Did you know that over 90% of dropshipping businesses fail due to insufficient funding? This shocking statistic highlights the importance of understanding Dropshipping Funding Options. For anyone diving into the world of dropshipping, securing the right financial backing can mean the difference between success and failure. In this article, we will explore various funding avenues available for dropshipping ventures, helping you navigate the often complex financial landscape.

Dropshipping funding options refer to the various methods and sources of capital that entrepreneurs can use to finance their dropshipping businesses. This includes loans, grants, and alternative financing methods designed to help you cover startup costs and operational expenses.

- Understanding funding options is crucial for success.

- Various financing methods are available.

- Each option has its pros and cons.

- Proper planning can prevent financial pitfalls.

- Alternative funding can be a game-changer.

- Crowdfunding is gaining popularity.

- Financial institutions offer tailored solutions.

- Credit management is essential.

- Success stories can inspire your journey.

- Expert insights can guide your decisions.

Understanding the Importance of Funding

Funding is the lifeblood of any business, and dropshipping is no exception. With the rise of e-commerce, many aspiring entrepreneurs are eager to start their dropshipping ventures. However, they often overlook the importance of securing adequate funding. Without the right financial resources, your dream of running a successful dropshipping store could quickly turn into a nightmare.

For instance, imagine launching your online store only to realize you lack the funds to market your products effectively. This situation can lead to low sales and, ultimately, business failure. Exploring various funding options can help you avoid such pitfalls and ensure you have enough capital to cover inventory, marketing, and other essential expenses.

By understanding the different funding avenues available, you can make informed decisions about which options best suit your needs. This knowledge will also prepare you for the next section, where we’ll delve into the various types of funding options available for dropshipping businesses.

| Importance of Funding | Explanation |

| Provides Capital | Necessary for startup and operational costs |

| Affects Growth | Determines your ability to scale |

| Prevents Pitfalls | Helps avoid cash flow issues |

- Funding is essential for dropshipping success

- Lack of capital can lead to failure

- Different options cater to various needs

- Understanding funding is crucial for growth

“A goal without a plan is just a wish.”

Types of Dropshipping Funding Options

When it comes to dropshipping funding, there are several options to consider. From traditional loans to modern crowdfunding platforms, each method has its unique advantages and disadvantages. Knowing these options can empower you to choose the best fit for your business model.

For example, a business loan from a bank can provide a significant amount of capital upfront, but it often comes with strict repayment terms and interest rates. On the other hand, crowdfunding allows you to raise funds from a community of supporters who believe in your business idea, often without the need for repayment. Understanding the nuances of each option is key to making an informed decision.

As we explore these various funding options, remember that your choice should align with your business goals and financial situation. With this foundation in place, let’s move on to the next section to discuss how to evaluate which funding option is best for you.

- Business Loans

- Crowdfunding

- Grants

- Angel Investors

- Peer-to-Peer Lending

– Choose funding options that align with your business goals.

Evaluating Your Funding Needs

Before jumping into any funding option, it’s crucial to evaluate your specific financial needs. What are the startup costs associated with your dropshipping business? How much capital do you need to sustain operations in the initial months? Taking the time to assess these factors will save you from making hasty financial decisions later on.

For example, consider creating a detailed budget that outlines all expected expenses, from product sourcing to marketing campaigns. This exercise not only clarifies your funding needs but also helps you identify potential financial gaps that could hinder your business growth.

Once you have a clear understanding of your funding requirements, you can effectively approach potential funding sources. This strategic approach will prepare you for the next section, where we will discuss how to present your funding request to lenders or investors.

| Funding Assessment | Description |

| Assess Startup Costs | Identify all initial expenses |

| Identify Operational Expenses | Understand ongoing costs |

| Create a Detailed Budget | Outline financial needs |

- Assess startup costs

- Identify operational expenses

- Create a detailed budget

- Clarify funding needs for potential investors

“Planning is bringing the future into the present.”

