Did you know that nearly 70% of people feel lost when it comes to managing their finances? The Coach Financial Plan is a structured approach to help individuals navigate their financial journeys with confidence. Essentially, it’s a personalized roadmap that guides you through your financial goals, whether that’s saving for a home, planning for retirement, or simply managing day-to-day expenses. Financial coaching has become an essential resource for those seeking clarity and direction in their financial lives.

Here are a few things you should know about a Coach Financial Plan:

– It’s tailored to your unique financial situation.

– It helps you set and achieve specific financial goals.

– It can provide accountability and support through the process.

– It often includes budgeting, saving strategies, and investment guidance.

Understanding a Financial Coaching Plan

A financial coaching plan is like a personalized GPS for your money. You start with your current financial situation, and your coach helps you map out a route to where you want to be. This plan includes various elements such as budgeting, saving, investing, and even debt management. The beauty of having a coach is that they can help break down complex financial concepts into manageable steps, making it easier for you to understand and implement.

For example, let’s say you’re a recent college graduate with student loans and a desire to travel the world. Your financial coach would help you create a plan that balances paying off debt while also saving for that dream trip. They might suggest setting aside a small percentage of your income each month for travel while also focusing on making extra payments towards your loans. This dual approach not only keeps your travel dreams alive but also ensures that you’re actively managing your debt. The ability to focus on multiple goals at once is a significant advantage of working with a coach.

Moreover, a well-structured financial coaching plan empowers you to take control of your financial future. It provides you with a clear direction, allowing you to see the steps you need to take to reach your goals. With the support of your coach, you can feel confident in making financial decisions that align with your values and aspirations. They can help you identify your priorities, whether it’s saving for a home, planning for retirement, or simply building an emergency fund. This level of personalization is something that generic financial advice simply can’t offer.

| Key Components | Description |

|---|---|

| Budgeting | Track and manage your income and expenses. |

| Goal Setting | Define short-term and long-term financial goals. |

| Debt Management | Strategies for paying off debts effectively. |

| Investment Planning | Guidance on how to grow your savings. |

- Financial coaching plans are customized.

- They help in setting clear goals.

- They include strategies for saving and investing.

“A goal without a plan is just a wish.” 💭

In summary, a financial coaching plan is not just about numbers; it’s about creating a life that aligns with your dreams and aspirations. With the right guidance, you can transform your financial landscape and achieve the financial freedom you desire. The journey might seem daunting, but with a personalized plan in hand, you’ll find yourself navigating through your financial life with clarity and purpose.

The Benefits of Hiring a Financial Coach

When you think about hiring a financial coach, you might wonder what exactly you’d get out of it. Well, let me tell you, the benefits are pretty impressive! A financial coach provides not just advice but also support and accountability. They are there to guide you through your financial journey, helping you make informed decisions that align with your goals and values.

One of the primary advantages of working with a financial coach is their expertise. They have the knowledge and experience to help you navigate the often complex world of personal finance. For instance, if you’re struggling to stick to a budget, your coach can help you identify areas where you might be overspending and suggest practical changes. They might recommend using budgeting apps or creating a more realistic spending plan that aligns with your lifestyle. This personalized approach can make a significant difference in your financial habits.

Moreover, having someone to discuss your financial fears and aspirations with can be incredibly motivating. You’ll feel less alone in your journey and more empowered to take action. A financial coach can provide accountability through regular check-ins, ensuring that you stay on track with your goals. This accountability can be a game-changer, especially when life gets busy, and it’s easy to lose focus on your financial objectives.

Another benefit is that a financial coach can help you set specific and achievable goals. They can guide you in defining what success looks like for you, whether it’s paying off debt, saving for a home, or planning for retirement. By breaking down these goals into actionable steps, you can make progress without feeling overwhelmed. This structured approach not only boosts your confidence but also helps you see tangible results over time.

| Benefits of Financial Coaching | Description |

|---|---|

| Accountability | Regular check-ins to keep you on track. |

| Expertise | Access to professional financial knowledge. |

| Customized Strategies | Tailored plans that fit your unique needs. |

| Emotional Support | Encouragement during challenging times. |

- Financial coaches provide accountability.

- They help you understand financial concepts.

- Their support can help you stay motivated.

“Success is the sum of small efforts, repeated day in and day out.” 🌟

Steps to Create a Financial Plan

Creating a financial plan might sound daunting, but it’s really just a series of steps that you can tackle one at a time. First off, you need to assess your current financial situation. This means gathering all your financial documents, including income statements, expenses, and any debts. Understanding where you stand financially is the foundation of any successful financial coaching plan.

