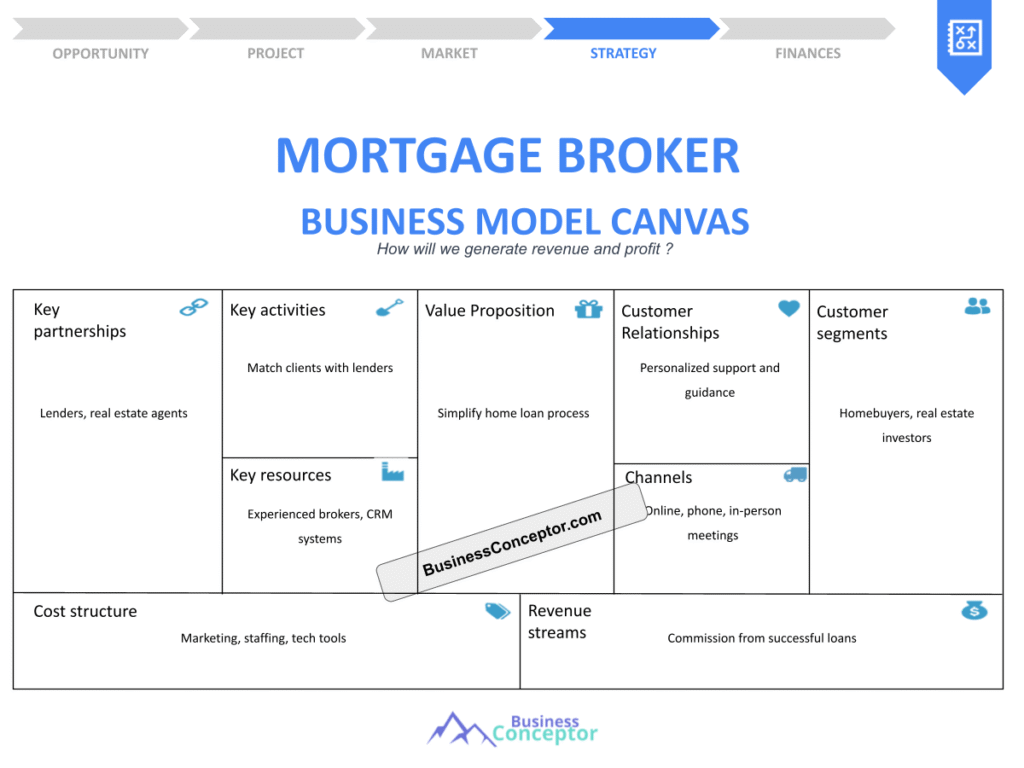

The Mortgage Broker Business Model Canvas is a powerful tool that can transform how you approach your mortgage brokerage. It’s like a roadmap for your business, helping you visualize all the crucial components that contribute to its success. Simply put, it’s a strategic management tool that outlines how your mortgage brokerage will create, deliver, and capture value. This isn’t just a fancy buzzword; it’s essential for anyone looking to thrive in the competitive mortgage market.

Here’s what you need to know about the Mortgage Broker Business Model Canvas:

- Key Components: Understand the essential elements that make up your business model.

- Customer Segments: Identify who your clients are and how to reach them.

- Revenue Streams: Learn how to monetize your services effectively.

- Value Propositions: Define what makes your brokerage unique.

- Key Partners: Discover who you need to collaborate with for success.

Understanding the Mortgage Broker Business Model

Let’s dive into what a mortgage broker business model is all about. A mortgage broker acts as a middleman between borrowers and lenders, helping clients find the best mortgage products for their needs. But it’s not just about connecting people; it’s about understanding the nuances of the mortgage market, the needs of clients, and the intricacies of financial products. This understanding is what sets successful brokers apart from those who struggle to make their mark.

The business model revolves around various components, such as:

- Customer Relationships: Building trust and rapport with clients is crucial. It often starts with excellent customer service and transparent communication. Clients are more likely to return to brokers who have treated them well and provided valuable advice.

- Key Activities: This includes everything from marketing your services to managing client applications and maintaining relationships with lenders. Understanding these activities allows brokers to streamline their processes for better efficiency.

- Cost Structure: Understanding where your money goes is vital. This includes costs for technology, marketing, staff salaries, and more. A well-planned cost structure can lead to higher profit margins.

By using the Mortgage Broker Business Model Canvas, you gain clarity on how each of these components interacts with one another. It allows you to visualize the entire operation of your brokerage, making it easier to spot weaknesses and areas for improvement. For instance, if you notice that your customer acquisition costs are too high, you can strategize on how to lower them, perhaps by enhancing your online presence or leveraging social media.

