Did you know that nearly 30% of dropshipping businesses face legal challenges within their first year? Dropshipping Legal Considerations are essential for anyone looking to thrive in the e-commerce landscape. In this article, we’ll dive deep into the legal framework that governs dropshipping, ensuring you’re well-informed and compliant. Essentially, dropshipping involves selling products without holding inventory, which introduces a unique set of legal responsibilities for sellers.

- Understand the fundamental legal requirements for dropshipping.

- Learn about the importance of contracts and agreements.

- Discover consumer protection laws that affect dropshippers.

- Explore tax implications and compliance for your business.

- Gain insights into intellectual property issues.

- Get familiar with shipping and returns regulations.

- Understand the legal risks involved in dropshipping.

- Learn how to protect your business from fraud.

- Discover best practices for compliance audits.

- Find actionable steps to ensure legal safety in your dropshipping journey.

Legal Requirements for Dropshipping

Starting a dropshipping business without understanding the legal requirements is like sailing without a compass. You may end up lost or worse, in trouble. First off, you need to familiarize yourself with the legal landscape that governs e-commerce. This includes knowing your obligations as a seller, such as obtaining the necessary business licenses and permits, adhering to consumer protection laws, and ensuring compliance with tax regulations.

For example, if you’re selling products across state lines, you need to be aware of the sales tax requirements in each state. Some states require you to collect sales tax based on the buyer’s location, while others might have different regulations. Also, consider that some products may require specific permits or certifications, especially in categories like food or electronics. Ignoring these legalities can lead to hefty fines or even the closure of your business.

In summary, navigating the legal requirements for dropshipping is critical for your success. Understanding these laws not only protects your business but also builds trust with your customers. Now, let’s transition to the next section, where we’ll dive deeper into the contracts and agreements necessary for a successful dropshipping business.

| Requirement | Description |

|---|---|

| Business License | Necessary for operating legally in your state |

| Sales Tax Compliance | Rules for collecting and remitting sales tax |

| Consumer Protection Laws | Regulations ensuring customer rights |

- Obtain necessary business licenses

- Ensure compliance with sales tax regulations

- Understand consumer protection laws

Knowledge of the law is the first step to success.

Contracts and Agreements in Dropshipping

Contracts are the backbone of any dropshipping operation. They outline the terms of your relationships with suppliers, customers, and even your own team. A well-structured contract can help prevent misunderstandings and protect you from potential legal disputes. Make sure to include details about product quality, shipping times, and payment terms.

For instance, a clear agreement with your supplier can stipulate the quality of goods, ensuring you’re not held liable for defective products. Moreover, having a solid return policy in your agreements can save you from customer dissatisfaction. According to recent surveys, businesses with clear contracts are 60% less likely to face legal disputes. That’s a significant statistic for anyone in e-commerce!

To wrap up this section, having solid contracts and agreements is not just about legal protection; it’s also about building strong relationships with your partners and customers. Next, let’s explore consumer protection laws that every dropshipper should be aware of.

- Define the scope of the agreement.

- Specify payment terms and conditions.

- Include quality assurance clauses.

- Outline shipping and handling procedures.

- Establish a clear returns policy.

The above steps must be followed rigorously for optimal success.

Consumer Protection Laws for Dropshippers

Consumer protection laws are designed to ensure that customers are treated fairly and ethically. As a dropshipper, it’s vital to understand these laws because they affect how you interact with your customers. From providing accurate product descriptions to ensuring a secure checkout process, these regulations shape your business operations.

For example, the Federal Trade Commission (FTC) mandates that all advertising must be truthful and not misleading. If you misrepresent a product, you could face penalties. Additionally, providing a clear privacy policy that outlines how you handle customer data is not just good practice; it’s often a legal requirement.

In conclusion, adhering to consumer protection laws not only helps you avoid legal trouble but also builds trust with your customers, which is crucial for long-term success. Now, let’s look at the tax implications of dropshipping, as understanding this area is equally important.