Next, set specific financial goals. Whether it’s saving for a home, building an emergency fund, or investing for retirement, defining what you want to achieve is crucial. Your coach can help you prioritize these goals based on your current situation and aspirations. For example, if you have high-interest debt, your coach might suggest focusing on paying that off first before allocating funds to savings. This prioritization ensures that you’re making the most effective use of your resources.

Once your goals are set, it’s time to develop a strategy. This could involve creating a budget, establishing a savings plan, and even deciding on investments. Your coach can guide you through each of these steps, providing insights and resources that make the process smoother. Lastly, regularly review and adjust your plan as needed. Life changes, and so should your financial strategy! Keeping an open line of communication with your coach during these reviews is essential for staying on course.

| Steps to Create a Financial Plan | Description |

|---|---|

| Assess Current Situation | Gather all financial documents. |

| Set Specific Goals | Define what you want to achieve financially. |

| Develop a Strategy | Create a plan that includes budgeting and saving. |

| Review and Adjust | Regularly check in on your progress. |

- Start with a financial assessment.

- Set clear, actionable goals.

- Create a flexible strategy that adapts to changes.

“Planning is bringing the future into the present.” 🗓️

In summary, creating a financial plan with the help of a financial coach allows you to take control of your financial future. By following the steps outlined above, you can develop a personalized strategy that aligns with your goals and sets you on a path to success.

Financial Coaching for Entrepreneurs

Entrepreneurs have unique financial challenges that require tailored strategies. A financial coach can help you navigate the complexities of running a business while managing personal finances. For instance, separating business and personal expenses is crucial, and your coach can guide you on how to do this effectively. This separation not only helps in maintaining clarity in your financial records but also aids in tax preparation and financial analysis.

Moreover, planning for irregular income is essential for entrepreneurs. Your financial coach can help you create a budgeting strategy that accommodates fluctuations in income while still allowing for savings and investments. For example, they might suggest setting aside a percentage of your income during high-earning months to cover leaner periods. This proactive approach can provide you with a financial cushion, ensuring that you can meet both personal and business expenses without stress.

Additionally, understanding tax obligations and retirement planning is vital for business owners. Your coach can provide guidance on how to maximize deductions and prepare for retirement while running your business. They might recommend setting up a retirement account specifically designed for self-employed individuals, such as a Solo 401(k) or a SEP IRA, which can help you save significantly for the future while also benefiting from tax advantages.

| Financial Planning for Entrepreneurs | Description |

|---|---|

| Separate Business and Personal Finances | Strategies for managing both effectively. |

| Budget for Irregular Income | Create a flexible budget that adapts to income changes. |

| Understand Tax Obligations | Learn about deductions and retirement planning. |

- Separate your business and personal finances.

- Create a flexible budget for fluctuating income.

- Understand tax implications for business owners.

“Entrepreneurship is neither a science nor an art. It is a practice.” 💼

Goal-Based Financial Planning

Goal-based financial planning is all about aligning your financial decisions with your life goals. This approach helps you prioritize what matters most to you, whether it’s buying a home, funding your child’s education, or preparing for retirement. When you work with a financial coach, they will help you identify these goals and develop a plan that reflects your values and aspirations.

Setting specific goals is not just about stating what you want; it’s about creating a roadmap to get there. Your financial coach will guide you in defining what success looks like for you. For example, if your goal is to buy a home, your coach will help you determine how much you need to save for a down payment and how to adjust your budget to reach that target. This kind of focused planning can be incredibly motivating, as you can see your progress toward your goals in real-time.

Moreover, tracking your progress towards these goals is crucial. Regular check-ins with your coach can help you stay motivated and make necessary adjustments along the way. If you find that you’re falling behind on your savings, your coach can help you identify areas where you can cut back or suggest alternative strategies to boost your savings. This ongoing support ensures that you remain accountable and focused on achieving your financial objectives.

| Goal-Based Financial Planning | Description |

|---|---|

| Align Finances with Life Goals | Ensure your financial decisions reflect your values. |

| Set Various Timeframes | Create a mix of short-term and long-term goals. |

| Track Progress | Regularly assess your advancement towards goals. |

- Align your financial plan with personal values.

- Set a mix of short and long-term goals.

- Regularly track your progress to stay on course.

