The dropshipper financial plan is your roadmap to success in the e-commerce world. It’s a strategic document that outlines how to manage your finances while running a dropshipping business. If you think about it, having a solid financial plan is like having a GPS for your business journey; it helps you navigate through costs, profits, and everything in between. Without it, you might find yourself lost, struggling to make ends meet, or worse, running into debt without even knowing how it happened.

A dropshipper financial plan is essential for anyone looking to thrive in the competitive landscape of online retail. Here are some vital aspects that this plan should cover:

- Startup costs and budgeting.

- Monthly expenses and cash flow.

- Profit margins and pricing strategies.

- Financial forecasting and projections.

- Tools and templates to simplify planning.

Understanding the Basics of a Dropshipper Financial Plan

Creating a dropshipper financial plan is crucial for anyone looking to start or grow a dropshipping business. It involves analyzing your costs, understanding your revenue streams, and making informed decisions to ensure profitability. Many new dropshippers overlook this step, thinking they can wing it. But trust me, without a financial plan, you might find yourself lost and struggling to make ends meet.

For example, when I started my dropshipping venture, I underestimated my monthly expenses, which included everything from Shopify fees to shipping costs. By the end of the first month, I was shocked to see how much I spent versus what I earned. This experience taught me the importance of having a clear financial plan right from the start. Without it, I could have easily run into cash flow issues that could jeopardize my business.

One of the biggest advantages of having a dropshipper financial plan is that it provides a clear picture of your financial health. You can track your income and expenses, which helps you set realistic sales goals. Additionally, a financial plan can help you identify potential pitfalls before they become significant issues. For instance, understanding your startup costs can prevent you from overspending on unnecessary items and help you allocate resources more effectively.

| Key Components | Description |

|---|---|

| Startup Costs | Initial investments required to start your business. |

| Monthly Expenses | Regular costs incurred during operation. |

| Revenue Streams | Different ways your business can earn money. |

| Profit Margins | The difference between your sales price and costs. |

- A financial plan helps track income and expenses.

- It aids in setting realistic sales goals.

- Planning reduces financial stress and uncertainty.

“A goal without a plan is just a wish.” - Antoine de Saint-Exupéry 😊

In summary, a dropshipper financial plan is not just a document; it’s an essential tool that can guide your business decisions and set you on a path to success. By understanding your costs and potential revenue, you can create a roadmap that leads to sustainable growth and profitability. As you move forward in your dropshipping journey, keep this plan updated and refer back to it regularly. It will be your ally in making informed decisions and achieving your business goals.

Setting Up Your Dropshipping Budget Template

Having a budget is like having a safety net; it ensures that you know exactly where your money is going. A dropshipping budget template can help you track your income, expenses, and profits in a structured way. This is particularly important in a business model like dropshipping, where margins can be thin and unexpected costs can arise at any moment. By setting up a budget template, you can have a clearer view of your financial landscape and make informed decisions.

When I first created my budget template, I included all the necessary categories, such as marketing costs, product sourcing, and operational expenses. This approach helped me visualize my financial situation and adjust my strategies accordingly. The key is to update this template regularly to reflect any changes in your business or market conditions. For instance, if you notice a spike in advertising costs due to a seasonal promotion, adjusting your budget accordingly can help you maintain profitability.

One of the advantages of having a well-structured dropshipping budget template is that it allows you to allocate funds wisely across all categories. This helps you identify areas where you might be overspending and where you can cut back. For example, if you find that your shipping expenses are higher than expected, you might want to explore different suppliers or shipping options to reduce costs. A budget template also enables you to set aside funds for unforeseen expenses, ensuring that your business remains agile and capable of adapting to changes.

| Budget Category | Amount Allocated |

|---|---|

| Marketing | $200/month |

| Product Sourcing | $300/month |

| Operational Costs | $150/month |

- Allocate funds wisely across all categories.

- Regularly review and adjust your budget.

- Keep track of unexpected expenses.

