision-making.

“Effective strategies lead to sustainable profitability.” 🚀

Startup Profitability Optimization Strategies

Optimizing startup profitability is a crucial endeavor for any new business looking to succeed in a competitive market. By implementing effective optimization strategies, startups can not only improve their financial performance but also create a sustainable growth trajectory. This involves examining various aspects of the business to identify areas for improvement and making informed decisions that lead to increased profitability.

One of the first steps in this optimization process is to conduct a thorough analysis of your cost structure. Understanding where your money is going is essential for identifying unnecessary expenses. Startups often have various operational costs, such as marketing, salaries, and overhead. By closely analyzing these expenses, you can pinpoint areas where you can cut costs without compromising quality. For instance, if you find that your marketing budget is disproportionately high compared to the revenue generated, it may be time to reassess your marketing strategies and focus on more cost-effective channels.

Another key aspect of optimizing profitability is improving pricing strategies. Many startups underestimate the importance of setting the right prices for their products or services. Conducting market research to understand what customers are willing to pay can provide valuable insights. Additionally, consider implementing dynamic pricing strategies that adjust prices based on demand, seasonality, or customer segmentation. This flexibility can maximize revenue potential and enhance profit margins.

Moreover, leveraging data analytics can significantly contribute to your optimization efforts. By utilizing analytics tools, startups can gain insights into customer behavior, sales trends, and operational efficiency. This data-driven approach enables you to make informed decisions that align with market demands. For example, if your analysis reveals that a particular product is consistently underperforming, you can investigate the reasons behind it and make necessary adjustments to improve its appeal or consider phasing it out altogether.

| Optimization Strategy | Description |

|---|---|

| Cost Structure Analysis | Identifying unnecessary expenses to improve margins |

| Pricing Strategies | Adjusting prices based on market demand and research |

| Data Analytics | Utilizing tools to gain insights into performance |

- Key Takeaways:

- Analyze your cost structure for potential savings.

- Implement effective pricing strategies to boost profit margins.

- Leverage data analytics for informed decision-making.

“Optimization is the key to unlocking your startup’s potential.” 🔑

Investor-Ready Financial Reports for Startups

Creating investor-ready financial reports is essential for startups seeking funding and partnerships. These reports provide a comprehensive overview of your financial health and performance, allowing potential investors to assess the viability of your business. High-quality financial reports can significantly enhance your credibility and increase your chances of securing investment.

First and foremost, your financial reports should include key components such as the income statement, balance sheet, and cash flow statement. The income statement shows your revenues, expenses, and profits over a specific period, giving investors insight into your operational performance. The balance sheet provides a snapshot of your assets, liabilities, and equity, helping investors understand your financial position at a given point in time. Lastly, the cash flow statement outlines how cash flows in and out of your business, which is critical for assessing liquidity and operational efficiency.

Additionally, including financial forecasts can demonstrate your growth potential. Investors are often interested in seeing projections for revenue, expenses, and profitability over the next few years. This not only shows that you have a clear vision for the future but also that you have a plan for achieving your financial goals. Providing assumptions behind these forecasts can also add credibility, as it shows you have considered various factors that could impact your performance.

Moreover, presenting your financial data in a visually appealing manner can make a significant difference. Utilize charts, graphs, and tables to illustrate key metrics and trends. Visual representations can make complex data easier to understand, enabling investors to quickly grasp your financial situation. Additionally, a well-organized presentation of your financial reports reflects professionalism and attention to detail, which can positively influence investor perceptions.

| Financial Report Component | Description |

|---|---|

| Income Statement | Shows revenues, expenses, and profits |

| Balance Sheet | Snapshot of assets, liabilities, and equity |

| Cash Flow Statement | Outlines cash inflows and outflows |

- Key Takeaways:

- Include essential components in your financial reports.

- Provide financial forecasts to demonstrate growth potential.

- Utilize visuals to enhance understanding and appeal.

