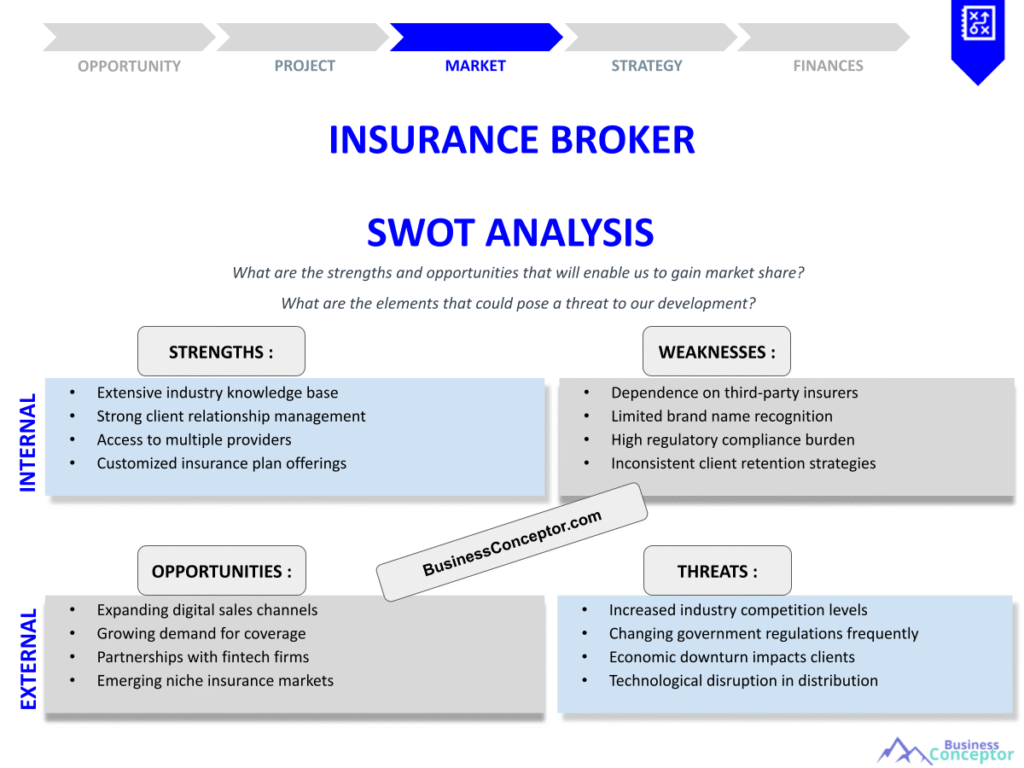

Did you know that a well-executed Insurance Broker SWOT Analysis can be the game-changer for agencies trying to navigate the complex landscape of the insurance market? An Insurance Broker SWOT Analysis is a strategic planning tool that helps identify the Strengths, Weaknesses, Opportunities, and Threats related to an insurance brokerage. It’s like looking in a mirror but for your business strategy—seeing what you do well, what needs work, what opportunities are out there, and what challenges you face.

Here’s what you need to know:

– Strengths: What sets your brokerage apart?

– Weaknesses: Where can you improve?

– Opportunities: What market trends can you capitalize on?

– Threats: What external factors could jeopardize your business?

Understanding the Components of a SWOT Analysis

When diving into the nitty-gritty of an Insurance Broker SWOT Analysis, it’s crucial to understand each component. Strengths are your internal advantages—think of things like experienced staff or a solid client base. For example, if your brokerage has built a reputation for exceptional customer service, that becomes a key strength that can set you apart in a crowded market.

Weaknesses are the areas where you might be lacking, like outdated technology or limited market reach. Imagine a brokerage that has great agents but struggles with technology—this can limit client reach and operational efficiency. Addressing these weaknesses is crucial for long-term success.

