Did you know that around 90% of startups fail within their first five years? A solid Digital Entrepreneur Financial Plan can be the lifeline that keeps your business afloat. This plan isn’t just a bunch of numbers thrown together; it’s a roadmap to ensure you’re managing your finances effectively, making informed decisions, and setting your business up for success. Think of it as the GPS for your financial journey in the digital world. When you have a structured plan, you can navigate the ups and downs of entrepreneurship with confidence.

Here’s what you’ll learn in this article:

– The key components of a financial plan for digital entrepreneurs.

– Practical steps to create and implement your financial plan.

– Real-life examples to inspire your own planning.

Understanding the Digital Entrepreneur Financial Plan

Creating a financial plan for a digital business may sound daunting, but it’s crucial for your success. A Digital Entrepreneur Financial Plan outlines your business’s financial goals and the strategies to achieve them. It includes budgeting, cash flow management, and projections for future growth. Having a solid plan helps you stay organized, anticipate challenges, and allocate resources efficiently. You’ll be able to focus on growing your business rather than worrying about unexpected expenses.

When I started my first online business, I had no clue about financial planning. I just winged it, and let me tell you, it was a mess! Without a plan, I struggled to keep track of my expenses and income. I learned the hard way that having a structured approach is essential. The benefits of a well-crafted financial plan are immense. It helps you identify your funding needs, manage your cash flow, and ultimately leads to better decision-making.

Here are some advantages of having a Digital Entrepreneur Financial Plan:

– **Clarity and Focus**: A financial plan gives you a clear direction and allows you to focus on your goals.

– **Informed Decision-Making**: With accurate financial data, you can make better decisions about investments, hiring, and marketing.

– **Risk Management**: Understanding your finances helps you prepare for uncertainties and manage risks effectively.

– **Financial Discipline**: A structured plan encourages you to stick to a budget and avoid unnecessary expenses.

As I navigated my entrepreneurial journey, I realized that the right financial plan could be the difference between success and failure. It’s not just about crunching numbers; it’s about creating a strategy that aligns with your business vision. A financial plan acts as your business’s backbone, supporting your growth and helping you stay on track.

Key Components of a Financial Plan

The first step in creating your Digital Entrepreneur Financial Plan is to understand its key components. Each element plays a vital role in ensuring your business is financially sound and prepared for growth. Let’s break it down:

- Budgeting: Knowing where your money goes is essential. A budget helps you track your income and expenses, ensuring that you don’t overspend.

- Cash Flow Management: Keeping track of your income and expenses is critical for maintaining liquidity. Understanding cash flow allows you to anticipate shortfalls and plan accordingly.

- Forecasting: Predicting future financial performance based on historical data helps you set realistic goals and prepare for market fluctuations.

- Funding Strategies: Knowing how to finance your business is crucial. This includes understanding the different funding sources available to you, such as personal savings, loans, or crowdfunding.

When I first created my financial plan, I used spreadsheets to track everything. It wasn’t fancy, but it worked! I listed all my income sources and expenses, which helped me see where I could cut costs and improve my cash flow. Understanding these components will empower you to make informed decisions and create a sustainable business model.

“A budget is telling your money where to go instead of wondering where it went.” 💸

| Component | Description |

|---|---|

| Budgeting | Outlining your expected income and expenses. |

| Cash Flow Management | Tracking money coming in and going out. |

| Forecasting | Estimating future revenues and expenses. |

| Funding Strategies | Identifying sources for financing your business. |

Key Information:

– A financial plan is crucial for your business.

– It helps you track your money and plan for the future.

– Essential components include budgeting, cash flow, and forecasting.

Steps to Create Your Financial Plan

Now that you understand what a financial plan is, let’s dive into how to create one. The first step is to gather all your financial information. This includes your income, expenses, debts, and any assets you have. Having a clear picture of your finances is essential to develop a robust Digital Entrepreneur Financial Plan. This step may seem tedious, but trust me, it’s worth it. It sets the foundation for everything that follows.

When I first created my financial plan, I was overwhelmed by the amount of data I had to collect. But once I got organized, it became easier to manage. I used spreadsheets to track everything, which allowed me to visualize my finances better. I listed all my income sources and expenses, which helped me see where I could cut costs and improve my cash flow. This is the first advantage of having a structured financial plan: it helps you identify areas for improvement.

