The insurance broker customer segments are more diverse than you might think. Did you know that understanding these segments can significantly enhance how brokers connect with their clients? Insurance brokers cater to various customer types, each with unique needs and preferences. Grasping these distinctions not only helps brokers tailor their services but also drives customer satisfaction and loyalty. The importance of identifying and understanding these segments cannot be overstated, as it allows brokers to streamline their marketing efforts and ultimately improve their bottom line.

Here’s what you’ll learn in this article:

– The different types of customer segments in the insurance industry.

– Key characteristics of each segment, including demographics and behaviors.

– Real-life examples to illustrate how brokers can effectively engage with each segment.

– Practical strategies for improving customer retention and acquisition based on these segments.

Types of Insurance Broker Customer Segments

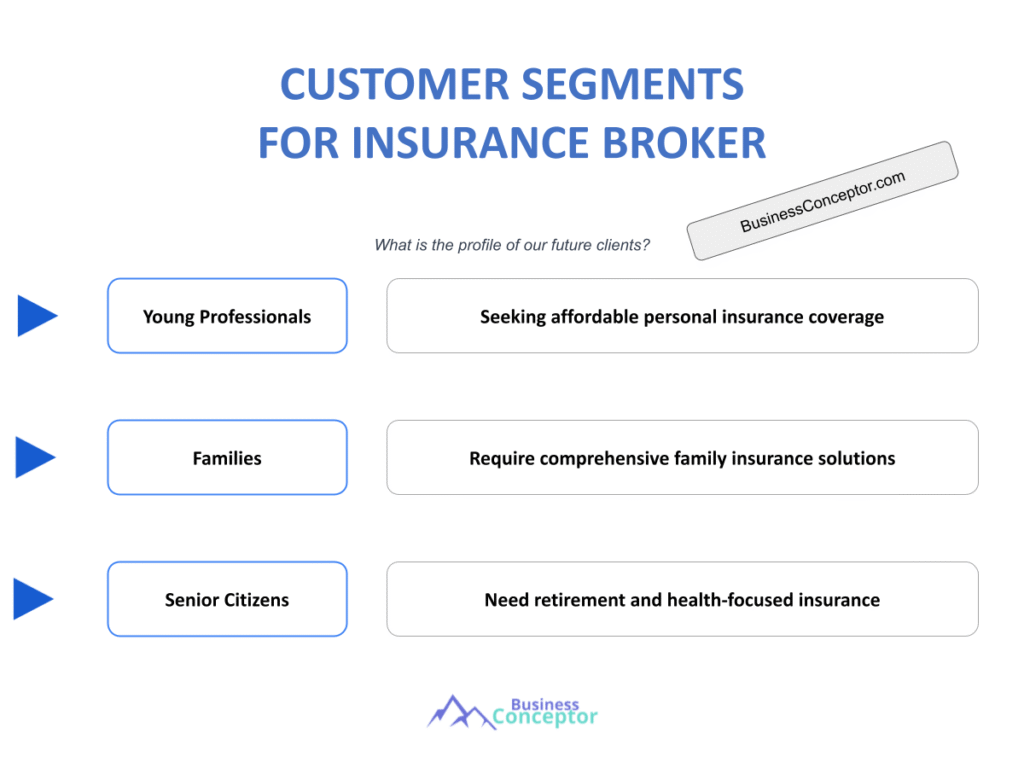

When diving into the world of insurance broker customer segments, it’s essential to recognize that not all clients are created equal. Insurance brokers typically categorize their clients based on several factors, including demographics, needs, and behaviors. For instance, you might find segments like individuals seeking personal insurance, small businesses looking for commercial coverage, or high-net-worth clients needing specialized policies. Understanding these distinctions allows brokers to customize their services and marketing efforts, ensuring that they meet the specific needs of each group.

Take millennials and Gen Z clients, for example. These younger generations often prefer digital engagement and personalized services. They are tech-savvy and likely to conduct online research before making any decisions. On the other hand, older generations may appreciate more traditional, face-to-face interactions. Recognizing these preferences allows brokers to tailor their outreach and service offerings accordingly, which can lead to better customer experiences and increased loyalty.