Opportunities are those external factors that could benefit your brokerage, such as emerging markets or new regulations that favor your services. Think about how recent changes in health insurance laws opened up new markets for agencies that adapted quickly. Lastly, Threats are the potential challenges that could hinder your success, like increased competition or economic downturns. Understanding these threats allows you to develop strategies to mitigate their impact.

| Component | Description |

|---|---|

| Strengths | Internal advantages your brokerage has |

| Weaknesses | Internal areas that need improvement |

| Opportunities | External factors that could benefit you |

| Threats | External challenges that could harm you |

- Key Takeaways: Understanding each component is vital for effective analysis.

- Regularly reassess these components as the market changes.

“In the midst of chaos, there is also opportunity.” - Sun Tzu

Let’s break down the strengths and weaknesses of your insurance brokerage. Identifying your strengths might include factors such as a strong reputation, niche expertise, or a dedicated client service team. For example, if your brokerage specializes in health insurance, that can be a unique strength in a saturated market. You can leverage this expertise to offer personalized services that other brokerages might not provide, making you a go-to option for clients seeking specialized advice.

On the flip side, weaknesses could be things like high employee turnover or a lack of online presence. If your agency has great agents but struggles with technology, this can limit client reach and operational efficiency. Consider how embracing new technologies could streamline processes and enhance the client experience. Addressing these weaknesses is crucial for long-term success and can be the difference between thriving and merely surviving in a competitive landscape.

| Strengths | Weaknesses |

|---|---|

| Strong client relationships | Limited digital marketing skills |

| Expertise in niche markets | High employee turnover |

- Key Takeaways: List your brokerage’s strengths and weaknesses to guide strategy.

- Focus on leveraging strengths while addressing weaknesses.

“Strength does not come from physical capacity. It comes from an indomitable will.” - Mahatma Gandhi

Exploring Opportunities in the Market

Now, let’s chat about the opportunities available in the insurance market. The insurance industry is always evolving, and staying ahead means recognizing trends you can take advantage of. One significant opportunity is the rise of digital platforms for insurance sales. With more consumers turning to online solutions for their insurance needs, brokerages that embrace technology can reach a broader audience than ever before. For instance, implementing an intuitive website with an easy-to-use interface can attract tech-savvy clients who prefer to manage their policies online.

Moreover, social media is transforming how insurance brokers engage with potential clients. Platforms like Facebook and LinkedIn allow brokers to share valuable content, build brand awareness, and connect with clients directly. By leveraging these platforms, you can create a strong online presence that enhances your brokerage’s visibility and credibility. Think about how targeted ads can help you reach specific demographics, such as young families looking for life insurance or small business owners needing liability coverage.

| Opportunity | Description |

|---|---|

| Digital transformation | Expanding reach via online platforms |

| Regulatory changes | New niches created by law adjustments |

- Key Takeaways: Stay informed about market trends to seize opportunities.

- Flexibility is key to adapting to new market demands.

“Opportunities don't happen, you create them.” - Chris Grosser

Another opportunity lies in understanding and adapting to regulatory changes. The insurance landscape is often influenced by new laws and regulations that can open up niche markets. For example, recent changes in health insurance laws have created new opportunities for agencies that can quickly adapt their offerings. If your brokerage can identify these changes and tailor your services accordingly, you can position yourself as a leader in emerging markets. By staying ahead of the curve, you can attract clients who are looking for specialized knowledge and services that align with their needs.

Recognizing Threats in the Industry

Every insurance broker should also be aware of the threats lurking in the industry. Increased competition can come from both traditional firms and new tech-driven entrants. For instance, insurtech companies are changing the game with innovative solutions that attract clients. These companies often utilize advanced technology to offer faster quotes, streamlined services, and personalized coverage options. If your brokerage does not keep pace with these innovations, you risk losing clients to competitors who can offer better, more efficient services.

Moreover, economic fluctuations pose a significant threat. If a recession hits, clients may cut back on coverage or switch to cheaper options. This shift can lead to a decline in revenue for your brokerage. Understanding these threats allows you to develop strategies to mitigate their impact. For instance, diversifying your service offerings can help cushion your brokerage against economic downturns. If you provide a range of insurance products—from health and auto to business liability—you can appeal to a broader audience, making your business more resilient.

| Threat | Description |

|---|---|

| Increased competition | More firms entering the market |

| Economic downturns | Clients reducing coverage or switching plans |

- Key Takeaways: Regularly assess external threats to stay competitive.

