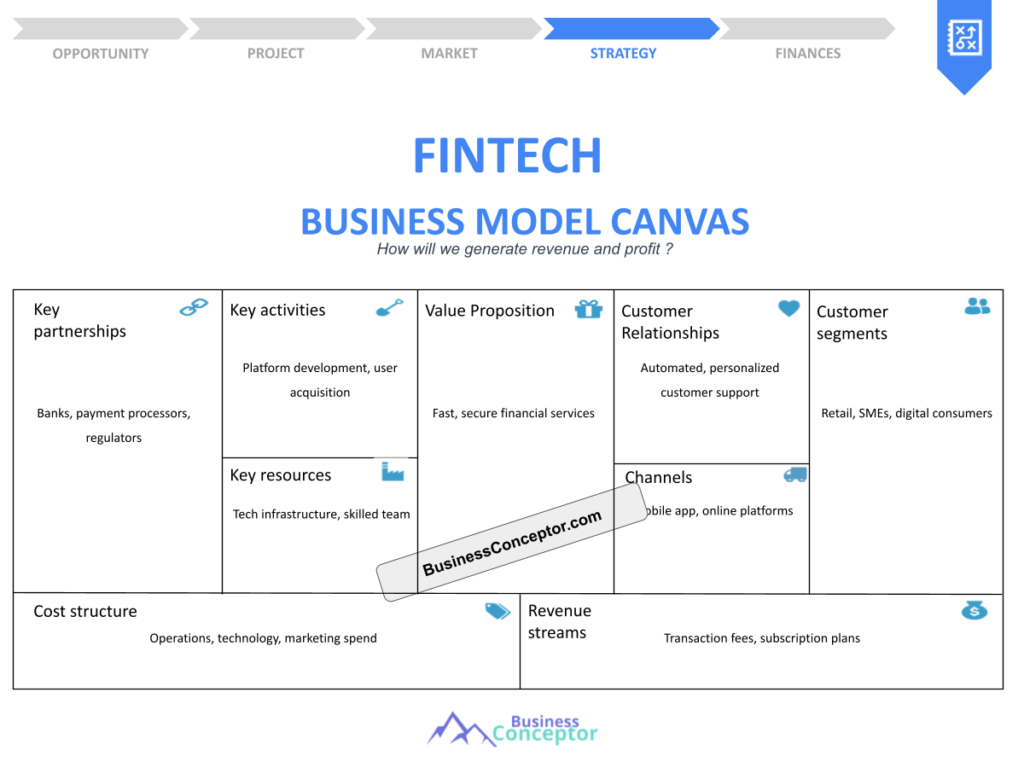

Did you know that the fintech industry has been revolutionizing how we think about money? The Fintech Business Model Canvas is a powerful tool that helps startups visualize their business strategy. Essentially, it’s a framework that outlines how a fintech company creates, delivers, and captures value. This method has gained traction among entrepreneurs because it simplifies complex business concepts into easily digestible components, making it easier to navigate the competitive landscape of financial technology.

Here’s what you’ll learn in this guide:

– What the Fintech Business Model Canvas is and why it’s essential.

– Key components that make up a successful canvas.

– Real-life examples of fintech companies using this model.

– Tips for creating your own Fintech Business Model Canvas.

– Common pitfalls to avoid when starting out.

Understanding the Fintech Business Model Canvas

The Fintech Business Model Canvas serves as a roadmap for entrepreneurs in the financial technology sector. It helps you visualize every aspect of your business, from customer segments to revenue streams. By utilizing this canvas, you can easily identify what works and what doesn’t, making adjustments along the way. This adaptability is crucial in an industry that changes as rapidly as fintech.

For example, let’s say you’re launching a mobile payment app. Your canvas will guide you in defining your target audience, your unique value proposition, and how you plan to generate revenue. This structured approach not only clarifies your business idea but also makes it easier to communicate with potential investors. Moreover, it fosters collaboration among team members, as everyone can see the complete picture of the business model, making discussions more productive and focused.

The Fintech Business Model Canvas includes several essential components that allow you to break down your business into manageable parts. Here are some key components:

| Component | Description |

|---|---|

| Customer Segments | Who are your customers? |

| Value Proposition | What makes your offering unique? |

| Revenue Streams | How will you earn money? |

- Key Information:

– The canvas is vital for clarity and focus.