Here’s a summary table to illustrate some key components:

| Component | Description |

|---|---|

| Customer Segments | Individuals and families seeking mortgages |

| Value Propositions | Tailored mortgage solutions and expert guidance |

| Revenue Streams | Commissions, fees from lenders, and service charges |

Key Takeaway: A successful mortgage broker business model requires a deep understanding of your customers and the mortgage market. By focusing on these key elements, you can create a more effective strategy that drives growth and profitability. Understanding these components also prepares you to adapt as the market changes, ensuring that your brokerage remains competitive and relevant in an ever-evolving landscape.

“A business model is like a blueprint; without it, you're building on shaky ground!”

Defining Customer Segments for Your Brokerage

When you’re building a business model canvas for your mortgage brokerage, defining your customer segments is a critical step. Who are your clients? Are they first-time homebuyers, real estate investors, or perhaps people looking to refinance their existing mortgages? Knowing your audience allows you to tailor your services and marketing strategies effectively. This isn’t just about demographics; it’s about understanding their motivations, pain points, and what drives their decisions.

For instance, first-time homebuyers might need more hand-holding through the mortgage process, while seasoned investors might be looking for quick approvals and competitive rates. This distinction is vital because it informs how you market your services, what products you recommend, and how you communicate with your clients. By segmenting your customers, you can provide personalized experiences that resonate more deeply with their specific needs.

Here’s a breakdown of potential customer segments:

| Segment | Characteristics |

|---|---|

| First-time Homebuyers | Need guidance, often have limited knowledge |

| Real Estate Investors | Seeking competitive rates and quick turnaround |

| Refinancers | Looking to lower rates or access equity |

Key Insight: Tailoring your services to meet the specific needs of each segment can significantly enhance customer satisfaction and loyalty. For example, you might offer educational workshops for first-time buyers to help them understand the mortgage process better. On the other hand, for investors, you could provide market analysis and insights to help them make informed decisions. The more you cater to the unique characteristics of each segment, the more likely you are to build lasting relationships that lead to repeat business and referrals.

Moreover, utilizing technology such as CRM systems can help you track interactions with different customer segments. This data allows you to refine your approach continuously, ensuring that you meet the evolving needs of your clients. The ability to analyze customer data effectively means you can anticipate their needs and provide solutions even before they ask for them. This proactive approach can set you apart from your competition and solidify your reputation as a trusted advisor in the mortgage industry.

“Knowing your audience is half the battle won!” 😊

Crafting a Unique Value Proposition

Now that you’ve identified your customer segments, it’s time to craft your value proposition. What makes your mortgage brokerage stand out from the competition? A strong value proposition clearly communicates the benefits your services offer to clients. This is crucial in a crowded market where potential clients are bombarded with choices.

For example, if you specialize in helping first-time buyers navigate the complexities of securing a mortgage, highlight that expertise in your messaging. You could emphasize that your brokerage offers personalized consultations, where clients receive tailored advice based on their financial situation. Or, if you provide innovative technology that allows clients to track their applications in real-time, showcase that as a unique selling point. This not only improves transparency but also enhances the client experience, making them feel more involved and informed throughout the process.

Here’s a quick summary table of potential value propositions:

| Value Proposition | Description |

|---|---|

| Personalized Service | Tailored advice for each client’s unique needs |

| Quick Approval Processes | Fast tracking of applications for quicker closings |

| Competitive Rates | Access to a wide range of lenders for best rates |

Key Takeaway: A compelling value proposition not only attracts clients but also helps retain them. It’s essential to communicate this effectively across all your marketing channels, from your website to social media. Regularly revisiting and refining your value proposition based on market trends and customer feedback will ensure it remains relevant and compelling.

Additionally, consider using testimonials and success stories from satisfied clients to reinforce your value proposition. This social proof can be incredibly persuasive for potential clients who are on the fence about choosing your services. Remember, your value proposition is more than just a statement; it’s a promise of the experience your clients will receive when they work with you.

“Your value proposition is your calling card; make it memorable!”

Identifying Revenue Streams for Your Business

Every business needs to know how it will make money, and your mortgage brokerage is no exception. Understanding your revenue streams is vital for sustainability and growth. Typically, mortgage brokers earn money through commissions paid by lenders when a loan is closed. However, there are several potential revenue streams to consider, each with its unique advantages that can enhance your overall profitability.

For example, you might charge fees for services such as credit analysis, consulting, or even lead generation. These additional fees not only provide immediate cash flow but also position you as an expert in the field. By offering specialized services, you can create a diversified income portfolio that can withstand market fluctuations. This approach reduces reliance on a single source of income, which is crucial during economic downturns or shifts in the housing market.