- Develop contingency plans for economic fluctuations.

“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday's logic.” - Peter Drucker

Creating an Action Plan Based on Your SWOT Analysis

After completing your Insurance Broker SWOT Analysis, the next step is to create an action plan. This means taking your findings and translating them into concrete steps. For instance, if you identified a weakness in digital marketing, your action plan might include hiring a digital marketing consultant or investing in training for your team. By addressing these weaknesses directly, you can enhance your brokerage’s overall effectiveness and client engagement.

Moreover, it’s essential to prioritize your opportunities. If a new regulation opens a niche market, develop a targeted marketing strategy to attract those clients. A focused approach ensures that your efforts yield maximum impact. For example, if you notice an increase in demand for cyber insurance due to rising online threats, you can tailor your offerings and marketing materials to speak directly to businesses concerned about cybersecurity. This proactive approach not only sets you apart from competitors but also positions your brokerage as an industry leader in emerging areas.

| Component | Action Steps |

|---|---|

| Addressing weaknesses | Hire staff, invest in training |

| Capitalizing on opportunities | Develop targeted marketing strategies |

- Key Takeaways: Transform SWOT findings into actionable steps.

- Align strengths with opportunities for maximum impact.

“Plans are nothing; planning is everything.” - Dwight D. Eisenhower

In addition to addressing weaknesses and capitalizing on opportunities, it’s vital to create a timeline for implementing your action plan. Setting deadlines for each step not only keeps your team accountable but also helps maintain momentum. Regular check-ins can also ensure that everyone stays on track and that any necessary adjustments are made promptly. For example, if a particular marketing campaign isn’t yielding the expected results, you can pivot quickly rather than waiting until the end of the quarter to reassess. This agile approach can make a significant difference in your brokerage’s responsiveness to market changes and client needs.

Regularly Reviewing and Updating Your SWOT Analysis

Lastly, don’t forget that a SWOT analysis isn’t a one-and-done deal. The insurance market is dynamic, and your analysis should reflect that. Regularly reviewing and updating your SWOT analysis helps you stay relevant and responsive to changes. Set a schedule—maybe quarterly or bi-annually—to revisit your strengths, weaknesses, opportunities, and threats. This practice ensures your brokerage remains agile and prepared for whatever challenges may come your way.

During these reviews, consider not only the internal factors but also external influences such as market trends, economic shifts, and competitive landscape changes. For instance, if you notice that more clients are opting for eco-friendly insurance options, this could indicate a shift in consumer preferences that your brokerage needs to address. Adapting to these trends can lead to new business opportunities and help solidify your brokerage’s reputation as a forward-thinking leader in the industry.

| Review Frequency | Purpose |

|---|---|

| Quarterly | Assess changes in strengths and weaknesses |

| Bi-Annually | Re-evaluate market opportunities and threats |

- Key Takeaways: Regular updates keep your strategy relevant.

- Agility in response to market changes is crucial.

“The only constant in life is change.” - Heraclitus

Implementing Technology in Your Brokerage

In today’s fast-paced world, integrating technology into your insurance brokerage is not just an option; it’s a necessity. The impact of technology on the insurance industry has been profound, reshaping how brokers interact with clients and manage operations. For example, utilizing a robust Customer Relationship Management (CRM) system can streamline your processes, allowing you to manage client interactions more effectively. With features like automated follow-ups and detailed analytics, a good CRM can enhance client satisfaction and retention rates.

Moreover, embracing digital tools can provide your brokerage with a competitive edge. Imagine implementing online quoting systems that allow potential clients to receive instant quotes based on their specific needs. This not only improves the customer experience but also positions your brokerage as a tech-savvy option in a market where clients increasingly expect instant access to information.

| Technology | Benefits |

|---|---|

| CRM Systems | Streamlined client management and enhanced satisfaction |

| Online Quoting Systems | Instant quotes and improved customer experience |

- Key Takeaways: Integrating technology is essential for modern brokerages.