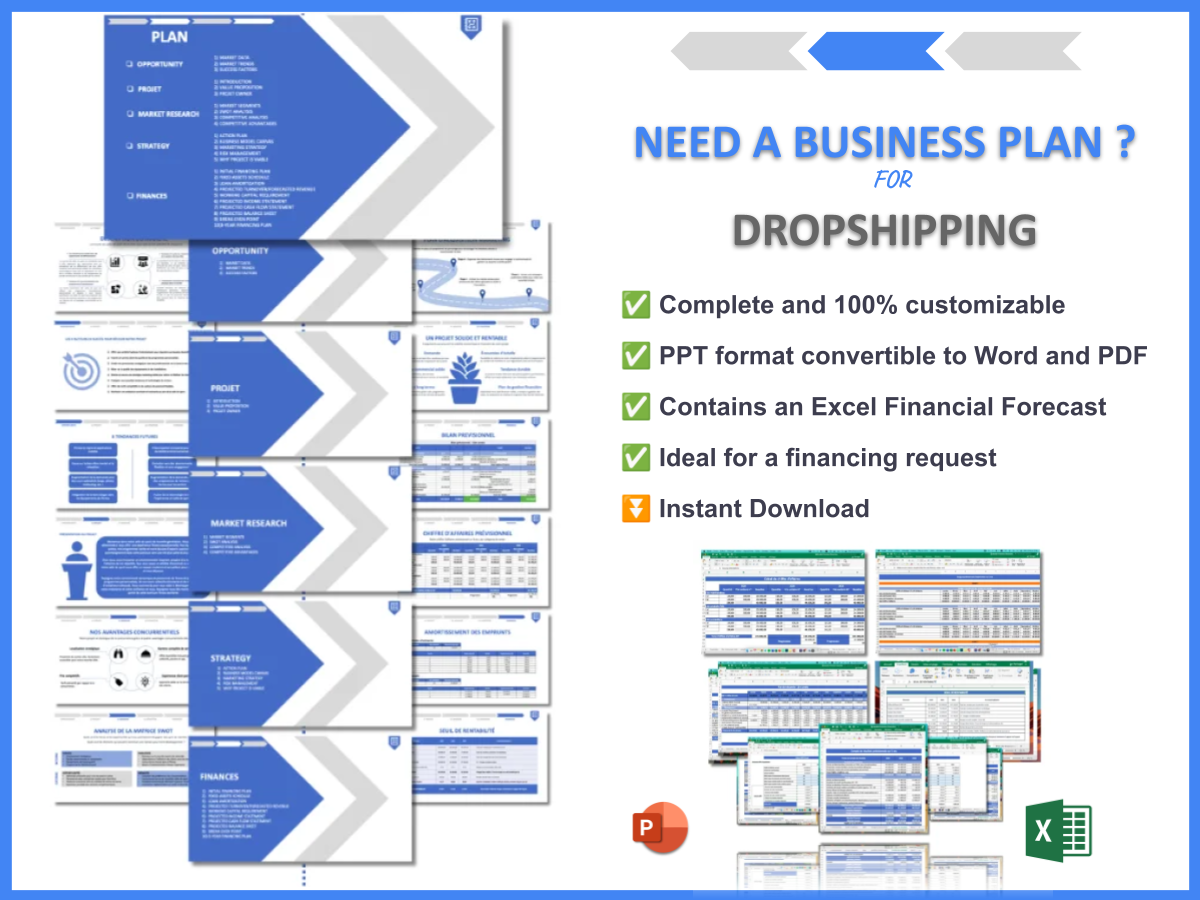

Crafting Your Business Plan for Funding

A well-crafted business plan is essential when seeking funding for your dropshipping venture. This document should clearly outline your business model, market analysis, and financial projections. Lenders and investors want to see that you have a solid plan for how you intend to use their funds and generate a return on investment.

Include detailed information about your target market, marketing strategies, and sales projections. For instance, if you plan to target millennials with eco-friendly products, highlight the growing trend in sustainable consumerism and how your business aligns with it. Such insights can significantly enhance your funding application.