“Budgeting isn't about limiting yourself—it's about making the things that excite you possible.” 💰

Calculating Your Dropshipping Profit Margins

Understanding your profit margins is vital for the sustainability of your dropshipping business. The profit margin is the percentage of revenue that exceeds your costs, and knowing this helps you set competitive prices while ensuring profitability. Calculating your profit margins is not just a number-crunching exercise; it’s a crucial aspect of your financial strategy that can dictate your long-term success.

When I realized my profit margins were lower than expected, I had to reevaluate my pricing strategy. I found that certain suppliers had hidden fees that ate into my profits. By adjusting my pricing to reflect these costs while remaining competitive, I was able to improve my margins significantly. For example, if your product sells for $50, but your total cost (including shipping, supplier fees, and advertising) is $30, your profit margin is 40%. Knowing this number helps you determine how much you can invest in marketing while still making a profit.

Another advantage of understanding your dropped shipping profit margins is that it allows you to make informed decisions about scaling your business. If you know your margins are healthy, you might decide to invest more in advertising or explore new product lines. On the other hand, if your margins are tight, it might be time to reassess your business model or look for more cost-effective suppliers. Additionally, regularly calculating your profit margins can help you spot trends in your business, allowing you to pivot quickly if necessary.

| Revenue | Costs | Profit Margin |

|---|---|---|

| $1,000 | $600 | 40% |

- Regularly calculate your profit margins.

- Adjust pricing based on supplier costs and market demand.

- Understand the difference between gross and net profit.

“Profit is not just about making money; it’s about making a difference.” 💡

Monthly Expenses Every Dropshipper Should Consider

Managing monthly expenses is crucial for maintaining a healthy cash flow in your dropshipping business. As a dropshipper, you have various recurring expenses that need to be accounted for. This includes everything from your e-commerce platform fees to advertising costs. Being aware of these expenses helps you avoid unexpected financial pitfalls and ensures that your business remains profitable.

When I first sat down to list my monthly expenses, I was surprised by how many little costs added up. For example, I hadn’t initially considered the cost of returns, which can eat into your profits if not managed properly. By creating a comprehensive list of all my monthly expenses, I was able to identify areas where I could cut costs and optimize my spending. This experience highlighted the importance of tracking these expenses closely to avoid any financial surprises.

One of the key advantages of keeping an eye on your monthly expenses is that it enables you to make informed decisions about your business operations. For instance, if you find that your advertising expenses are significantly higher than your sales, it may be time to rethink your marketing strategy. Additionally, understanding your monthly expenses can help you set realistic sales targets and financial goals. This way, you can ensure that your business remains on a steady path toward growth.

| Expense Type | Estimated Monthly Cost |

|---|---|

| Shopify Subscription | $29 |

| Marketing/Ads | $200 |

| Shipping Costs | $150 |

- Keep a detailed list of all monthly expenses.

- Monitor and adjust expenses as needed.

- Consider using accounting software for better tracking.

“The secret to getting ahead is getting started.” - Mark Twain 🚀

Cash Flow Planning for Dropshippers

Cash flow is the lifeblood of any business. It’s essential to ensure that you have enough cash to cover your expenses while investing in growth opportunities. A cash flow plan helps you visualize when money comes in and goes out, allowing you to make informed financial decisions. For dropshippers, where timing can significantly affect operations, having a clear cash flow plan is crucial.

I once faced a cash flow crisis when I didn’t anticipate a large order. My supplier required upfront payment, and I had not budgeted for that. This experience highlighted the need for proactive cash flow planning. By forecasting my cash flow based on expected sales and expenses, I could avoid similar situations in the future. A cash flow plan allows you to predict shortfalls and take corrective action before they become significant problems.

Another advantage of having a well-structured cash flow plan is that it enables you to identify trends in your income and expenses. For example, if you notice that sales tend to dip during certain months, you can prepare for that by adjusting your marketing strategies or cutting back on non-essential expenses. Understanding your cash flow can also help you make informed decisions about when to invest in inventory or marketing campaigns, ensuring that you maximize your return on investment.

| Cash Inflows | Cash Outflows |

|---|---|

| Sales Revenue | Operating Expenses |

| Investment Income | Supplier Payments |

- Regularly forecast cash flow to anticipate needs.