- Ensure truthful advertising

- Provide accurate product descriptions

- Maintain a clear privacy policy

Trust is built on transparency and honesty.

Tax Implications for Dropshipping

Tax implications are one of the most complex areas of dropshipping. As a seller, you need to understand how sales tax works in your jurisdiction and whether you’re required to collect it. This can vary greatly depending on where you and your customers are located.

For example, some states have implemented “economic nexus” laws, meaning if you sell a certain amount in a state, you must collect sales tax from customers in that state, regardless of your physical presence. Not complying with these tax laws can lead to significant fines, so it’s essential to stay informed and possibly consult a tax professional.

To sum up, understanding the tax implications of your dropshipping business is not just about compliance; it’s about ensuring your business remains profitable. Next, we’ll delve into the legal risks involved in dropshipping and how to mitigate them.

| Tax Type | Description |

|---|---|

| Sales Tax | Collected based on buyer’s location |

| Income Tax | Taxes on your business profits |

- Research local tax laws

- Consult a tax professional

- Keep accurate sales records

Understanding tax laws is crucial for success.

Legal Risks in Dropshipping

Every business faces legal risks, and dropshipping is no exception. The unique nature of dropshipping can expose you to various liabilities, from product defects to shipping issues. It’s crucial to identify these risks early on to mitigate them effectively.

For example, if a customer receives a defective product and decides to take legal action, you could be held liable, especially if you didn’t have a solid contract with your supplier. Additionally, if your supplier fails to deliver products on time, it could lead to customer dissatisfaction and lost sales.

In conclusion, being proactive about identifying and managing legal risks is vital for the longevity of your dropshipping business. Now, let’s look into how to protect your business from fraud, which is another significant concern for dropshippers.

- Product liability issues.

- Shipping delays and their repercussions.

- Contractual disputes with suppliers.

- Data breaches and privacy concerns.

- Misleading advertising claims.

Always have a risk management plan in place.

Protecting Your Dropshipping Business from Fraud

Fraud is an ever-present threat in the e-commerce world, and dropshipping is particularly vulnerable due to the nature of the business model. Protecting your business from fraud requires a multifaceted approach that includes secure payment processing and vigilant monitoring of transactions.

For example, using a reputable payment processor with built-in fraud protection can significantly reduce your risk. Additionally, implementing measures like customer verification and monitoring for unusual activity can help catch fraudulent transactions before they become a problem.

To wrap this section up, safeguarding your dropshipping business from fraud is not just about technology; it’s also about staying informed and proactive. Next, we’ll discuss best practices for compliance audits to ensure your business remains on the right side of the law.

| Strategy | Description |

|---|---|

| Secure Payment Methods | Use trusted payment processors |

| Transaction Monitoring | Keep an eye on suspicious activities |

- Use fraud detection software

- Implement customer verification processes

- Regularly monitor transactions

Stay vigilant; prevention is key.

Compliance Audits for Dropshipping

Conducting compliance audits is an essential practice for any dropshipping business. These audits help you identify areas where you may not be meeting legal requirements and allow you to make necessary adjustments before issues arise.

For instance, reviewing your contracts, tax compliance, and consumer protection measures can reveal gaps that need addressing. Regular audits can also provide peace of mind, knowing that your business is operating within the legal framework.

In conclusion, compliance audits are a proactive way to safeguard your dropshipping business against potential legal pitfalls. Now, let’s discuss the critical actions you can take to ensure your business remains compliant and successful.

- Review contracts with suppliers and customers.

- Assess compliance with tax regulations.

- Evaluate consumer protection measures.

- Monitor advertising practices for legality.

- Conduct regular data protection assessments.

Regular audits are crucial for long-term success.

Best Practices for Dropshipping Compliance

Implementing best practices for compliance is essential for any dropshipping business. These practices not only help you stay within the law but also enhance your credibility and trustworthiness in the eyes of your customers.