Here’s a breakdown of the practical steps you can take to create your Digital Entrepreneur Financial Plan:

1. **Gather Financial Data**: Collect all relevant financial documents, such as bank statements, invoices, and receipts. This includes both personal and business finances if you’re a solopreneur.

2. **Identify Income Sources**: List all ways your business makes money. This could include product sales, services, affiliate marketing, and any other revenue streams.

3. **Outline Expenses**: Write down all your monthly expenses, fixed and variable. This should include everything from rent and utilities to marketing costs and software subscriptions.

4. **Calculate Cash Flow**: Subtract your expenses from your income to see how much you have left. This will help you understand your financial health and whether you need to make adjustments.

By taking these steps, you’ll have a clearer view of your financial situation. You’ll be able to identify patterns and trends that can inform your decisions moving forward. The second advantage is that it encourages financial discipline. Knowing your numbers keeps you accountable and helps you avoid unnecessary spending.

“The more you know about your finances, the more empowered you are to make decisions.” 🌟

| Step | Description |

|---|---|

| Gather Financial Data | Collect income, expenses, and assets. |

| Identify Income Sources | List all sources of revenue. |

| Outline Expenses | Write down all monthly expenses. |

| Calculate Cash Flow | Determine your available cash after expenses. |

Key Information:

– Start by gathering all your financial data.

– Know your income and expenses to manage cash flow.

– Calculating cash flow is vital for understanding your financial health.

Budgeting Tips for Digital Entrepreneurs

Budgeting is a fundamental aspect of your Digital Entrepreneur Financial Plan. It helps you allocate your resources wisely and avoid overspending. The importance of budgeting cannot be overstated, especially when you’re running a digital business where expenses can quickly spiral out of control. When I first started budgeting, I made a lot of mistakes, but those experiences taught me invaluable lessons.

To effectively manage your finances, you need to establish a solid budget. Here are some effective budgeting strategies to help you:

– **Set Clear Goals**: Define what you want to achieve financially. Having specific goals gives your budgeting efforts a purpose. For example, you might want to save for new software or a marketing campaign.

– **Use Budgeting Tools**: Leverage apps and software to track expenses. Tools like QuickBooks or Mint can automate much of the process and provide you with real-time insights into your financial situation.

– **Review Regularly**: Make it a habit to check your budget monthly. This allows you to make adjustments based on actual performance and stay on track toward your financial goals.

When I implemented these strategies, I noticed a significant change in how I managed my business finances. The clarity that comes from having a budget allows you to make informed decisions about where to invest your money. Additionally, it fosters a sense of financial discipline, which is crucial for long-term success. You’ll find yourself less stressed about money and more focused on growing your business.

“A budget is a plan for how you will spend your money.” 📊

| Strategy | Description |

|---|---|

| Set Clear Goals | Define your financial objectives. |

| Use Budgeting Tools | Utilize software or apps for tracking. |

| Review Regularly | Check your budget and adjust as needed. |

Key Information:

– Budgeting is essential for financial control.

– Use tools to simplify the budgeting process.

– Regular reviews help keep your budget on track.

Cash Flow Management for Online Businesses

Managing cash flow is critical for any business, especially in the digital space where transactions can happen quickly. It’s important to know when money is coming in and when it’s going out. A well-structured Digital Entrepreneur Financial Plan emphasizes the significance of cash flow management, allowing you to maintain liquidity and avoid financial pitfalls.

When I first started my online business, I thought I had plenty of cash flow because I had a steady stream of sales. However, I quickly learned that it wasn’t just about how much money was coming in; it was also about when it was coming in. Unexpected expenses can arise at any time, and if you’re not prepared, it can lead to a cash crunch. By understanding cash flow management, you can anticipate shortfalls and plan accordingly, which is one of the key advantages of having a solid financial plan.

Here are some key cash flow strategies to consider:

– **Track Your Income**: Knowing when you receive payments is crucial. Implementing a system to track income will help you understand your financial cycles better. This can include using accounting software that provides real-time updates on payments received.

– **Monitor Expenses**: Keep tabs on where your money is going. Regularly review your expenses to identify any unnecessary costs that can be cut. This proactive approach ensures that you’re not spending beyond your means.

– **Plan for Fluctuations**: Be prepared for seasonal changes in cash flow. Many businesses experience ebbs and flows in income throughout the year. By forecasting these fluctuations, you can set aside a reserve to cover lean periods.