By presenting a comprehensive business plan, you increase your chances of securing the funding you need. With this knowledge, let’s transition to the next section, where we’ll discuss common mistakes to avoid when seeking funding.

| Elements of a Strong Business Plan | Description |

| Executive Summary | Brief overview of the business |

| Market Analysis | Insights into the target market |

| Financial Projections | Estimated income and expenses |

- Executive Summary

- Market Analysis

- Marketing Strategy

- Financial Projections

- Funding Request

– Choose funding options that align with your business goals.

Common Mistakes in Seeking Funding

When seeking funding for your dropshipping business, it’s important to be aware of common mistakes that can derail your efforts. Many entrepreneurs fail to prepare adequately, leading to missed opportunities and wasted time.

For example, submitting a generic funding request without tailoring it to the specific lender’s criteria can result in immediate rejection. Take the time to research each funding source and customize your proposal to meet their requirements. This attention to detail can make a significant difference in your funding success.

By avoiding these common pitfalls, you can increase your chances of securing the financial backing you need. Next, we will discuss strategies for maintaining good credit, which is vital for future funding opportunities.

| Common Mistakes to Avoid | Consequence |

| Generic Proposals | Rejection |

| Poor Financial Planning | Cash Flow Issues |

- Avoid generic funding requests

- Research funding sources thoroughly

- Tailor proposals to specific lenders

- Plan finances carefully

“Success is where preparation and opportunity meet.”

Maintaining Good Credit for Future Funding

Maintaining good credit is crucial for securing funding in the future. Lenders often assess your credit history to determine your creditworthiness. A strong credit score can lead to better loan terms and lower interest rates, making it easier to finance your dropshipping business.

To maintain good credit, pay your bills on time, reduce debt, and keep your credit utilization low. For instance, if you have multiple credit cards, try to keep your balance below 30% of the credit limit. These practices can help you build a positive credit history, which is essential for future funding opportunities.

With a solid understanding of how to maintain good credit, you’ll be better positioned to secure funding when you need it. Now, let’s explore how to leverage social proof and testimonials to attract investors or lenders.

| Tips for Maintaining Good Credit | Description |

| Pay Bills on Time | Avoid late payments |

| Reduce Debt | Keep balances low |

| Monitor Credit Report | Check for errors |

- Pay bills on time

- Keep debt low

- Monitor your credit report

- Use credit responsibly

Leveraging Social Proof and Testimonials

In the world of dropshipping, social proof and testimonials can play a significant role in attracting funding. Lenders and investors often look for evidence that your business has traction and credibility. By showcasing positive customer feedback and success stories, you can build trust and enhance your funding prospects.

For instance, consider displaying testimonials prominently on your website or including them in your funding proposal. Real-life success stories can illustrate the potential for growth and profitability, making your business more appealing to potential investors.

As you build a solid reputation through social proof, you’ll find it easier to secure funding. This leads us to the final section, where we will summarize key takeaways and encourage you to take action.

| Benefits of Social Proof | Description |

| Builds Trust | Increases credibility |

| Attracts Investors | Shows potential for success |

- Showcase customer testimonials

- Highlight success stories

- Build a strong online presence

- Use social proof in funding proposals

“Success comes to those who persevere.”

Final Thoughts on Dropshipping Funding Options

Navigating the world of dropshipping funding can be challenging, but with the right knowledge and strategies, you can secure the financial resources needed to launch and grow your business. Understanding the different funding options available is crucial for your success.

By assessing your funding needs, crafting a solid business plan, avoiding common mistakes, maintaining good credit, and leveraging social proof, you’ll be well-equipped to attract the funding you need. Remember, preparation is key in this competitive landscape.