For example, maintaining clear and transparent communication with your customers about shipping times and return policies can prevent misunderstandings and build trust. Additionally, regularly updating your privacy policy to reflect current data protection laws is vital for compliance.

In summary, adhering to best practices for compliance is not just about legal requirements; it’s about fostering a positive relationship with your customers. Next, we’ll explore critical aspects of dropshipping that can impact your business.

| Practice | Description |

|---|---|

| Clear Communication | Be transparent with customers about policies |

| Regular Updates | Keep your privacy policy current |

- Communicate openly with customers

- Update policies regularly

- Train staff on compliance matters

Transparency builds trust.

Critical Aspects of Dropshipping

Understanding the critical aspects of dropshipping can significantly influence your business’s success. From supplier relationships to understanding market demand, these factors play a crucial role in your operations.

For instance, building strong relationships with reliable suppliers ensures product quality and timely shipping, which are essential for customer satisfaction. Moreover, staying updated on market trends can help you adapt your product offerings to meet consumer demands.

To conclude, being aware of the critical aspects of dropshipping allows you to make informed decisions that positively impact your business. Now, let’s wrap up everything we’ve discussed in this article.

Success lies in understanding your market.

- Foster strong supplier relationships

- Stay informed on market trends

- Regularly review your business practices

Conclusion

In conclusion, navigating the world of dropshipping requires a solid understanding of various legal considerations. From contracts and consumer protection laws to tax implications and fraud protection, being informed is key to running a successful business. By implementing the best practices and being proactive in compliance, you can ensure that your dropshipping venture thrives.