– It encourages a structured approach to business planning.

– Helps in identifying customer needs and value propositions.

“A clear vision leads to successful execution.” 💡

One of the most significant advantages of using the Fintech Business Model Canvas is its ability to foster innovation. When you map out your business model, it encourages you to think critically about each component. Are you addressing the right customer segments? Is your value proposition compelling enough? This process can lead to new ideas and strategies that may not have emerged otherwise. Additionally, it helps you to stay focused on your goals, ensuring that every aspect of your business aligns with your overall vision.

Another advantage is the ease of communication. When pitching your fintech startup to investors or partners, having a well-structured canvas allows you to present your business idea clearly and concisely. Investors are often inundated with pitches, and a visually appealing canvas can set your proposal apart from the rest. It demonstrates that you have a solid understanding of your business and its market, which can inspire confidence in potential stakeholders.

Moreover, the Fintech Business Model Canvas is a living document. As your business evolves, you can continuously update the canvas to reflect changes in your strategy, market conditions, or customer feedback. This flexibility ensures that you are always aligned with the current state of your business and the fintech landscape. It’s not just a one-time exercise; it’s an ongoing journey that can adapt to the dynamic nature of the industry.

Key Components of the Fintech Business Model Canvas

When constructing your own Fintech Business Model Canvas, it’s essential to understand its core components. Each element plays a critical role in shaping your business strategy and ensuring that all aspects are aligned to create a successful enterprise. The canvas is divided into nine essential building blocks that guide you in defining your business model effectively.

Starting with Customer Segments, you need to identify who your ideal customers are. Are you targeting millennials looking for easier payment methods, or are you focused on small businesses seeking financial management solutions? Understanding your customer segments is crucial because it informs your marketing strategies, product features, and overall business direction. For instance, if your target audience is tech-savvy individuals, your app should prioritize user experience and cutting-edge technology. This precise identification helps tailor your offerings to meet specific needs, ultimately enhancing customer satisfaction and loyalty.

Next, let’s delve into the Value Proposition. This component is where you define what makes your product or service special. A successful fintech company, like a neobank, might offer lower fees and a user-friendly app interface. By articulating a strong value proposition, you differentiate your business from competitors and attract your target audience. It’s essential to convey how your solution solves a problem or fulfills a need that customers have. For example, if you’re developing a peer-to-peer lending platform, your value proposition could highlight lower interest rates and faster approval times compared to traditional banks. This clarity not only draws customers in but also helps in aligning your team’s efforts toward a common goal.

| Component | Description |

|---|---|

| Customer Segments | Defines the target audience. |

| Value Proposition | Outlines unique offerings that solve customer problems. |

| Channels | How will you reach your customers? |

- Key Information:

– Identifying customer segments helps tailor marketing strategies.

– A strong value proposition differentiates your business in a crowded market.

– Effective channels are crucial for customer engagement.

“Understanding your audience is half the battle won.” 🎯

After defining your customer segments and value propositions, the next step is to consider the Channels through which you will reach your customers. This could include online platforms, social media, email marketing, or even partnerships with other businesses. For example, if you’re launching a budgeting app, you might choose to promote it through social media channels where your target audience spends their time. Effective channels not only enhance visibility but also improve customer acquisition and retention rates.

Another critical component is Revenue Streams. This element focuses on how your business will make money. Are you planning to charge a subscription fee, transaction fees, or perhaps a freemium model where basic features are free, but premium features come at a cost? Understanding your revenue streams is vital for long-term sustainability. For instance, a mobile payment app might generate revenue through transaction fees, while a financial planning tool could adopt a subscription model. Clearly defining these streams allows you to project your financials accurately and make informed decisions about pricing strategies and growth initiatives.

Real-Life Examples of Successful Fintech Business Models

Let’s take a look at some fintech companies that have successfully utilized the Business Model Canvas. Companies like PayPal and Square are perfect examples of how this framework can guide a fintech startup. PayPal revolutionized online payments by focusing on convenience and security. Their canvas highlighted the importance of user trust, which they built through secure transactions and responsive customer support. By clearly defining their Customer Segments as both individual consumers and businesses, they tailored their marketing and product offerings to meet diverse needs.