Additionally, customer profiles can include variables like income level, lifestyle, and risk tolerance. For instance, a young family might prioritize affordable health insurance, while a small business owner may seek comprehensive liability coverage to protect their assets. By understanding these differences, brokers can create more effective marketing campaigns and service offerings that resonate with their target audiences.

| Customer Segment | Key Characteristics |

|---|---|

| Millennials | Digital-first, value personalization |

| Small Business Owners | Cost-conscious, seek comprehensive coverage |

| High-Net-Worth Clients | Require specialized and tailored services |

- Brokers should consider both demographic and psychographic factors when segmenting their clients.

- Understanding client behavior can lead to better retention strategies.

- Personalization is key for engaging younger audiences.

“Understanding your customer is the first step to serving them better!” 😊

In summary, recognizing the various types of insurance broker clients and tailoring services to meet their distinct needs is crucial. By doing so, brokers can enhance their marketing strategies and ultimately drive better business outcomes. This understanding not only boosts client satisfaction but also fosters long-term relationships that are beneficial for both parties. The more brokers understand their clients, the better equipped they are to provide services that truly resonate with them.

Insurance Broker Market Segmentation Strategies

Market segmentation is a critical strategy for insurance brokers. By categorizing clients into distinct groups, brokers can tailor their marketing efforts to resonate with specific audiences. This approach can lead to more effective campaigns and higher conversion rates. Brokers can utilize various segmentation methods, such as geographic, demographic, psychographic, and behavioral segmentation.

For instance, a broker might focus on geographic segmentation by targeting clients in a specific area, like urban centers, where there’s a higher concentration of small businesses. By honing in on a particular location, brokers can create marketing messages that address the unique needs and challenges faced by businesses in that area. Similarly, demographic segmentation allows brokers to target clients based on age, income, and family status. For example, a broker might develop campaigns aimed at young families who are looking for affordable health insurance options.

Behavioral segmentation looks at how clients interact with insurance products. Some clients may frequently compare policies online before making a decision, while others might rely on recommendations from friends or family. Understanding these behaviors allows brokers to fine-tune their marketing messages and delivery methods. For instance, if a broker identifies that a significant portion of their clients prefers online research, they can focus on enhancing their digital presence and providing comprehensive online resources. This not only improves the client experience but also positions the broker as a trusted source of information.

| Segmentation Type | Description |

|---|---|

| Geographic | Based on location |

| Demographic | Based on age, income, and family status |

| Psychographic | Based on lifestyle and values |

| Behavioral | Based on purchasing habits |

- Tailored marketing campaigns can yield better results.

- Brokers should focus on the preferred communication channels of each segment.

- Understanding behavioral patterns can enhance service offerings.

“The right message to the right person can make all the difference!” 🚀

By employing effective market segmentation strategies, brokers can significantly improve their outreach and engagement with clients. This targeted approach not only leads to higher conversion rates but also builds long-lasting relationships. When clients feel that their unique needs are being addressed, they are more likely to trust and remain loyal to their broker, creating a win-win situation.

Customer Profiles for Insurance Brokers

Creating detailed customer profiles is essential for insurance brokers. These profiles should encompass various aspects of the client, including demographics, needs, preferences, and buying behaviors. For example, a profile for a small business owner might highlight their need for liability coverage, their budget constraints, and their preference for online communication. Understanding these elements allows brokers to offer tailored solutions that resonate with each client’s specific situation.

Moreover, understanding psychographics—such as values, attitudes, and lifestyles—can provide deeper insights into what motivates clients. A high-net-worth client might value exclusivity and personalized service, while a millennial client may prioritize transparency and social responsibility in their insurance provider. By crafting profiles that include both demographic and psychographic information, brokers can develop marketing strategies that are more aligned with their clients’ values and expectations.

Using these profiles, brokers can craft marketing messages that resonate with each segment. For instance, a broker targeting environmentally conscious millennials might emphasize sustainable practices and eco-friendly policies in their marketing materials. When marketing messages align with the values of the target audience, brokers can enhance engagement and conversion rates. Additionally, well-defined customer profiles enable brokers to anticipate client needs, allowing for proactive service that can improve overall satisfaction.

| Customer Profile | Key Needs |

|---|---|

| Small Business Owner | Comprehensive coverage, budget-friendly options |

| Millennial Client | Digital engagement, personalized options |

| High-Net-Worth Individual | Tailored services, exclusivity |

- Customer profiles should be dynamic and updated regularly.

- Tailoring messages to client values can improve engagement.