Here’s a summary table of potential revenue streams:

| Revenue Stream | Description |

|---|---|

| Lender Commissions | Earnings from lenders upon loan closure |

| Service Fees | Charges for consulting or additional services |

| Lead Generation | Selling leads to other brokers or lenders |

Key Insight: Diversifying your revenue streams can help your business weather economic fluctuations. By identifying multiple ways to earn income, you create a more stable financial foundation. For instance, if the market sees a downturn in home purchases, your consulting fees or lead generation services can still provide income. Additionally, offering a mix of services can attract a broader client base, ensuring you have different avenues for revenue.

Moreover, understanding your clients’ needs can help you tailor your offerings. For instance, if you notice many clients are interested in refinancing, you could develop a specific service around that, including personalized consultations and assistance with paperwork. This proactive approach not only increases your revenue but also builds trust with your clients, making them more likely to return for future needs.

“Don’t put all your eggs in one basket!” 🥚

Establishing Key Partnerships

In the mortgage brokerage business, partnerships are key to success. Building relationships with lenders, real estate agents, and financial advisors can open doors to new clients and opportunities. These partnerships can also enhance your service offerings, allowing you to provide comprehensive solutions to your clients. For instance, having a solid relationship with a local real estate agent can lead to referrals, while collaborating with financial advisors can help you gain clients looking for mortgage advice alongside their investment strategies.

Strong partnerships can enhance your credibility in the market. When potential clients see that you work with reputable lenders or agents, they’re more likely to trust you. This trust can translate into more business as clients feel confident that you can provide them with the best options available. Additionally, partnerships can lead to co-marketing opportunities, where you and your partners can promote each other’s services, further expanding your reach.

Here’s a summary table of potential key partners:

| Key Partner | Benefits |

|---|---|

| Lenders | Access to a variety of mortgage products |

| Real Estate Agents | Referral opportunities and co-marketing strategies |

| Financial Advisors | Enhanced service offerings for clients |

Key Takeaway: Strong partnerships can significantly enhance your brokerage’s reach and credibility. It’s not just about the immediate benefits; it’s about building a network that can support your business long-term. Regularly engaging with your partners through meetings, networking events, and social gatherings can strengthen these relationships. The more you invest in your partnerships, the more likely they are to yield fruitful results in the form of referrals and collaborative opportunities.

Additionally, consider creating formal agreements that outline how both parties will benefit from the partnership. This clarity can help prevent misunderstandings and ensure that both sides are committed to making the partnership work. Ultimately, strong partnerships can be a game-changer for your mortgage brokerage, providing you with the resources and connections needed to thrive in a competitive market.

“Teamwork makes the dream work!” 🤝

Analyzing the Cost Structure

Understanding your cost structure is vital to maintaining a profitable mortgage brokerage. This includes fixed costs, like office rent and salaries, and variable costs, such as marketing expenses and technology investments. By analyzing these costs, you can identify areas where you can save money and improve efficiency. A well-defined cost structure allows you to make informed decisions about where to invest resources and how to price your services effectively.

For instance, consider your fixed costs. These are expenses that remain constant regardless of your business activity. They might include your office lease, utilities, and employee salaries. While these costs are necessary, they can strain your budget if not managed properly. Regularly reviewing these expenses can help you find opportunities for negotiation or cost-saving measures, such as switching to a more cost-effective office space or renegotiating contracts with service providers.

Variable costs, on the other hand, fluctuate based on your business activities. This category includes marketing expenses, commissions paid to employees, and costs associated with technology and software. By keeping a close eye on these variable costs, you can adjust your spending based on your current revenue. For example, during peak seasons, you might invest more in marketing to attract clients, whereas in slower periods, you might cut back to maintain profitability.

Here’s a summary table of potential costs:

| Cost Type | Description |

|---|---|

| Fixed Costs | Office space, salaries, and utilities |

| Variable Costs | Marketing, technology, and commission payouts |

| Operational Costs | Day-to-day expenses related to running the business |

Key Insight: Regularly reviewing your cost structure can help you stay financially healthy. By understanding both fixed and variable costs, you can make strategic adjustments that improve your bottom line. For example, if you notice that your marketing costs are high but not yielding sufficient leads, it may be time to reassess your marketing strategy. Perhaps focusing on digital marketing or social media advertising can yield better results at a lower cost.

