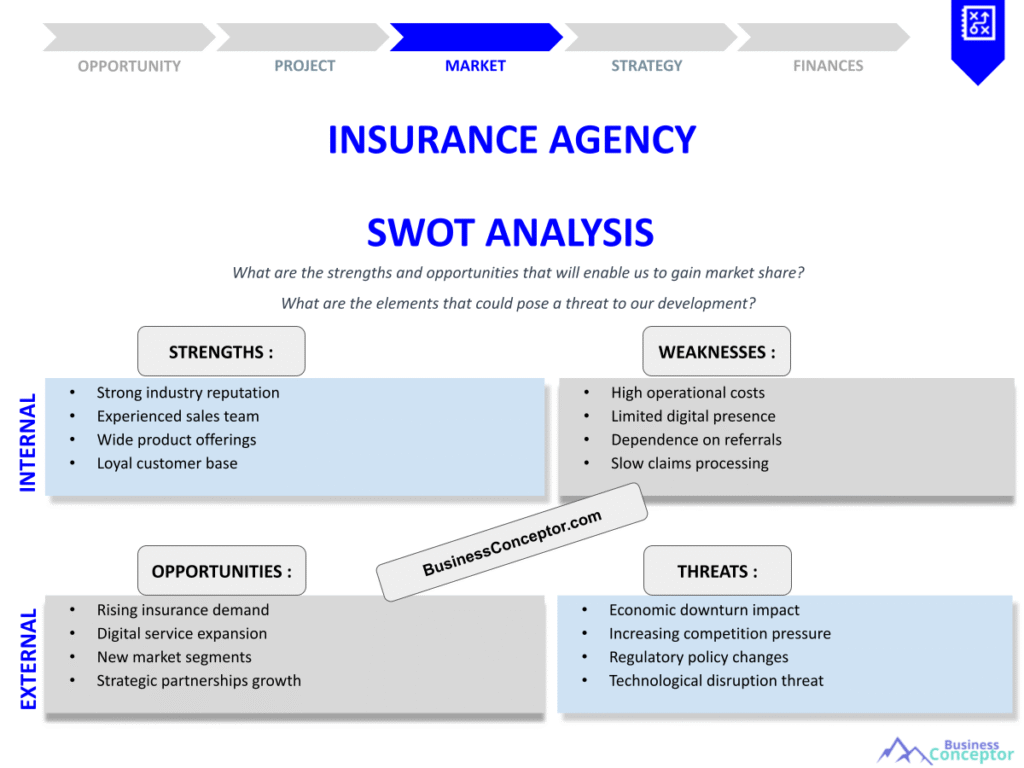

Did you know that a well-crafted Insurance Agency SWOT Analysis can be the secret sauce that helps insurance agencies thrive in a competitive market? An Insurance Agency SWOT Analysis dives deep into the strengths, weaknesses, opportunities, and threats that impact an insurance agency’s performance. This strategic tool not only helps you understand where you stand but also guides you in making informed decisions to grow your business. Here’s what you’ll discover in this article:

– What a SWOT analysis is and why it’s crucial for insurance agencies.

– How to identify your agency’s strengths and weaknesses.

– The opportunities and threats present in the current insurance market.

– Real-life examples and strategies to effectively implement a SWOT analysis in your agency.

Understanding the Basics of SWOT Analysis

SWOT analysis is a strategic planning technique that helps businesses identify internal and external factors affecting their operations. For insurance agencies, this analysis is particularly vital as it provides insights into how to navigate an ever-evolving market landscape. It can help you pinpoint what makes your agency stand out and where you might be falling short. The SWOT framework for insurance companies is not just a formality; it’s a roadmap that can lead to informed decision-making and strategic planning.

When conducting a SWOT analysis, it’s essential to engage various stakeholders in your agency, including agents, management, and even clients. This diverse input can yield a more comprehensive understanding of your agency’s positioning. The beauty of the SWOT methodology is that it fosters collaboration, allowing team members to contribute insights from their unique perspectives. For example, while management may focus on financial metrics, frontline agents can provide valuable insights into customer expectations and market trends.