- Brokers should leverage profiles for targeted marketing efforts.

“Personalization is not just a trend; it’s the future of customer service!” 🌟

In conclusion, creating detailed customer profiles allows brokers to better understand their clients, leading to improved service and satisfaction. By tailoring their marketing and service offerings to meet the unique needs of each segment, brokers can foster stronger relationships and drive business growth. The more brokers understand their clients, the better equipped they are to provide services that truly resonate with them.

Insurance Consumer Behavior Insights

Understanding insurance consumer behavior is vital for brokers aiming to attract and retain clients. Consumer behavior refers to how individuals make decisions regarding purchasing insurance. Factors influencing these decisions include personal experiences, peer recommendations, and online research. In today’s digital age, consumers are more empowered than ever to make informed choices about their insurance needs.

For example, many consumers today conduct extensive online research before purchasing insurance. They compare quotes, read reviews, and seek recommendations from friends and family. This shift means that brokers must recognize the importance of a strong online presence. Having a well-designed website, engaging social media profiles, and informative content can significantly impact how potential clients perceive a broker. A broker who provides valuable information and resources can build trust and establish themselves as a credible authority in the field.

Furthermore, the buyer journey for insurance can be segmented into stages: awareness, consideration, and decision. Brokers should tailor their marketing strategies to address the specific needs and concerns at each stage. For instance, during the awareness stage, providing educational content about different insurance products can help build trust and establish authority. This can be in the form of blog posts, videos, or infographics that explain complex insurance concepts in simple terms.

| Buyer Journey Stage | Key Focus |

|---|---|

| Aware | Educational content, brand awareness |

| Consideration | Comparisons, customer testimonials |

| Decision | Clear calls to action, easy contact options |

- Brokers should provide valuable content to guide consumers through their journey.

- Engaging with clients on social media can enhance brand visibility.

- Clear communication is essential for closing sales.

“A well-informed client is a happy client!” 💡

By understanding the intricacies of insurance consumer behavior, brokers can create targeted marketing strategies that resonate with their audience. This leads to higher engagement, increased trust, and ultimately better conversion rates. When clients feel informed and empowered, they are more likely to choose a broker who understands their needs and preferences, paving the way for long-term relationships.

The Role of AI in Insurance Segmentation

Artificial Intelligence (AI) is transforming how insurance brokers approach customer segmentation. By leveraging AI, brokers can analyze vast amounts of data to identify patterns and trends in consumer behavior. This data-driven approach allows for more precise segmentation and targeted marketing efforts. For instance, AI can help brokers analyze client interactions, preferences, and buying habits to create more accurate customer profiles.

One of the significant advantages of using AI in insurance segmentation is its ability to process and analyze data at an unprecedented scale. This enables brokers to uncover insights that would be impossible to identify manually. For example, AI can reveal that a particular demographic prefers specific types of coverage or that clients who engage with certain content are more likely to convert. By understanding these nuances, brokers can tailor their services and communications to meet the specific needs of each segment.

Moreover, AI can enhance personalization efforts. By utilizing chatbots and recommendation engines, brokers can provide clients with tailored advice and product suggestions based on their unique profiles. This not only improves customer satisfaction but also increases the likelihood of conversion. When clients receive personalized recommendations that align with their needs and preferences, they are more inclined to trust the broker and consider their services.

| AI Application | Benefit |

|---|---|

| Data Analysis | Enhanced customer profiling |

| Chatbots | 24/7 customer support and engagement |

| Recommendation Engines | Personalized product suggestions |

- AI can streamline the segmentation process for brokers.

- Personalized interactions can significantly improve client relationships.

- Leveraging AI tools can enhance operational efficiency.

“Embrace technology to stay ahead in the insurance game!” 🤖

By integrating AI into their practices, brokers can significantly enhance their ability to understand and serve their clients. This technology not only helps in refining customer segmentation but also in providing superior customer service. In a competitive industry, brokers who leverage AI will be better positioned to meet the evolving needs of their clients and maintain their relevance in the market.

Evolving Insurance Customer Expectations

Today’s insurance consumers have higher expectations than ever before. They demand transparency, responsiveness, and personalized service. As a broker, understanding these evolving expectations is crucial to remain competitive in the market. Clients are not just looking for policies; they seek a partnership with their insurance provider that aligns with their values and lifestyle.