- Maintain a buffer for unexpected expenses.

- Use cash flow management tools for tracking.

“Cash flow is king!” 👑

Financial Forecasting for Dropshippers

Financial forecasting is a crucial aspect of your dropshipper financial plan. It involves predicting your future financial outcomes based on historical data and market trends. This is particularly important in the fast-paced world of e-commerce, where changes can happen overnight. By understanding how to forecast your finances, you can set realistic sales targets and budget accordingly, ensuring that your business remains viable and profitable.

When I started forecasting my finances, I used past sales data to estimate future revenue. This exercise provided me with a clearer picture of what to expect and helped me set attainable goals. For example, if I noticed that my sales typically increase during holiday seasons, I could prepare by increasing my inventory or ramping up my marketing efforts in advance. This proactive approach allowed me to capitalize on peak sales periods rather than scrambling to catch up.

One of the major advantages of financial forecasting is that it helps you identify potential challenges before they arise. For instance, if your forecast indicates a dip in sales, you can take action to mitigate the impact, such as adjusting your marketing strategies or exploring new revenue streams. Additionally, accurate forecasting can enhance your credibility with potential investors or lenders, as it shows that you have a clear understanding of your business and its financial needs.

| Forecast Period | Expected Revenue | Expected Expenses |

|---|---|---|

| Q1 | $5,000 | $3,000 |

| Q2 | $6,000 | $3,500 |

- Use historical data for accurate forecasting.

- Update forecasts regularly based on market changes.

- Adjust business strategies based on forecast outcomes.

“Forecasting is about understanding the future through the lens of the present.” 🔮

Tools and Resources for Dropshipper Financial Planning

There are numerous tools available to help you with your dropshipper financial plan. From budgeting templates to accounting software, these resources can simplify the process and keep your finances organized. Having the right tools not only saves you time but also enhances your ability to make informed decisions based on accurate data.

I started using accounting software early on, and it made a world of difference. It helped me automate many tasks, from tracking expenses to generating financial reports. For instance, tools like QuickBooks or FreshBooks allow you to categorize your expenses, making it easier to see where your money is going. This level of organization helps you identify trends and adjust your strategies accordingly.

One of the key advantages of using financial planning tools is that they often come with built-in analytics features. These features can provide insights into your business performance, such as identifying your most profitable products or highlighting areas where you can cut costs. Additionally, many tools integrate with your e-commerce platform, allowing for seamless data transfer and more accurate reporting.

| Tool Type | Recommended Tool |

|---|---|

| Budgeting Software | QuickBooks |

| Accounting Software | FreshBooks |

| Profit Tracking | Shopify Analytics |

- Choose tools that fit your business needs.

- Regularly update and maintain your financial records.

- Leverage technology to streamline financial processes.

“The right tools can turn a challenging task into a simple one.” 🛠️

Understanding Dropshipping Key Performance Indicators (KPIs)

To ensure the success of your dropshipping business, it’s essential to track your performance through various Key Performance Indicators (KPIs). These metrics provide valuable insights into how well your business is performing and where improvements can be made. KPIs can help you make informed decisions based on data rather than guesswork, ultimately leading to increased profitability and efficiency.

When I first started tracking my KPIs, I was amazed at how much information I could gather from a few simple metrics. For example, monitoring my conversion rate helped me understand how many visitors were making purchases on my site. This insight allowed me to adjust my marketing strategies and website design to improve the shopping experience, ultimately leading to higher sales. Additionally, keeping an eye on my customer acquisition cost (CAC) helped me evaluate the effectiveness of my advertising campaigns. By reducing CAC, I could allocate more budget to profitable channels and increase my overall return on investment.

Some of the critical KPIs that every dropshipper should track include:

- Conversion Rate: The percentage of visitors who make a purchase.

- Average Order Value (AOV): The average amount spent by customers per transaction.

- Customer Acquisition Cost (CAC): The total cost of acquiring a new customer.

- Return on Ad Spend (ROAS): The revenue generated for every dollar spent on advertising.