- Digital tools enhance efficiency and client satisfaction.

“Technology is best when it brings people together.” - Matt Mullenweg

Additionally, data analytics plays a crucial role in understanding market trends and client behaviors. By analyzing data collected from various touchpoints, your brokerage can gain insights into what products are most in demand, which demographics are underserved, and how to tailor your marketing strategies effectively. For instance, if data shows a rising interest in health insurance among young professionals, you can develop targeted campaigns that speak directly to this audience, highlighting benefits that resonate with their lifestyle and needs. This data-driven approach not only helps in attracting new clients but also in retaining existing ones by providing them with relevant information and services.

Enhancing Client Relationships through Communication

Another vital aspect of thriving as an insurance broker is enhancing client relationships through effective communication. Building strong connections with your clients fosters trust and loyalty, which are essential for long-term success. Regular communication can take many forms, from personalized emails and newsletters to social media engagement. For example, sending out a monthly newsletter that offers insights into industry trends, tips on managing insurance needs, or even a spotlight on client success stories can keep your clients engaged and informed.

Moreover, utilizing multiple communication channels allows you to cater to the preferences of your clients. Some may prefer traditional methods like phone calls, while others may favor instant messaging or email. By offering various ways to connect, you can ensure that your clients feel valued and heard, leading to a more positive overall experience. This approach not only enhances client satisfaction but can also result in referrals, as happy clients are more likely to recommend your brokerage to friends and family.

| Communication Method | Advantages |

|---|---|

| Personalized Emails | Direct engagement and tailored content |

| Social Media | Wider reach and enhanced interaction |

- Key Takeaways: Effective communication is key to building strong client relationships.

- Utilizing multiple channels enhances client engagement.

“The most important thing in communication is hearing what isn't said.” - Peter Drucker

Investing in Training and Development

One of the most significant investments your brokerage can make is in the training and development of your team. The insurance industry is constantly evolving, with new products, regulations, and technologies emerging regularly. By prioritizing training, you ensure that your agents are equipped with the latest knowledge and skills necessary to meet client needs effectively. For instance, offering regular workshops on new insurance products or changes in regulations can keep your team informed and agile.

Moreover, investing in professional development not only enhances your team’s capabilities but also boosts morale and job satisfaction. When employees feel that their employer is committed to their growth, they are more likely to be engaged and motivated. This can lead to lower turnover rates, which is crucial in an industry where experienced agents are a valuable asset. Consider implementing mentorship programs where seasoned agents can share their expertise with newer team members, fostering a culture of continuous learning and collaboration.

| Investment Area | Benefits |

|---|---|

| Regular Training | Up-to-date knowledge and skills |

| Mentorship Programs | Knowledge sharing and team collaboration |

- Key Takeaways: Investing in training is essential for team effectiveness.

- Professional development enhances morale and reduces turnover.

“An investment in knowledge pays the best interest.” - Benjamin Franklin

Furthermore, technology can play a pivotal role in facilitating training and development. Online training platforms provide flexibility, allowing agents to learn at their own pace and access resources whenever needed. This approach not only accommodates diverse learning styles but also allows for ongoing education without the constraints of traditional classroom settings. For example, interactive e-learning modules can cover complex topics such as risk assessment and compliance, making it easier for agents to grasp essential concepts. By leveraging technology, your brokerage can create a robust training program that adapts to the needs of your team and the demands of the market.

Measuring Success and Adjusting Strategies

Finally, measuring the success of your Insurance Broker SWOT Analysis and the implementation of your strategies is crucial for continuous improvement. Regularly evaluating your performance against established benchmarks allows you to determine what is working and what needs adjustment. For instance, if you notice that a specific marketing campaign is underperforming, it’s essential to analyze the data and understand why. Are the target demographics not resonating with your message? Are the channels you’re using effective?