For instance, many clients expect quick responses to inquiries and a seamless claims process. This means brokers must invest in technology and training to ensure their teams can meet these demands effectively. A slow response time can lead to frustration and may push clients to seek services elsewhere. By implementing efficient customer relationship management (CRM) systems, brokers can streamline communication and ensure timely responses to client inquiries. This proactive approach not only enhances customer satisfaction but also builds trust and loyalty over time.

Moreover, clients are increasingly looking for insurance providers who align with their values, such as sustainability and community engagement. Brokers can capitalize on this trend by incorporating these values into their business models and marketing strategies. For example, a broker might promote eco-friendly insurance options or engage in community service initiatives. By doing so, they not only attract clients who share these values but also enhance their brand reputation in the marketplace.

| Customer Expectation | Broker Response |

|---|---|

| Transparency | Clear communication about policies |

| Quick Response | Efficient customer service processes |

| Personalization | Tailored services based on client needs |

- Listening to client feedback can lead to better service offerings.

- Brokers should be proactive in adapting to changing expectations.

- Building trust is essential for long-term client relationships.

“Stay ahead of the curve by anticipating your client’s needs!” 🌈

By actively engaging with clients and adapting to their evolving expectations, brokers can foster stronger relationships and improve client retention rates. The insurance landscape is changing rapidly, and those who can adapt to these changes will thrive. Embracing technology and aligning services with client values will not only enhance customer satisfaction but also position brokers as leaders in the industry.

Customer Retention Strategies for Brokers

Retaining clients is just as important as acquiring new ones. In the insurance industry, where trust and relationships are paramount, brokers must implement effective customer retention strategies. This can involve regular check-ins, personalized communications, and loyalty programs that reward long-term clients. By fostering a sense of loyalty, brokers can ensure that clients feel valued and appreciated.

For example, brokers can schedule annual reviews with clients to assess their coverage needs and make necessary adjustments. This proactive approach not only reinforces the broker-client relationship but also demonstrates a commitment to the client’s well-being. During these reviews, brokers can highlight any changes in the client’s life that might affect their insurance needs, such as a new job, marriage, or the purchase of a new home.

Additionally, offering value-added services, such as educational webinars or informative newsletters, can keep clients engaged and informed. When clients feel that they are receiving valuable information and support from their broker, they are more likely to remain loyal. This can be especially effective for clients who may not require frequent policy changes but still value the relationship with their broker. Regular communication helps maintain that connection and reinforces the idea that the broker is there to support them.

| Retention Strategy | Description |

|---|---|

| Annual Reviews | Regular assessments of client needs |

| Educational Content | Webinars and newsletters to keep clients informed |

| Loyalty Programs | Incentives for long-term clients |

- Regular communication fosters strong relationships with clients.

- Providing valuable resources can enhance client loyalty.

- Proactive engagement is key to retaining clients.

“A loyal client is worth their weight in gold!” 🏆

In conclusion, effective customer retention strategies are essential for brokers looking to build long-lasting relationships with their clients. By actively engaging with clients, offering personalized services, and providing valuable resources, brokers can foster loyalty and ensure their clients feel valued. In an industry where trust is key, brokers who prioritize retention will not only survive but thrive in a competitive landscape.