On the other hand, Square made payments accessible for small businesses through their point-of-sale systems. They identified their customer segment as small merchants and positioned their Value Proposition around simplicity and affordability. By providing an easy-to-use interface and transparent pricing, Square quickly gained traction among its target audience. This example illustrates how understanding customer needs and articulating a compelling value proposition can lead to rapid business growth.

Furthermore, these companies demonstrate the importance of refining your Revenue Streams. PayPal generates revenue through transaction fees, while Square also offers additional services, such as inventory management and financial analytics, allowing them to diversify their income sources. By continuously adapting their business models based on market feedback and evolving consumer behaviors, these companies have remained competitive in a fast-paced environment.

| Company | Customer Segment | Value Proposition |

|---|---|---|

| PayPal | Online shoppers and businesses | Secure and easy transactions |

| Square | Small businesses | Affordable payment solutions |

- Key Information:

– Real-life examples provide inspiration and insights.

– Understanding competitors can highlight market opportunities.

– Tailoring value propositions can improve customer acquisition.

“Success leaves clues; study them!” 📊

In summary, the Fintech Business Model Canvas is not just a theoretical tool; it’s a practical guide that can shape your business strategy. By understanding its components, learning from real-world examples, and refining your approach, you can position your fintech startup for success. The journey of creating a business model is as important as the model itself, as it fosters critical thinking, collaboration, and innovation within your team.

Tips for Creating Your Own Fintech Business Model Canvas

Creating your own Fintech Business Model Canvas can be an exciting yet challenging journey. It requires careful thought and strategic planning to ensure that all elements of your business are aligned. Here are some practical tips to get you started on this important task.

First, don’t rush the process. Take your time to research your market and understand your customers’ needs. Utilize tools such as surveys or focus groups to gather valuable insights. Understanding your target audience is critical, as it will inform your Value Proposition and help tailor your offerings to better meet their expectations. For example, if you’re developing a financial wellness app aimed at young professionals, focus groups can provide insights into their preferences regarding features, pricing, and usability.

Second, involve your team in the canvas creation. Diverse perspectives can lead to innovative ideas and stronger strategies. Each team member can bring unique insights based on their expertise, whether it’s marketing, technology, or customer service. Collaborating in this way not only fosters a sense of ownership but also aligns everyone toward a common goal. Remember, your Fintech Business Model Canvas is not just a document; it’s a shared vision that everyone in your organization should understand and contribute to.

| Tip | Description |

|---|---|

| Research Thoroughly | Understand your market and customer needs. |

| Collaborate with Team | Involve different perspectives for better ideas. |

| Be Flexible | Adapt your canvas as your business evolves. |

- Key Information:

– Research is foundational for a successful canvas.

– Team collaboration fosters innovation.

– Flexibility allows for responsiveness to market changes.

“Adaptability is the key to survival.” 🔑

Lastly, remember that your canvas is a living document. As you gain more insights and data, be prepared to revise and adapt your model. This flexibility ensures that you are always aligned with the current state of your business and the fintech landscape. Regularly reviewing and updating your Fintech Business Model Canvas can help you identify new opportunities and mitigate risks effectively. For instance, if a competitor launches a new feature that gains traction, you can quickly assess how it affects your value proposition and make necessary adjustments. This proactive approach will keep your business agile and responsive to market demands, which is essential for success in the fast-paced fintech industry.

Common Pitfalls to Avoid in Fintech Business Models

As you embark on your fintech journey, it’s crucial to be aware of common pitfalls that can derail your efforts. One major mistake is not clearly defining your Customer Segments. Without a specific target audience, your marketing efforts may fall flat, and you may struggle to resonate with potential customers. For instance, if you attempt to cater to both tech-savvy millennials and older, less tech-inclined individuals without a clear strategy, you may end up diluting your message and alienating both groups. Understanding your customers deeply will help you tailor your offerings and marketing strategies effectively.

Another pitfall is neglecting regulatory compliance. The fintech industry is heavily regulated, and failing to adhere to these rules can lead to costly setbacks. For example, if your platform offers lending services without the proper licensing, you could face significant fines and damage your brand’s reputation. It’s essential to stay informed about regulatory changes and ensure that your business model complies with local laws and regulations. Engaging with legal experts or compliance consultants early in the process can save you time and headaches down the line.