The advantages of effective cash flow management are numerous. For one, it provides peace of mind. Knowing that you have a handle on your finances allows you to focus on growing your business rather than worrying about making payroll or covering bills. Additionally, it enables better decision-making. When you have a clear picture of your cash flow, you can make informed decisions about investments, hiring, and expansion opportunities.

“Cash flow is the lifeblood of your business.” 💰

| Strategy | Description |

|---|---|

| Track Your Income | Know the timing of your incoming payments. |

| Monitor Expenses | Keep a close eye on outgoing cash. |

| Plan for Fluctuations | Anticipate changes in cash flow throughout the year. |

Key Information:

– Cash flow management is crucial for survival.

– Understanding income and expenses helps prevent cash shortages.

– Prepare for fluctuations to avoid financial stress.

Financial Forecasting for Digital Entrepreneurs

Forecasting is about predicting your financial future based on historical data and market trends. It’s essential for setting realistic goals and making informed decisions. A robust Digital Entrepreneur Financial Plan incorporates forecasting to help you understand where your business is headed. By looking at past performance, you can estimate future revenues and expenses, which is crucial for strategic planning.

When I started forecasting, I used past sales data to predict future income. It was a game changer! By analyzing trends, I could anticipate peak seasons and prepare my inventory accordingly. This proactive approach helped me avoid stockouts and capitalize on high-demand periods, ultimately boosting my revenue. The ability to forecast accurately is one of the main advantages of having a financial plan.

Here are some steps for effective forecasting:

1. **Analyze Historical Data**: Look at past sales and expenses to identify patterns. This analysis will serve as the foundation for your forecasts.

2. **Research Market Trends**: Stay updated on industry changes that may affect your business. This includes understanding competitor movements, market demands, and economic factors.

3. **Create Scenarios**: Develop best-case and worst-case scenarios to prepare for various outcomes. This flexibility allows you to adapt your strategies based on real-time data and shifts in the market.

By implementing these forecasting strategies, you’ll be better equipped to make informed decisions. One of the key advantages of accurate forecasting is that it reduces uncertainty. When you know what to expect, you can plan for growth or potential downturns, allowing you to allocate resources more effectively. It also enhances your credibility with investors and stakeholders, as they appreciate a business that has a clear vision and plan for the future.

“Forecasting is not about predicting the future; it’s about preparing for it.” 🔮

| Step | Description |

|---|---|

| Analyze Historical Data | Review past performance for insights. |

| Research Market Trends | Understand industry changes that may affect you. |

| Create Scenarios | Prepare for various possible outcomes. |

Key Information:

– Forecasting helps in planning and decision-making.

– Use historical data for better predictions.

– Prepare for different scenarios to mitigate risks.

Funding Strategies for Digital Businesses

Understanding how to fund your business is crucial for growth, especially in the competitive landscape of digital entrepreneurship. Many digital entrepreneurs struggle with financing, but there are various options available to help you sustain and expand your operations. A well-crafted Digital Entrepreneur Financial Plan includes clear funding strategies that align with your business goals.

When I first started my online business, I faced significant challenges in securing funds. I explored multiple avenues, from personal savings to crowdfunding, and learned valuable lessons along the way. Each funding source has its own pros and cons, and understanding them helped me make the right choice for my business. One of the main advantages of knowing your funding options is that it allows you to plan for the future and avoid cash flow issues.

Here are some common funding sources to consider:

– **Personal Savings**: Using your own money to invest in your business is a common approach. While it carries the risk of impacting your personal finances, it also allows you to maintain full control over your business without incurring debt.

– **Crowdfunding**: Platforms like Kickstarter or Indiegogo enable you to raise money from the public. This method not only provides funds but also validates your business idea by gauging interest from potential customers.

– **Loans and Grants**: Exploring bank loans or government grants can provide substantial funding. While loans require repayment, grants are typically free money that doesn’t need to be paid back, making them an attractive option.

The advantages of having a diverse funding strategy are significant. Firstly, it enhances your business’s financial stability. By not relying solely on one funding source, you can mitigate risks associated with cash shortages. Secondly, a well-thought-out funding plan increases your credibility with investors. They are more likely to support a business that has a clear understanding of its financial needs and funding sources.

“Funding is not just about money; it’s about enabling your vision.” 🌈

| Funding Source | Description |

|---|---|

| Personal Savings | Using your own funds for business growth. |

| Crowdfunding | Collecting small amounts from many people. |

| Loans and Grants | Seeking external financial support. |

Key Information:

– Various funding sources can help your business grow.