By regularly monitoring these KPIs, you can gain a clearer understanding of your business’s health and make data-driven decisions. For instance, if your conversion rate is low, it may indicate that your website needs optimization or that your marketing messages are not resonating with your target audience. Identifying such issues early can save you time and money in the long run.

| KPI | Description |

|---|---|

| Conversion Rate | Percentage of visitors who make a purchase. |

| Average Order Value (AOV) | Average amount spent per transaction. |

“What gets measured gets managed.” - Peter Drucker 📊

Leveraging Financial Templates for Dropshippers

Using financial templates can simplify the process of managing your dropshipper financial plan. Templates provide a structured format that helps you organize your data efficiently, allowing for easy tracking and analysis. Whether you’re budgeting, forecasting, or tracking expenses, having a template can save you time and reduce the risk of errors.

When I discovered financial templates designed specifically for dropshipping, it revolutionized my approach to financial planning. For example, a well-designed dropped shipping budget template allowed me to input my expenses and income in a straightforward manner. This clarity helped me quickly identify areas where I could cut costs or adjust my pricing strategy. Additionally, templates for financial forecasting helped me visualize my expected revenue and expenses over the coming months, allowing me to plan for seasonal fluctuations in sales.

One of the major advantages of leveraging financial templates is that they can be customized to fit your specific business needs. Whether you’re looking for a simple budget tracker or a comprehensive financial forecasting tool, there are numerous templates available online. Many of these templates come with built-in formulas that automatically calculate totals and percentages, reducing the time you spend on manual calculations.

| Template Type | Purpose |

|---|---|

| Budget Template | Track income and expenses. |

| Forecasting Template | Predict future financial performance. |

- Choose templates that fit your business model.

- Regularly update your templates to reflect current data.

- Use templates to streamline your financial processes.