Customer Segmentation and Targeting in Insurance

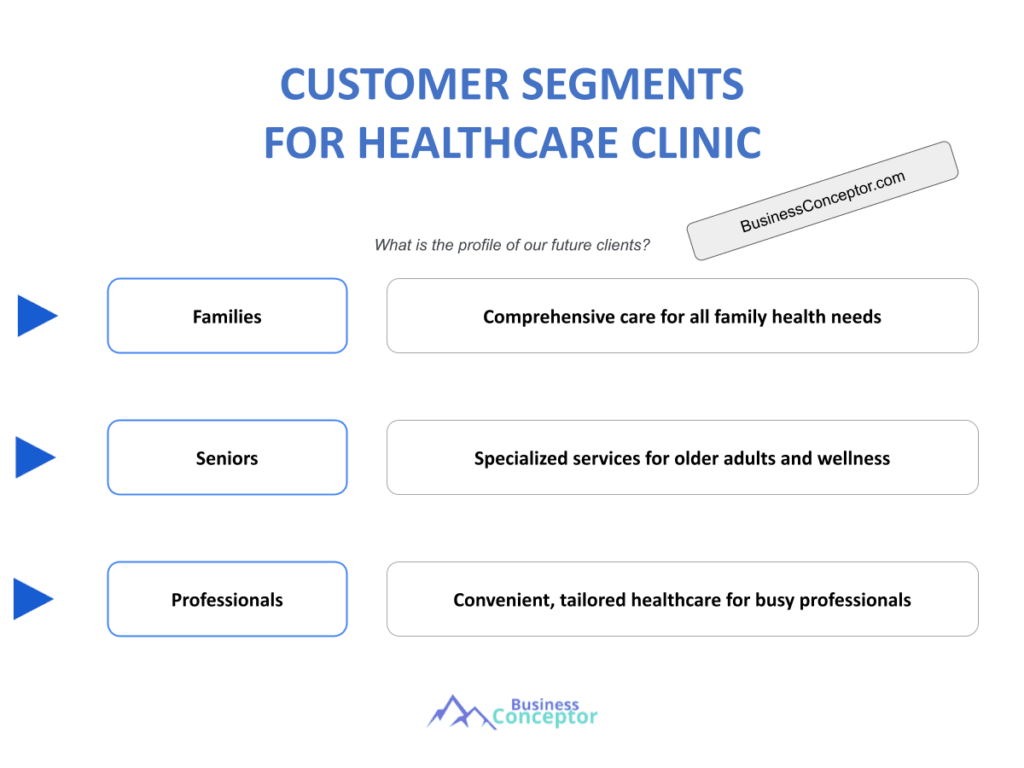

Effective customer segmentation is a cornerstone of successful marketing for insurance brokers. By understanding the different segments of the market, brokers can tailor their services and marketing strategies to better meet the needs of their clients. This not only enhances the client experience but also improves the overall effectiveness of marketing campaigns. For example, brokers can identify specific segments such as young families, retirees, or small business owners, each with distinct insurance needs and preferences.

Once brokers have identified these segments, they can develop targeted marketing campaigns that resonate with each group. For instance, a campaign aimed at young families might emphasize affordable health insurance options and coverage for children, while a campaign targeting small business owners could highlight liability coverage and employee benefits. By tailoring messages to address the specific concerns and priorities of each segment, brokers can increase engagement and conversion rates.

Moreover, effective segmentation allows brokers to allocate resources more efficiently. Instead of employing a one-size-fits-all approach, brokers can focus their efforts on the segments that are most likely to convert. This targeted approach not only reduces marketing costs but also maximizes return on investment. Additionally, by understanding the unique characteristics of each segment, brokers can anticipate their needs and proactively offer solutions, further enhancing client satisfaction and loyalty.

| Segmentation Strategy | Benefits |

|---|---|

| Identifying Target Segments | Allows for tailored marketing messages |

| Resource Allocation | Increases efficiency and reduces costs |

| Proactive Solutions | Enhances client satisfaction and loyalty |

- Targeted campaigns lead to higher engagement rates.

- Understanding client needs allows for better service offerings.

- Effective segmentation maximizes return on investment.

“The more you know your clients, the better you can serve them!” 🌟

In conclusion, implementing effective customer segmentation and targeting strategies is crucial for insurance brokers looking to thrive in a competitive market. By tailoring their approach to meet the unique needs of each segment, brokers can enhance their marketing effectiveness, improve client satisfaction, and ultimately drive business growth. This strategic focus on understanding and serving distinct customer segments is what sets successful brokers apart from the rest.

Future Trends in Insurance Broker Customer Segments

The landscape of insurance broker customer segments is continually evolving, and staying ahead of these trends is essential for brokers who wish to maintain their competitive edge. As technology advances and consumer behaviors shift, brokers must adapt their strategies to meet the changing demands of their clients. One of the most significant trends is the growing importance of digital engagement. Younger generations, particularly millennials and Gen Z, are increasingly turning to online platforms for their insurance needs. They expect seamless digital experiences, from obtaining quotes to managing their policies.

In response to this trend, brokers must invest in digital tools and platforms that enhance the client experience. This includes user-friendly websites, mobile applications, and online chat support. By providing a comprehensive digital experience, brokers can cater to the preferences of tech-savvy clients, ultimately improving satisfaction and retention rates. Furthermore, utilizing data analytics can help brokers understand client behavior and preferences, allowing for more personalized service and targeted marketing.