– Each option has its own benefits and risks.

– Choosing the right funding strategy is essential for success.

Financial Literacy for Digital Entrepreneurs

Financial literacy is the ability to understand and manage your financial resources effectively. For digital entrepreneurs, this skill is crucial for making informed decisions that can impact the success of your business. A strong foundation in financial literacy will empower you to navigate the complexities of your Digital Entrepreneur Financial Plan with confidence.

When I first started out, I realized I had a lot to learn about financial management. I struggled with concepts like cash flow, profit margins, and investment planning. However, as I invested time in educating myself, I began to see significant improvements in my business’s financial health. This is one of the most significant advantages of being financially literate: it equips you to make better decisions that lead to long-term success.

Here are some key areas to focus on for improving your financial literacy:

– **Understanding Financial Statements**: Familiarize yourself with balance sheets, income statements, and cash flow statements. These documents provide valuable insights into your business’s performance and financial health.

– **Budgeting and Forecasting**: Learn how to create and maintain a budget while forecasting future revenues and expenses. This skill will help you plan for growth and manage cash flow effectively.

– **Investment Strategies**: Understanding how to invest your profits wisely can lead to significant growth. Explore different investment options and learn how to evaluate their risks and rewards.

Enhancing your financial literacy has numerous advantages. It increases your confidence in managing your business finances and allows you to communicate effectively with financial professionals, such as accountants and investors. Additionally, it helps you identify potential financial pitfalls before they become major issues. By being proactive and informed, you can set your business up for sustainable growth.

“Financial literacy is not an end; it’s a journey.” 📚

| Focus Area | Description |

|---|---|

| Understanding Financial Statements | Familiarize yourself with key financial documents. |

| Budgeting and Forecasting | Learn to create and maintain a budget. |

| Investment Strategies | Explore options for investing profits wisely. |

Key Information:

– Financial literacy is crucial for informed decision-making.

– Understanding financial statements helps in assessing performance.

– Improving financial knowledge leads to better business outcomes.

Creating a Sustainable Business Model

Building a sustainable business model is essential for long-term success in the digital landscape. A well-thought-out Digital Entrepreneur Financial Plan not only focuses on short-term profits but also ensures that your business can thrive in the future. This involves understanding your market, your customer base, and how to generate consistent revenue over time.

When I first ventured into the online business world, I was tempted to chase quick profits without considering sustainability. However, as I gained experience, I realized that focusing solely on short-term gains can be detrimental. A sustainable business model allows you to weather market fluctuations and adapt to changing consumer preferences, which is one of the key advantages of strategic planning.

Here are some steps to create a sustainable business model:

– **Identify Your Value Proposition**: Determine what makes your business unique and why customers should choose you over competitors. This clarity helps in positioning your brand effectively in the market.

– **Diversify Revenue Streams**: Relying on a single source of income can be risky. Explore different avenues for generating revenue, such as offering complementary products or services, affiliate marketing, or subscription models.

– **Focus on Customer Retention**: Acquiring new customers is important, but retaining existing ones is often more cost-effective. Implement loyalty programs, provide excellent customer service, and engage with your audience regularly to keep them coming back.

The advantages of establishing a sustainable business model are substantial. First, it enhances your resilience against economic downturns. By diversifying your revenue streams and focusing on customer loyalty, you can maintain steady cash flow even during challenging times. Second, a sustainable model attracts investors. Investors are more likely to support a business that demonstrates long-term viability and a clear strategy for growth.

“Sustainability is not a goal; it’s a way of life.” 🌍

| Step | Description |

|---|---|

| Identify Your Value Proposition | Determine what makes your business unique. |

| Diversify Revenue Streams | Explore different avenues for generating income. |

| Focus on Customer Retention | Implement strategies to keep existing customers. |

Key Information:

– A sustainable business model is essential for long-term success.

– Diversifying income sources reduces risk.

– Focusing on customer retention is more cost-effective than acquiring new customers.

Managing Recurring Payments in Digital Startups

In the realm of digital entrepreneurship, managing recurring payments is a critical component of your Digital Entrepreneur Financial Plan. Many online businesses rely on subscription models or recurring billing systems, making it essential to have a strategy in place for handling these transactions. Effective management of recurring payments ensures consistent cash flow and helps maintain customer satisfaction.