Lastly, don’t underestimate the importance of technology. A robust tech infrastructure is essential for scaling your operations and ensuring customer satisfaction. If your platform is slow, buggy, or difficult to use, customers will quickly lose interest. Invest in quality software development and user experience design to create a seamless experience for your users. For instance, if you’re developing a mobile app, prioritize features like quick loading times, intuitive navigation, and responsive customer support. These aspects can significantly enhance user retention and drive referrals.

| Pitfall | Consequence |

|---|---|

| Undefined Target Audience | Ineffective marketing strategies. |

| Ignoring Compliance | Legal issues and financial penalties. |

| Weak Technology | Poor customer experience and operational failures. |

- Key Information:

– Clearly defining your audience is crucial for success.

– Compliance is non-negotiable in fintech.

– Technology plays a vital role in business scalability.

“Learn from others’ mistakes to avoid making your own.” ⚠️

By being aware of these common pitfalls, you can better prepare your fintech startup for success. A well-defined Fintech Business Model Canvas not only helps you avoid these mistakes but also guides you in making informed decisions as you navigate the complexities of the fintech landscape. Remember, the road to success in fintech is paved with continuous learning and adaptation.

Leveraging Partnerships in Fintech Business Models

In the fintech landscape, partnerships can be a game-changer. Collaborating with established financial institutions or tech companies can provide your startup with credibility and access to valuable resources. For instance, partnering with a bank can help you navigate regulatory challenges more easily. Banks often have the infrastructure and experience necessary to comply with complex regulations, which can be particularly beneficial for new entrants in the fintech space. This partnership not only offers you guidance but also enhances your reputation, making it easier to gain the trust of potential customers.

Moreover, alliances with tech companies can enhance your service offerings, such as integrating advanced analytics or AI capabilities into your platform. This not only improves your Value Proposition but also helps you stay competitive in a fast-evolving market. For example, if you partner with a data analytics firm, you can leverage their expertise to provide personalized financial advice to your users, thus increasing user engagement and satisfaction.

Additionally, partnerships can significantly broaden your reach. By collaborating with established brands, you can tap into their customer base and expand your market presence. For instance, if your startup focuses on mobile payments, partnering with a popular e-commerce platform can introduce your services to a wider audience, driving user acquisition and increasing transaction volumes. This strategic approach can be particularly advantageous for startups that may lack the marketing budget to compete with larger players in the industry.

| Type of Partnership | Benefit |

|---|---|

| Bank Partnerships | Access to resources and regulatory guidance. |

| Tech Collaborations | Enhanced product offerings through innovation. |

- Key Information:

– Strategic partnerships can accelerate growth.

– They provide access to valuable resources and expertise.

– Collaborations can enhance your service offerings.

“Together, we achieve more.” 🤝

Furthermore, partnerships can lead to shared risk and cost savings. By collaborating with other businesses, you can pool resources and share the financial burden of development and marketing efforts. This is particularly advantageous for startups that may be operating on tight budgets. For example, if you are developing a new financial technology product, partnering with another fintech startup can allow you to share development costs and leverage each other’s strengths. This collaborative approach can lead to more innovative solutions and a faster time-to-market.

In conclusion, leveraging partnerships in your Fintech Business Model Canvas can provide numerous advantages, from enhancing credibility to broadening market reach. By strategically aligning with established players in the industry, you can create a more robust business model that not only meets the needs of your customers but also positions your startup for long-term success. The key is to identify partners whose strengths complement your weaknesses, creating a win-win situation for all parties involved.

The Future of Fintech Business Models

The fintech landscape is ever-evolving, and staying ahead requires foresight and adaptability. Emerging technologies like blockchain and AI are shaping new business models. For instance, blockchain can streamline processes and reduce costs, while AI can enhance customer experiences through personalized services. These technologies are not just trends; they represent a fundamental shift in how financial services are delivered and consumed. By incorporating these innovations into your Fintech Business Model Canvas, you can differentiate your offering and provide added value to your customers.

Moreover, trends like embedded finance and open banking are creating opportunities for innovation. Embedded finance allows businesses to integrate financial services directly into their products, making it easier for customers to access the financial tools they need without leaving the platform they are already using. For example, an e-commerce platform might offer financing options at checkout, simplifying the purchasing process for consumers. Open banking, on the other hand, facilitates data sharing between banks and third-party providers, enabling the development of more personalized and competitive financial products. Understanding these trends and how they impact your business model is crucial for remaining competitive in the fintech space.