“Templates are the skeleton of your financial success.” 🏗️

Recommendations

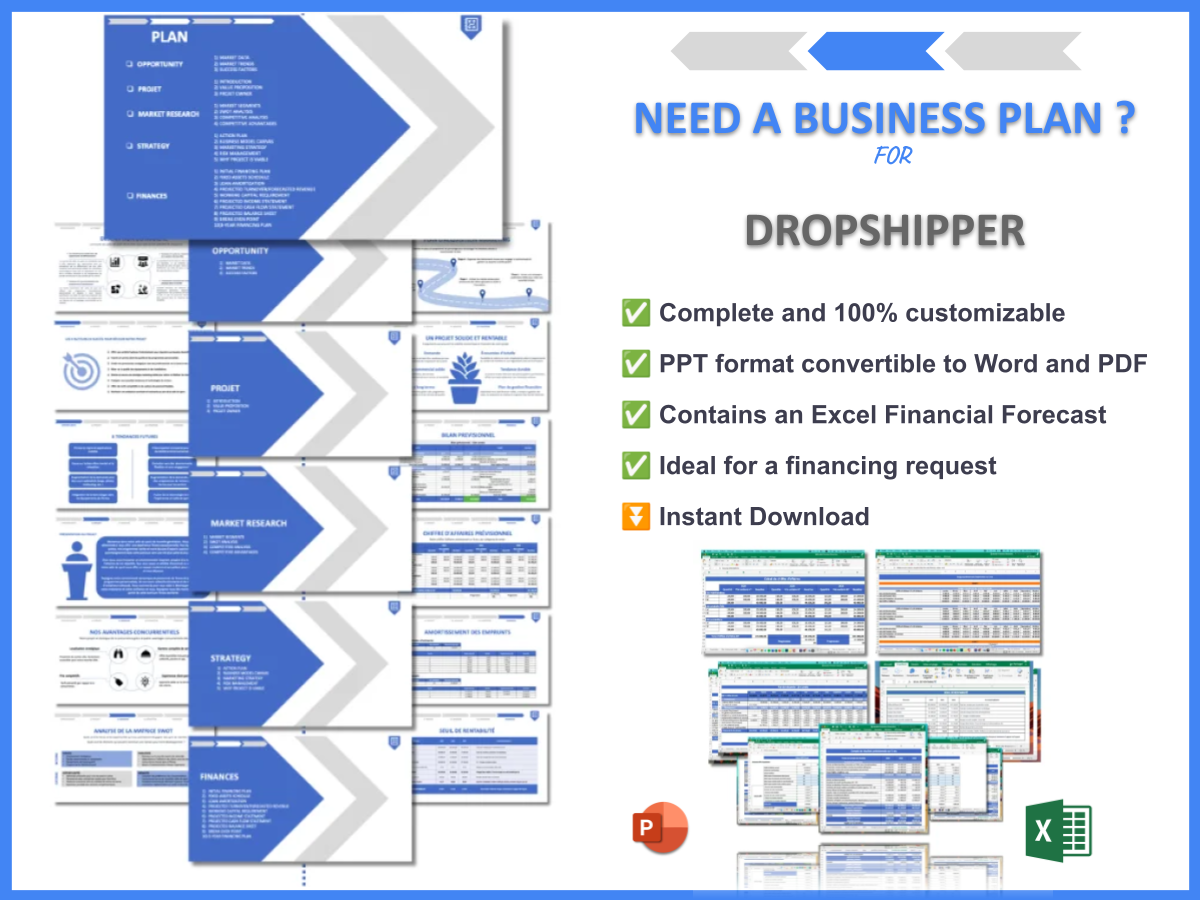

In summary, creating a comprehensive dropshipper financial plan is essential for navigating the complexities of the dropshipping business model. This plan not only helps you manage your finances but also enables you to make informed decisions that can lead to increased profitability and growth. For those looking for a structured approach, we recommend using a Dropshipper Business Plan Template that provides a solid foundation for your financial planning.

Additionally, to further enhance your understanding of dropshipping, we encourage you to explore the following articles:

- Dropshipper SWOT Analysis – Key Insights Revealed

- Dropshippers: How to Achieve High Profits

- Dropshipper Business Plan: Comprehensive Guide with Examples

- The Ultimate Guide to Starting a Dropshipping Business: Step-by-Step Example

- Crafting a Marketing Plan for Your Dropshipper Business (+ Example)

- Create a Business Model Canvas for Dropshipper: Examples and Tips

- Customer Segments for Dropshippers: Examples and Analysis

- How Much Does It Cost to Start a Dropshipper Business?

- Dropshipper Feasibility Study: Detailed Analysis

- Dropshipper Risk Management: Detailed Analysis

- Ultimate Guide to Dropshipper Competition Study

- How to Navigate Legal Considerations in Dropshipper?

- Dropshipper Funding Options: Expert Insights

- Dropshipper Growth Strategies: Scaling Success Stories

FAQ

How do I create a dropshipping business plan?

To create a successful dropshipping business plan, begin by outlining your business objectives, target market, and financial projections. Include sections on startup costs, monthly expenses, and a marketing strategy. Utilizing a structured template can streamline this process and ensure you cover all essential aspects.

What should be included in a dropshipping budget template?

A comprehensive dropped shipping budget template should include categories for product sourcing costs, shipping expenses, marketing costs, and operational fees. This allows you to track your financial performance and make adjustments as needed.

How can I calculate my dropshipping profit margins?

To calculate your dropped shipping profit margins, subtract your total costs (including product costs, shipping, and fees) from your sales revenue. Divide the result by your sales revenue and multiply by 100 to get a percentage. This will give you a clear view of your profitability.

What are the key performance indicators for dropshippers?

Key performance indicators (KPIs) for dropshippers include conversion rates, average order value, customer acquisition costs, and return on ad spend. Monitoring these metrics helps you assess your business’s health and identify areas for improvement.

How do I manage my dropshipping cash flow?

Managing dropped shipping cash flow involves forecasting your cash inflows and outflows to ensure you have enough liquidity to cover expenses. Regularly review your cash flow statements and adjust your budgeting to account for seasonal fluctuations in sales.

What tools can I use for dropshipping financial planning?

Several tools can assist with dropped shipping financial planning, including accounting software like QuickBooks and budgeting tools. These resources can help you track your income, expenses, and profits more effectively, allowing for better decision-making.