When I implemented a subscription model for one of my services, I quickly learned the importance of managing recurring payments. Initially, I faced challenges with payment processing and customer retention. However, by streamlining my payment system and communicating effectively with my customers, I was able to enhance their experience and boost my revenue. This experience highlighted one of the key advantages of properly managing recurring payments: it fosters customer loyalty and increases lifetime value.

Here are some strategies for effectively managing recurring payments:

– **Choose the Right Payment Processor**: Select a payment processor that suits your business needs. Consider factors such as fees, ease of use, and integration with your existing systems.

– **Automate Billing**: Use software to automate your billing process. Automation reduces errors and ensures that payments are collected on time, improving your cash flow.

– **Communicate with Customers**: Keep your customers informed about billing cycles, payment methods, and any changes to pricing. Clear communication builds trust and reduces the likelihood of payment disputes.

The advantages of effectively managing recurring payments are numerous. For one, it stabilizes your cash flow, making it easier to plan for expenses and investments. Additionally, a seamless payment experience enhances customer satisfaction, leading to higher retention rates. When customers feel secure and valued, they are more likely to remain loyal and refer others to your business.

“Recurring payments create a predictable revenue stream.” 💳

| Strategy | Description |

|---|---|

| Choose the Right Payment Processor | Select a processor that fits your business needs. |

| Automate Billing | Streamline the billing process to reduce errors. |

| Communicate with Customers | Keep customers informed about billing and payment. |

Key Information:

– Managing recurring payments is crucial for cash flow.

– Automation can improve efficiency and reduce errors.

– Clear communication enhances customer loyalty.