As you embark on your dropshipping journey, don’t hesitate to seek advice and support from experts in the field. With the right funding, your dropshipping business can thrive and reach new heights.

| Key Takeaway | Summary |

| Explore Funding Options | Research various methods available |

| Craft a Business Plan | Outline your strategy for success |

| Avoid Common Mistakes | Stay diligent and informed |

- Explore different funding options

- Assess your financial needs

- Create a comprehensive business plan

- Maintain good credit

- Leverage social proof

Key Actions and Recommendations

As you prepare to seek funding for your dropshipping business, consider these key actions. Each step is designed to guide you through the funding process and help you make informed decisions that will impact your success.

By following these recommendations, you’ll be better positioned to secure the financial backing you need. Whether you’re applying for a loan or seeking investors, preparation and strategy are your best allies.

With the right approach, you can navigate the challenges of funding and propel your dropshipping business to new heights. Now is the time to take action and start your journey toward financial success.

“Success is where preparation and opportunity meet.”

- Research funding options thoroughly

- Create a detailed business plan

- Maintain good credit history

- Leverage testimonials and social proof

- Take action to secure funding

Conclusion

In conclusion, understanding Dropshipping Funding Options is essential for aspiring entrepreneurs looking to launch their businesses successfully. By exploring various funding avenues, crafting a solid business plan, and avoiding common mistakes, you can secure the financial resources needed to thrive in the competitive e-commerce landscape.

We encourage you to take advantage of the Dropshipping Business Plan Template to help structure your business effectively. This template can guide you in outlining your strategies and securing the funding you need.

Additionally, check out our articles for more insights on DROPSHIPPING:

- SWOT Analysis for Dropshipping Business: Key Strategies for Success

- Crafting a Business Plan for Your Dropshipping Venture: Step-by-Step Guide

- How to Create a Financial Plan for Your Dropshipping Business: Step-by-Step Guide (+ Template)

- Step-by-Step Guide to Starting a Dropshipping Business

- Crafting a Dropshipping Marketing Plan: Step-by-Step Guide and Example

- Create a Successful Dropshipping Business Model Canvas: Step-by-Step Guide

- Customer Segments in Dropshipping: Who Are Your Target Audiences?

- Dropshipping Profitability: Tips for Financial Success

- How Much Does It Cost to Start a Dropshipping Business?

- Dropshipping Feasibility Study: Detailed Analysis

- Dropshipping Competition Study: Detailed Insights

- Dropshipping Risk Management: Detailed Analysis

- Dropshipping Legal Considerations: Expert Analysis

- Scaling Dropshipping: Key Growth Strategies

FAQ Section

What are the best funding options for dropshipping?

Some of the best funding options for dropshipping include business loans, crowdfunding, and grants that can provide the necessary capital to start your business.

How much capital do I need to start dropshipping?

The amount of capital required to start a dropshipping business can vary, but typically ranges from $1,000 to $5,000, depending on your niche and marketing strategy.

Can I get funding without a business plan?

It is challenging to secure funding without a well-structured business plan, as lenders and investors want to see a clear strategy for how you intend to use their funds.

What role does credit play in funding?

Your credit history plays a significant role in determining your eligibility for funding, as a strong credit score can lead to better loan terms and lower interest rates.

Are there grants available for dropshipping businesses?

Yes, various organizations offer grants specifically for e-commerce and dropshipping ventures to help cover startup costs.

How can I leverage social proof for funding?

You can leverage social proof by showcasing positive customer testimonials and success stories to build credibility and attract potential investors.

Is crowdfunding a viable option for dropshipping?

Absolutely! Many entrepreneurs have successfully utilized crowdfunding to finance their dropshipping businesses by engaging with a community of supporters.

What are common mistakes to avoid when seeking funding?

Common mistakes include submitting generic proposals and failing to tailor your funding requests to specific lenders’ criteria, which can lead to rejection.

How can I maintain good credit for future funding?

To maintain good credit, pay your bills on time, reduce your debt, and regularly monitor your credit report for any errors.

What are some effective strategies for presenting a funding request?

Customize your proposal, highlight market potential, and showcase your financial projections to make your funding request more appealing to lenders and investors.