“The future belongs to those who believe in the beauty of their dreams.” ✨

In summary, goal-based financial planning allows you to create a financial strategy that is not only effective but also deeply personal. By working closely with a financial coach, you can transform your financial landscape and achieve the life you envision, one goal at a time.

Creating a Savings Strategy

Building a savings strategy is essential for financial stability and long-term success. It’s not just about putting money away; it’s about being strategic with your savings. Your financial coach can help you determine how much to save each month based on your income and expenses. This involves analyzing your current financial situation and setting realistic savings goals that align with your overall financial plan.

A common approach is the 50/30/20 rule, which suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings. Your financial coach can help you adjust these percentages based on your unique situation. For instance, if you have significant debt, your coach might recommend increasing the savings percentage temporarily to focus on building an emergency fund or paying off high-interest debt. This flexibility in your savings strategy ensures that you can adapt to changing circumstances while still working towards your financial goals.

Additionally, having specific savings goals can make the process easier and more motivating. Whether you’re saving for an emergency fund, a vacation, or a new car, having a target can help you stay focused. Your financial coach can assist you in setting these goals and developing a timeline to achieve them. For example, if you want to save for a vacation in a year, your coach will help you calculate how much you need to set aside each month to reach that goal. This clear roadmap makes it easier to stay committed to your savings plan.

| Creating a Savings Strategy | Description |

|---|---|

| Determine Monthly Savings | Assess how much you can realistically save. |

| Consider the 50/30/20 Rule | Allocate your income effectively. |

| Set Specific Savings Goals | Have clear targets to work towards. |

- Assess your income to determine savings.

- Use the 50/30/20 rule as a guideline.

- Set clear savings goals for motivation.

“Saving is a great habit, but without a plan, it’s just a dream.” 💰

Debt Management Strategies

Managing debt can feel like a heavy burden, but with the right strategies, it can be tackled effectively. A financial coach can help you assess your debts and prioritize them based on interest rates and balances. This assessment is crucial for developing a plan that will allow you to pay off your debts efficiently and effectively. For instance, if you have multiple debts, your coach may suggest focusing on the highest interest debts first, which can save you money in the long run.

One common method for debt repayment is the snowball method, where you pay off your smallest debts first to build momentum. This approach can be incredibly motivating, as you’ll see debts eliminated quickly. On the other hand, the avalanche method focuses on paying off high-interest debts first, which can be more cost-effective over time. Your financial coach can help you determine which strategy best fits your personality and financial situation, ensuring that you stay engaged and motivated throughout the process.

In addition to repayment strategies, your financial coach can guide you on how to avoid accumulating more debt while managing your existing obligations. They might suggest creating a budget that limits discretionary spending or finding ways to increase your income. For example, if you’re consistently overspending in certain categories, your coach can help you identify those areas and suggest practical changes. This proactive approach not only helps you manage your current debt but also sets you up for a healthier financial future.

| Debt Management Strategies | Description |

|---|---|

| Prioritize Debts | Focus on paying off debts based on interest rates. |

| Snowball vs. Avalanche Method | Choose a method that works for you. |

| Avoiding New Debt | Strategies to prevent future debt accumulation. |

- Assess and prioritize your debts.

- Choose a debt repayment strategy that fits your style.

- Create a budget to help avoid new debts.

“It’s not about how much money you make; it’s about how much you keep.” 💸

In summary, managing debt effectively is crucial for achieving financial freedom. With the guidance of a financial coach, you can develop personalized strategies that empower you to take control of your financial situation, reduce stress, and pave the way for a more secure future.

Exploring Financial Coaching Tools

In today’s digital age, there are numerous tools available to support your financial coaching journey. From budgeting apps to investment platforms, these tools can enhance your financial literacy and help you stay organized. Your financial coach can recommend specific tools that align with your goals, making it easier for you to track your progress and manage your finances effectively.

For instance, if you’re looking to track your spending, apps like Mint or YNAB (You Need A Budget) can be incredibly helpful. These tools allow you to categorize your expenses, set budget limits, and receive alerts when you approach those limits. This level of visibility into your spending habits can be a game-changer, as it empowers you to make informed decisions about where to cut back and how to allocate funds more effectively.

Additionally, many coaches use financial planning software to create detailed plans and projections. These tools can help you visualize your financial future and make informed decisions. For example, a coach might use software that allows you to input your current financial situation and goals, generating scenarios based on different savings or investment strategies. This not only helps you understand the potential outcomes of your decisions but also provides a clear path forward.

| Financial Coaching Tools | Description |

|---|---|

| Budgeting Apps | Tools to track and manage spending. |

| Investment Platforms | Resources for growing your savings. |

| Financial Planning Software | Software for detailed financial projections. |

- Use budgeting apps to manage spending.