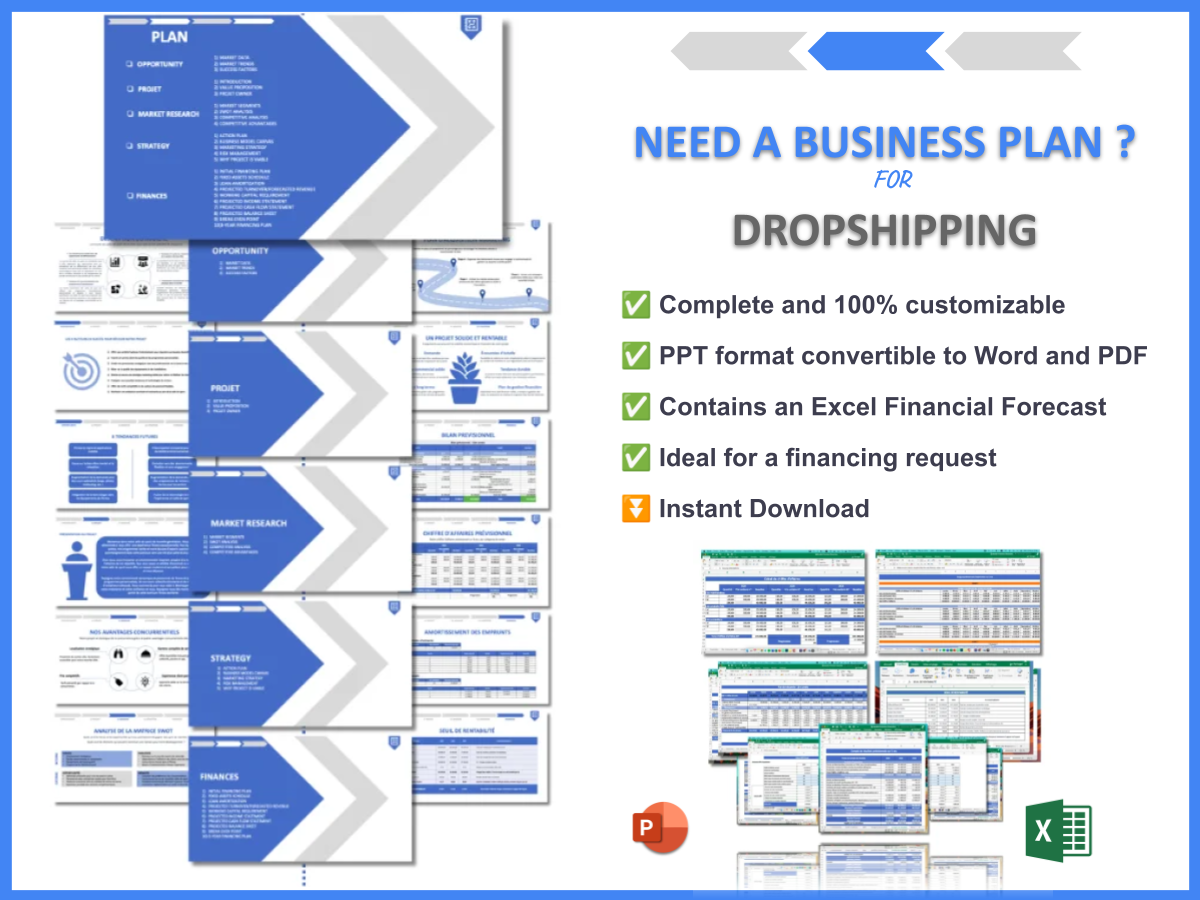

For those looking to start their journey, consider using our Dropshipping Business Plan Template to guide your planning process effectively.

Additionally, you may find our other articles helpful:

- SWOT Analysis for Dropshipping Business: Key Strategies for Success

- Crafting a Business Plan for Your Dropshipping Venture: Step-by-Step Guide

- How to Create a Financial Plan for Your Dropshipping Business: Step-by-Step Guide (+ Template)

- Step-by-Step Guide to Starting a Dropshipping Business

- Crafting a Dropshipping Marketing Plan: Step-by-Step Guide and Example

- Create a Successful Dropshipping Business Model Canvas: Step-by-Step Guide

- Customer Segments in Dropshipping: Who Are Your Target Audiences?

- Dropshipping Profitability: Tips for Financial Success

- How Much Does It Cost to Start a Dropshipping Business?

- Dropshipping Feasibility Study: Detailed Analysis

- Dropshipping Competition Study: Detailed Insights

- Dropshipping Risk Management: Detailed Analysis

- Dropshipping Funding Options: Expert Insights

- Scaling Dropshipping: Key Growth Strategies

FAQ Section

What are the legal requirements for starting a dropshipping business?

To start a dropshipping business, you must obtain necessary business licenses, comply with local tax regulations, and understand consumer protection laws that govern online sales.

How can I protect my dropshipping business from fraud?

Implementing secure payment processing methods, utilizing fraud detection software, and conducting thorough customer verification can help protect your business from fraud.

What is the importance of contracts in dropshipping?

Contracts are crucial for clarifying the terms of your relationships with suppliers and customers, reducing the risk of misunderstandings and legal disputes.

How often should I conduct compliance audits?

It is advisable to conduct compliance audits at least once a year or whenever significant changes occur within your business or relevant laws.

What consumer protection laws do dropshippers need to follow?

Dropshippers must adhere to laws that ensure truthful advertising, provide accurate product descriptions, and maintain a clear privacy policy regarding customer data.

How do tax implications affect my dropshipping business?

Understanding tax implications can affect pricing and profit margins; knowing when to collect sales tax is crucial for legal compliance.

What are the risks associated with dropshipping?

Risks in dropshipping include product liability, shipping delays, and potential contractual disputes with suppliers.

How can I ensure my advertising is compliant?

To ensure compliance in advertising, all promotions should be truthful and non-deceptive, following FTC guidelines for advertising practices.

What should be included in my dropshipping agreements?

Your dropshipping agreements should cover product quality, payment terms, shipping details, and return policies to protect all parties involved.

What are the best practices for compliance in dropshipping?

Best practices include open communication with customers, regularly updating policies, and training staff on compliance matters to ensure smooth operations.