Additionally, identifying your agency’s strengths is crucial for leveraging competitive advantages. Strong customer relationships, a robust reputation, or specialized expertise can differentiate you from competitors. On the other hand, recognizing weaknesses allows you to address gaps in your service or operational inefficiencies. For instance, if you discover that your agency struggles with technology adoption, you can prioritize investing in modern tools to enhance service delivery.

| Category | Description |

|---|---|

| Strengths | Unique aspects that give your agency a competitive edge, like customer service excellence or specialized products. |

| Weaknesses | Areas needing improvement, such as limited online presence or lack of specialized staff. |

| Opportunities | Market trends you can capitalize on, like digital transformation or emerging customer needs. |

| Threats | External challenges, including regulatory changes or increased competition. |

Key Takeaways:

– SWOT analysis is essential for strategic planning.

– Engaging stakeholders enriches the analysis.

– Identifying strengths and weaknesses helps in decision-making.

“Knowing yourself is the beginning of all wisdom.” - Aristotle 😊

Identifying Strengths and Weaknesses

Every insurance agency has its own unique set of strengths and weaknesses. Understanding these can set the groundwork for making smart, strategic choices that can lead to sustainable growth. Identifying your agency’s strengths is essential because these are the qualities that give you a competitive edge in the crowded insurance market. For instance, if your agency is known for exceptional customer service, that’s a strength you can leverage in your marketing efforts. Happy clients often lead to referrals, which are invaluable in the insurance business.

On the flip side, acknowledging your weaknesses is equally important. This could include areas where your agency struggles, such as a limited online presence or outdated technology. I remember working with a small agency that had a stellar reputation for face-to-face interactions but lagged in digital engagement. They had a fantastic team, but their website was not optimized for mobile, and they were missing out on a younger demographic that prefers online communication. This situation highlighted the need for a balanced approach where both strengths and weaknesses are addressed. By recognizing these weaknesses, your agency can create targeted strategies to improve. For example, investing in a user-friendly website or implementing a digital marketing strategy could transform your agency’s outreach.

To effectively utilize the SWOT analysis for insurance business, it’s beneficial to gather input from various stakeholders. Engaging agents, management, and even clients can offer a well-rounded perspective on what your agency excels at and where it needs improvement. Regular brainstorming sessions can help your team discuss these aspects openly. The insights gathered can then be documented, allowing you to create a clear picture of your agency’s positioning in the market.

| Strengths | Weaknesses |

|---|---|

| Strong local reputation | Limited online marketing efforts |

| Experienced and knowledgeable staff | Outdated technology |

| High customer retention rates | Inefficient claims processing |

Key Takeaways:

– Recognize your agency’s unique strengths.

– Don’t shy away from identifying weaknesses.

– Use this information to create actionable strategies.

“Strength lies in differences, not in similarities.” - Stephen R. Covey 🌟

Exploring Opportunities in the Market

Opportunities in the insurance market can be a goldmine for agencies willing to adapt and innovate. With the rise of digital technology, many agencies are leveraging online platforms to reach customers more effectively. Have you thought about how you can use social media or email marketing to connect with potential clients? For example, I once worked with an agency that launched an online quote tool. This not only attracted more leads but also streamlined the quoting process, making it easier for customers to engage with us. The agency saw a significant increase in inquiries, demonstrating the effectiveness of embracing digital tools.

Additionally, the growing demand for personalized products is another opportunity worth exploring. Consumers today are looking for insurance solutions that cater specifically to their needs. For instance, if you can offer tailored coverage options based on individual risk profiles, you could stand out in the market. Implementing data analytics can help you understand your clients better and create customized solutions that meet their specific needs. By staying attuned to market trends, your agency can develop innovative products that address evolving customer expectations.

Moreover, there are emerging markets that many agencies overlook. Expanding into underserved regions or niche markets can provide significant growth opportunities. For example, targeting young professionals with specific insurance needs or focusing on new homeowners can help you capture a demographic that is often ignored. Conducting thorough market research will allow you to identify these gaps and develop strategies to fill them effectively.

| Opportunities | Examples |

|---|---|

| Digital transformation | Implementing online quote tools |

| Growing demand for personalized products | Tailoring coverage based on individual needs |

| Expansion into underserved markets | Targeting niche markets with specific offerings |

Key Takeaways:

– Stay updated on digital trends.

– Tailor products to meet customer needs.

– Explore niche markets for expansion.