- Explore investment platforms for growth.

- Financial planning software can enhance your strategy.

“The right tools can make all the difference.” 🔧

Debt Management Strategies

Managing debt can feel like a heavy burden, but with the right strategies, it can be tackled effectively. A financial coach can help you assess your debts and prioritize them based on interest rates and balances. This assessment is crucial for developing a plan that will allow you to pay off your debts efficiently and effectively. For instance, if you have multiple debts, your coach may suggest focusing on the highest interest debts first, which can save you money in the long run.

One common method for debt repayment is the snowball method, where you pay off your smallest debts first to build momentum. This approach can be incredibly motivating, as you’ll see debts eliminated quickly. On the other hand, the avalanche method focuses on paying off high-interest debts first, which can be more cost-effective over time. Your financial coach can help you determine which strategy best fits your personality and financial situation, ensuring that you stay engaged and motivated throughout the process.

In addition to repayment strategies, your financial coach can guide you on how to avoid accumulating more debt while managing your existing obligations. They might suggest creating a budget that limits discretionary spending or finding ways to increase your income. For example, if you’re consistently overspending in certain categories, your coach can help you identify those areas and suggest practical changes. This proactive approach not only helps you manage your current debt but also sets you up for a healthier financial future.

| Debt Management Strategies | Description |

|---|---|

| Prioritize Debts | Focus on paying off debts based on interest rates. |

| Snowball vs. Avalanche Method | Choose a method that works for you. |

| Avoiding New Debt | Strategies to prevent future debt accumulation. |

- Assess and prioritize your debts.

- Choose a debt repayment strategy that fits your style.

- Create a budget to help avoid new debts.

“It’s not about how much money you make; it’s about how much you keep.” 💸

In summary, managing debt effectively is crucial for achieving financial freedom. With the guidance of a financial coach, you can develop personalized strategies that empower you to take control of your financial situation, reduce stress, and pave the way for a more secure future.