Companies that can harness these trends will likely lead the market in the future. By being proactive and adopting a forward-thinking approach, you can position your startup as an innovator rather than a follower. This involves continuously evaluating your Value Proposition and adapting it to meet changing consumer expectations and technological advancements. For instance, if you notice a growing demand for sustainable investing options, consider incorporating features that allow users to invest in environmentally friendly funds.

| Trend | Implication |

|---|---|

| Blockchain Technology | More efficient and secure transactions. |

| AI Integration | Enhanced customer experiences and insights. |

- Key Information:

– Emerging technologies are reshaping the industry.

– Innovation is key to staying competitive.

– Understanding trends can guide strategic decisions.

“The future belongs to those who prepare for it today.” 🔮

In conclusion, the future of fintech is bright, filled with opportunities for those willing to embrace change and innovate. By leveraging emerging technologies and adapting your Fintech Business Model Canvas accordingly, you can create a sustainable business that not only meets the needs of today’s consumers but also anticipates the demands of tomorrow’s market. Stay curious, remain adaptable, and always look for ways to enhance your offerings, and you will be well on your way to achieving success in the dynamic world of fintech.

Creating a Sustainable Fintech Business Model Canvas

Creating a sustainable Fintech Business Model Canvas is essential for long-term success in the rapidly evolving financial technology landscape. Sustainability in this context goes beyond environmental concerns; it encompasses the financial viability and resilience of your business model. A well-structured canvas not only helps you identify key components of your business but also allows you to evaluate how these components can work together to create a sustainable enterprise.

One of the most significant aspects of sustainability is understanding your Revenue Streams. You need to establish multiple avenues for income to ensure that your business can weather fluctuations in the market. For example, a fintech company that relies solely on transaction fees may struggle during economic downturns when transaction volumes drop. However, by diversifying your revenue streams—such as offering subscription-based services, premium features, or consulting—your business can maintain stability even in challenging times. This diversification can also enhance your Value Proposition, as it allows you to offer a broader range of services to your customers.

Additionally, consider the importance of customer retention in creating a sustainable model. It’s often more cost-effective to retain existing customers than to acquire new ones. Your Fintech Business Model Canvas should include strategies for enhancing customer loyalty, such as personalized experiences, rewards programs, or continuous engagement through valuable content. For instance, if you run a budgeting app, sending users tailored tips based on their spending habits can keep them engaged and encourage them to continue using your service.

| Aspect | Importance |

|---|---|

| Revenue Streams | Diversification ensures financial stability. |

| Customer Retention | Cost-effective strategy for long-term success. |

- Key Information:

– Sustainability is crucial for long-term viability.

– Diversifying revenue streams enhances stability.

– Retaining customers is more cost-effective than acquiring new ones.

“Sustainable growth is the key to lasting success.” 🌱

Another vital factor in creating a sustainable Fintech Business Model Canvas is your approach to innovation. In the fast-paced fintech environment, staying ahead of trends and technological advancements is crucial. This means being open to new ideas and continuously improving your offerings. Regularly solicit feedback from your customers and use this information to refine your services. This not only helps you stay relevant but also builds a loyal customer base that feels valued and heard.

Moreover, consider the impact of partnerships on sustainability. Collaborating with other fintech companies or established financial institutions can provide access to new technologies, customer segments, and resources. This synergistic approach can enhance your capabilities and improve your overall business model. For instance, partnering with a data analytics firm can enable you to offer advanced features that set you apart from competitors, thus enhancing your Value Proposition and driving growth. The key is to identify partners whose strengths complement your weaknesses, creating a mutually beneficial relationship that fosters innovation and sustainability.

Final Thoughts on the Fintech Business Model Canvas

The Fintech Business Model Canvas is an invaluable tool for entrepreneurs looking to carve their niche in the financial technology sector. By understanding its components, learning from real-world examples, and avoiding common pitfalls, you can set your business up for success. The journey of creating a business model is as important as the model itself, as it fosters critical thinking, collaboration, and innovation within your team.

As you work on your Fintech Business Model Canvas, always keep an eye on the future. The fintech industry is known for its rapid changes and disruptions, making it essential to remain adaptable. Regularly revisit and revise your canvas to reflect new insights, market conditions, and technological advancements. This iterative approach will help you stay relevant and competitive.