By adopting a data-driven approach, you can make informed decisions that enhance your brokerage’s effectiveness. Utilize key performance indicators (KPIs) such as client acquisition rates, customer satisfaction scores, and retention rates to gauge your success. This quantitative feedback can guide your strategies and help you pivot quickly in response to market changes.

| Performance Indicator | Purpose |

|---|---|

| Client Acquisition Rates | Measure effectiveness of marketing strategies |

| Customer Satisfaction Scores | Gauge client happiness and loyalty |

- Key Takeaways: Regular evaluation is essential for ongoing success.

- Data-driven decisions enhance strategy effectiveness.

“What gets measured gets managed.” - Peter Drucker

In conclusion, a proactive approach to measuring success and adjusting strategies based on data can propel your brokerage to new heights. The combination of investing in training, embracing technology, and continuously evaluating performance creates a dynamic environment where your team can thrive. By fostering a culture of learning and adaptation, your brokerage will not only meet the current demands of the market but also be well-positioned for future challenges and opportunities.

Recommendations

In summary, conducting a thorough Insurance Broker SWOT Analysis is essential for understanding your brokerage’s strengths, weaknesses, opportunities, and threats. This strategic tool can help you make informed decisions that enhance your operations and client relationships. To further assist you in developing your business, consider using the Insurance Broker Business Plan Template, which provides a comprehensive framework for your brokerage’s success.

Additionally, explore our related articles on Insurance Brokers to expand your knowledge and improve your business strategies:

- Article 1 on Insurance Brokers: Unlocking Profit Potential

- Article 2 on Insurance Broker Business Plan: Template and Tips

- Article 3 on Insurance Broker Financial Plan: Step-by-Step Guide with Template

- Article 4 on Building an Insurance Broker Business: A Complete Guide with Practical Examples

- Article 5 on Start Your Insurance Broker Marketing Plan with This Example

- Article 6 on Start Your Insurance Broker Business Model Canvas: A Comprehensive Guide

- Article 7 on Understanding Customer Segments for Insurance Brokers (with Examples)

- Article 8 on How Much Does It Cost to Start an Insurance Broker Business?

- Article 9 on Ultimate Insurance Broker Feasibility Study: Tips and Tricks

- Article 10 on Ultimate Guide to Insurance Broker Risk Management

- Article 11 on Ultimate Guide to Insurance Broker Competition Study

- Article 12 on Essential Legal Considerations for Insurance Broker

- Article 13 on Exploring Funding Options for Insurance Broker

- Article 14 on How to Implement Growth Strategies for Insurance Broker

FAQ

What are the strengths and weaknesses of an insurance broker?

The strengths of an insurance broker often include a strong client base, specialized knowledge in certain types of insurance, and effective communication skills. On the other hand, common weaknesses might involve limited technology use or high employee turnover, which can hinder operational efficiency.

How can an insurance broker identify opportunities in the market?

To identify opportunities, an insurance broker should keep an eye on emerging market trends, such as shifts in consumer preferences towards online services or new regulations that could create demand for specific insurance products. Engaging with industry reports and networking can also uncover valuable insights.

What threats do insurance brokers face today?

Insurance brokers today face various threats, including increased competition from both traditional firms and insurtech companies. Economic fluctuations can also pose challenges, as they may lead clients to seek cheaper coverage options or reduce their insurance spending.

What role does technology play in insurance brokerage?

Technology plays a vital role in the operations of an insurance brokerage by streamlining processes, enhancing client interactions, and providing valuable data analytics. Implementing systems like CRM software can improve client management, while online quoting tools can enhance customer experience.

How can insurance brokers enhance client relationships?

Insurance brokers can enhance client relationships by maintaining open lines of communication, offering personalized service, and providing valuable resources such as newsletters and updates on industry trends. Utilizing multiple communication channels, like email and social media, ensures clients feel engaged and valued.

What is the importance of continuous training for insurance brokers?

Continuous training is crucial for insurance brokers to stay current with industry changes, new products, and regulations. Investing in training not only improves the skills of the team but also boosts employee morale and retention, leading to a more effective brokerage.