“Well-prepared financial reports can open doors to new opportunities.” 🚪

Recommendations

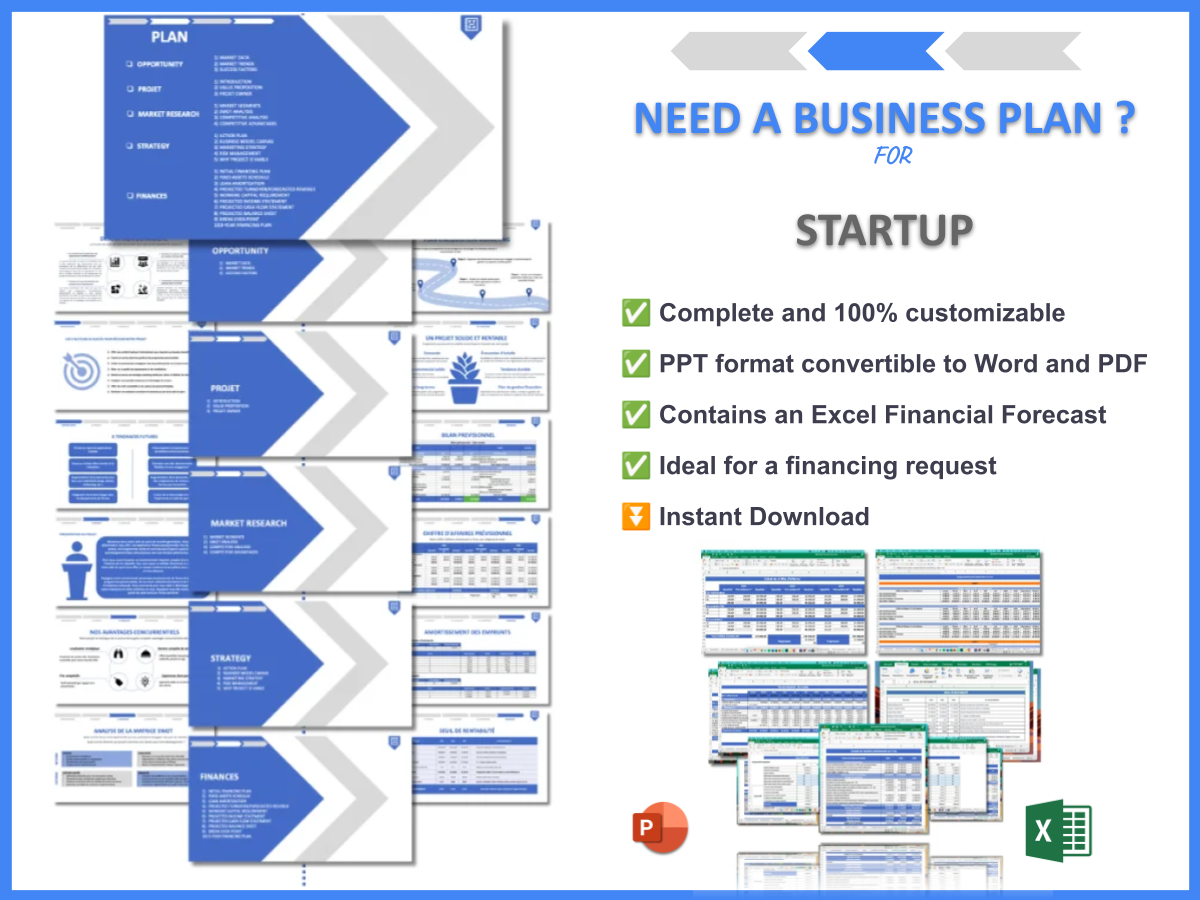

In summary, achieving startup profitability requires a multifaceted approach that includes understanding profitability metrics, effective financial planning, and implementing sustainable growth strategies. For those looking to create a solid foundation for their business, we recommend checking out the Startup Business Plan Template, which provides an excellent framework to guide your planning process.

Additionally, we encourage you to explore our related articles on startup topics to deepen your understanding and enhance your business strategies:

- Article 1 on Startup SWOT Analysis: Key Insights for Success

- Article 2 on Startup Business Plan: Template and Tips

- Article 3 on Financial Planning for Startups: A Detailed Guide with Examples

- Article 4 on Starting a Startup: The Complete Guide with Practical Examples

- Article 5 on Create a Winning Marketing Plan for Your Startup (+ Example)

- Article 6 on Start Your Startup Right: Crafting a Business Model Canvas with Examples

- Article 7 on Key Customer Segments for Startups: Examples and Analysis

- Article 8 on How Much Does It Cost to Launch a Startup?

- Article 9 on Ultimate Startup Feasibility Study: Tips and Tricks

- Article 10 on Ultimate Guide to Startup Risk Management

- Article 11 on Ultimate Guide to Startup Competition Study

- Article 12 on Essential Legal Considerations for Startup

- Article 13 on Exploring Funding Options for Startup

- Article 14 on How to Implement Growth Strategies for Startups

FAQ

How can I make a startup profitable?

To make a startup profitable, focus on understanding your profitability metrics, streamline your cost structure, and implement effective revenue models. Conducting market research and adapting your pricing strategies can also contribute to increased profitability.

What are key metrics to measure startup profitability?

Key metrics include gross profit margin, net income, and burn rate. Monitoring these metrics regularly can help you assess your startup’s financial health and make informed decisions to improve profitability.

How important is financial planning for startups?

Financial planning is crucial for startups as it helps in budgeting, forecasting, and managing cash flow. A solid financial plan enables you to allocate resources effectively and prepare for future growth.

What are sustainable growth strategies for startups?

Sustainable growth strategies include focusing on customer retention, diversifying revenue streams, and optimizing operational efficiency. These strategies can help ensure long-term success and stability for your startup.

What are some common revenue models for startups?

Common revenue models for startups include subscription-based, pay-per-use, and tiered pricing. Each model has its advantages, and choosing the right one depends on your business type and customer preferences.

How can I improve my startup’s cash flow management?

Improving cash flow management can be achieved by creating a cash flow statement, implementing favorable payment terms, and maintaining a reserve fund. Regular monitoring of cash inflows and outflows is essential for avoiding cash shortages.