Recommendations

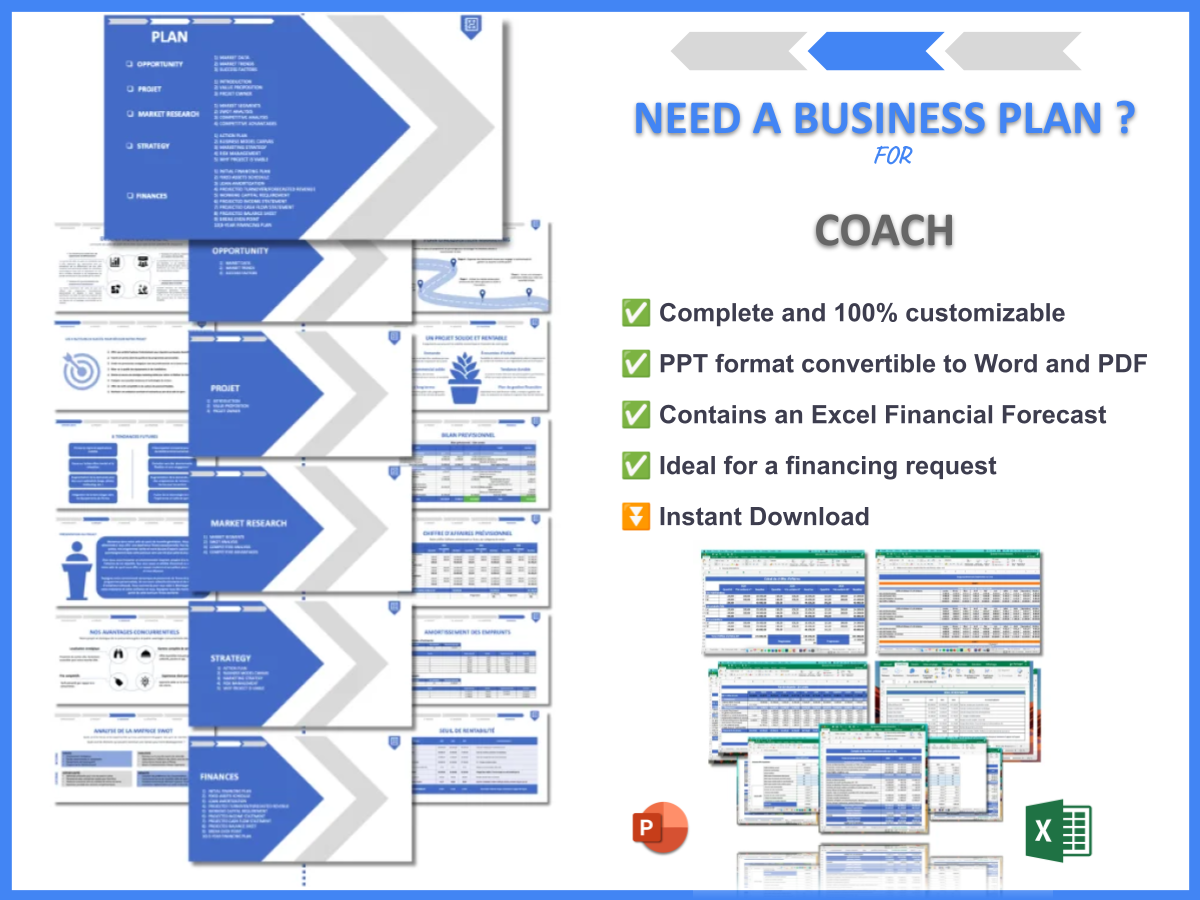

In this article, we’ve explored the essential steps and examples of a Coach Financial Plan, highlighting the numerous benefits of hiring a financial coach and creating a structured financial strategy. By following these guidelines, you can take control of your financial future and achieve your personal and professional goals. For those looking to establish a solid foundation for their coaching business, consider utilizing the Coach Business Plan Template. This comprehensive template will help you outline your vision and strategies effectively.

Additionally, if you’re interested in expanding your knowledge about coaching, check out our related articles:

- Coach SWOT Analysis: Strengths and Opportunities

- Coaches: How Profitable Is This Career?

- Coach Business Plan: Template and Examples

- How to Start a Coaching Business: A Detailed Guide with Examples

- Start a Coach Marketing Plan: Strategies and Examples

- Crafting a Business Model Canvas for a Coach: A Comprehensive Guide

- Coach Customer Segments: Examples and Effective Strategies

- How Much Does It Cost to Operate a Coaching Business?

- How to Start a Feasibility Study for a Coaching Business?

- Ultimate Guide to Coach Risk Management

- Coach Competition Study: Essential Guide

- Coach Legal Considerations: Expert Analysis

- Coach Funding Options: Comprehensive Guide

- How to Implement Growth Strategies for Coach

FAQ

What is a financial coaching plan?

A financial coaching plan is a personalized roadmap designed to help individuals achieve their financial goals. It typically includes elements such as budgeting, saving strategies, and investment guidance, tailored to the client’s unique situation.

How can I make a financial roadmap?

To create a financial roadmap, start by assessing your current financial situation. Identify your short-term and long-term goals, and then work with a financial coach to develop a structured plan that outlines the steps needed to achieve those goals.

What are the benefits of hiring a financial coach?

Hiring a financial coach offers numerous benefits, including personalized guidance, accountability, and expertise in financial matters. Coaches help clients navigate complex financial situations, set realistic goals, and develop effective strategies to reach those goals.

What is the difference between a financial coach and advisor?

A financial coach focuses on educating clients about financial concepts and helping them develop personal finance skills, while a financial advisor typically manages investments and offers advice on financial products. Coaches empower clients to make informed decisions, whereas advisors may take a more hands-on approach.

What are some DIY financial planning strategies?

DIY financial planning strategies include creating a budget, setting up an emergency fund, and using financial apps to track spending. Additionally, educating yourself about personal finance through books, online courses, or workshops can enhance your financial literacy.

What are the key components of a financial plan?

Key components of a financial plan typically include budgeting, goal setting, debt management, and investment planning. These elements work together to create a comprehensive strategy that helps individuals achieve their financial objectives.

How can I improve my financial wellness?

Improving your financial wellness involves assessing your financial situation, creating a budget, saving for emergencies, and setting clear financial goals. Working with a financial coach can provide additional support and accountability in this process.

What are effective budgeting techniques for families?

Effective budgeting techniques for families include the 50/30/20 rule, using budgeting apps to track expenses, and involving all family members in the budgeting process to ensure everyone is on the same page about financial goals and spending.

How do I manage personal finances effectively?

To manage personal finances effectively, create a budget, track your spending, set financial goals, and regularly review your financial situation. Consider working with a financial coach for personalized guidance and strategies tailored to your needs.