Furthermore, investing in technology can initially seem costly, but it often pays off in the long run. Implementing a robust CRM system can automate many administrative tasks, allowing you to focus on client relationships and lead generation. This efficiency can ultimately reduce operational costs while increasing revenue potential. The key is to balance your investments wisely, ensuring that each dollar spent contributes to your overall business goals.

“Know your numbers, and you’ll never go hungry!” 💰

Leveraging Technology Trends

In today’s fast-paced world, technology plays a crucial role in the mortgage industry. From digital applications to AI-driven lead generation, embracing technology can set your brokerage apart from the competition. Staying updated on tech trends can help you find new ways to serve your clients better and streamline your operations. In an industry where efficiency and customer service are paramount, leveraging technology is not just an option; it’s a necessity.

For instance, adopting a digital mortgage platform can simplify the application process for clients, making it easier for them to secure their loans. These platforms often come equipped with user-friendly interfaces that allow clients to track their applications in real-time. This transparency not only improves the client experience but also reduces the number of inquiries you receive about application status, freeing up your time to focus on other important tasks.

Utilizing data analytics is another technology trend that can significantly benefit your brokerage. By analyzing customer behavior and preferences, you can tailor your services to meet their needs more effectively. For example, if data shows that a significant portion of your clients are interested in refinancing options, you can create targeted marketing campaigns that address this need. This personalized approach can increase conversion rates and lead to higher client satisfaction.

Here’s a summary table of technology trends:

| Technology Trend | Benefits |

|---|---|

| Digital Mortgage Platforms | Streamlined application processes |

| AI and Machine Learning | Enhanced customer insights and lead generation |

| CRM Systems | Improved client management and communication |

Key Takeaway: Embracing technology can lead to improved efficiency and customer satisfaction. The right tools can help you automate mundane tasks, allowing you to focus on what truly matters—building relationships with your clients. Additionally, technology can provide valuable insights that inform your business strategies, helping you stay ahead of market trends.

In conclusion, as the mortgage industry continues to evolve, staying ahead of technological advancements will be crucial. Regularly investing in technology not only enhances your operational capabilities but also positions your brokerage as a leader in innovation. This forward-thinking approach can attract more clients and improve your overall market presence.

“Adapt or get left behind!” 🚀

Building a Sustainable Business Model

Creating a sustainable business model is essential for long-term success in the mortgage brokerage industry. This involves not just understanding your market but also being adaptable to changes within it. Economic shifts, regulatory changes, and evolving consumer preferences can all impact your brokerage. Regularly reviewing and updating your business model canvas ensures that you stay relevant and competitive. It’s a living document that should evolve as your business grows and as the market changes.

To build a sustainable model, start by conducting a thorough market analysis. Understand the current trends in the mortgage industry, such as shifts toward digital solutions or changes in consumer behavior. For example, with the rise of online lenders, traditional brokerages may need to adapt their offerings to include more digital services. This could involve enhancing your online presence or providing virtual consultations to meet clients where they are.

Another crucial aspect of sustainability is maintaining a strong relationship with your clients. Regular feedback can provide valuable insights into what your clients value most and where you can improve. Implementing customer satisfaction surveys or follow-up calls can help you gauge client satisfaction and adapt your services accordingly. Happy clients are more likely to refer others and become repeat customers, which is vital for a sustainable business model.

Here’s a summary table of sustainability considerations:

| Sustainability Factor | Description |

|---|---|

| Market Trends | Staying informed about industry changes |

| Customer Feedback | Incorporating client suggestions for improvement |

| Continuous Learning | Investing in ongoing training and development |

Key Insight: A sustainable business model can help your brokerage thrive, even in challenging times. By being proactive about market changes and client needs, you can position your business for long-term success. Additionally, investing in your team through training and development can enhance your service quality and operational efficiency. A well-trained team is better equipped to handle client inquiries and deliver exceptional service, which is crucial in the competitive mortgage landscape.

Moreover, consider adopting sustainable business practices, such as reducing paper usage and implementing eco-friendly policies. Not only do these practices help the environment, but they can also enhance your brand image and appeal to environmentally-conscious clients. Ultimately, a sustainable business model is about creating a resilient brokerage that can adapt, grow, and succeed over time.

“Sustainability is the key to longevity!” 🌱

Understanding Regulatory Compliance

In the mortgage brokerage industry, understanding and adhering to regulatory compliance is non-negotiable. Regulations can vary significantly by region, and staying compliant is crucial to avoid legal issues that could jeopardize your business. Not only does compliance protect your brokerage from potential fines, but it also enhances your credibility with clients. When clients know that you adhere to industry standards, they are more likely to trust you with their financial needs.