“Opportunities don't happen. You create them.” - Chris Grosser 🚀

Recognizing Threats in the Industry

Every insurance agency must also be aware of the threats that could derail its success. These threats can range from regulatory changes to competitive pressures. For instance, new regulations might require additional compliance measures, straining your resources and potentially impacting profitability. It’s essential to stay informed about legislative changes that affect the insurance sector, as non-compliance can lead to hefty fines or damage your agency’s reputation. In my experience, I once worked at an agency that faced significant challenges when new regulations were introduced, requiring us to overhaul our processes. While it was challenging, it also pushed us to become more efficient and improve our client service.

Another significant threat is the increasing competition in the insurance market. With more players entering the field, especially with the rise of digital-only insurance providers, traditional agencies must find ways to differentiate themselves. This means understanding your unique value proposition and effectively communicating it to your target audience. For example, if your agency specializes in a particular niche, such as life insurance or commercial policies, you can leverage that specialization to attract clients who are seeking expert advice. It’s all about finding your unique angle in a crowded marketplace.

Moreover, external factors such as economic downturns can also pose a threat to your agency’s success. When the economy falters, consumers tend to be more cautious with their spending, often leading to reduced demand for insurance products. It’s crucial to have contingency plans in place to navigate these challenges. For instance, offering flexible payment plans or bundling services can make your products more appealing during tough economic times. By preparing for potential downturns, your agency can better weather the storm and maintain customer loyalty.

| Threats | Examples |

|---|---|

| Increased competition | New entrants in the market |

| Regulatory changes | New compliance requirements |

| Economic downturns | Reduced consumer spending |

Key Takeaways:

– Stay informed about industry regulations.

– Analyze your competition regularly.

– Develop contingency plans for economic fluctuations.

“In the middle of difficulty lies opportunity.” - Albert Einstein 🌈

Implementing Your SWOT Analysis

Now that you’ve identified your agency’s strengths, weaknesses, opportunities, and threats, it’s time to put this knowledge into action. Implementing your SWOT analysis effectively can create a roadmap for your agency’s future. Start by prioritizing the areas that need immediate attention. For instance, if you’ve identified a weakness in your online presence, consider investing in a comprehensive digital marketing strategy. This could involve revamping your website, optimizing for search engines, or utilizing social media platforms to reach a broader audience.

Creating a strategic plan based on your SWOT analysis can help you allocate resources effectively. It’s all about using what you’ve learned to drive growth and improve your agency’s performance. For example, if your analysis shows that you have a strong reputation but lack digital engagement, you can focus on enhancing your online visibility while maintaining your excellent customer service. This balanced approach will allow you to leverage your strengths while addressing areas that need improvement.

Furthermore, it’s essential to involve your team in the implementation process. By engaging your staff, you not only foster a sense of ownership but also benefit from their insights and experiences. Consider organizing workshops or brainstorming sessions where team members can contribute ideas on how to implement the strategies derived from your SWOT analysis. This collaborative approach can lead to innovative solutions that might not have been considered otherwise.

| Action Steps | Examples |

|---|---|

| Develop a marketing strategy | Invest in SEO and social media campaigns |

| Address weaknesses | Upgrade technology and training for staff |

| Leverage strengths | Promote your agency’s unique offerings |

| Prepare for threats | Develop compliance and risk management plans |

Key Takeaways:

– Prioritize areas for improvement.

– Develop actionable strategies based on your findings.

– Use strengths to counteract weaknesses and threats.

“Success usually comes to those who are too busy to be looking for it.” - Henry David Thoreau 🌟

Evaluating and Revising Your SWOT Analysis

It’s essential to continuously evaluate and revise your SWOT analysis. The insurance market is constantly changing, so what worked last year may not be effective today. Regularly reviewing your SWOT analysis can help you adapt and stay ahead of the competition. I’ve learned the hard way that neglecting to update our strategies can lead to missed opportunities. Make it a habit to revisit your SWOT analysis at least once a year, or even more frequently if significant changes occur in the market.

One effective way to evaluate your SWOT analysis is to set specific benchmarks for success. For instance, if you identified a weakness in your online presence, you could track website traffic, social media engagement, and conversion rates over time. By establishing measurable goals, you can assess whether the strategies you implemented are having the desired effect. This data-driven approach can help you identify what’s working and what needs adjustment.