Recommendations

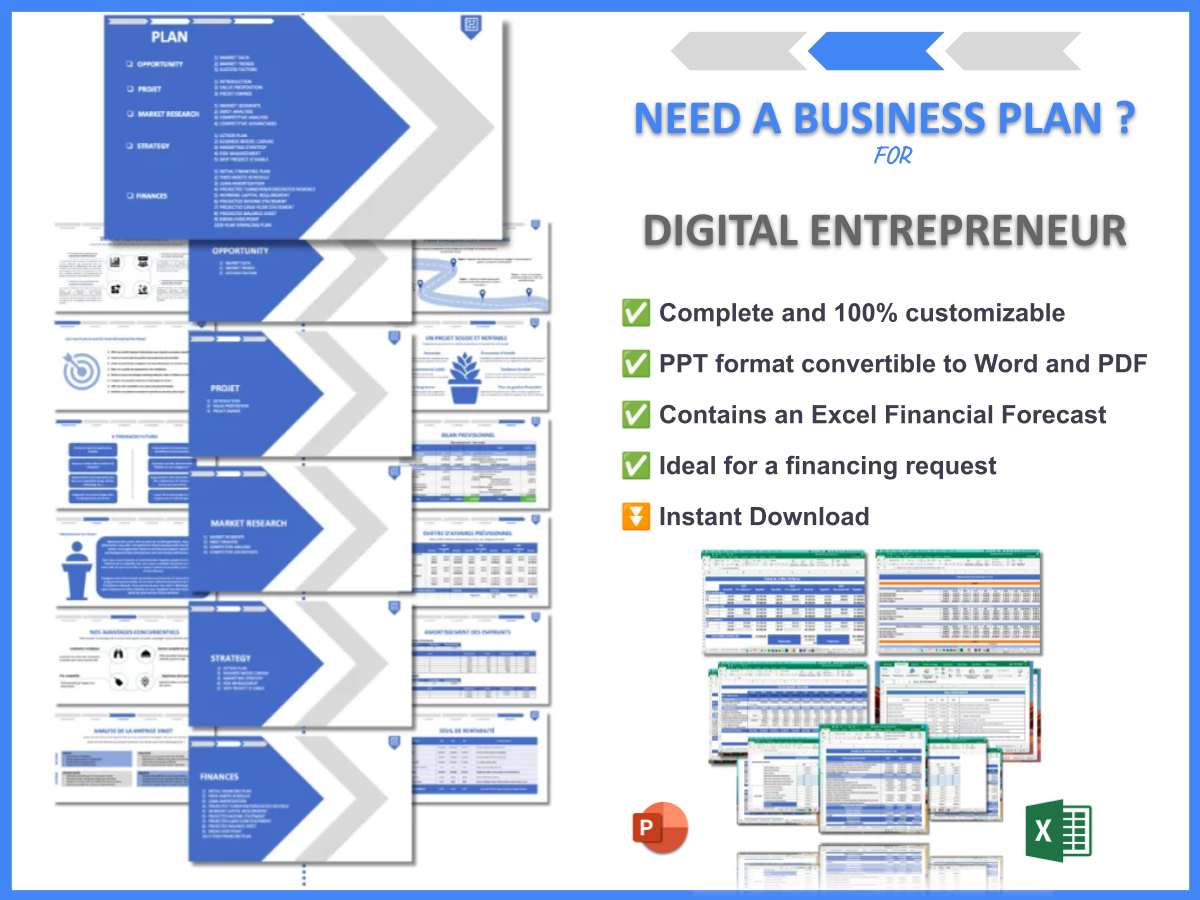

In summary, creating a comprehensive Digital Entrepreneur Financial Plan is essential for navigating the challenges of online business. This plan includes crucial components like budgeting, cash flow management, forecasting, and funding strategies, all aimed at ensuring the long-term success of your digital venture. To further assist you in your journey, consider using our Digital Entrepreneur Business Plan Template, which provides a structured approach to developing your business strategy.

Additionally, you may find the following articles valuable in expanding your knowledge and skills as a Digital Entrepreneur:

– Article 1 on Digital Entrepreneur SWOT Analysis Insights

– Article 2 on Digital Entrepreneurship: A Path to High Profits?

– Article 3 on Digital Entrepreneur Business Plan: Comprehensive Guide with Examples

– Article 4 on The Ultimate Guide to Starting a Digital Entrepreneurship: Step-by-Step Example

– Article 5 on Building a Marketing Plan for Digital Entrepreneur Services (+ Example)

– Article 6 on How to Build a Business Model Canvas for Digital Entrepreneur?

– Article 7 on Customer Segments for Digital Entrepreneurs: Who Are Your Potential Clients?

– Article 8 on How Much Does It Cost to Start a Digital Entrepreneur Business?

– Article 9 on Digital Entrepreneur Feasibility Study: Comprehensive Guide

– Article 10 on Digital Entrepreneur Risk Management: Comprehensive Strategies

– Article 11 on Digital Entrepreneur Competition Study: Essential Guide

– Article 12 on What Legal Considerations Should You Know for Digital Entrepreneur?

– Article 13 on Digital Entrepreneur Funding Options: Comprehensive Guide

– Article 14 on Digital Entrepreneur Growth Strategies: Scaling Success Stories

FAQ

How do I create a financial plan for a digital business?

To create a financial plan for your digital business, start by gathering all relevant financial information, including income sources, expenses, and assets. Next, outline your budgeting strategy, manage cash flow effectively, and set realistic financial forecasts. A structured approach will help you identify potential funding needs and ensure your business is financially sound.

What are some budgeting tips for digital entrepreneurs?

For digital entrepreneurs, budgeting is crucial for financial health. Start by setting clear financial goals and using budgeting tools to track your income and expenses. Regularly review your budget to make adjustments as necessary, ensuring that you remain on track with your financial objectives. This discipline helps prevent overspending and promotes sustainable growth.

What is cash flow management in digital businesses?

Cash flow management involves tracking the money coming in and going out of your business. For digital entrepreneurs, it is essential to understand when you receive payments and when expenses occur. By monitoring your cash flow, you can anticipate shortfalls and make informed decisions regarding investments and operational costs, ultimately ensuring your business’s financial stability.

What are the key components of a digital business financial plan?

The key components of a digital business financial plan include budgeting, cash flow management, financial forecasting, and funding strategies. Each element plays a critical role in helping you understand your financial health and make informed decisions. A comprehensive financial plan allows you to set realistic goals and develop strategies to achieve them.

How can I improve my financial literacy as a digital entrepreneur?

Improving your financial literacy involves familiarizing yourself with key financial concepts, such as understanding financial statements, budgeting, and investment strategies. Consider taking online courses, reading books, or following financial blogs that focus on entrepreneurship. The more you learn about managing finances, the better equipped you will be to make informed decisions for your business.

What are the funding options available for digital entrepreneurs?

Digital entrepreneurs have various funding options, including personal savings, crowdfunding, loans, and grants. Each option has its advantages and disadvantages, so it’s essential to evaluate which sources align best with your business goals and financial needs. Diversifying your funding sources can enhance financial stability and reduce risk.