Another emerging trend is the increasing demand for personalized insurance solutions. Clients are no longer satisfied with generic policies; they seek coverage that reflects their unique lifestyles and needs. Brokers can leverage data to create customized insurance packages that address specific client concerns, such as environmental sustainability or coverage for unique assets. This level of personalization not only enhances client satisfaction but also positions brokers as trusted advisors who understand and prioritize their clients’ individual needs.

| Trend | Implication for Brokers |

|---|---|

| Digital Engagement | Need for user-friendly online platforms |

| Personalized Solutions | Custom insurance packages for clients |

| Data Utilization | Enhanced understanding of client preferences |

- Investing in digital tools is essential for modern brokers.

- Personalized services lead to higher client satisfaction.

- Understanding trends helps brokers stay competitive.

“The future belongs to those who adapt to change!” 🌍

In summary, staying attuned to future trends in insurance broker customer segments will enable brokers to remain relevant and successful in an ever-changing market. By embracing digital engagement and offering personalized solutions, brokers can meet the expectations of their clients and foster long-lasting relationships. The insurance industry is evolving, and those who adapt to these changes will thrive in the years to come.

Recommendations

In summary, understanding insurance broker customer segments is essential for brokers aiming to enhance their marketing strategies and improve client satisfaction. By employing effective segmentation techniques, brokers can tailor their services to meet the unique needs of different clients, ultimately leading to stronger relationships and increased profitability. For those looking to start or refine their insurance brokerage, consider utilizing the Insurance Broker Business Plan Template, which offers a comprehensive framework to guide your business strategy.

Additionally, you may find the following articles related to insurance brokers particularly helpful:

- Insurance Broker SWOT Analysis Essentials

- Insurance Brokers: Unlocking Profit Potential

- Insurance Broker Business Plan: Template and Tips

- Insurance Broker Financial Plan: Step-by-Step Guide with Template

- Building an Insurance Broker Business: A Complete Guide with Practical Examples

- Start Your Insurance Broker Marketing Plan with This Example

- Start Your Insurance Broker Business Model Canvas: A Comprehensive Guide

- How Much Does It Cost to Start an Insurance Broker Business?

- Ultimate Insurance Broker Feasibility Study: Tips and Tricks

- Ultimate Guide to Insurance Broker Risk Management

- Ultimate Guide to Insurance Broker Competition Study

- Essential Legal Considerations for Insurance Broker

- Exploring Funding Options for Insurance Broker

- How to Implement Growth Strategies for Insurance Broker

FAQ

What are the different types of insurance broker clients?

The types of insurance broker clients can vary widely, including individuals seeking personal insurance, small business owners looking for commercial coverage, and high-net-worth clients needing specialized policies. Each segment has unique needs and preferences, making it essential for brokers to understand these distinctions for effective service delivery.

How do insurance brokers segment their customers?

Insurance brokers typically segment their customers based on various factors such as demographics, psychographics, and behavioral data. By analyzing these characteristics, brokers can tailor their marketing strategies and services to better meet the specific needs of each customer segment.

What is the significance of customer profiles for insurance brokers?

Creating detailed customer profiles is vital for brokers as it helps them understand the unique needs, preferences, and behaviors of their clients. These profiles enable brokers to develop targeted marketing strategies and personalized services that enhance client satisfaction and loyalty.

How can brokers improve customer retention?

Brokers can improve customer retention by implementing strategies such as regular check-ins, personalized communication, and loyalty programs. By actively engaging with clients and providing ongoing support, brokers can foster strong relationships that encourage long-term loyalty.

What role does technology play in insurance segmentation?

Technology, particularly artificial intelligence, plays a significant role in insurance segmentation by enabling brokers to analyze large datasets to identify patterns in consumer behavior. This data-driven approach allows for more precise segmentation and targeted marketing efforts, ultimately improving client engagement and satisfaction.

How do evolving customer expectations affect insurance brokers?

As customer expectations evolve, brokers must adapt their services to meet the demands for transparency, responsiveness, and personalized solutions. By staying attuned to these changes, brokers can ensure they remain competitive and relevant in the marketplace.

What are the emerging trends in insurance broker customer segments?

Emerging trends in insurance broker customer segments include the increasing importance of digital engagement and the demand for personalized insurance solutions. Brokers who invest in digital tools and offer customized packages are better positioned to meet the needs of modern consumers.