To ensure compliance, familiarize yourself with the regulations that govern mortgage lending in your area. This includes understanding licensing requirements, consumer protection laws, and fair lending practices. For instance, in many regions, mortgage brokers must be licensed and may need to complete continuing education courses to maintain their licenses. This commitment to staying informed about regulatory changes demonstrates professionalism and builds trust with your clients.

Furthermore, consider implementing a compliance management system that can help you track regulatory changes and ensure that your brokerage adheres to all necessary guidelines. This system can include regular audits, training for your staff, and updates on new regulations. By proactively managing compliance, you can reduce the risk of potential legal challenges and create a culture of accountability within your brokerage.

Here’s a summary table of compliance considerations:

| Compliance Area | Description |

|---|---|

| Licensing Requirements | Ensuring all brokers are properly licensed |

| Consumer Protection Laws | Adhering to laws that protect consumers |

| Fair Lending Practices | Ensuring all clients are treated fairly |

Key Insight: Understanding regulatory compliance is essential for the longevity of your mortgage brokerage. Not only does it protect your business, but it also enhances your reputation in the market. Clients are more likely to choose a brokerage that demonstrates a commitment to ethical practices and compliance with laws.

Additionally, consider fostering relationships with legal experts or compliance consultants who can provide guidance on navigating complex regulations. This investment can save you time and resources in the long run, allowing you to focus on growing your business while ensuring that you remain compliant with all necessary regulations.

In conclusion, regulatory compliance is not just a requirement; it’s an opportunity to strengthen your brokerage’s reputation and build trust with your clients. By prioritizing compliance, you position your brokerage for long-term success in the competitive mortgage industry.

“Compliance is the foundation of trust!” 🔒

Recommendations

As you embark on your journey to establish a successful mortgage brokerage, it’s crucial to have a solid foundation in place. The insights shared in this article about building a Mortgage Broker Business Model Canvas can help you create a robust strategy that addresses the key components of your business. For those looking for a comprehensive resource, consider using the Mortgage Broker Business Plan Template. This template offers a structured approach to planning and can be invaluable in setting your business on the right track.

Additionally, we encourage you to explore our related articles that provide further insights into various aspects of running a mortgage brokerage. Here’s a quick list of recommended readings:

- Mortgage Broker SWOT Analysis Insights

- Mortgage Brokers: Secrets to High Profitability

- Mortgage Broker Business Plan: Essential Steps and Examples

- Mortgage Broker Financial Plan: Essential Steps and Example

- Building a Mortgage Broker Business: A Complete Guide with Practical Examples

- Crafting a Marketing Plan for Your Mortgage Broker Business (+ Example)

- Customer Segments for Mortgage Brokers: Who Are Your Potential Clients?

- How Much Does It Cost to Establish a Mortgage Broker Business?

- How to Conduct a Feasibility Study for Mortgage Broker?

- How to Implement Effective Risk Management for Mortgage Broker?

- Mortgage Broker Competition Study: Comprehensive Analysis

- Mortgage Broker Legal Considerations: Comprehensive Guide

- What Funding Options Are Available for Mortgage Broker?

- How to Scale a Mortgage Broker: Proven Growth Strategies

FAQ

What is a mortgage broker business model?

A mortgage broker business model outlines how a broker operates, including the processes for connecting borrowers with lenders. It encompasses key components such as customer segments, value propositions, and revenue streams, ensuring that the broker can effectively serve clients and maintain profitability.

How do mortgage brokers make money?

Mortgage brokers primarily earn income through commissions paid by lenders when a loan is closed. They may also charge fees for services such as consulting or lead generation, creating multiple revenue streams that contribute to their overall earnings.

What are the key partners in mortgage brokering?

Key partners in mortgage brokering include lenders, real estate agents, and financial advisors. These partnerships can enhance the broker’s service offerings, provide referral opportunities, and improve overall client satisfaction by delivering comprehensive solutions.

What customer segments should a mortgage broker target?

Identifying the right customer segments is crucial for success. Potential segments include first-time homebuyers, real estate investors, and individuals looking to refinance. Tailoring services to meet the specific needs of each segment can enhance client satisfaction and loyalty.

What is the importance of a business model canvas for mortgage brokers?

The business model canvas is a strategic tool that helps mortgage brokers visualize and plan the key components of their business. It facilitates understanding of customer relationships, cost structures, and revenue streams, ultimately leading to better decision-making and improved operational efficiency.

How can technology improve a mortgage brokerage?

Leveraging technology can significantly enhance a mortgage brokerage by streamlining processes, improving client interactions, and providing data-driven insights. Tools like digital mortgage platforms and CRM systems can automate tasks, reduce operational costs, and enhance overall client experience.