In addition to tracking your progress, gathering feedback from stakeholders is crucial for refining your SWOT analysis. Engaging your team in discussions about the analysis can provide new insights and highlight areas that may need further exploration. For example, frontline agents may have firsthand experience with customer feedback that reveals trends you hadn’t previously considered. This collaborative approach can lead to a more comprehensive understanding of your agency’s strengths and weaknesses, ultimately leading to more effective strategies.

| Evaluation Steps | Actions |

|---|---|

| Schedule regular reviews | Set quarterly meetings to discuss SWOT findings |

| Adapt to market changes | Update strategies based on new opportunities |

| Gather feedback | Involve staff and clients in the evaluation process |

Key Takeaways:

– Regularly review your SWOT analysis.

– Adapt to changes in the market.

– Involve stakeholders in the evaluation process.

“The measure of intelligence is the ability to change.” - Albert Einstein 🔄

Creating a Strategic Action Plan

Once you’ve completed your SWOT analysis and gathered insights from your evaluations, the next step is to create a strategic action plan. This plan will serve as a roadmap for your agency, guiding your decision-making and resource allocation. Start by outlining specific goals based on your findings. For instance, if your analysis revealed a strong opportunity in the digital space, your action plan might include goals for enhancing your online marketing efforts or developing new digital products.

It’s essential to break down these goals into actionable steps. For example, if one of your goals is to improve your agency’s online presence, your action steps might include redesigning your website, creating a content marketing strategy, and investing in social media advertising. By outlining clear, actionable steps, you make it easier for your team to understand what needs to be done and how they can contribute to achieving these goals.

Additionally, consider assigning responsibilities for each action item to specific team members. This accountability not only ensures that tasks are completed but also fosters a sense of ownership among your staff. Regular check-ins can help keep everyone on track and provide opportunities to discuss any challenges that may arise. For example, if a team member is struggling with a particular task, they can seek assistance or collaborate with others to find solutions.

| Action Plan Components | Examples |

|---|---|

| Set specific goals | Increase online leads by 30% in six months |

| Outline actionable steps | Launch a social media campaign targeting millennials |

| Assign responsibilities | Designate a team member to oversee website updates |

Key Takeaways:

– Create a strategic action plan based on your SWOT analysis.

– Break down goals into actionable steps.

– Assign responsibilities to ensure accountability.

“Plans are nothing; planning is everything.” - Dwight D. Eisenhower 📈

Leveraging Your SWOT Analysis for Growth

Once you have your SWOT analysis and strategic action plan in place, the next step is to leverage these tools for growth. Utilizing your SWOT analysis effectively can help your insurance agency make informed decisions that promote long-term success. Start by focusing on your identified strengths. For instance, if your agency is known for its excellent customer service, consider how you can enhance this reputation further. You might implement customer feedback systems to gather insights on service satisfaction or introduce loyalty programs that reward long-term clients. This not only strengthens customer relationships but also attracts new clients who are drawn to your agency’s positive reputation.

Additionally, addressing your weaknesses is critical for sustainable growth. If your SWOT analysis revealed that your agency has limited digital presence, take proactive steps to improve it. This could involve investing in a user-friendly website, optimizing it for search engines, and engaging with clients on social media platforms. As you enhance your online visibility, you can tap into a broader audience and create new revenue streams. A well-executed digital marketing strategy can significantly increase your leads and conversions, ultimately leading to business growth.

Moreover, seizing opportunities identified in your SWOT analysis is essential. For instance, if your analysis indicates a growing demand for personalized insurance products, consider developing tailored offerings that meet specific customer needs. You might use data analytics to segment your market and create targeted marketing campaigns. By staying ahead of industry trends and adapting your offerings accordingly, your agency can become a leader in innovation within the insurance sector.

| Growth Strategies | Examples |

|---|---|

| Enhance customer service | Implement feedback systems and loyalty programs |

| Improve digital presence | Invest in website optimization and social media engagement |

| Develop personalized products | Create tailored offerings based on customer data |

Key Takeaways:

– Leverage strengths to enhance customer relationships.

– Address weaknesses to improve overall performance.

– Seize opportunities to innovate and expand your offerings.