Moreover, don’t forget to leverage the community around you. Engage with other fintech entrepreneurs, attend industry events, and participate in discussions. This networking can provide valuable insights and foster collaborations that can enhance your business model. The fintech landscape is vast, and by connecting with others, you can learn from their experiences and share your knowledge, ultimately contributing to a more innovative and sustainable industry.

| Key Takeaway | Implication |

|---|---|

| Adaptability | Essential for staying relevant in a fast-changing market. |

| Community Engagement | Networking can lead to valuable insights and collaborations. |

- Key Information:

– The canvas is a living document that requires regular updates.

– Engaging with the community can provide additional insights.

– Adaptability is crucial for long-term success.

“The future belongs to those who prepare for it today.” 🔮

In summary, the Fintech Business Model Canvas is more than just a planning tool; it’s a comprehensive framework that can guide your fintech startup toward sustainable success. By focusing on customer needs, embracing innovation, and leveraging partnerships, you can create a robust business model that not only meets today’s demands but is also prepared for tomorrow’s challenges. Stay curious, remain adaptable, and always look for ways to enhance your offerings, and you will be well on your way to achieving success in the dynamic world of fintech.

Recommendations

In summary, the Fintech Business Model Canvas is an essential tool for anyone looking to succeed in the financial technology sector. It provides a structured approach to understanding key components such as Customer Segments, Value Proposition, and Revenue Streams, which are critical for building a sustainable business. To help you take the next step in your fintech journey, we recommend checking out the Fintech Business Plan Template, which offers a comprehensive framework for developing your business strategy.

Additionally, you might find these related articles on Fintech helpful in expanding your knowledge and refining your approach:

- Fintech SWOT Analysis: Insights & Trends

- Fintech: Strategies for Maximizing Profitability

- Fintech Business Plan: Template and Tips

- Fintech Financial Plan: A Detailed Guide

- Comprehensive Guide to Launching a Fintech Business: Tips and Examples

- Create a Marketing Plan for Your Fintech Business (+ Example)

- Identifying Customer Segments for Fintech Companies (with Examples)

- How Much Does It Cost to Establish a Fintech Business?

- What Are the Steps for a Successful Fintech Feasibility Study?

- What Are the Key Steps for Risk Management in Fintech?

- Fintech Competition Study: Comprehensive Analysis

- Fintech Legal Considerations: Comprehensive Guide

- How to Secure Funding for Fintech?

- Fintech Growth Strategies: Scaling Examples

FAQ

What is a Fintech Business Model Canvas?

The Fintech Business Model Canvas is a strategic tool that allows entrepreneurs in the financial technology sector to visualize and outline their business model. It breaks down essential components such as Customer Segments, Value Proposition, and Revenue Streams, helping startups create a structured approach to their business planning and execution.

How do I identify customer segments in fintech?

Identifying Customer Segments in fintech involves understanding the specific groups of consumers or businesses that your product or service will target. This can be achieved through market research, surveys, and analyzing consumer behavior to tailor your offerings to meet their unique needs and preferences. For instance, you might focus on millennials looking for convenient payment solutions or small businesses needing financial management tools.

What are common revenue models for fintech companies?

Common Revenue Models for fintech companies include transaction fees, subscription services, and premium features. Some companies may also explore partnerships with other businesses to create bundled offerings or use data analytics to provide personalized financial advice for a fee. Diversifying your revenue streams is crucial for long-term sustainability.

How can partnerships benefit my fintech startup?

Partnerships can significantly benefit your fintech startup by providing access to resources, expertise, and established customer bases. Collaborating with banks can offer regulatory guidance, while partnerships with tech companies can enhance your service offerings through innovative solutions. This collaborative approach can lead to improved Value Propositions and increased market reach.

What role does technology play in a fintech business model?

Technology is at the core of any fintech business model. It enables the delivery of services, enhances user experiences, and allows for the automation of processes. Investing in a robust technological infrastructure is essential for scaling your operations, ensuring security, and maintaining customer satisfaction in a competitive market.

How can I ensure the sustainability of my fintech business model?

To ensure the sustainability of your fintech business model, focus on diversifying your Revenue Streams, enhancing customer retention, and embracing continuous innovation. Regularly review and adapt your Fintech Business Model Canvas to reflect market changes and consumer needs. This proactive approach will help your business remain competitive and resilient in the long run.