“Success is not just about what you accomplish in your life, it's about what you inspire others to do.” - Unknown 🌟

Communicating Your SWOT Analysis Insights

Finally, effectively communicating the insights from your SWOT analysis is crucial for ensuring that all team members are aligned and working toward the same goals. Begin by sharing the findings with your entire team, ensuring that everyone understands the implications of the SWOT analysis on their roles. This transparency fosters a culture of collaboration and allows team members to see how their contributions fit into the broader strategic framework.

Consider organizing workshops or meetings where you can discuss the SWOT analysis findings in detail. Encourage open dialogue and solicit feedback from your team. This can lead to new ideas and strategies that you may not have considered. By involving your staff in the discussion, you empower them to take ownership of the strategies and initiatives that emerge from the analysis.

Moreover, keep the lines of communication open as you implement your action plan. Regular updates on progress and challenges can help maintain momentum and motivate your team. For example, consider setting up a shared dashboard that tracks the progress of various initiatives derived from your SWOT analysis. This not only keeps everyone informed but also creates accountability as team members can see how their efforts contribute to the overall success of the agency.

| Communication Strategies | Examples |

|---|---|

| Share findings with the team | Organize workshops to discuss SWOT analysis |

| Encourage open dialogue | Solicit feedback during meetings |

| Provide regular updates | Create a shared dashboard for tracking progress |

Key Takeaways:

– Communicate SWOT analysis insights with your team.

– Foster a culture of collaboration and ownership.

– Keep the communication open during the implementation process.

“The art of communication is the language of leadership.” - James Humes 🗣️

Recommendations

In summary, conducting a thorough Insurance Agency SWOT Analysis is essential for understanding your agency’s position in the market. By identifying your strengths, weaknesses, opportunities, and threats, you can create a strategic action plan that drives growth and enhances your agency’s performance. To help you further, we recommend checking out the Insurance Agency Business Plan Template. This template provides a solid foundation for structuring your business plan effectively.

Additionally, we encourage you to explore our related articles on Insurance Agency topics that can provide valuable insights and strategies:

- Insurance Agencies: How Profitable Can They Be?

- Insurance Agency Business Plan: Comprehensive Guide with Examples

- Insurance Agency Financial Plan: Essential Steps and Example

- Starting an Insurance Agency: A Comprehensive Guide with Examples

- Create a Marketing Plan for Your Insurance Agency (+ Example)

- Building a Business Model Canvas for an Insurance Agency: Examples and Tips

- Customer Segments for Insurance Agencies: Examples and Analysis

- How Much Does It Cost to Operate an Insurance Agency?

- What Are the Steps for a Successful Insurance Agency Feasibility Study?

- What Are the Key Steps for Risk Management in Insurance Agency?

- What Are the Steps for a Successful Insurance Agency Competition Study?

- How to Navigate Legal Considerations in Insurance Agency?

- How to Secure Funding for Insurance Agency?

- Insurance Agency Growth Strategies: Scaling Guide

FAQ

What is an Insurance Agency SWOT Analysis?

An Insurance Agency SWOT Analysis is a strategic tool used to identify and evaluate the strengths, weaknesses, opportunities, and threats that impact an insurance agency. This analysis helps agencies understand their position in the market and develop strategies for growth and improvement.

How do I identify strengths in my insurance agency?

To identify strengths, consider factors such as your agency’s reputation, customer service quality, and specialized expertise. Engaging with team members and clients can provide valuable insights into what sets your agency apart from competitors.

What are some common weaknesses in insurance agencies?

Common weaknesses in insurance agencies may include limited online presence, outdated technology, or inefficient processes. Identifying these areas allows agencies to address them proactively and improve overall performance.

What opportunities should insurance agencies look for?

Insurance agencies should look for opportunities such as emerging market trends, the demand for personalized products, and advancements in technology. By adapting to these changes, agencies can enhance their offerings and attract new clients.

What threats do insurance agencies face?

Insurance agencies face various threats, including increased competition, regulatory changes, and economic downturns. Staying informed about these challenges is crucial for developing effective strategies to mitigate their impact.

How often should I revise my SWOT analysis?

It’s recommended to revise your SWOT analysis at least once a year or more frequently if significant changes occur in the market. Regular evaluations help ensure that your strategies remain relevant and effective.